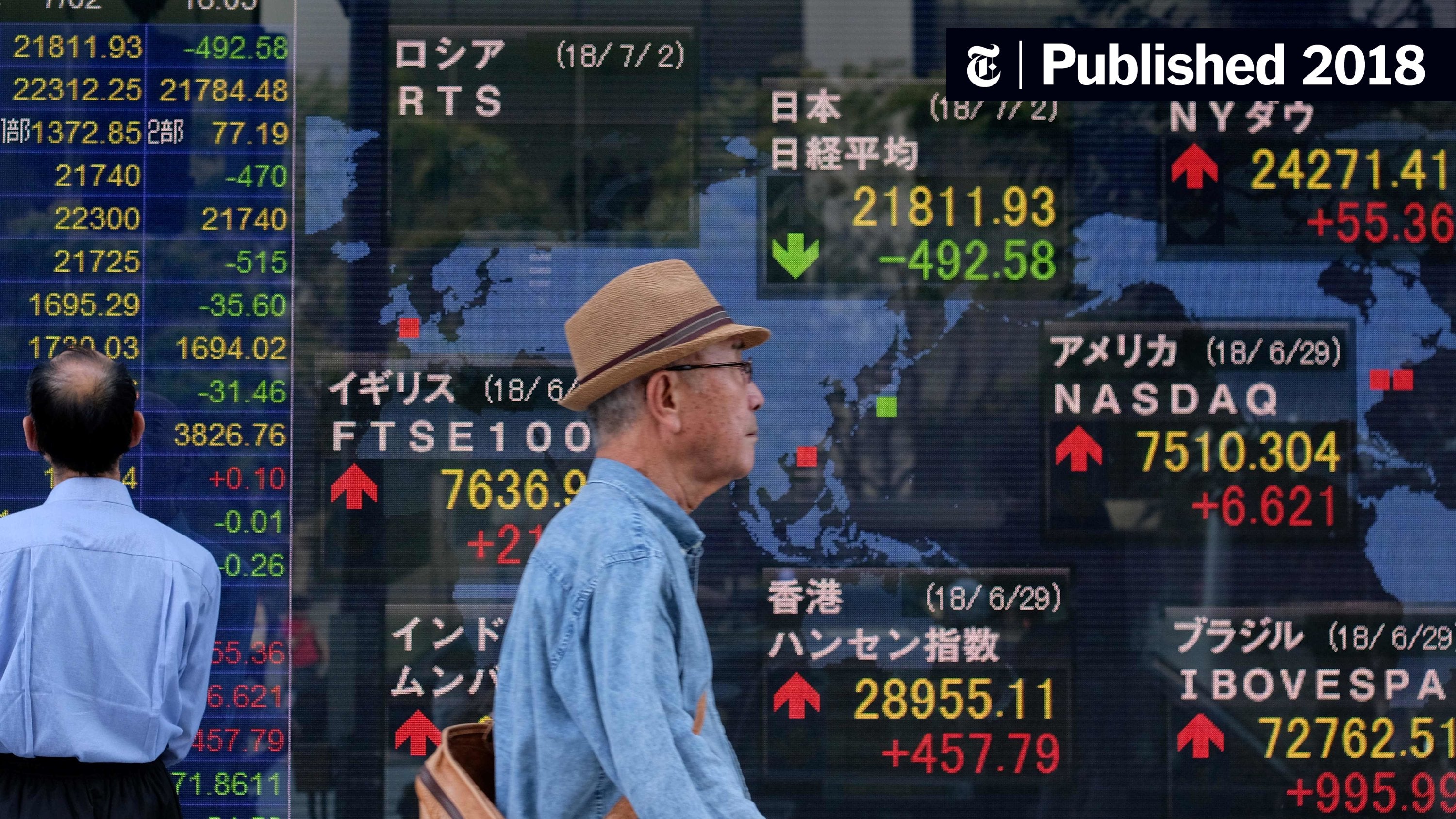

Amsterdam Exchange Plummets 7% As Trade War Concerns Rise

Table of Contents

Trade War Uncertainty Fuels Amsterdam Exchange Decline

The escalating trade tensions between major global powers are directly linked to the anxieties fueling the Amsterdam Exchange decline. Increased uncertainty regarding future trade agreements and policies is severely impacting investor confidence. Specific events contributing to this downturn include:

-

Increased tariffs on key Dutch exports: Newly imposed tariffs on Dutch agricultural products and manufactured goods have significantly reduced export competitiveness, directly impacting the profitability of numerous companies listed on the Amsterdam Exchange.

-

Uncertainty regarding future trade agreements: The lack of clarity surrounding future trade deals creates a climate of fear and speculation, discouraging investment and prompting existing investors to divest.

-

Impact on global supply chains affecting Dutch businesses: Disruptions to global supply chains caused by trade disputes are leading to increased costs and reduced efficiency for Dutch companies, further exacerbating the negative market sentiment.

-

Negative sentiment from international investors: International investors, wary of the increasing instability, are withdrawing their investments from the Amsterdam Exchange, further accelerating the decline. This outflow of capital is exacerbating the market downturn.

Impact on Key Sectors of the Amsterdam Exchange

The downturn hasn't affected all sectors equally. The technology, energy, and financial sectors have been particularly hard hit. For example:

-

Technology: Several prominent tech companies listed on the Amsterdam Exchange experienced double-digit percentage drops, reflecting anxieties about reduced consumer spending and supply chain disruptions.

-

Energy: The energy sector, already grappling with fluctuating oil prices, has suffered additional losses due to trade war-related uncertainty and the potential for reduced demand.

-

Financials: Banks and financial institutions have also seen significant declines, reflecting concerns about increased credit risk and potential defaults in the current climate of economic uncertainty.

The specific performance of individual companies varies, but the overall trend shows a sharp decrease across multiple sectors, indicating a broad-based impact of the trade war concerns. Experts predict sustained vulnerability in these sectors until greater trade clarity is established.

Investor Sentiment and Market Volatility Following the Drop

The market plunge has understandably led to significant shifts in investor sentiment, characterized by widespread fear, uncertainty, and doubt (FUD). Trading volumes have surged, reflecting a flurry of activity as investors attempt to react to the rapidly changing situation. Volatility indicators show a considerable increase, highlighting the unstable nature of the market. Investors are now employing various strategies to mitigate the risks, including:

-

Increased volatility in trading: Sharp price fluctuations are causing significant challenges for investors attempting to time the market.

-

Shifting investor sentiment (fear, uncertainty, doubt): The prevailing sentiment is one of caution, with many investors adopting a wait-and-see approach.

-

Strategies: diversification, hedging, risk management: Investors are focusing on diversification of their portfolios, implementing hedging strategies to protect against further losses, and enhancing risk management protocols.

Potential Long-Term Effects on the Amsterdam Exchange and the Dutch Economy

The 7% drop in the Amsterdam Exchange is not an isolated incident; it carries significant potential long-term consequences for both the exchange itself and the Dutch economy. Continued market instability is a real possibility, potentially impacting economic growth and investor confidence for an extended period. The potential long-term effects include:

-

Potential for sustained market instability: If trade tensions remain unresolved, the Amsterdam Exchange could experience prolonged volatility and sluggish growth.

-

Long-term effects on economic growth: The decline could stifle economic growth in the Netherlands, affecting job creation and overall prosperity.

-

Government response and potential policy changes: The Dutch government may need to implement fiscal or monetary policies to mitigate the negative economic consequences of the trade war.

Conclusion: Navigating the Aftermath of the Amsterdam Exchange Plummet

The 7% drop in the Amsterdam Exchange underscores the significant impact of rising trade war concerns on market sentiment and investor confidence. The decline is driven by increased tariffs, uncertainty surrounding future trade agreements, and disruptions to global supply chains. The consequences are far-reaching, affecting multiple sectors and raising concerns about long-term economic growth. To navigate this challenging period, it is crucial to monitor the Amsterdam Exchange closely, understand the risks associated with the current trade climate, and develop a robust investment strategy to mitigate losses. Further research into the trade war impact and exploring various investment strategies are essential to weather this market volatility. Stay informed and make informed decisions to protect your investments.

Featured Posts

-

Ecb Faiz Politikasi Ve Avrupa Borsalari Guencel Durum Degerlendirmesi

May 24, 2025

Ecb Faiz Politikasi Ve Avrupa Borsalari Guencel Durum Degerlendirmesi

May 24, 2025 -

Yevrobachennya Kudi Podilisya Peremozhtsi Za Ostanni 10 Rokiv

May 24, 2025

Yevrobachennya Kudi Podilisya Peremozhtsi Za Ostanni 10 Rokiv

May 24, 2025 -

Tracking The Nav Amundi Dow Jones Industrial Average Ucits Etf Distribution

May 24, 2025

Tracking The Nav Amundi Dow Jones Industrial Average Ucits Etf Distribution

May 24, 2025 -

Escape To The Country Nicki Chapmans Profitable Property Investment

May 24, 2025

Escape To The Country Nicki Chapmans Profitable Property Investment

May 24, 2025 -

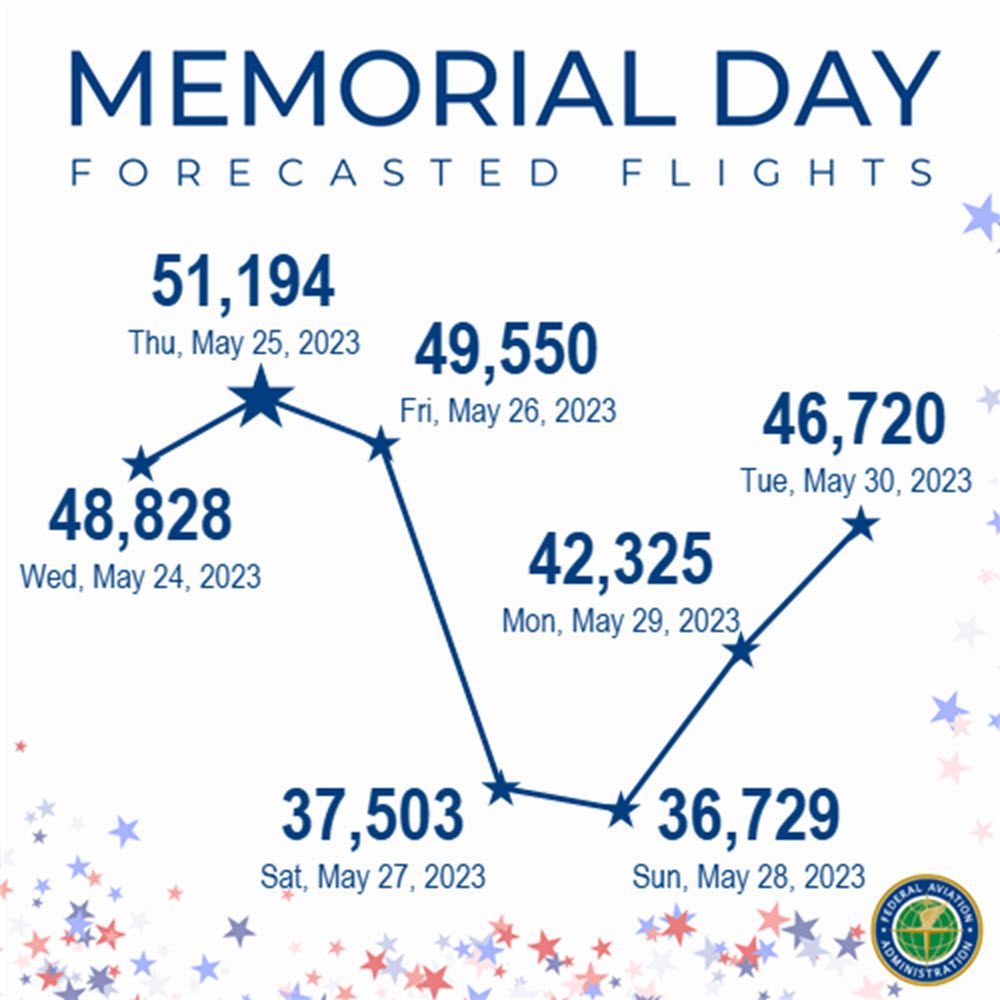

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 24, 2025

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 24, 2025

Latest Posts

-

Bof A Reassures Investors Why Stretched Valuations Arent A Worry

May 24, 2025

Bof A Reassures Investors Why Stretched Valuations Arent A Worry

May 24, 2025 -

Are Thames Water Executive Bonuses Justified

May 24, 2025

Are Thames Water Executive Bonuses Justified

May 24, 2025 -

The Thames Water Bonus Scandal Examining The Facts

May 24, 2025

The Thames Water Bonus Scandal Examining The Facts

May 24, 2025 -

Public Outrage Over Thames Water Executive Bonuses

May 24, 2025

Public Outrage Over Thames Water Executive Bonuses

May 24, 2025 -

Thames Waters Executive Pay Scandal Or Standard Practice

May 24, 2025

Thames Waters Executive Pay Scandal Or Standard Practice

May 24, 2025