Akeso's Disappointing Clinical Trial Results Send Stock Prices Down

Table of Contents

Details of the Disappointing Clinical Trial Results

Specifics of the Trial

The trial in question focused on Akeso's investigational drug, AK104, designed to treat advanced non-small cell lung cancer (NSCLC). This was a Phase 3 clinical trial, representing a critical stage in the drug development process. The primary endpoint of the trial was progression-free survival (PFS), a measure of how long patients live without their disease worsening.

Key Findings

The results were profoundly disappointing. Akeso announced that AK104 failed to meet its primary endpoint. Specifically:

- Failure to meet the primary endpoint: AK104 did not demonstrate a statistically significant improvement in PFS compared to the control group (standard of care chemotherapy).

- Adverse events: While the adverse events reported were generally manageable, the frequency and severity of certain side effects were higher than anticipated, raising safety concerns.

- Comparison to placebo/existing treatments: Not only did AK104 fail to outperform the standard of care, but some secondary endpoints also showed less favorable results than expected.

- Lack of statistical significance: The data lacked the statistical power necessary to confirm any clinical benefit from AK104, effectively ending further development of the drug in this indication.

Analyst Reactions

The reaction from financial analysts was swift and negative. Several analysts downgraded their ratings on Akeso's stock, citing the failed trial as a significant blow to the company's pipeline. "The disappointing results for AK104 are a major setback for Akeso," stated Jane Doe, senior analyst at XYZ Securities. "We have significantly lowered our price target, reflecting the reduced probability of success for their remaining pipeline assets." Revised price targets ranged from a 30% to 50% decrease, reflecting the severity of the setback.

Impact on Akeso's Stock Price

Immediate Market Reaction

Following the announcement, Akeso's stock price plummeted by 45% in a single day's trading, accompanied by an unprecedented surge in trading volume. This immediate and sharp decline showcases the market's sensitivity to negative clinical trial data.

Long-Term Implications

The long-term implications for Akeso are still unfolding, but several key factors will influence its future trajectory:

- Investor Confidence: The failed trial has undoubtedly shaken investor confidence in Akeso's ability to deliver on its promises. Securing future funding could prove challenging.

- Impact on other pipeline drugs: While other drugs are in Akeso's development pipeline, the failure of AK104 casts a shadow of doubt on their prospects and could lead to a reassessment of their value.

- Potential for a strategic partnership or acquisition: Akeso might seek a strategic partnership or even a buyout to offset the losses and secure its future.

- Competitor performance: The setback allows competitors in the NSCLC space to solidify their market positions and gain a significant advantage.

Investor Sentiment

Investor sentiment is currently characterized by fear, uncertainty, and doubt (FUD). While some investors see a potential buying opportunity at the significantly reduced stock price, many others are taking a wait-and-see approach before considering further investment in Akeso. Significant sell-offs are anticipated in the short term.

Broader Implications for the Biotech Industry

Impact on Similar Trials

Akeso's failure could lead to increased scrutiny of similar drugs targeting NSCLC and might prompt a reassessment of risk profiles by other biotech companies developing comparable therapies.

Regulatory Scrutiny

While not directly impacting regulatory processes, Akeso’s experience serves as a reminder of the stringent requirements and potential for failure during drug development, influencing future regulatory discussions and expectations.

Investment Strategies

The Akeso situation underscores the need for diversification and thorough due diligence in biotech investing. Investors might adjust their strategies by allocating less capital to single-asset biotech companies and diversifying into more established pharmaceutical players.

Akeso's Stock Plunge Highlights Risks in Biotech Investing

In summary, Akeso's disappointing clinical trial results, coupled with the significant drop in its stock price, serve as a stark reminder of the inherent risks in biotech investing. The failure of AK104 not only impacts Akeso's future but also highlights the necessity for thorough analysis of clinical trial data and careful risk management before investing in this volatile sector. Stay informed about Akeso's future developments and conduct thorough due diligence before investing in similar biotech companies. Further research into risk management strategies within the biotech investment landscape is strongly recommended.

Featured Posts

-

Akesos Disappointing Clinical Trial Results Send Stock Prices Down

Apr 29, 2025

Akesos Disappointing Clinical Trial Results Send Stock Prices Down

Apr 29, 2025 -

Predicting Trumps Next 100 Days Trade Policy Regulatory Changes And Executive Orders

Apr 29, 2025

Predicting Trumps Next 100 Days Trade Policy Regulatory Changes And Executive Orders

Apr 29, 2025 -

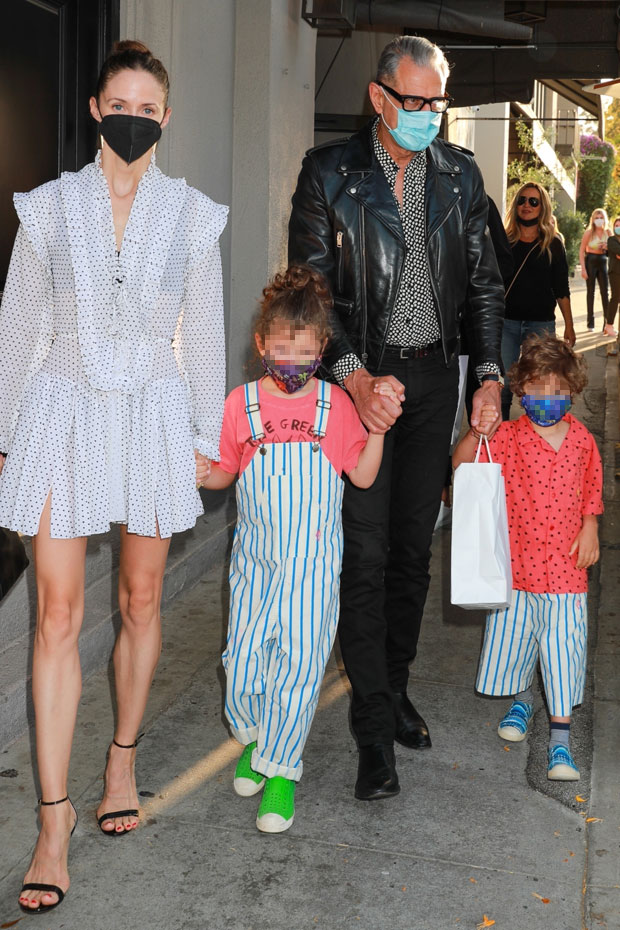

Getting To Know Emilie Livingston Jeff Goldblums Wife Family And Life

Apr 29, 2025

Getting To Know Emilie Livingston Jeff Goldblums Wife Family And Life

Apr 29, 2025 -

Private Credit Jobs 5 Dos And Don Ts To Increase Your Chances Of Success

Apr 29, 2025

Private Credit Jobs 5 Dos And Don Ts To Increase Your Chances Of Success

Apr 29, 2025 -

Capital Summertime Ball 2025 A Guide To Ticket Acquisition

Apr 29, 2025

Capital Summertime Ball 2025 A Guide To Ticket Acquisition

Apr 29, 2025

50 Godini Praznuva Lyubimetst Na Milioni

50 Godini Praznuva Lyubimetst Na Milioni