Ackman On US-China Trade War: A Long-Term Perspective

Table of Contents

Ackman's Initial Stance on the US-China Trade War

In the early stages of the US-China trade war, Ackman, like many analysts, likely expressed concerns about the potential negative consequences. His initial analysis probably focused on the immediate impacts of tariffs and trade restrictions.

- His views on specific industries: Ackman likely highlighted sectors heavily reliant on trade between the US and China, such as technology and manufacturing. He may have predicted disruptions in supply chains and increased costs for consumers. Companies heavily reliant on Chinese manufacturing or Chinese consumers likely came under scrutiny.

- His assessment of the economic consequences: His early assessments probably included predictions of slowed economic growth for both nations, increased inflation in the US due to tariffs, and potential retaliatory measures from China. The potential for a global economic slowdown likely featured prominently in his analysis.

- Specific investments or divestments: While specific investment decisions aren't always public knowledge, it's plausible that Ackman adjusted his portfolio based on his initial assessment of the trade war's impact. This might have involved divesting from companies particularly vulnerable to trade disruptions or investing in sectors expected to benefit from the shifting global landscape.

The Evolving Landscape: Ackman's Adapting Perspective

As the US-China trade war progressed, the situation became more nuanced. Ackman's perspective likely evolved in response to key events and shifts in the geopolitical climate.

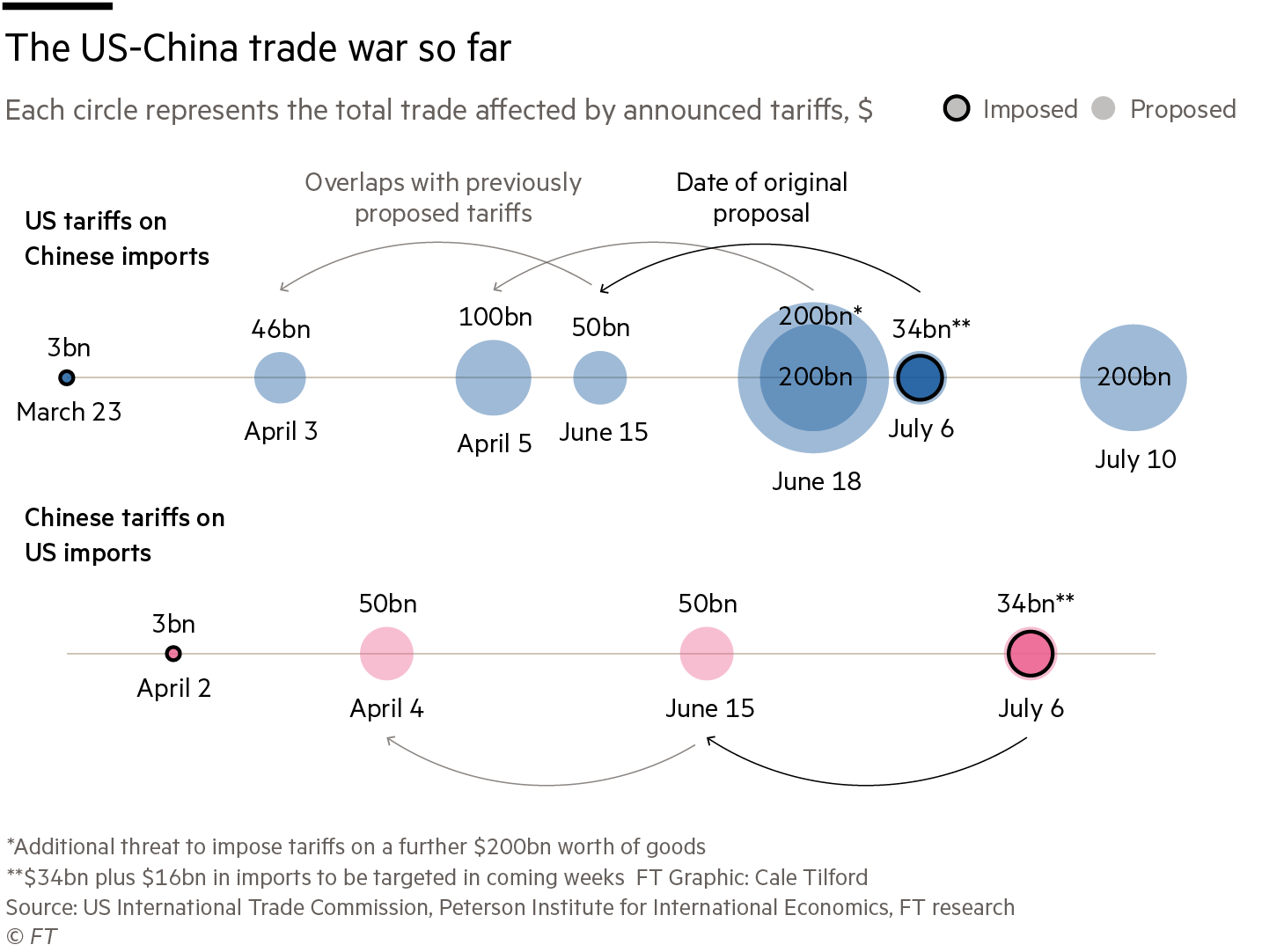

- Key events influencing his changing perspective: Trade deal negotiations, changes in tariff levels, and the overall escalation or de-escalation of tensions undoubtedly shaped his evolving view. Major technological developments and shifts in global supply chains also played a critical role.

- Adjustments in investment strategies: Based on these developments, Ackman likely refined his investment strategies. He might have shifted his focus to companies better positioned to navigate the complexities of the trade war or those benefiting from reshoring or nearshoring initiatives.

- Assessment of the trade war's effectiveness: His assessment of the trade war's effectiveness likely changed over time, considering its impact on both the US and Chinese economies and its influence on global trade relations.

Long-Term Implications: Ackman's Forecasts

Predicting the long-term implications of the US-China trade war is a challenging task. However, Ackman's insights into the future of US-China relations likely provide valuable perspectives for investors.

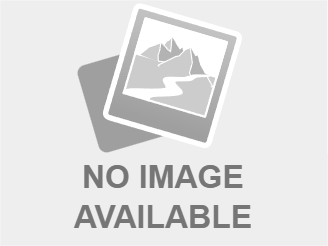

- Predictions regarding global economic growth and stability: His forecasts may involve scenarios of sustained economic growth, albeit potentially slower than in a less-conflictual environment, or more pessimistic predictions of prolonged economic stagnation or even recession.

- Outlook on the future of US-China trade relations: Ackman might foresee a continued period of tension and strategic competition, or a possible gradual de-escalation and a new equilibrium in trade relations.

- Potential scenarios and their impacts: His analysis likely considers various scenarios, including a complete decoupling of the two economies, a partial decoupling focused on certain sectors, or a return to a more cooperative relationship. Each scenario would have significantly different consequences for global markets.

Geopolitical Ramifications: Ackman's Analysis

The US-China trade war extends beyond economic impacts. Ackman's analysis likely incorporates the geopolitical ramifications.

- Impact on global supply chains: The trade war highlighted vulnerabilities in global supply chains. Ackman's analysis likely addresses the long-term impact on global manufacturing, logistics, and the strategic importance of diversification.

- Role of technology and innovation: The trade war exacerbated competition in technology and innovation. Ackman's insights likely consider the long-term implications for technological leadership and the race for technological dominance.

- Broader influence on international relations: The trade conflict has broader geopolitical implications. Ackman's analysis may discuss its impact on alliances, power dynamics, and the future of global governance.

Investing Strategies Informed by Ackman's Perspective

By understanding Ackman's perspective on the US-China trade war, investors can make more informed decisions.

- Identifying potential investment opportunities: Ackman's insights might help identify companies poised to benefit from reshoring, nearshoring, or technological innovation spurred by the trade war.

- Mitigating risks associated with the trade war: His analysis helps investors assess risks and develop strategies to mitigate potential losses from trade disruptions or geopolitical instability.

- Strategies for navigating economic uncertainty: Understanding Ackman's perspectives on the trade war's economic impacts can help investors develop robust strategies for navigating periods of increased economic uncertainty.

Conclusion

Bill Ackman's evolving perspective on the Ackman US-China Trade War offers valuable insights into the complexities of this ongoing conflict. His analysis highlights the importance of considering not only the immediate economic consequences but also the long-term geopolitical ramifications and their influence on investment strategies. By understanding Ackman's insights and remaining updated on the evolving situation through relevant financial news and analysis, investors can better navigate the uncertain landscape of the US-China trade relationship. Further research into Ackman's work on the Ackman US-China Trade War is highly recommended for informed investment decisions.

Featured Posts

-

Dax Bundestag Elections And Business Indicators A Complex Interplay

Apr 27, 2025

Dax Bundestag Elections And Business Indicators A Complex Interplay

Apr 27, 2025 -

Paolini Y Pegula Sorpresa En Dubai Eliminadas De La Wta 1000

Apr 27, 2025

Paolini Y Pegula Sorpresa En Dubai Eliminadas De La Wta 1000

Apr 27, 2025 -

Wta Finals 2023 Austria And Singapore Host Decisive Matches

Apr 27, 2025

Wta Finals 2023 Austria And Singapore Host Decisive Matches

Apr 27, 2025 -

Electric Vehicle Sales Slowdown Canadian Consumer Interest Wanes

Apr 27, 2025

Electric Vehicle Sales Slowdown Canadian Consumer Interest Wanes

Apr 27, 2025 -

Ariana Grandes Hair And Tattoo Transformation Finding The Right Professionals

Apr 27, 2025

Ariana Grandes Hair And Tattoo Transformation Finding The Right Professionals

Apr 27, 2025

Latest Posts

-

The U S Dollar And Presidential Economic Policy A Case Study Of The Nixon Administration And Beyond

Apr 28, 2025

The U S Dollar And Presidential Economic Policy A Case Study Of The Nixon Administration And Beyond

Apr 28, 2025 -

Could The U S Dollar Experience Its Worst Start Since Nixon An Economic Assessment

Apr 28, 2025

Could The U S Dollar Experience Its Worst Start Since Nixon An Economic Assessment

Apr 28, 2025 -

U S Dollars First 100 Days A Historical Perspective And Economic Forecast

Apr 28, 2025

U S Dollars First 100 Days A Historical Perspective And Economic Forecast

Apr 28, 2025 -

Analyzing The U S Dollars Performance A Comparison To The Nixon Presidency

Apr 28, 2025

Analyzing The U S Dollars Performance A Comparison To The Nixon Presidency

Apr 28, 2025 -

The U S Dollar A Troubled First 100 Days Under The Current Presidency

Apr 28, 2025

The U S Dollar A Troubled First 100 Days Under The Current Presidency

Apr 28, 2025