7-Year Prison Term For GPB Capital Founder David Gentile In Ponzi Scheme Case

Table of Contents

The founder of GPB Capital, David Gentile, has been sentenced to seven years in prison for orchestrating a massive Ponzi scheme that defrauded investors of hundreds of millions of dollars. This landmark case highlights the devastating consequences of financial fraud and underscores the importance of investor due diligence. This article delves into the specifics of the Gentile case, the impact on investors, and the broader implications for the financial world.

The GPB Capital Ponzi Scheme: Unraveling the Fraud

GPB Capital Holdings, once a seemingly successful investment firm, operated under a deceptive business model that ultimately proved to be a sophisticated Ponzi scheme. The scheme, masterminded by David Gentile, preyed on unsuspecting investors seeking high returns. Keywords like GPB Capital Ponzi scheme, David Gentile fraud, investment fraud, and securities fraud are crucial to understanding the nature of this financial crime.

- Description of the fraudulent activities: GPB Capital raised significant capital from investors by promising high yields from investments in various businesses, including car dealerships and waste management companies. However, these promised returns were largely fabricated. Instead of investing the funds as promised, Gentile and his associates used incoming funds to pay earlier investors, a hallmark characteristic of a classic Ponzi scheme.

- Methods used to attract investors: The scheme relied on sophisticated marketing strategies that emphasized high returns and low risk. False promises were made about the performance of underlying investments, and misleading statements were made to potential investors to inflate the perceived success of the company.

- Timeline of the scheme's operation: The GPB Capital Ponzi scheme ran for several years, steadily accumulating funds from investors before the fraudulent activities were eventually uncovered.

- Scale of the fraud and the amount of money involved: The scheme involved hundreds of millions of dollars, causing significant financial losses to a large number of investors across the country.

David Gentile's Role and Conviction

David Gentile, as the founder and CEO of GPB Capital, played a central role in orchestrating the Ponzi scheme. His conviction highlights the severe consequences of engaging in such criminal activity. Keywords such as David Gentile conviction, GPB Capital sentencing, criminal charges, and financial crimes accurately reflect the legal proceedings.

- Charges filed against Gentile: Gentile faced multiple criminal charges, including securities fraud and wire fraud, reflecting the extensive nature of his fraudulent activities.

- Evidence presented during the trial: The prosecution presented compelling evidence demonstrating Gentile's direct involvement in the scheme, including internal documents, financial records, and witness testimonies.

- The judge's reasoning behind the 7-year sentence: The judge's sentence considered the massive scale of the fraud, the number of victims affected, and the deliberate nature of Gentile's actions.

- Gentile's plea and any statements made during the proceedings: While the specifics of Gentile's plea and statements may vary, his conviction underscores the gravity of his actions and the strength of the evidence against him.

Impact on Investors and the Financial Industry

The GPB Capital Ponzi scheme had a devastating impact on numerous investors who suffered significant financial losses. Keywords such as GPB Capital victims, investor losses, financial industry regulation, and SEC investigation highlight the broader ramifications of this case.

- Number of victims affected: The precise number of victims is yet to be determined but is likely extensive, given the substantial amount of money involved.

- Amount of money lost by investors: Hundreds of millions of dollars were lost by investors who believed they were making sound investments.

- Impact on investor confidence: The scandal eroded investor confidence in the financial industry, highlighting the vulnerability of even sophisticated investors to complex fraud schemes.

- Regulatory responses and investigations following the scandal: The SEC (Securities and Exchange Commission) and other regulatory bodies launched investigations into GPB Capital's activities and implemented measures to prevent similar fraudulent schemes in the future. These investigations are ongoing.

Lessons Learned and Preventing Future Ponzi Schemes

The GPB Capital case offers crucial lessons for investors and highlights the importance of proactive measures to prevent future Ponzi schemes. Keywords like investor protection, due diligence, identifying Ponzi schemes, and financial literacy are key here.

- Importance of thorough research before investing: Investors should conduct thorough due diligence before investing in any investment opportunity. This includes verifying the legitimacy of the investment firm, reviewing its track record, and understanding the risks involved.

- Red flags to watch out for in investment opportunities: Investors should be wary of unusually high returns, promises of guaranteed profits, pressure to invest quickly, and difficulty obtaining information about the investment.

- The role of regulatory bodies in protecting investors: Regulatory bodies like the SEC play a vital role in protecting investors by enforcing securities laws and investigating potential fraud.

- Importance of financial literacy and seeking professional advice: Investing in financial literacy and seeking professional financial advice from qualified advisors can help individuals make informed investment decisions and protect themselves from fraud.

Conclusion

The 7-year prison sentence handed down to David Gentile serves as a stark reminder of the devastating consequences of financial fraud. The GPB Capital Ponzi scheme highlights the importance of investor vigilance and robust regulatory oversight. The case underscores the need for greater financial literacy and due diligence among investors. Understanding the intricacies of the GPB Capital case and the David Gentile conviction is crucial for protecting yourself from similar schemes. Learn more about protecting your investments and recognizing the signs of a Ponzi scheme. Stay informed about financial fraud and protect yourself from becoming a victim.

Featured Posts

-

Should Pam Bondis Decision To Release Jeffrey Epstein Files Be Supported A Voters Perspective

May 10, 2025

Should Pam Bondis Decision To Release Jeffrey Epstein Files Be Supported A Voters Perspective

May 10, 2025 -

Is Palantir Stock A Buy Before May 5th Unanimous Wall Street Prediction

May 10, 2025

Is Palantir Stock A Buy Before May 5th Unanimous Wall Street Prediction

May 10, 2025 -

Den Pobedy Vladimir Zelenskiy Bez Podderzhki Soyuznikov

May 10, 2025

Den Pobedy Vladimir Zelenskiy Bez Podderzhki Soyuznikov

May 10, 2025 -

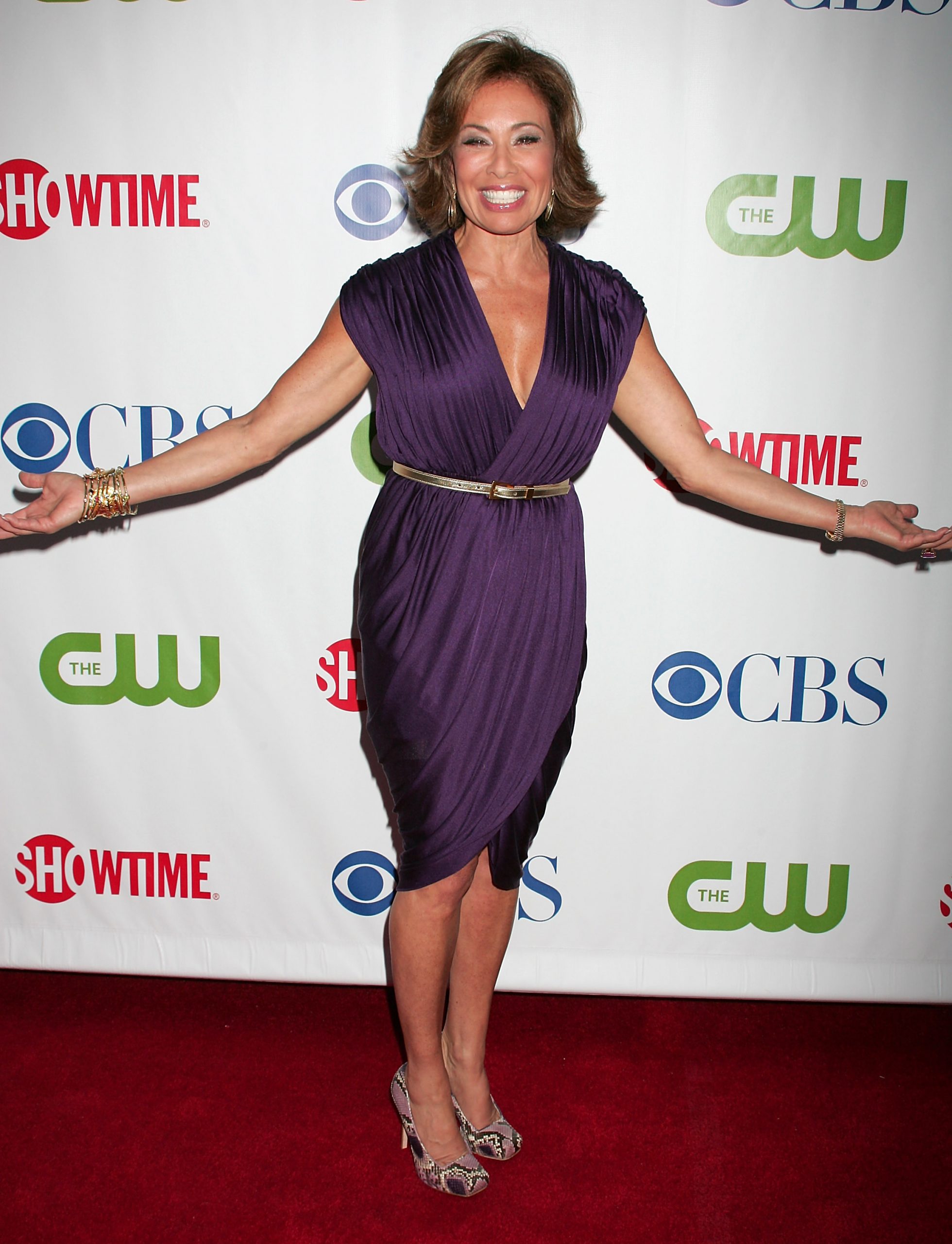

Understanding Jeanine Pirro Background Achievements And Financial Success

May 10, 2025

Understanding Jeanine Pirro Background Achievements And Financial Success

May 10, 2025 -

Unprovoked Racist Stabbing Leaves Man Dead Woman In Custody

May 10, 2025

Unprovoked Racist Stabbing Leaves Man Dead Woman In Custody

May 10, 2025

Latest Posts

-

Gazas Plight Hunger Sickness And Crime Under Blockade

May 11, 2025

Gazas Plight Hunger Sickness And Crime Under Blockade

May 11, 2025 -

Shifting Alliances Pentagon Considers Placing Greenland Under Northern Command

May 11, 2025

Shifting Alliances Pentagon Considers Placing Greenland Under Northern Command

May 11, 2025 -

North Dakota Health Officials Quarantine Unvaccinated Students Due To Measles

May 11, 2025

North Dakota Health Officials Quarantine Unvaccinated Students Due To Measles

May 11, 2025 -

Stock Market Reaction 80 Tariffs And Uk Trade Deal Uncertainty

May 11, 2025

Stock Market Reaction 80 Tariffs And Uk Trade Deal Uncertainty

May 11, 2025 -

Pentagons Book Review Directive Impact On Military Academy Libraries

May 11, 2025

Pentagons Book Review Directive Impact On Military Academy Libraries

May 11, 2025