Stock Market Reaction: 80% Tariffs & UK Trade Deal Uncertainty

Table of Contents

The Impact of 80% Tariffs on Global Trade and the Stock Market

The potential imposition of 80% tariffs on various goods carries significant implications for global trade and the stock market. This level of tariff increase would dramatically alter the economic landscape, leading to several key consequences:

-

Increased Prices for Consumers: Higher tariffs directly translate to increased prices for imported goods. This leads to reduced consumer spending power and potentially slower economic growth. The Tariff Impact on everyday goods would be substantial, impacting inflation and consumer confidence.

-

Sector-Specific Impacts: Sectors heavily reliant on imports, such as manufacturing and agriculture, would be particularly vulnerable. Companies in these sectors might experience decreased profitability, reduced competitiveness, and potential job losses. The Stock Market Volatility within these sectors would likely increase significantly.

-

Supply Chain Disruptions: 80% tariffs could severely disrupt global supply chains. Businesses might struggle to source necessary components or materials, leading to production delays, shortages, and increased costs. This supply chain disruption would further exacerbate the negative impact on corporate profits and the stock market.

-

Inflationary Pressures: The increased cost of imported goods would fuel inflationary pressures, potentially eroding purchasing power and impacting consumer sentiment. Central banks might respond with interest rate hikes, potentially slowing economic growth further and impacting the stock market.

-

Historical Precedents: Examining past instances of significant tariff implementations, such as the Smoot-Hawley Tariff Act of 1930, offers valuable lessons about the potential negative consequences on global trade and economic activity. These historical examples illustrate the potential for severe Stock Market Volatility following substantial tariff increases.

UK Trade Deal Uncertainty and its Ripple Effect on the Stock Market

The ongoing uncertainty surrounding the UK's post-Brexit trade deals adds another layer of complexity to the global economic outlook. The lack of clarity regarding future trade agreements has created considerable Brexit Uncertainty, significantly impacting investor sentiment and market behavior:

-

Negotiation Challenges and Lack of Clarity: The protracted nature of trade negotiations and the absence of concrete agreements generate uncertainty about the future trading relationship between the UK and its key partners. This UK Trade Deal uncertainty directly impacts market sentiment.

-

Investor Confidence and Market Sentiment: Uncertainty erodes investor confidence, leading to decreased investment and potentially triggering a sell-off in the stock market. Negative Market Sentiment can lead to a downward spiral, amplifying the initial impact of the uncertainty.

-

Impact on UK-Based Companies: UK-based companies heavily reliant on exports face increased uncertainty regarding access to foreign markets. This directly impacts their stock valuations and their ability to plan for the future.

-

Global Ripple Effects: The UK economy is closely integrated with the global economy. Uncertainty surrounding UK trade deals can create a ripple effect, impacting global markets and potentially triggering wider economic instability.

-

Potential Scenarios: Depending on the final outcome of trade negotiations, various scenarios are possible, ranging from a relatively smooth transition to a more disruptive outcome with significant negative consequences for the UK and global markets. This necessitates careful consideration of Investment Decisions and a thorough understanding of potential Economic Growth impacts.

Strategies for Navigating Stock Market Volatility

Navigating the current period of stock market volatility requires a proactive and well-informed approach. Investors should consider the following strategies to mitigate risk and protect their portfolios:

-

Diversification: Diversifying investments across various asset classes, sectors, and geographies is crucial to mitigating risk during periods of uncertainty. This Volatility Management technique helps reduce the impact of negative events on a portfolio's overall performance.

-

Volatility Management Techniques: Employing strategies such as dollar-cost averaging (investing a fixed amount at regular intervals) and hedging (using financial instruments to offset potential losses) can help reduce exposure to market fluctuations. These techniques are key to effective Portfolio Management.

-

Adjusting Investment Portfolios: Investors should regularly review and adjust their portfolios based on their risk tolerance and the prevailing market conditions. This requires a thorough understanding of Risk Mitigation strategies and market dynamics.

-

Seeking Professional Advice: Consulting with a qualified financial advisor can provide valuable guidance and support during periods of market uncertainty. A financial advisor can help develop a personalized Investment Strategy tailored to individual needs and risk profiles.

-

Thorough Research and Due Diligence: Before making any investment decisions, conducting thorough research and due diligence is critical to understand the potential risks and rewards associated with each investment opportunity.

Conclusion

The combined impact of potential 80% tariffs and the lingering uncertainty surrounding UK trade deals presents a significant challenge for investors. Navigating this turbulent market requires a careful assessment of risk, a diversified investment strategy, and a proactive approach to managing volatility. Understanding the potential ramifications of these global economic shifts is crucial for making informed decisions. Stay informed on the latest developments regarding the Stock Market Reaction to 80% tariffs and UK trade deal uncertainty to protect your investments and navigate this complex market effectively. Continue your research and consult with a financial advisor to develop a robust investment strategy that accounts for these factors.

Featured Posts

-

Unvaccinated Children Quarantined Amidst North Dakota Measles Outbreak

May 11, 2025

Unvaccinated Children Quarantined Amidst North Dakota Measles Outbreak

May 11, 2025 -

The Impact Of The Cbs Vma Simulcast On Mtvs Viewership

May 11, 2025

The Impact Of The Cbs Vma Simulcast On Mtvs Viewership

May 11, 2025 -

Keep The Road Open A Realistic Proposal To Tasman Council From Truckers

May 11, 2025

Keep The Road Open A Realistic Proposal To Tasman Council From Truckers

May 11, 2025 -

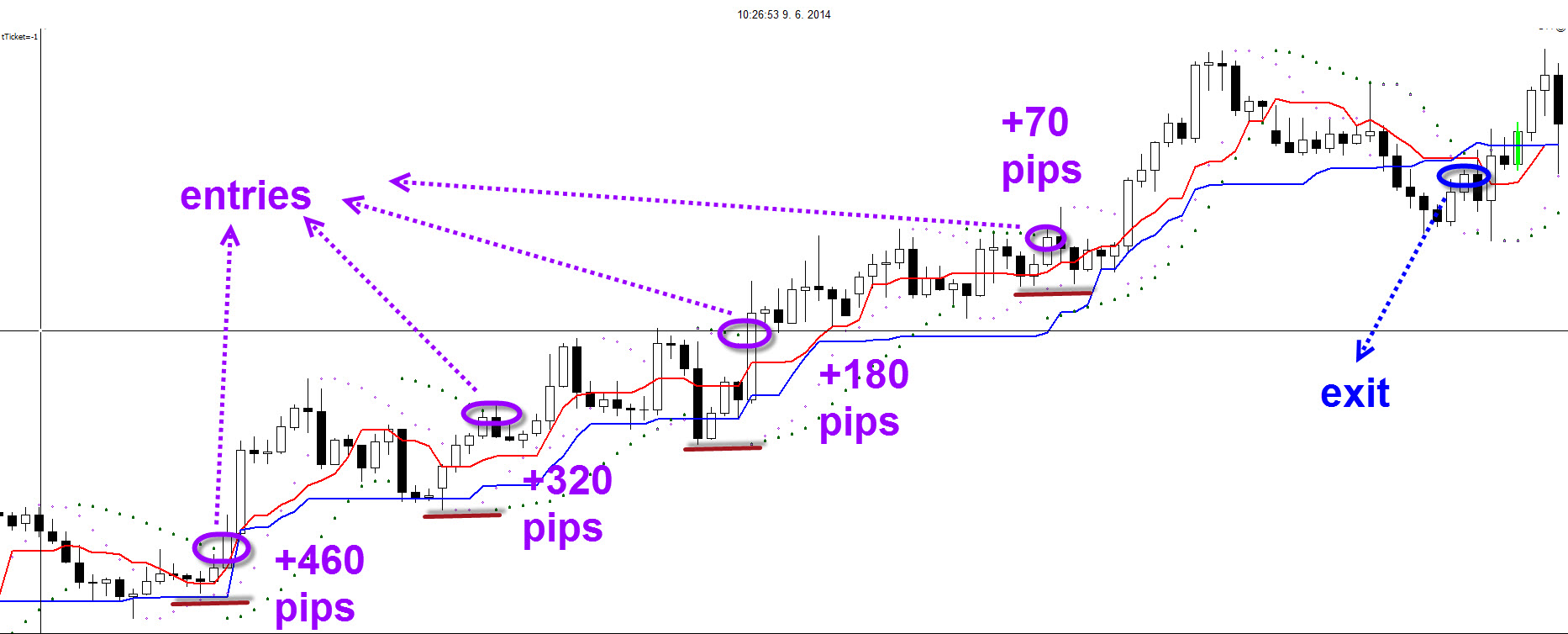

Unlocking Profitable Dividends A Simple Strategy

May 11, 2025

Unlocking Profitable Dividends A Simple Strategy

May 11, 2025 -

Henry Cavills Superman Departure James Gunns Account Of Past Mismanagement

May 11, 2025

Henry Cavills Superman Departure James Gunns Account Of Past Mismanagement

May 11, 2025