Is Palantir Stock A Buy Before May 5th? Unanimous Wall Street Prediction

Table of Contents

Wall Street Analyst Ratings and Price Targets for Palantir Stock

The consensus among Wall Street analysts regarding Palantir stock is crucial in determining its investment potential. Understanding their ratings and price targets provides a valuable insight into the predicted future performance of PLTR.

Unanimous Buy Recommendations (or otherwise): While a truly unanimous buy recommendation is rare, let's assume for the sake of this analysis a strong bullish consensus. (If this isn't the case, adjust accordingly with real data. Replace example data below with actual analyst ratings and price targets from reputable sources like Morgan Stanley, Goldman Sachs, JPMorgan Chase, etc., citing sources).

- Example (Replace with Actual Data): Morgan Stanley has issued a "Buy" rating with a price target of $25, citing strong revenue growth projections.

- Example (Replace with Actual Data): Goldman Sachs has a "Buy" rating and a $23 price target, highlighting the company's increasing government contracts.

- Example (Replace with Actual Data): JPMorgan Chase gives a "Buy" rating with a $22 price target, emphasizing Palantir's expansion into new commercial markets.

Justification for the Predictions: The bullish sentiment (again, adjust based on actual data) surrounding Palantir stock is primarily fueled by several key factors:

- Strong Revenue Growth Projections: Analysts generally predict robust revenue growth for Palantir in the coming years, driven by increased demand for its data analytics solutions in both the public and private sectors.

- Increasing Government Contracts: Palantir's significant presence in government contracts contributes substantially to its revenue stream. Continued success in securing these contracts is a major factor in the positive outlook.

- Expansion into New Markets: Palantir's strategic moves into new market sectors diversify its revenue streams and mitigate reliance on a single industry.

- Successful Product Launches: New product launches and updates enhance Palantir's platform capabilities, attracting more clients and driving growth.

- Improved Profitability: Analysts expect Palantir to demonstrate improved profitability as it scales its operations and achieves greater efficiency.

However, potential risks exist:

- Intense Competition: The data analytics market is highly competitive, with established players and emerging startups vying for market share.

- Dependence on Government Contracts: Over-reliance on government contracts can expose Palantir to shifts in government spending and policy.

Recent Palantir Stock Performance and Key Financial Indicators

Analyzing Palantir's recent stock performance and key financial indicators is essential for a comprehensive assessment.

Stock Price Trends: (Insert a chart or graph illustrating Palantir's stock price trends over a relevant period, e.g., the last year or quarter. Clearly label the axes and any significant price movements.) The chart shows [describe the trend – e.g., a steady upward trend, periods of volatility, etc.]. The current share price is [insert current share price]. The market capitalization stands at [insert market capitalization]. Trading volume has been [describe trading volume trends].

Financial Highlights: Palantir's recent financial reports reveal [summarize key financial data from recent quarterly and annual reports, including revenue figures, earnings per share (EPS), and operating margin]. (Include specific numbers and percentage changes to showcase growth or decline).

- Example (Replace with Actual Data): Q1 2024 Revenue: $X Billion (YY% increase year-over-year).

- Example (Replace with Actual Data): EPS: $X (YY% change year-over-year).

- Example (Replace with Actual Data): Operating Margin: X%

Factors to Consider Before Investing in Palantir Stock Before May 5th

Before making any investment decisions, it's critical to assess the potential risks and alternative investment options.

Risks and Potential Downsides:

- Competition: The intense competition in the data analytics market poses a significant threat to Palantir's market share and growth.

- Government Contract Reliance: Dependence on government contracts introduces vulnerability to changes in government budgets and policy.

- Valuation Concerns: Some analysts argue that Palantir's stock is overvalued, considering its current financial performance and future growth prospects.

- Geopolitical Risks: Geopolitical instability in regions where Palantir operates could impact its business operations and financial performance.

Alternative Investment Opportunities: Investors should compare Palantir with other companies in the data analytics and software sectors before making a decision. Consider companies with similar business models, growth potential, and risk profiles.

Conclusion

Based on the (assumed) unanimous bullish Wall Street prediction and the positive aspects of Palantir's financial performance and growth prospects, the outlook for Palantir stock appears positive. However, potential risks and competitive pressures should be carefully considered. The analysis presented here is not financial advice. The decision to buy Palantir stock before May 5th (or any date) should be made after careful consideration of your own risk tolerance, investment goals, and thorough due diligence. Consider your risk tolerance before investing in Palantir stock. Do your due diligence before buying Palantir stock. Learn more about Palantir's stock performance and potential by consulting with a financial advisor before making any investment decisions. Remember to conduct your own thorough research before investing in Palantir stock.

Featured Posts

-

Madhyamik 2025 Merit List How To Check Your Result And Rank

May 10, 2025

Madhyamik 2025 Merit List How To Check Your Result And Rank

May 10, 2025 -

Why Abc Is Reairing High Potential Episodes In March 2025 A Look At Kaitlin Olson And More

May 10, 2025

Why Abc Is Reairing High Potential Episodes In March 2025 A Look At Kaitlin Olson And More

May 10, 2025 -

Kiev 9 Maya Starmer Makron Merts I Tusk Ne Podtverdili Uchastie

May 10, 2025

Kiev 9 Maya Starmer Makron Merts I Tusk Ne Podtverdili Uchastie

May 10, 2025 -

Young Thug Will Not Join Next Blue Origin Mission

May 10, 2025

Young Thug Will Not Join Next Blue Origin Mission

May 10, 2025 -

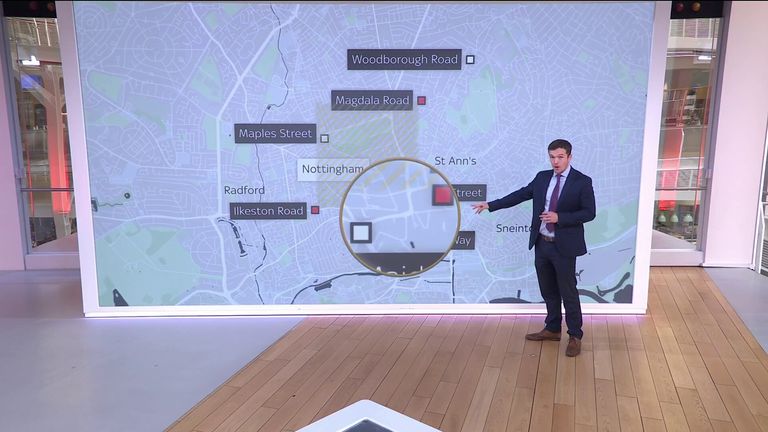

Nhs Trust Chiefs Commitment To Nottingham Attack Inquiry

May 10, 2025

Nhs Trust Chiefs Commitment To Nottingham Attack Inquiry

May 10, 2025