2% Drop In Amsterdam Stock Exchange Following Trump's Latest Tariffs

Table of Contents

Immediate Impact of the Tariffs on the AEX

The announcement of the new tariffs triggered an immediate and sharp reaction in the Amsterdam Stock Exchange. The AEX index plummeted by precisely 2%, representing a considerable loss in market capitalization. Trading volume surged significantly, indicating heightened investor activity and a scramble to adjust portfolios. This unusual trading activity was characterized by a sell-off across multiple sectors, highlighting the widespread concern generated by the news.

- Sectors Most Affected: The technology and automotive sectors were among the hardest hit. Technology companies, heavily reliant on global supply chains, faced increased costs and potential disruptions. The automotive sector, already grappling with other economic headwinds, suffered further blows from the added tariffs on imported parts.

- Individual Companies: Several prominent Dutch companies, including [insert example of a Dutch company in technology or automotive sector and its percentage drop], experienced significant share price drops, reflecting the broad-based negative impact.

- Comparison to Other Exchanges: While other European stock exchanges also felt the pressure, the AEX's 2% drop was notably steeper than the declines seen in, for example, the FTSE 100 or the CAC 40, indicating a potentially heightened sensitivity to these specific tariffs within the Dutch market.

Investor Sentiment and Market Reactions

Investor sentiment following the tariff announcement was overwhelmingly negative. A wave of uncertainty swept through the market, leading to a significant increase in selling pressure and a sharp decrease in buying activity. Financial analysts described the mood as "cautious" and "risk-averse."

- Investor Behavior: Many investors opted to liquidate assets, seeking to minimize potential losses in a rapidly changing environment. This resulted in a significant outflow of capital from the Amsterdam Stock Exchange.

- Uncertainty's Role: The lack of clarity regarding the long-term implications of these tariffs fueled uncertainty, making investors hesitant to commit to new investments. This uncertainty is a major driver of market volatility.

- Hedging Strategies: Some investors adopted hedging strategies to mitigate potential losses, such as investing in safe-haven assets like gold or government bonds. Others diversified their portfolios to reduce exposure to specific sectors vulnerable to trade disruptions.

Potential Long-Term Consequences for the Dutch Economy

The 2% drop in the AEX is not just a short-term blip; it signals potential long-term consequences for the Dutch economy. The Netherlands, as a highly export-oriented nation, is particularly vulnerable to disruptions in global trade. The interconnected nature of the global economy means that the impact of these tariffs will likely reverberate throughout various sectors.

- Impact on Exports and Imports: Dutch exports, especially those to the United States, are likely to face increased challenges due to the tariffs. This could negatively impact economic growth and potentially lead to job losses in export-dependent industries. Similarly, imported goods could become more expensive, increasing inflation.

- Effects on Employment and Economic Growth: The uncertainty created by the ongoing trade war could discourage investment and hinder economic growth. Job creation might be negatively impacted, particularly in industries heavily reliant on international trade.

- Government Response: The Dutch government is likely to monitor the situation closely and potentially implement mitigation strategies to cushion the blow to the economy. This could include support packages for affected industries or initiatives to promote diversification of trade partners.

Comparison to Previous Tariff Impacts

This recent decline in the AEX echoes previous instances where tariffs negatively impacted the Amsterdam Stock Exchange. While the specifics differ, the underlying theme remains consistent: uncertainty regarding international trade significantly affects investor confidence and market performance. Past experiences show that the market's response to tariff announcements tends to be volatile, with both short-term drops and subsequent periods of recovery.

Navigating the Aftermath of the 2% Drop on the Amsterdam Stock Exchange

The 2% drop in the AEX index underscores the significant impact of President Trump's new tariffs on the Dutch economy. The immediate reaction showcased market volatility and negative investor sentiment, while the potential long-term consequences for Dutch exports, employment, and economic growth are considerable. While uncertainty remains, understanding the historical context and potential government responses allows for a more informed outlook. It is crucial to remain informed about developments on the Amsterdam Stock Exchange and the impact of ongoing trade tensions. Further resources on understanding AEX index fluctuations and the impact of tariffs on the Amsterdam Stock Exchange performance can be found at [insert links to relevant financial news websites and resources]. Stay vigilant in monitoring Amsterdam Stock Exchange performance to navigate the complexities of this evolving situation.

Featured Posts

-

Mengungkap Sejarah Porsche 356 Warisan Zuffenhausen Jerman

May 24, 2025

Mengungkap Sejarah Porsche 356 Warisan Zuffenhausen Jerman

May 24, 2025 -

Find Your Dream Car Pts Riviera Blue Porsche 911 S T

May 24, 2025

Find Your Dream Car Pts Riviera Blue Porsche 911 S T

May 24, 2025 -

Schekotat Nervy Vzglyad Fedora Lavrova Na Pavla I I Zhanr Trillera

May 24, 2025

Schekotat Nervy Vzglyad Fedora Lavrova Na Pavla I I Zhanr Trillera

May 24, 2025 -

The Bury M62 Relief Road A Forgotten Plan

May 24, 2025

The Bury M62 Relief Road A Forgotten Plan

May 24, 2025 -

Ae Xplore England Airpark And Alexandria International Airports New Global Travel Initiative

May 24, 2025

Ae Xplore England Airpark And Alexandria International Airports New Global Travel Initiative

May 24, 2025

Latest Posts

-

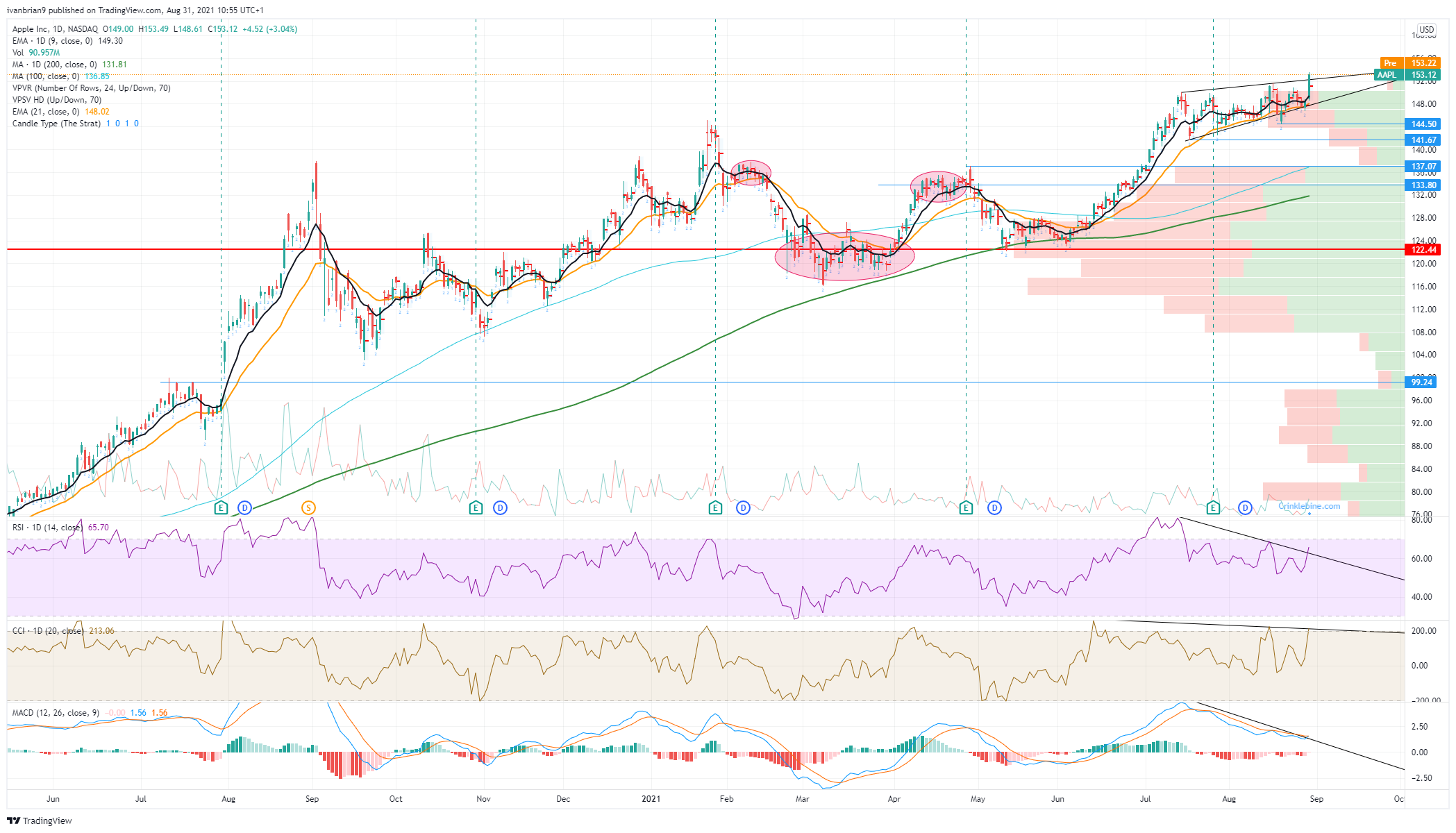

Analyzing Apple Stock Before Its Fiscal Q2 Report

May 24, 2025

Analyzing Apple Stock Before Its Fiscal Q2 Report

May 24, 2025 -

Understanding Apple Stocks Aapl Future Price Levels

May 24, 2025

Understanding Apple Stocks Aapl Future Price Levels

May 24, 2025 -

Apple Price Target Lowered But Wedbush Remains Confident What Does It Mean For Investors

May 24, 2025

Apple Price Target Lowered But Wedbush Remains Confident What Does It Mean For Investors

May 24, 2025 -

Where Will Apple Stock Aapl Go Next Key Price Level Predictions

May 24, 2025

Where Will Apple Stock Aapl Go Next Key Price Level Predictions

May 24, 2025 -

Mia Farrow And Sadie Sink Broadway Reunion Captured In Photo 5162787

May 24, 2025

Mia Farrow And Sadie Sink Broadway Reunion Captured In Photo 5162787

May 24, 2025