10-Year Mortgages In Canada: A Look At Consumer Behaviour

Table of Contents

The Appeal of 10-Year Mortgages in Canada

The increasing adoption of 10-year mortgages reflects a desire for stability and long-term financial planning.

Predictability and Financial Planning

- Long-term financial stability: A fixed interest rate for a decade provides significant financial predictability, allowing for better budgeting and long-term financial planning.

- Predictable monthly payments: Knowing your mortgage payment won't change for ten years eliminates the uncertainty associated with fluctuating interest rates.

- Protection against interest rate hikes: 10-year mortgages shield borrowers from potential interest rate increases during the term, safeguarding against unexpected financial strain.

- Budgeting ease: The consistent monthly payment simplifies budgeting and allows for better allocation of financial resources.

A fixed interest rate offers considerable peace of mind, particularly beneficial in periods of economic uncertainty. This stability allows Canadians to confidently plan for other financial goals, like saving for retirement or their children's education.

Lower Monthly Payments (Compared to Shorter Terms)

- Lower monthly payments: Spreading the mortgage amortization over a longer period results in significantly lower monthly payments.

- Increased affordability for higher purchase prices: Lower monthly payments allow individuals to afford more expensive properties, potentially entering the market at a higher price point than they might with a shorter-term mortgage.

- Potential for larger down payments: With lower monthly outlays, borrowers might be able to allocate more funds toward a larger down payment, reducing their overall interest payments and potentially shortening their mortgage term.

For example, a $500,000 mortgage amortized over 25 years will have lower monthly payments than the same mortgage amortized over 15 years. This is because the principal is spread out over a longer period, resulting in smaller monthly installments.

Factors Influencing Consumer Decisions

Several key factors influence a Canadian homeowner's decision to opt for a 10-year mortgage.

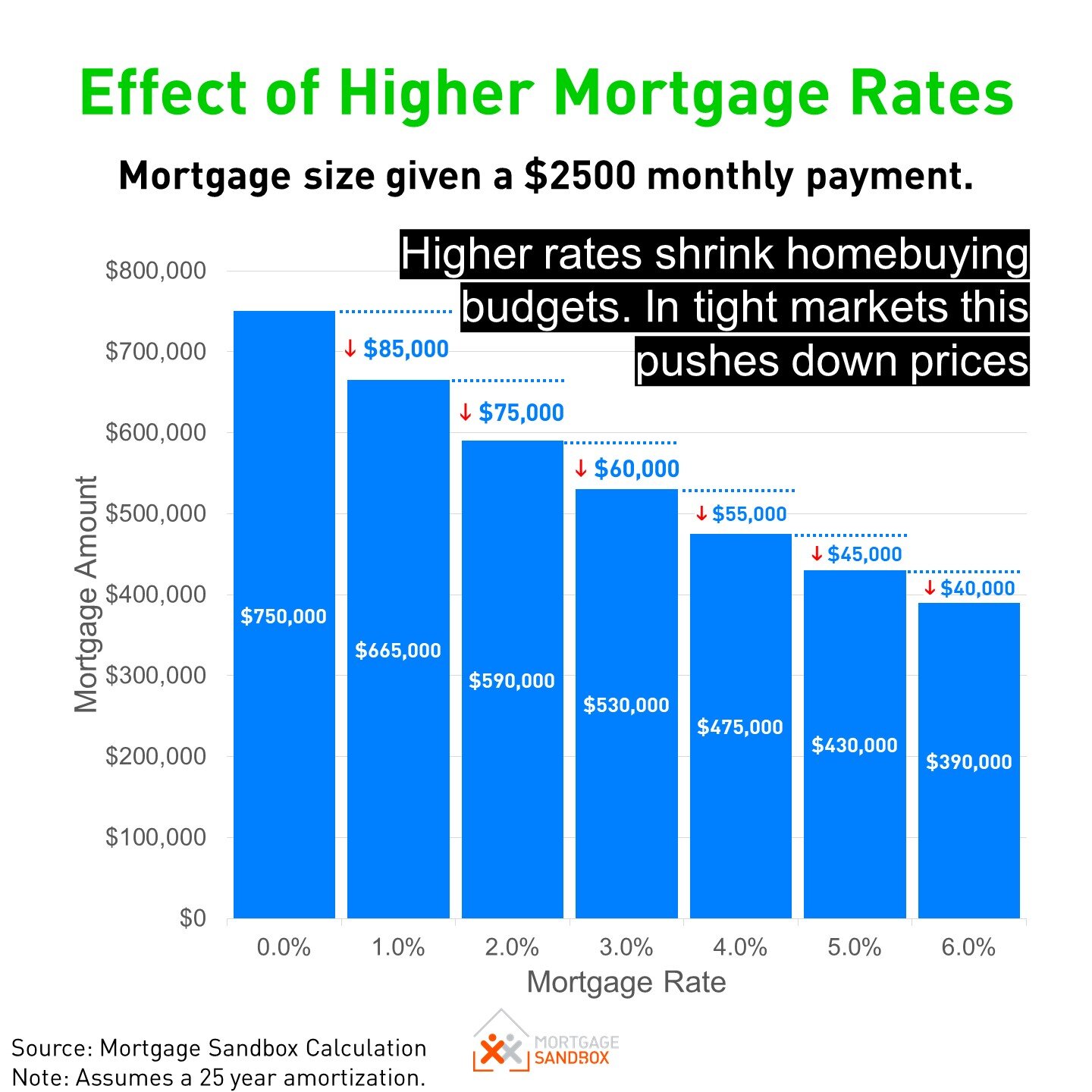

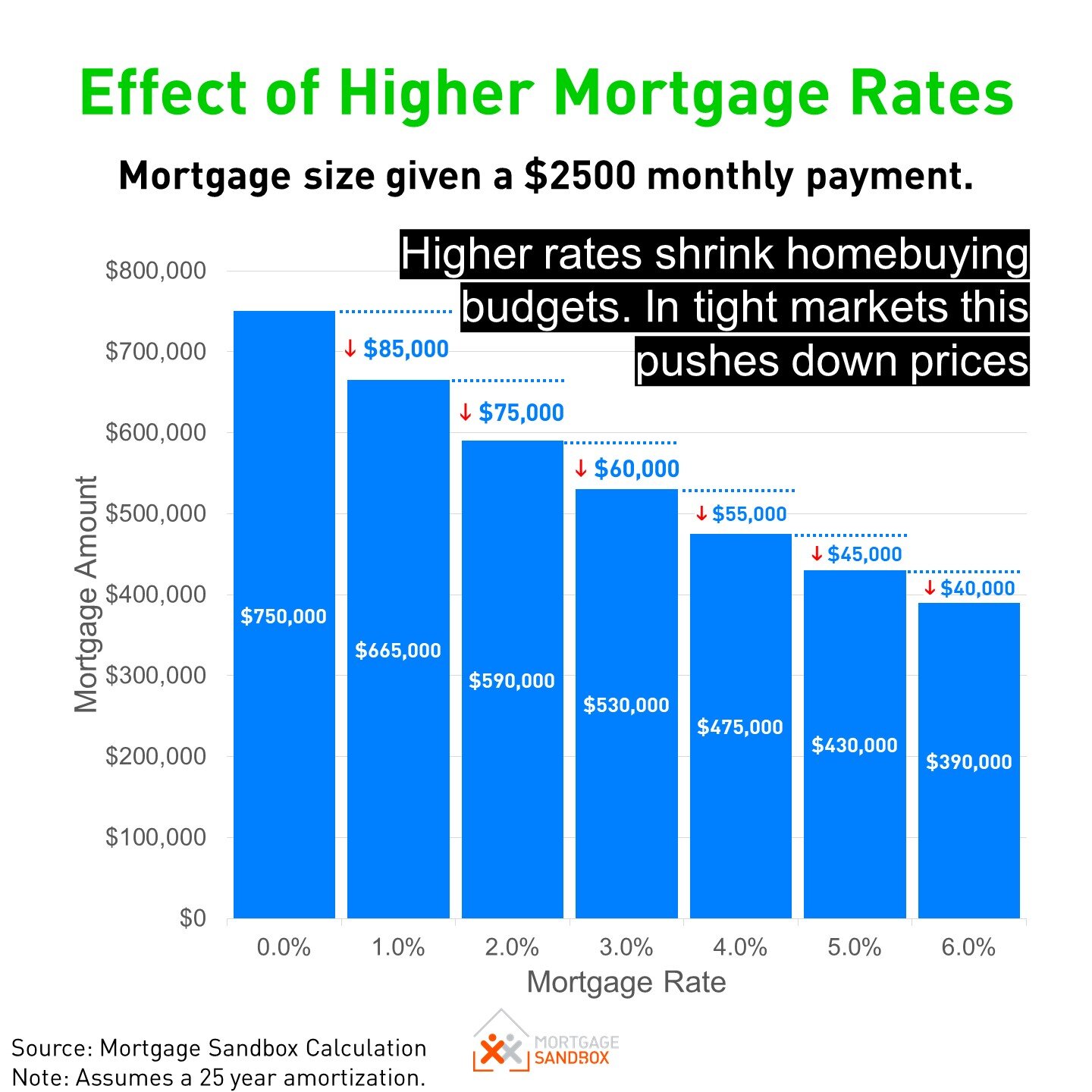

Interest Rate Environment

- Impact of current interest rates: Low interest rates make 10-year fixed-rate mortgages more attractive, as borrowers lock in a favourable rate for an extended period.

- Historical interest rate trends: Examining past interest rate fluctuations helps predict potential future rate movements, impacting the decision-making process.

- Predictions for future rates: Economic forecasts and expert opinions on future interest rate trends significantly influence whether a 10-year mortgage seems like a sound investment.

The current interest rate environment plays a crucial role. If rates are low, locking in a fixed rate for 10 years appears advantageous. Conversely, if rates are expected to rise, the appeal of a 10-year mortgage might diminish.

Personal Financial Circumstances

- Income stability: Consistent income is essential to ensure the long-term affordability of a 10-year mortgage.

- Savings: A sufficient financial cushion is crucial to manage potential unexpected expenses and mitigate risks.

- Debt levels: Existing debt obligations must be considered to assess overall financial capacity.

- Risk tolerance: Individuals with a lower risk tolerance might prefer the stability of a longer-term fixed-rate mortgage.

- Long-term financial goals: A 10-year mortgage aligns well with long-term financial planning, offering stability and predictability.

Individual circumstances vary widely. A stable income and substantial savings offer a stronger foundation for managing a 10-year mortgage.

Market Conditions

- Housing market trends: Anticipations regarding future house price appreciation influence the perceived value of a long-term mortgage commitment.

- Availability of properties: Market conditions can impact the overall feasibility of securing a 10-year mortgage, depending on the availability of suitable properties.

- Potential for home price appreciation: If the housing market is expected to grow significantly, a 10-year mortgage allows borrowers to benefit from potential home equity growth.

The Canadian real estate market plays a significant role. A buoyant market might encourage individuals to commit to a longer-term mortgage.

Potential Downsides and Considerations

While appealing, 10-year mortgages present potential drawbacks that need careful consideration.

Prepayment Penalties

- Understanding prepayment penalties: These penalties are incurred if the mortgage is paid off early. They can be substantial with a 10-year mortgage.

- Strategies for minimizing penalties: Understanding the terms and conditions, and exploring potential strategies to minimize penalties, are crucial.

- Potential financial implications: Unexpected life changes, such as job relocation, might trigger substantial prepayment penalties.

Borrowers must fully understand the associated penalties before committing to a 10-year term. Consulting a mortgage professional is highly recommended.

Interest Rate Risk (Long Term)

- Potential for higher interest rates in the future: While locking in a rate is beneficial, it also means missing out on potential rate decreases in the future.

- Impact on refinancing options: Refinancing after ten years might be more expensive than if shorter-term mortgages were used, especially if interest rates have decreased.

The risk lies in potentially missing out on lower interest rates available in the future.

Lifestyle Changes and Flexibility

- Consideration for future life changes: Unforeseen circumstances, such as job loss, relocation, or family growth, could impact the ability to maintain the mortgage payments.

- Potential inflexibility of a 10-year term: Compared to shorter-term mortgages, 10-year mortgages offer less flexibility to adjust to changing circumstances.

A 10-year mortgage requires careful consideration of long-term stability and commitment, potentially limiting flexibility in response to unexpected events.

Comparing 10-Year Mortgages to Other Options

Considering alternatives helps determine the suitability of a 10-year mortgage.

5-Year Mortgages

- Comparison of interest rates: 5-year mortgages offer more frequent opportunities to renegotiate rates, potentially benefiting from lower rates in the future.

- Flexibility: 5-year terms provide greater flexibility in adapting to changing financial circumstances.

- Financial commitment: The shorter commitment period involves less financial risk.

5-year mortgages offer more flexibility but less long-term stability than 10-year options.

Variable Rate Mortgages

- Comparison of interest rates: Variable rate mortgages offer potentially lower initial interest rates compared to fixed rates.

- Potential savings: If interest rates decrease, variable rate mortgages may offer significant savings.

- Risks associated with variable rates: However, increasing rates can lead to substantially higher monthly payments.

Variable rate mortgages provide potential savings but introduce greater uncertainty regarding monthly payments.

Conclusion

Consumer behaviour surrounding 10-year mortgages in Canada indicates a growing preference for long-term financial stability and predictability. While offering lower monthly payments and protection against rate hikes, they also carry risks, including substantial prepayment penalties and less flexibility compared to shorter-term options. Therefore, carefully weigh your personal financial circumstances, risk tolerance, and long-term goals before making a decision. Research 10-year mortgage options thoroughly, and consult a financial advisor to determine if a 10-year mortgage in Canada is the right choice for you. Learn more about the benefits and drawbacks of long-term mortgages to make an informed decision.

Featured Posts

-

Kontrowersyjny Eksport Trotylu Z Polski Analiza Zamowienia

May 06, 2025

Kontrowersyjny Eksport Trotylu Z Polski Analiza Zamowienia

May 06, 2025 -

A 3 7 Billion Deal Gold Fields To Buy Gold Road

May 06, 2025

A 3 7 Billion Deal Gold Fields To Buy Gold Road

May 06, 2025 -

Exploring The B J Novak And Mindy Kaling Relationship Friends More Than Friends

May 06, 2025

Exploring The B J Novak And Mindy Kaling Relationship Friends More Than Friends

May 06, 2025 -

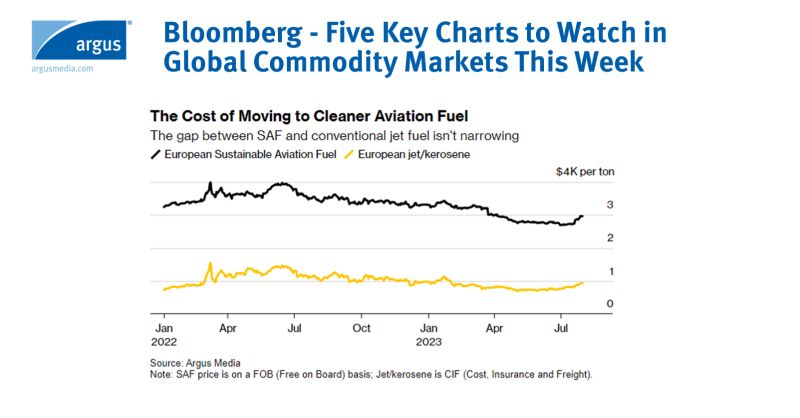

Global Commodity Markets 5 Key Charts To Watch Now

May 06, 2025

Global Commodity Markets 5 Key Charts To Watch Now

May 06, 2025 -

Who Will Win Sam Altman And Elon Musks Competition To Create The Next Generation Everything App

May 06, 2025

Who Will Win Sam Altman And Elon Musks Competition To Create The Next Generation Everything App

May 06, 2025

Latest Posts

-

Duze Zamowienie Trotylu Polska Na Swiatowym Rynku Materialow Wybuchowych

May 06, 2025

Duze Zamowienie Trotylu Polska Na Swiatowym Rynku Materialow Wybuchowych

May 06, 2025 -

Polska I Eksport Trotylu Rzut Oka Na Duze Zamowienie

May 06, 2025

Polska I Eksport Trotylu Rzut Oka Na Duze Zamowienie

May 06, 2025 -

Zamowienie Na Trotyl Z Polski Implikacje Dla Bezpieczenstwa

May 06, 2025

Zamowienie Na Trotyl Z Polski Implikacje Dla Bezpieczenstwa

May 06, 2025 -

Analyzing The Popularity Of Leon Thomas And Halle Baileys Rather Be Alone

May 06, 2025

Analyzing The Popularity Of Leon Thomas And Halle Baileys Rather Be Alone

May 06, 2025 -

Kontrowersyjny Eksport Trotylu Z Polski Analiza Zamowienia

May 06, 2025

Kontrowersyjny Eksport Trotylu Z Polski Analiza Zamowienia

May 06, 2025