A$3.7 Billion Deal: Gold Fields To Buy Gold Road

Table of Contents

Deal Details and Financial Implications

The A$3.7 billion acquisition of Gold Road Resources by Gold Fields represents a substantial investment in the Australian gold mining sector. The deal structure likely involves a combination of cash and shares, offering Gold Road shareholders a premium over the company's prevailing market value. Gold Fields’ financing strategy will be crucial in successfully executing this acquisition. Securing adequate funding and managing potential increases in debt levels will be key considerations. The specifics of the financing, including the proportion of cash versus shares and the potential impact on Gold Fields’ credit rating, remain to be fully detailed. However, the size of the deal suggests a significant financial commitment from Gold Fields.

- Acquisition price per share: (To be confirmed upon official announcement)

- Expected closing date: (To be confirmed upon official announcement)

- Potential impact on Gold Fields' debt levels: Significant increase likely, requiring careful management.

- Synergies and cost savings anticipated: Integration of operations should lead to economies of scale and cost reductions.

Strategic Rationale for Gold Fields

Gold Fields' acquisition of Gold Road is driven by a strategic imperative to expand its gold reserves and enhance its operational footprint. Gold Road's primary asset, the Gruyere gold mine in the prolific Yilgarn region of Western Australia, is a key driver of this deal. This acquisition significantly bolsters Gold Fields’ existing portfolio, providing access to high-quality gold reserves and production capacity. The Yilgarn region is known for its rich gold deposits, making this a strategically sound move for expansion. The acquisition aligns with Gold Fields' broader strategy of consolidating its position as a major player in the global gold mining industry.

- Access to high-quality gold reserves in the Yilgarn region: This ensures a stable long-term supply of gold.

- Diversification of Gold Fields' asset portfolio: Reduces dependence on individual mines and mitigates risk.

- Potential for operational synergies and cost reductions: Combining operations will likely lead to efficiency gains.

- Strengthening of Gold Fields' market position: Increases market share and competitive advantage.

Impact on Gold Road Shareholders and Employees

The acquisition presents a significant opportunity for Gold Road shareholders, who stand to receive a premium for their shares based on the offer price. The offer price per share (to be announced officially) will determine the financial gain for Gold Road investors. For Gold Road employees, the integration into Gold Fields presents both opportunities and uncertainties. While job security may be affected initially, there is potential for career advancement within a larger, more diversified company. The successful integration will require careful planning and communication to ensure a smooth transition for the workforce. Regulatory approvals from relevant authorities will be required before the deal can be finalized.

- Offer price per share for Gold Road shareholders: (To be confirmed upon official announcement)

- Expected timeline for the integration of Gold Road into Gold Fields: (To be confirmed upon official announcement)

- Potential changes to operational structure and management: Integration will likely lead to some restructuring.

- Future outlook for employment within the combined entity: Potential for both job losses and new opportunities.

Market Reaction and Industry Analysis

The market's reaction to the Gold Fields acquisition of Gold Road will be closely watched. Post-announcement stock price movements of both Gold Fields and Gold Road will provide insights into investor sentiment. Analyst reports will offer diverse perspectives on the deal’s strategic merits, considering factors such as valuation, synergies, and the impact on future profitability. This acquisition could trigger a wave of consolidation within the gold mining sector, prompting further mergers and acquisitions as companies strive to expand their operations and increase efficiency. The prevailing gold price will also significantly influence the transaction's long-term success.

- Stock price performance of Gold Fields and Gold Road post-announcement: A key indicator of market sentiment.

- Analyst commentary on the deal's strategic merit: Diverse opinions are expected.

- Potential impact on competitor companies: May trigger a response from rivals.

- Predictions for future gold mining consolidation: Increased activity is anticipated.

Conclusion: The Future of Gold Fields and the Gold Mining Industry Post-Acquisition

The A$3.7 billion acquisition of Gold Road Resources by Gold Fields marks a significant turning point for both companies and the broader gold mining landscape. This deal underscores the ongoing consolidation within the sector, driven by the need for efficiency gains, access to high-quality reserves, and strengthened market positions. The strategic rationale for the acquisition is clear: access to Gruyere’s gold reserves in the Yilgarn region, operational synergies, and overall market share growth. The long-term success will depend on effective integration, careful financial management, and the prevailing gold price. Further research into the Gold Road Resources assets and their integration into the Gold Fields portfolio is crucial for a complete understanding of the deal's impact. Stay informed about future developments in the gold mining industry following this significant Gold Fields acquisition. Monitor the evolving gold price and its influence on the mining sector's activities.

Featured Posts

-

The Trump Administration And Trade A Balancing Act Between Deals And Economic Stability

May 06, 2025

The Trump Administration And Trade A Balancing Act Between Deals And Economic Stability

May 06, 2025 -

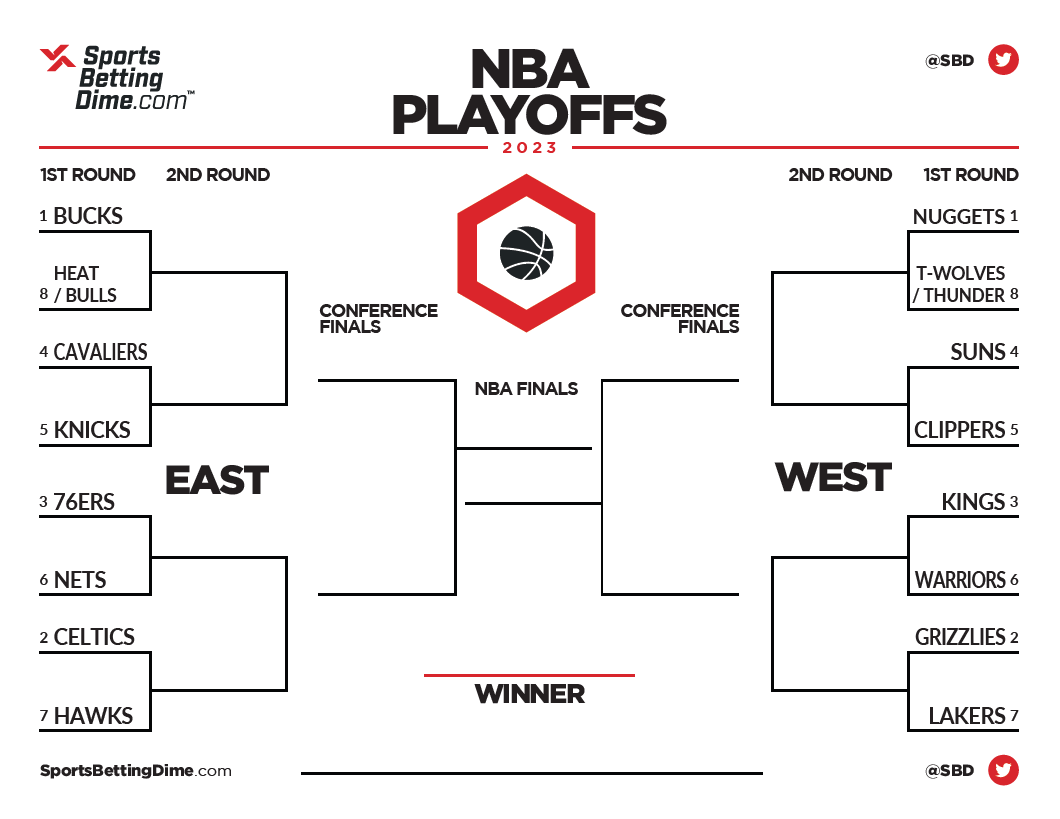

Knicks Vs Celtics 2025 Nba Playoffs Where To Watch

May 06, 2025

Knicks Vs Celtics 2025 Nba Playoffs Where To Watch

May 06, 2025 -

Romania Votes Far Right And Centrist Candidates Vie For Presidency

May 06, 2025

Romania Votes Far Right And Centrist Candidates Vie For Presidency

May 06, 2025 -

The Countrys Top New Business Locations A Comprehensive Map

May 06, 2025

The Countrys Top New Business Locations A Comprehensive Map

May 06, 2025 -

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025

Latest Posts

-

Spak Kontrollon Banesen E Motrave Nikolli

May 06, 2025

Spak Kontrollon Banesen E Motrave Nikolli

May 06, 2025 -

The End Of An Era Sex Lives Of College Girls Cancelled After Two Seasons

May 06, 2025

The End Of An Era Sex Lives Of College Girls Cancelled After Two Seasons

May 06, 2025 -

Sex Lives Of College Girls Cancelled Why The Show Wont Return

May 06, 2025

Sex Lives Of College Girls Cancelled Why The Show Wont Return

May 06, 2025 -

The Sex Lives Of College Girls Hbo Max Cancels Hit Show

May 06, 2025

The Sex Lives Of College Girls Hbo Max Cancels Hit Show

May 06, 2025 -

New Hulu Series Mindy Kalings Adult Comedy

May 06, 2025

New Hulu Series Mindy Kalings Adult Comedy

May 06, 2025