Yuan Support Measures Underwhelm: PBOC's 2024 Intervention

Table of Contents

Analyzing the PBOC's 2024 Yuan Support Measures

The PBOC has employed a range of measures in 2024 to support the Yuan, yet the CNY weakness persists. Let's examine these interventions and their impact:

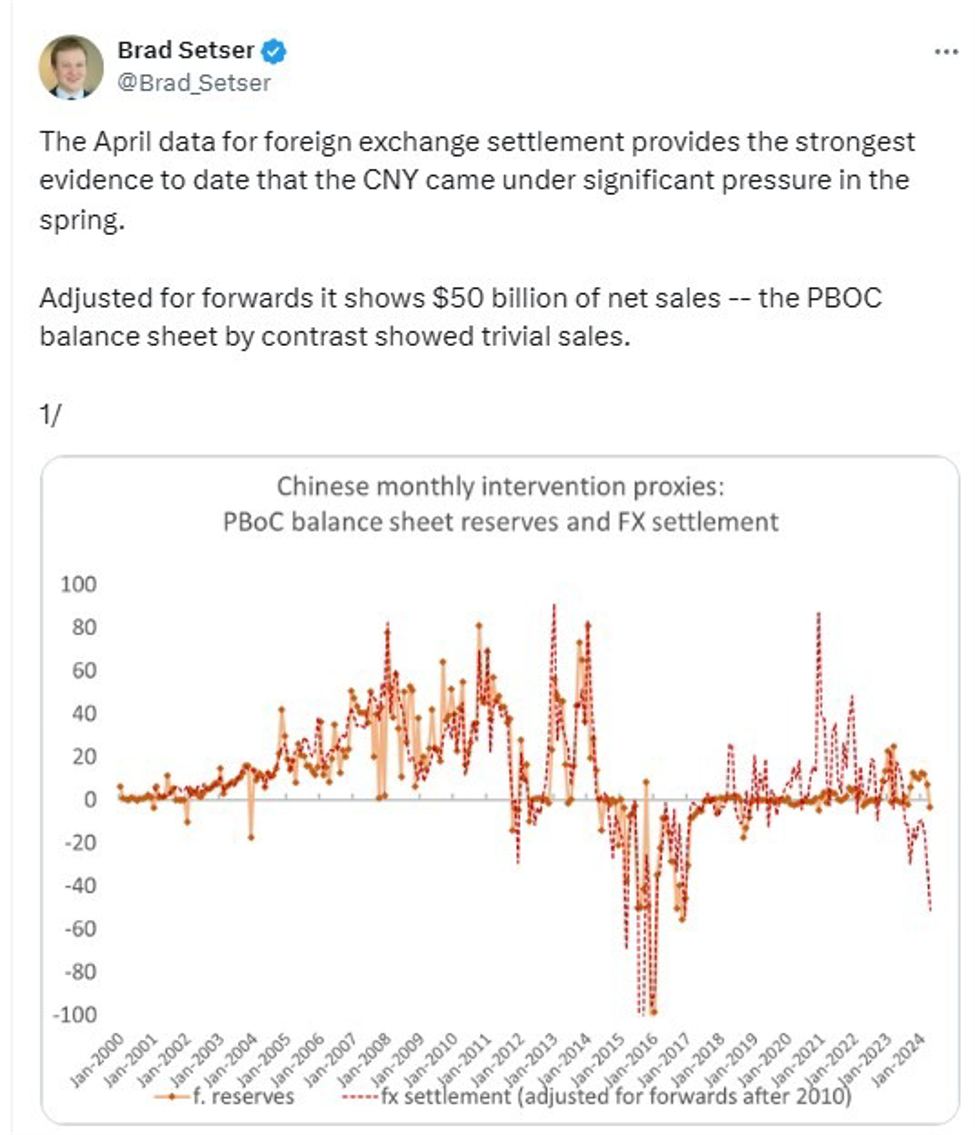

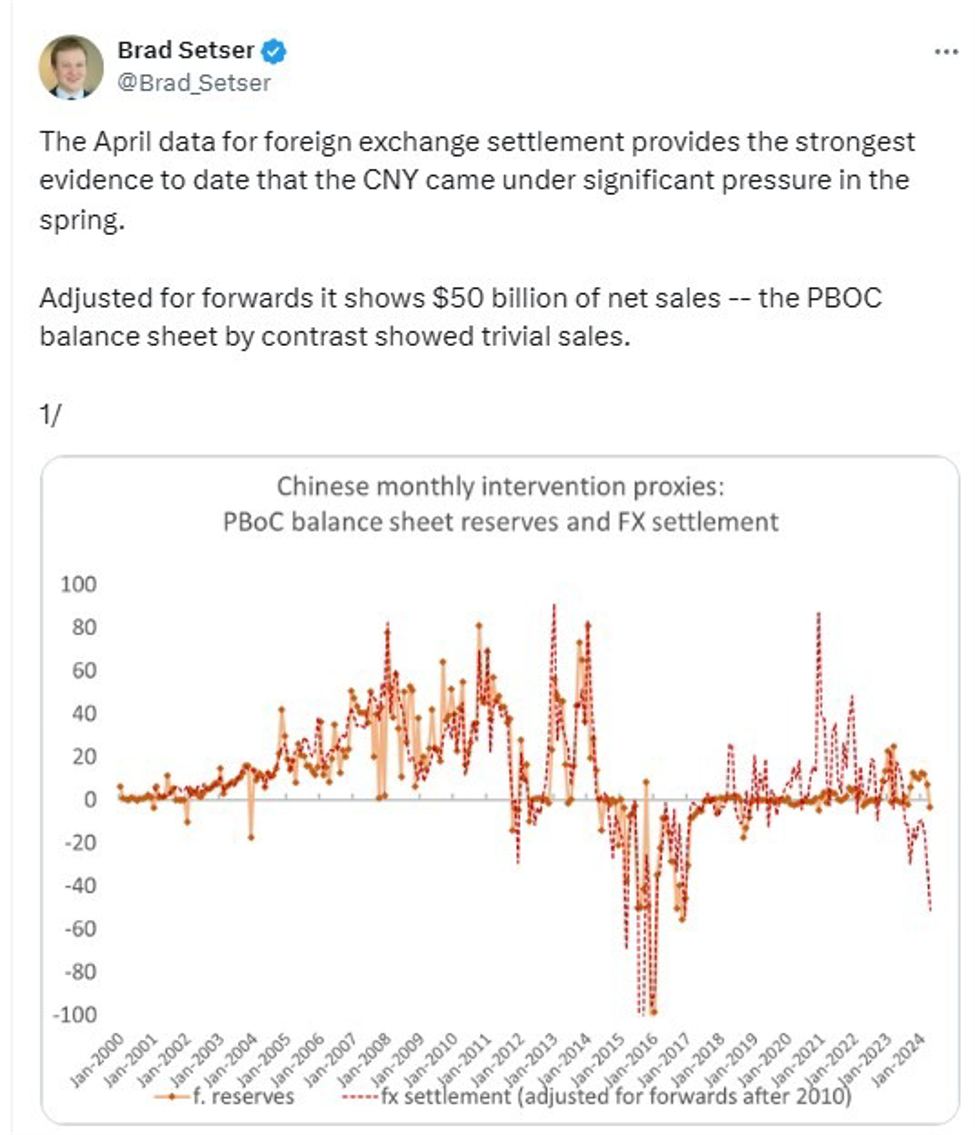

Foreign Exchange Reserve Management

The PBOC has utilized several tools to manage foreign exchange reserves and influence the Yuan's value:

- Increased foreign exchange sales: The PBOC has reportedly sold significant amounts of US dollars to increase the supply of Yuan in the market, aiming to boost its value.

- Adjustments to reserve requirements: Changes to reserve requirements for banks can influence their lending capacity and indirectly impact the Yuan's exchange rate.

- Verbal interventions: The PBOC has issued statements reiterating its commitment to maintaining stability in the foreign exchange market.

However, these measures have proven insufficient to halt the Yuan's decline. The effectiveness has been hampered by larger global economic forces and a lack of confidence in the Chinese economy. Some analysts suggest the scale of intervention hasn't been sufficient to counter the significant pressure on the CNY. Conversely, others argue that the PBOC's actions have prevented a more dramatic fall, acting as a crucial buffer against more significant devaluation.

Interest Rate Adjustments and Monetary Policy

The PBOC has also adjusted interest rates to influence the Yuan's value and broader economic activity:

- Changes in benchmark lending rates: Adjustments to the Loan Prime Rate (LPR) aim to stimulate borrowing and economic growth, potentially boosting demand for the Yuan.

- Impact on borrowing costs: Lower interest rates can encourage investment and consumption, indirectly supporting the currency.

While intended to stimulate the economy and indirectly support the Yuan, these interest rate adjustments haven't fully offset the negative impacts of global economic uncertainty and domestic challenges. The effectiveness is further complicated by the fact that US interest rates remain higher, making dollar-denominated assets more attractive to international investors. This outflow of capital puts downward pressure on the Yuan, regardless of domestic monetary policy.

Underlying Factors Contributing to Yuan Weakness

The Yuan's weakness is not solely attributable to the PBOC's policies; several significant underlying factors are at play:

Geopolitical Risks and Trade Tensions

Geopolitical uncertainties significantly impact investor sentiment towards the Yuan:

- US-China relations: Strained relations between the US and China create uncertainty and deter foreign investment, weakening demand for the Yuan.

- Taiwan tensions: Escalating tensions around Taiwan further contribute to investor apprehension and capital flight.

- Global trade uncertainty: Protectionist trade policies and global trade disputes create an unpredictable environment, negatively affecting the Yuan.

These risks erode investor confidence, leading to capital outflows and putting downward pressure on the CNY's exchange rate.

Domestic Economic Challenges

Internal economic headwinds further contribute to the Yuan's weakness:

- Slowing economic growth: China's economic growth has slowed, making the country less attractive for foreign investment.

- Property market downturn: The ongoing crisis in China's real estate sector impacts investor confidence and economic stability.

- High debt levels: High levels of corporate and government debt create vulnerabilities within the Chinese economy.

These domestic challenges undermine investor confidence and reduce the appeal of the Yuan, exacerbating its decline against other major currencies.

Market Reactions and Future Outlook for the Yuan

The market's reaction to the PBOC's interventions and the underlying economic factors has been mixed:

Investor Sentiment and Capital Flows

- Capital outflows: Investor concerns have led to significant capital outflows from China, increasing pressure on the Yuan.

- Changes in foreign investment: Foreign direct investment (FDI) into China has slowed, further weakening demand for the Yuan.

Negative investor sentiment and capital flight directly contribute to the Yuan's weakening exchange rate.

Predictions and Potential Scenarios

Predicting the future of the Yuan is challenging, but several scenarios are possible:

- Continued gradual devaluation: The Yuan may experience a slow but steady decline against the dollar if current trends persist.

- Increased PBOC intervention: The PBOC might intensify its interventions, potentially through more aggressive foreign exchange sales or further interest rate adjustments. The effectiveness of such measures remains uncertain.

- Stabilization and recovery: A combination of improved domestic economic performance and reduced geopolitical risks could lead to Yuan stabilization and potential appreciation.

Conclusion: The Future of Yuan Support Measures

The PBOC's 2024 Yuan support measures have proven insufficient to counteract the ongoing CNY weakness. Underlying factors, including geopolitical risks, domestic economic challenges, and global economic conditions, have significantly impacted the Yuan's performance despite the PBOC's interventions. The effectiveness of future PBOC intervention remains questionable, and the outlook for the Yuan depends heavily on resolving these underlying issues. Stay informed about the ongoing developments impacting the Yuan and the effectiveness of future PBOC interventions by subscribing to our newsletter.

Featured Posts

-

Belgica Vs Portugal 0 1 Cronica Goles Y Resumen Del Encuentro

May 16, 2025

Belgica Vs Portugal 0 1 Cronica Goles Y Resumen Del Encuentro

May 16, 2025 -

Open Ai Simplifies Voice Assistant Development 2024 Event Highlights

May 16, 2025

Open Ai Simplifies Voice Assistant Development 2024 Event Highlights

May 16, 2025 -

Uk And Ireland Broadcast Rights For La Liga A New Tender Process Begins

May 16, 2025

Uk And Ireland Broadcast Rights For La Liga A New Tender Process Begins

May 16, 2025 -

Voennaya Agressiya Rf Masshtabnaya Ataka Na Ukrainu S Primeneniem Bolee 200 Raket I Dronov

May 16, 2025

Voennaya Agressiya Rf Masshtabnaya Ataka Na Ukrainu S Primeneniem Bolee 200 Raket I Dronov

May 16, 2025 -

The Potential For Surveillance Examining The Risks Of Ai In Mental Healthcare

May 16, 2025

The Potential For Surveillance Examining The Risks Of Ai In Mental Healthcare

May 16, 2025

Latest Posts

-

Recruiting Challenges For The Miami Heat Insights From Jimmy Butlers Time With The Warriors

May 16, 2025

Recruiting Challenges For The Miami Heat Insights From Jimmy Butlers Time With The Warriors

May 16, 2025 -

Miami Heats Future Star Problem Lessons From Jimmy Butlers Golden State Connection

May 16, 2025

Miami Heats Future Star Problem Lessons From Jimmy Butlers Golden State Connection

May 16, 2025 -

Finding Stability Microsoft In The Face Of Global Trade Tensions

May 16, 2025

Finding Stability Microsoft In The Face Of Global Trade Tensions

May 16, 2025 -

Jimmy Butlers Game 6 Picks Analyzing Rockets Vs Warriors Betting Odds

May 16, 2025

Jimmy Butlers Game 6 Picks Analyzing Rockets Vs Warriors Betting Odds

May 16, 2025 -

Jimmy Butlers Warriors Connection Why Miami Heat Might Face Recruiting Challenges

May 16, 2025

Jimmy Butlers Warriors Connection Why Miami Heat Might Face Recruiting Challenges

May 16, 2025