XRP's Uncertain Future: A Look At The Derivatives Market

Table of Contents

The Impact of the SEC Lawsuit on XRP Derivatives Trading

The SEC lawsuit casts a long shadow over XRP, influencing investor confidence and trading volumes in the XRP derivatives market. This uncertainty creates a complex and dynamic trading environment.

Regulatory Uncertainty and Market Sentiment

The unpredictable nature of the legal proceedings directly impacts market sentiment and trading activity.

- Increased volatility: Uncertain legal outcomes lead to significant price swings in XRP, making XRP derivatives trading exceptionally risky. Positive news regarding the lawsuit can trigger price surges, while negative news can cause sharp declines.

- Reduced trading volume: Some exchanges, wary of potential regulatory repercussions, have reduced or even halted XRP derivatives trading, limiting liquidity and impacting market depth.

- Shifting market sentiment: Investor sentiment fluctuates dramatically based on news and developments in the lawsuit. Positive rulings or settlements tend to boost confidence, while negative developments can trigger sell-offs.

Implications for Derivatives Pricing

The lawsuit's outcome profoundly influences XRP derivatives pricing, creating both substantial profit and loss opportunities.

- Options contracts: The price of XRP options reflects the market's uncertainty about XRP's future price. Options prices tend to increase when uncertainty is high, reflecting the increased risk associated with the underlying asset.

- Futures contracts: Futures contracts, while offering a hedging mechanism, are highly sensitive to news regarding the SEC lawsuit. Significant price movements in the spot market directly translate into fluctuations in futures prices.

- Implied volatility: The implied volatility of XRP derivatives – a measure of expected price fluctuations – often spikes during crucial moments in the lawsuit, indicating heightened market uncertainty.

Analyzing the XRP Derivatives Market Landscape

Understanding the types of XRP derivatives and the exchanges offering them is crucial for informed trading.

Types of XRP Derivatives Available

Several types of XRP derivatives cater to various trading strategies and risk appetites.

- Futures contracts: These agreements obligate the buyer to purchase or the seller to sell XRP at a predetermined price on a specified future date. They are commonly used for hedging or speculation.

- Options contracts: These grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) XRP at a specific price (strike price) before or on a certain date (expiration date). They offer flexibility and risk management tools.

- Perpetual swaps: These leveraged contracts allow traders to maintain long or short positions indefinitely, offering high potential returns but also significant risk due to leverage.

Major Exchanges Offering XRP Derivatives

Several cryptocurrency exchanges offer XRP derivatives trading, each with its own characteristics.

- Exchange A: (Insert exchange name and relevant details, e.g., trading volume, fees, margin requirements). Note: Replace "Exchange A" with actual exchange names and provide accurate data.

- Exchange B: (Insert exchange name and relevant details).

- Exchange C: (Insert exchange name and relevant details).

- Analyzing the market share of each exchange helps determine liquidity and potential price discrepancies.

- Comparing fees, margin requirements, and contract specifications across platforms is vital for optimizing trading costs and risk management.

- The concentration of XRP derivatives trading on specific platforms can impact liquidity and price discovery.

Risk Management in XRP Derivatives Trading

Effective risk management is paramount when trading XRP derivatives given the inherent volatility and legal uncertainties.

Understanding Volatility and Leverage

The high volatility of XRP and the use of leverage in derivatives amplify both potential profits and losses.

- Risk assessment: Thoroughly assess the potential risks before entering any XRP derivative trade. This involves understanding the impact of leverage and price fluctuations.

- Risk management strategies: Employ strategies such as stop-loss orders (automatically closing a position when it reaches a predetermined loss) and position sizing (limiting the amount invested in a single trade) to control risk.

- Over-leveraging: Avoid over-leveraging, as this significantly increases the potential for substantial losses. Start with small positions and gradually increase exposure as your understanding and experience grow.

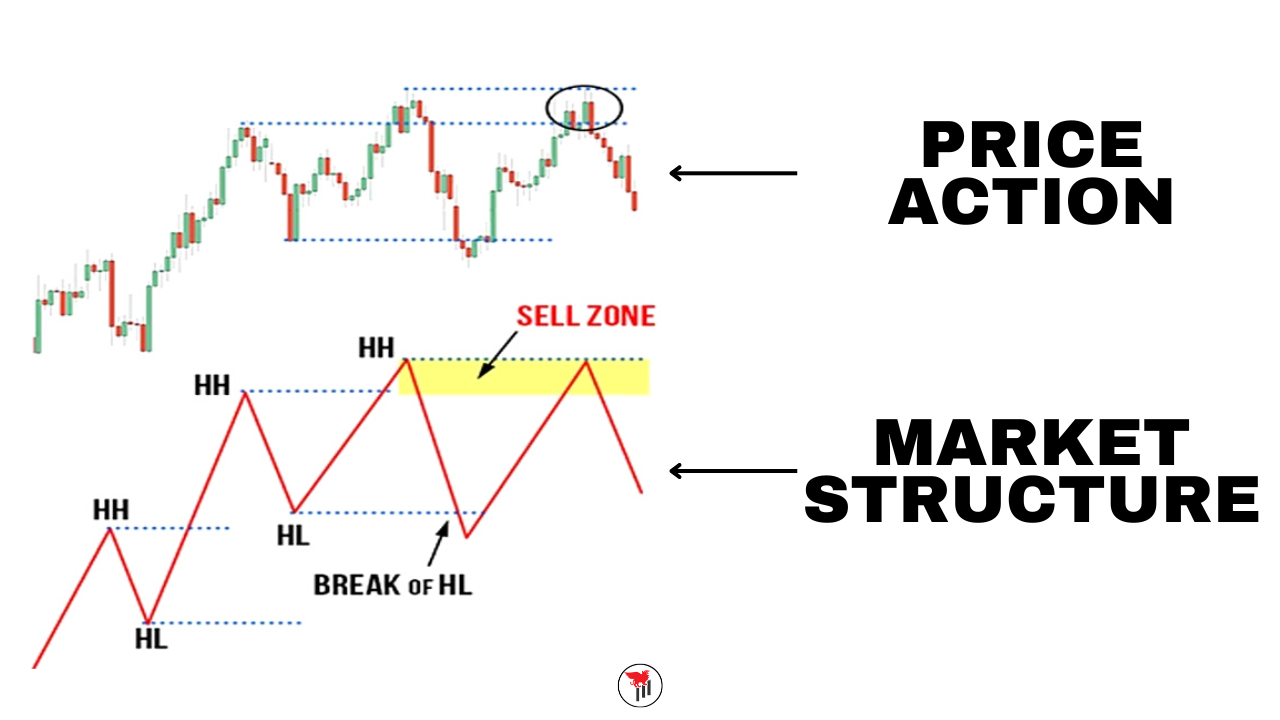

The Role of Fundamental Analysis and Technical Analysis

Combining fundamental and technical analysis provides a more comprehensive view of the XRP market.

- Fundamental analysis: Analyze news related to the SEC lawsuit, Ripple's technological developments, and broader adoption of XRP to understand the underlying value proposition.

- Technical analysis: Use price charts, indicators, and other technical tools to identify potential trading opportunities and predict price movements.

- Combined approach: Integrating both fundamental and technical analysis offers a more balanced approach to decision-making, enhancing trading performance while mitigating risks.

Conclusion

The XRP derivatives market offers exciting opportunities but also presents substantial risks. The ongoing SEC lawsuit introduces significant uncertainty and volatility, demanding a cautious and informed approach. Successful trading in XRP derivatives necessitates a thorough understanding of the legal landscape, market dynamics, and robust risk management techniques. Before entering this market, conduct thorough research, understand the associated risks, and only invest what you can afford to lose. By carefully analyzing market trends, employing effective risk management strategies, and staying informed about the legal developments surrounding XRP, traders can potentially navigate the uncertainties and make well-informed decisions in this complex and volatile market. Learn more about managing your risk in the volatile world of XRP derivatives and other cryptocurrency derivatives.

Featured Posts

-

Analisi Del Conclave L Influenza Dei Cardinali Del Sud Del Mondo E Delle Periferie Nella Scelta Del Successore Di Papa Francesco

May 07, 2025

Analisi Del Conclave L Influenza Dei Cardinali Del Sud Del Mondo E Delle Periferie Nella Scelta Del Successore Di Papa Francesco

May 07, 2025 -

Fantastic Four And Superman A 2024 Box Office Showdown

May 07, 2025

Fantastic Four And Superman A 2024 Box Office Showdown

May 07, 2025 -

The Rise Of A European Streaming Platform Macrons Influence

May 07, 2025

The Rise Of A European Streaming Platform Macrons Influence

May 07, 2025 -

Lotto 6aus49 Ergebnisse And Gewinnzahlen Mittwoch 9 4 2025

May 07, 2025

Lotto 6aus49 Ergebnisse And Gewinnzahlen Mittwoch 9 4 2025

May 07, 2025 -

The Minnesota Timberwolves Fate Riding On Chris Finchs Strategic Choices

May 07, 2025

The Minnesota Timberwolves Fate Riding On Chris Finchs Strategic Choices

May 07, 2025

Latest Posts

-

Dogecoin Shiba Inu And Sui Price Surge Reasons Behind The Rally

May 08, 2025

Dogecoin Shiba Inu And Sui Price Surge Reasons Behind The Rally

May 08, 2025 -

Why Reliability And Trust Are Crucial In Todays Crypto News Landscape

May 08, 2025

Why Reliability And Trust Are Crucial In Todays Crypto News Landscape

May 08, 2025 -

Understanding Ethereums Price A Comprehensive Analysis Of Market Factors And Future Trends

May 08, 2025

Understanding Ethereums Price A Comprehensive Analysis Of Market Factors And Future Trends

May 08, 2025 -

Ethereums Price Trajectory A Deep Dive Into Market Dynamics And Future Predictions

May 08, 2025

Ethereums Price Trajectory A Deep Dive Into Market Dynamics And Future Predictions

May 08, 2025 -

Predicting The Future Of Ethereum A Comprehensive Price Forecast

May 08, 2025

Predicting The Future Of Ethereum A Comprehensive Price Forecast

May 08, 2025