XRP's Meteoric Rise: Is Now The Time To Invest In Ripple?

Table of Contents

Understanding XRP and Ripple's Technology

Ripple's Payment Solution: Revolutionizing Cross-Border Payments

RippleNet, Ripple's payment solution, leverages blockchain technology to facilitate faster, cheaper, and more secure cross-border payments. This is achieved through a network connecting banks and financial institutions globally. The adoption of RippleNet by institutional players is a key factor driving XRP's value and potential.

- Speed: Transactions are processed significantly faster than traditional methods.

- Cost-effectiveness: Reduced transaction fees compared to SWIFT and other traditional systems.

- Security: Utilizing blockchain's inherent security features for enhanced transaction safety.

- Transparency: Provides real-time tracking and traceability of transactions.

XRP plays a crucial role within RippleNet, acting as a bridge currency to facilitate conversions between different fiat currencies. This ensures smooth and efficient transactions across borders, even when dealing with various currencies.

XRP's Unique Characteristics: A Deep Dive into the Cryptocurrency

XRP utilizes a unique consensus mechanism, distinct from Proof-of-Work (like Bitcoin) or Proof-of-Stake (like Ethereum). Its total supply is capped at 100 billion XRP, unlike Bitcoin's unlimited potential supply. This controlled supply is intended to manage inflation and maintain value. XRP boasts significantly faster transaction speeds than Bitcoin and Ethereum, making it a more efficient option for high-volume transactions.

- Advantages over Bitcoin: Faster transaction speeds, lower transaction fees.

- Advantages over Ethereum: Lower energy consumption, potentially higher transaction throughput.

- Disadvantages: Centralized nature of Ripple (compared to the decentralized nature of Bitcoin and Ethereum), susceptibility to regulatory changes. High market capitalization, meaning large price swings can cause significant losses for investors.

Analyzing XRP's Price History and Market Trends

Past Performance and Volatility: A Look at Historical Data

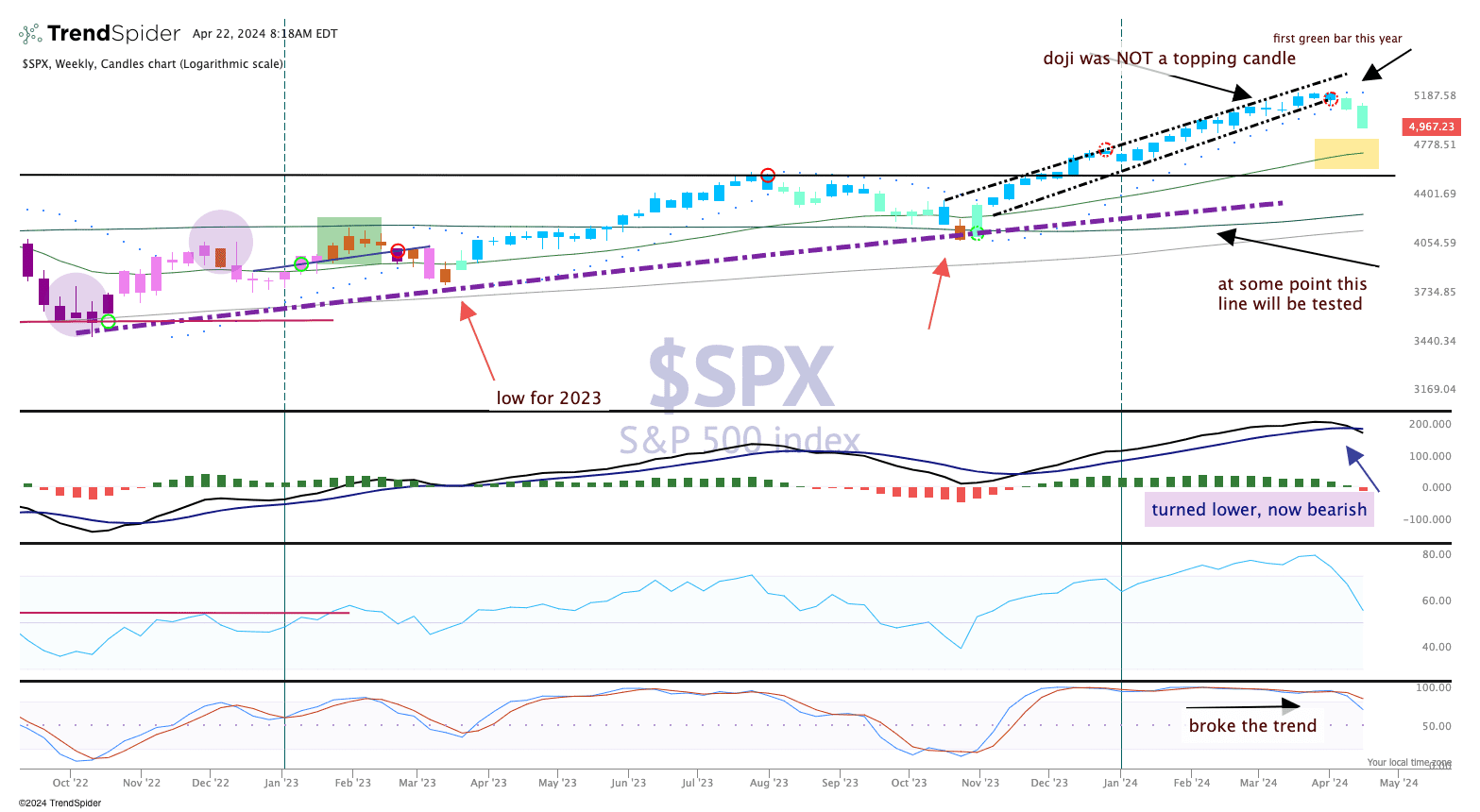

XRP's price has shown significant volatility throughout its history. It experienced a meteoric rise in 2017-2018, reaching an all-time high before undergoing a substantial correction. Analyzing historical data, including peaks and troughs, reveals a pattern of dramatic price swings influenced by market sentiment, regulatory news, and adoption rates.

[Insert chart or graph illustrating XRP's price history here]

Factors influencing XRP's past performance include:

- Regulatory announcements: Positive or negative news regarding Ripple's legal battles and regulatory scrutiny significantly impact XRP's price.

- Market sentiment: Overall cryptocurrency market trends and investor confidence play a vital role.

- Adoption rate: Increased adoption by financial institutions boosts demand and price.

Current Market Sentiment and Predictions: Expert Opinions and Future Outlook

Currently, the market sentiment surrounding XRP is mixed. While some analysts predict future price growth based on increasing institutional adoption and technological advancements, others express concerns about regulatory uncertainty and competition from other cryptocurrencies.

[Include a summary of different expert predictions and market forecasts here. Ensure to source these predictions accurately]

Factors influencing current market sentiment include:

- Ongoing legal battles: The SEC lawsuit against Ripple significantly impacts investor confidence.

- Technological advancements: Ripple's continuous development and improvements to RippleNet can influence positive sentiment.

- Competition: The emergence of alternative cross-border payment solutions impacts XRP's market share.

Assessing the Risks and Rewards of Investing in XRP

Potential Risks: Understanding the Investment Landscape

Investing in XRP carries significant risks. It's crucial to acknowledge these before considering investment:

- Regulatory uncertainty: The ongoing legal battles and the regulatory landscape surrounding cryptocurrencies remain volatile.

- Market volatility: XRP's price is highly susceptible to market fluctuations and speculative trading.

- Competition: Alternative cryptocurrencies and payment solutions pose a competitive threat.

- Technological risk: The possibility of unforeseen technological challenges or vulnerabilities.

Potential Rewards: High Growth Potential and Future Applications

Despite the risks, investing in XRP also offers potential rewards:

- High growth potential: If RippleNet gains widespread adoption, the demand for XRP could surge, driving price appreciation.

- Future of cross-border payments: XRP could play a key role in the future of global finance, leading to substantial long-term growth.

- Early adoption advantage: Investing early in a potentially disruptive technology can yield significant returns.

Due Diligence Before Investing in Ripple (XRP)

Research and Understanding: The Importance of Thorough Research

Before investing in XRP, or any cryptocurrency, thorough research is paramount. Understand the technology behind Ripple and XRP, analyze market trends, and assess the risks involved.

- Read the Ripple whitepaper: Gain a deep understanding of Ripple's technology and goals.

- Follow reputable news sources: Stay updated on industry news, regulatory developments, and market analysis.

- Consult with a financial advisor: Seek professional advice tailored to your individual financial situation.

Diversification and Risk Management: Protecting Your Investment

Diversification is key to mitigating risks. Don't put all your eggs in one basket. Spread your investments across different asset classes, including traditional investments and cryptocurrencies. Implement a robust risk management strategy by only investing what you can afford to lose.

- Diversify your portfolio: Reduce reliance on any single asset, including XRP.

- Set a stop-loss order: Limit potential losses by setting a price point at which you'll automatically sell your XRP.

- Invest only what you can afford to lose: Never invest money you need for essential expenses.

Conclusion: Is Now the Right Time to Invest in Ripple (XRP)?

Investing in XRP presents a complex scenario with both significant potential and considerable risk. While its technology and potential role in the future of cross-border payments are promising, regulatory uncertainty and market volatility cannot be ignored. After carefully considering the information presented, conduct your own thorough research to determine if investing in XRP aligns with your financial strategy and risk tolerance. Remember to prioritize due diligence and diversification to protect your investment. Investing in cryptocurrency, including XRP, should be a considered decision based on your individual circumstances and financial goals.

Featured Posts

-

The Great One Wayne Gretzkys Fast Facts And Stats

May 01, 2025

The Great One Wayne Gretzkys Fast Facts And Stats

May 01, 2025 -

Xrp Explained Uses Value And Future Potential

May 01, 2025

Xrp Explained Uses Value And Future Potential

May 01, 2025 -

Protecting Your Investments S And P 500 Downside Insurance Strategies

May 01, 2025

Protecting Your Investments S And P 500 Downside Insurance Strategies

May 01, 2025 -

Bhart Kshmyr Pr Ntyjh Khyz Mdhakrat Kywn Kre

May 01, 2025

Bhart Kshmyr Pr Ntyjh Khyz Mdhakrat Kywn Kre

May 01, 2025 -

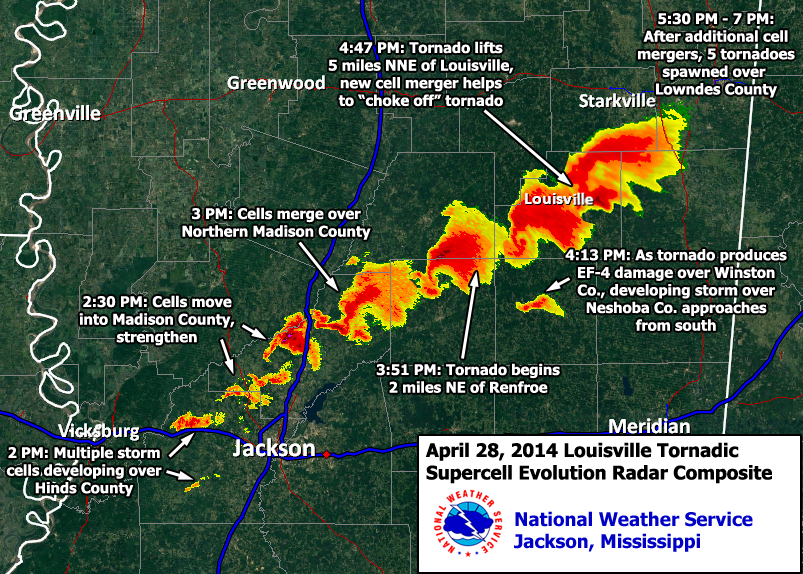

Eleven Years After The Louisville Tornado A Community Reflects

May 01, 2025

Eleven Years After The Louisville Tornado A Community Reflects

May 01, 2025