Protecting Your Investments: S&P 500 Downside Insurance Strategies

Table of Contents

Understanding S&P 500 Risk and Volatility

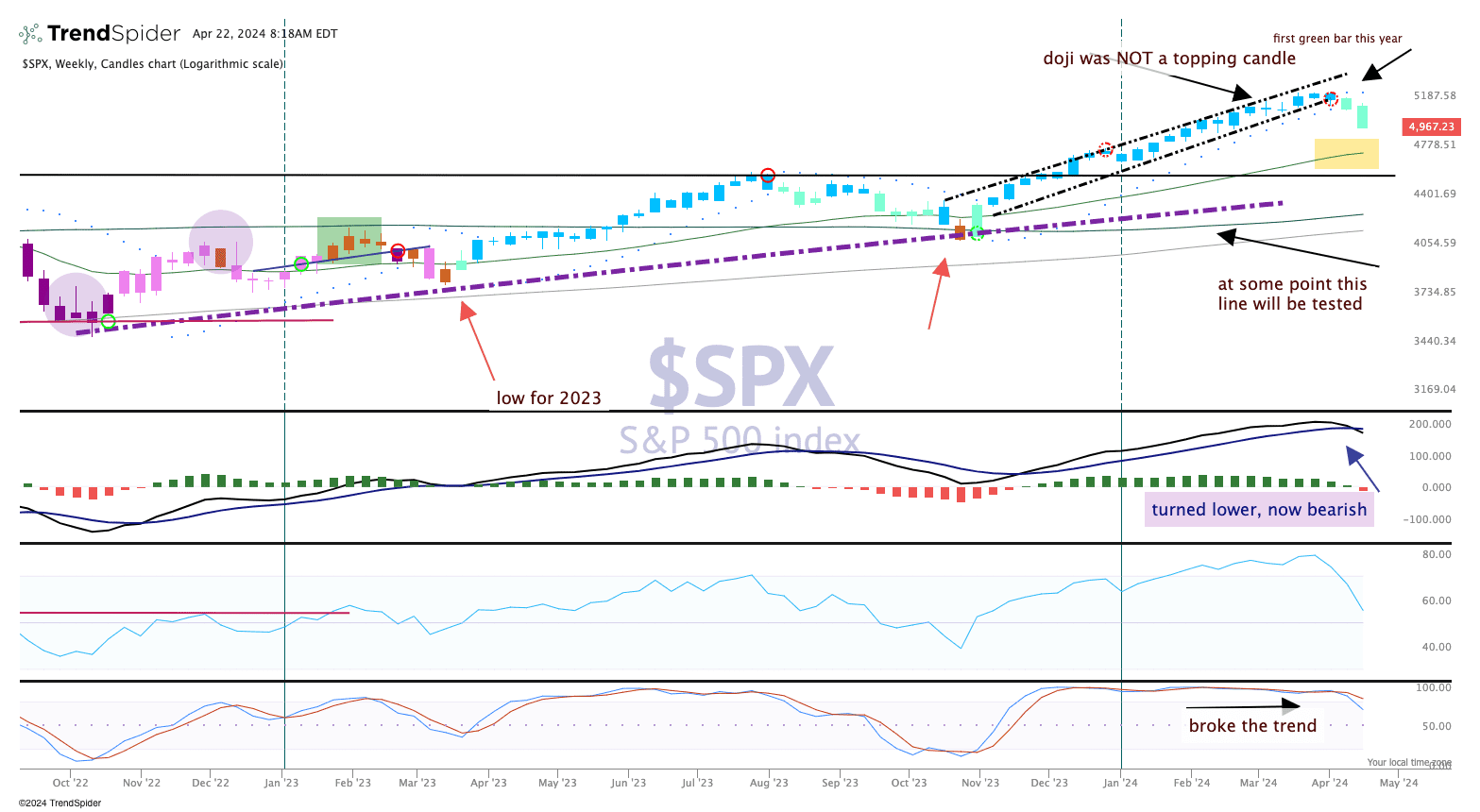

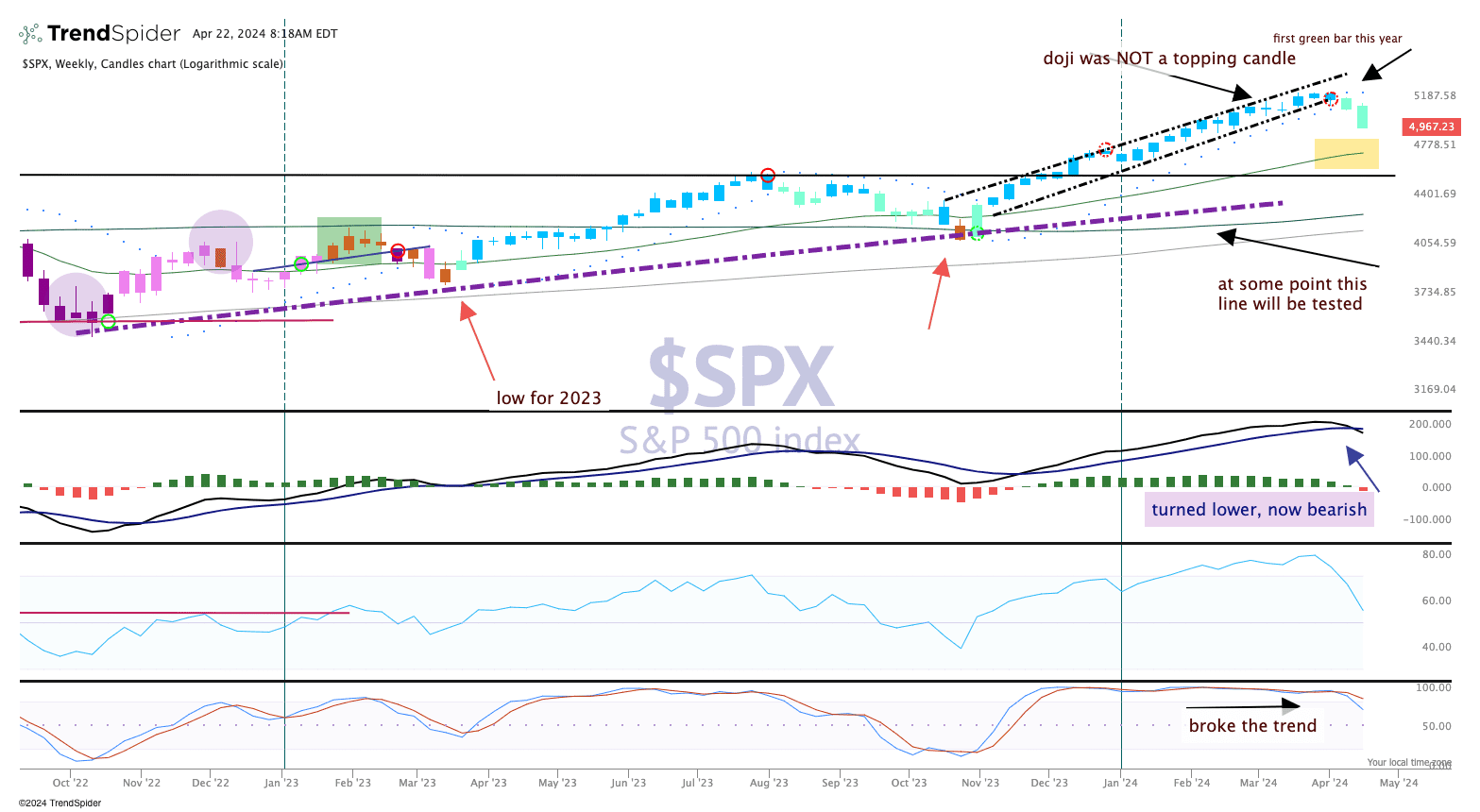

The S&P 500's historical volatility is a testament to the unpredictable nature of the market. Significant drops, like the 2008 financial crisis and the COVID-19 market crash, highlight the importance of understanding and managing investment risk. Several factors influence S&P 500 fluctuations:

- Economic Indicators: Changes in interest rates, inflation, GDP growth, and unemployment rates directly impact company performance and market sentiment.

- Geopolitical Events: International conflicts, political instability, and unexpected global events can create significant market uncertainty and volatility.

- Market Sentiment: Investor confidence and overall market psychology play a huge role. Fear and panic selling can exacerbate downward trends.

Understanding your risk tolerance is paramount. Are you a conservative investor comfortable with lower returns for less risk, or do you have a higher risk tolerance and are willing to accept greater volatility for potentially higher returns? Knowing your risk profile is the first step in creating an effective S&P 500 downside insurance strategy.

Assessing Your Investment Portfolio's Exposure to S&P 500 Risk

Before implementing any downside protection strategy, assess your portfolio's exposure to S&P 500 risk.

- S&P 500 Exposure: Determine the percentage of your portfolio invested in S&P 500 index funds, ETFs (exchange-traded funds), or individual stocks that closely track the index.

- Portfolio Beta: Calculate your portfolio's beta, a measure of volatility relative to the overall market. A beta of 1 indicates your portfolio moves in line with the market; a beta greater than 1 suggests higher volatility, while a beta less than 1 implies lower volatility.

- Diversification: A well-diversified portfolio is crucial for mitigating risk. Don't put all your eggs in one basket! Spread your investments across different asset classes to reduce the impact of any single market downturn.

Strategies for S&P 500 Downside Insurance

Several strategies can help protect your investments from S&P 500 downside risk.

Options Strategies (Protective Puts)

Protective puts are a common options trading strategy for downside protection. You buy put options on the S&P 500 (or an S&P 500 ETF), giving you the right, but not the obligation, to sell the underlying asset at a specified price (the strike price) before the option expires. This acts as insurance, limiting your potential losses if the market falls. However, remember that you pay a premium for this protection, reducing your potential profits if the market rises significantly.

Collars

A collar involves simultaneously buying put options and selling call options on the same underlying asset. This strategy limits both upside and downside potential, creating a defined range of possible outcomes. While offering downside protection, the potential for substantial gains is capped. Carefully consider the trade-off between protection and upside potential.

Inverse ETFs

Inverse ETFs aim to deliver returns that are the opposite of the performance of a particular index, like the S&P 500. While these can provide short-term downside protection during market declines, they are risky. Remember:

- Time Decay: Inverse ETFs can lose value over time due to the nature of their leveraged strategies.

- Leveraged Losses: Amplified losses during periods of unexpected market movement.

- Short-Term Strategy: Inverse ETFs are best utilized as short-term hedging tools, not long-term investments.

Diversification Beyond the S&P 500

Diversification is perhaps the most crucial aspect of risk management. While focusing on S&P 500 downside insurance, don't neglect the importance of a diversified portfolio:

- Bonds: Bonds offer lower returns but typically provide stability during stock market downturns.

- Real Estate: Real estate can act as a hedge against inflation and offer diversification benefits.

- Commodities: Commodities like gold are often considered safe haven assets during periods of market uncertainty.

Conclusion: Securing Your Financial Future with S&P 500 Downside Insurance

Protecting your investments from potential S&P 500 downturns requires a proactive approach. By understanding your risk tolerance, diversifying your portfolio, and considering strategies like protective puts, collars, or carefully chosen inverse ETFs, you can significantly reduce your exposure to market volatility. Remember that S&P 500 protection is most effective when incorporated into a broader investment strategy aligned with your long-term financial goals. Consult with a financial advisor to develop a personalized S&P 500 downside insurance strategy tailored to your specific needs and risk profile. Effective risk management and a comprehensive investment plan are key to securing your financial future.

Featured Posts

-

Dragons Den Success Strategies Tips And Tricks For Entrepreneurs

May 01, 2025

Dragons Den Success Strategies Tips And Tricks For Entrepreneurs

May 01, 2025 -

Multiple Fatalities Including Children After Car Strikes After School Program

May 01, 2025

Multiple Fatalities Including Children After Car Strikes After School Program

May 01, 2025 -

Exploring Shared Resources A Guide To Project Muse

May 01, 2025

Exploring Shared Resources A Guide To Project Muse

May 01, 2025 -

Kort Geding Gemeente Kampen Eist Stroomnetaansluiting Van Enexis

May 01, 2025

Kort Geding Gemeente Kampen Eist Stroomnetaansluiting Van Enexis

May 01, 2025 -

England Vs France Six Nations Dalys Crucial Late Contribution

May 01, 2025

England Vs France Six Nations Dalys Crucial Late Contribution

May 01, 2025

Latest Posts

-

Alteawn Khtt Mtynt Ltezyz Alslslt Almmyzt Dd Almnafst Alshbabyt

May 01, 2025

Alteawn Khtt Mtynt Ltezyz Alslslt Almmyzt Dd Almnafst Alshbabyt

May 01, 2025 -

Alteawn Yezz Slslt Mmyzth Dd Alshbab

May 01, 2025

Alteawn Yezz Slslt Mmyzth Dd Alshbab

May 01, 2025 -

Tran Dau Mo Man Day Kich Tinh Tai Chung Ket Giai Bong Da Thanh Nien Sinh Vien

May 01, 2025

Tran Dau Mo Man Day Kich Tinh Tai Chung Ket Giai Bong Da Thanh Nien Sinh Vien

May 01, 2025 -

Vong Chung Ket Giai Bong Da Thanh Nien Sinh Vien Nhung Pha Bong Man Nhan

May 01, 2025

Vong Chung Ket Giai Bong Da Thanh Nien Sinh Vien Nhung Pha Bong Man Nhan

May 01, 2025 -

Giai Bong Da Sinh Vien Chung Ket Khoi Tranh Soi Noi

May 01, 2025

Giai Bong Da Sinh Vien Chung Ket Khoi Tranh Soi Noi

May 01, 2025