XRP (Ripple) Price Under $3: Should You Invest Right Now?

Table of Contents

XRP, the cryptocurrency powering Ripple's payment network, is trading below $3. This significant price drop has many investors questioning whether now is the time to buy or sit on the sidelines. This article delves into the current market situation, analyzing the factors influencing XRP's price and helping you decide if investing in XRP at this price point is right for you. The decision to invest in XRP, or any cryptocurrency, requires careful consideration of both its potential and inherent risks.

Analyzing the Current XRP Market Situation

Recent Price Fluctuations and Volatility

XRP's price has experienced considerable volatility in recent months. While it once traded significantly higher, reaching highs of [Insert High Price and Date], it has recently fallen below the $3 mark. This fluctuation reflects the overall crypto market's sensitivity to various factors.

- October 26, 2023: XRP price dropped to $[Insert Price] following [mention news event, e.g., negative SEC news].

- November 15, 2023: A slight rebound to $[Insert Price] was observed after [mention news event, e.g., positive Ripple development].

- Current Market Sentiment: Overall sentiment remains cautious, with many analysts watching the ongoing SEC lawsuit closely.

Factors Influencing XRP's Price

Several factors influence XRP's price, including macroeconomic conditions, regulatory developments, and adoption rates.

- Macroeconomic Factors: Broader market trends, inflation rates, and interest rate hikes by central banks significantly impact cryptocurrency prices, including XRP.

- Regulatory News: The ongoing SEC lawsuit against Ripple Labs heavily influences investor confidence and XRP's price. Positive or negative developments in this case can trigger significant price swings.

- Adoption Rates: Increased adoption of Ripple's payment solutions by financial institutions could boost XRP's demand and price. Conversely, slow adoption could put downward pressure on the price.

- Technological Advancements: Improvements to Ripple's technology and the introduction of new features could attract investors and positively impact XRP's price. Competitor cryptocurrencies and their advancements also play a role. For example, [mention a competitor and its impact].

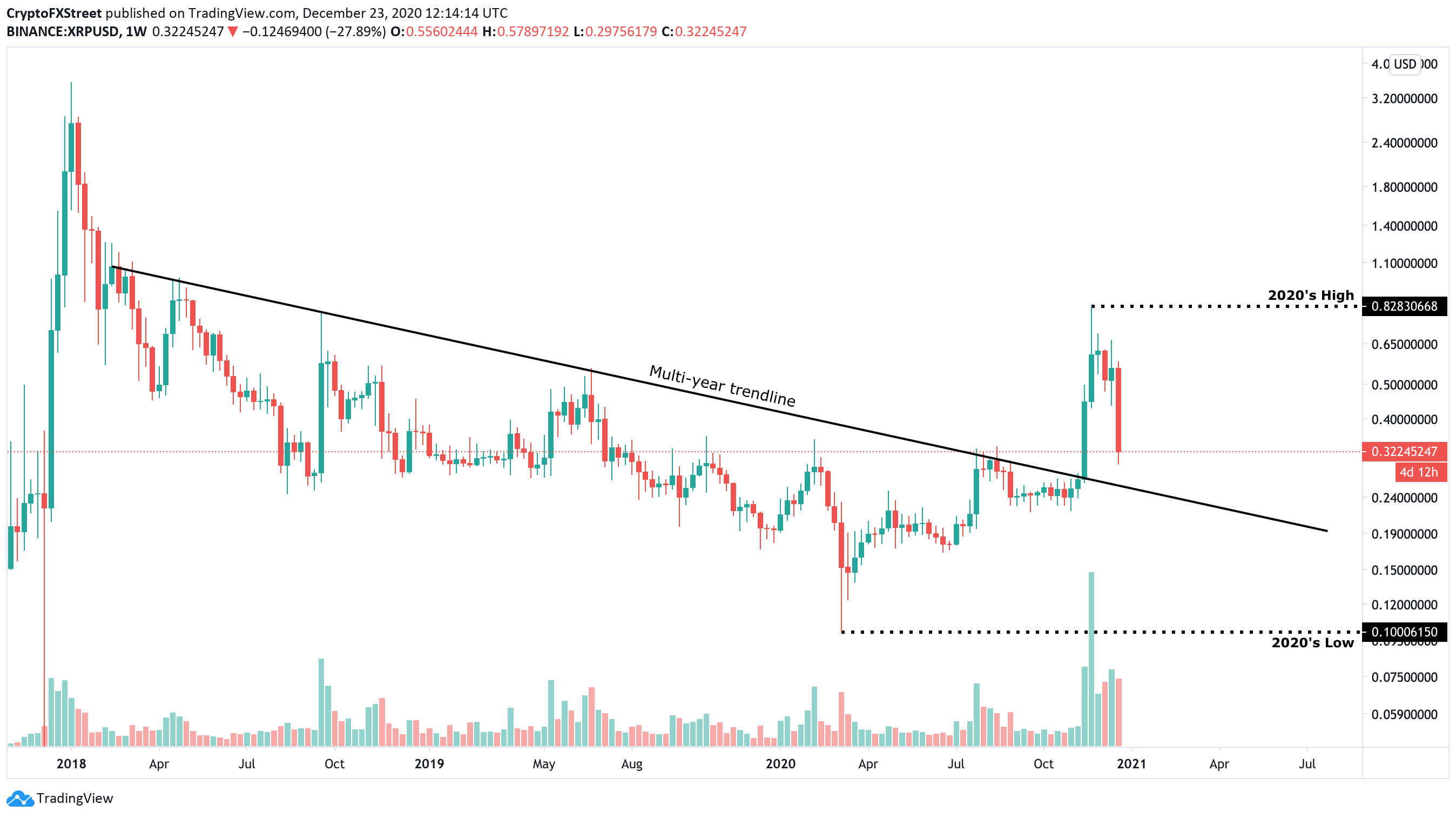

Technical Analysis of XRP

Technical analysis provides insights into potential future price movements. Looking at XRP's charts reveals:

- Support and Resistance Levels: The $3 level might act as a support level, preventing further price drops. However, resistance levels at $[Insert Resistance Levels] may need to be broken for a sustained price increase.

- Trading Volume: High trading volume during price increases suggests strong buying pressure. Low volume could signal indecision or weakness.

- Technical Indicators: Indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and various moving averages can help predict potential price trends. [Include chart if possible, showing RSI, MACD, and moving averages].

The Case for Investing in XRP Below $3

Potential for Growth

Despite the current price dip, several factors suggest potential for XRP growth:

- Ripple's Partnerships: Ripple has established partnerships with numerous financial institutions globally, facilitating cross-border payments. These partnerships could drive future XRP adoption.

- Technological Advancements: Continuous improvements to RippleNet's technology could attract more users and enhance the network's efficiency.

- Future Use Cases: Expanding use cases beyond cross-border payments, such as in decentralized finance (DeFi) and supply chain management, could increase XRP's demand.

- Long-Term Price Projections (with caveats): While predicting future cryptocurrency prices is inherently speculative, some analysts project significant growth for XRP in the long term, based on [mention factors].

Lower Entry Point

Buying XRP at a lower price like this presents a potential advantage:

- Potential for Higher Returns: If the price rises, investors who bought at a lower price will experience higher returns.

- Dollar-Cost Averaging: Investing a fixed amount of money regularly, regardless of price fluctuations, can mitigate risk and potentially lead to better long-term returns.

The Risks of Investing in XRP Below $3

Ongoing Legal Battle with the SEC

The SEC lawsuit against Ripple remains a significant risk factor:

- Potential Outcomes: A negative outcome could significantly impact XRP's price and potentially lead to delisting from exchanges. A positive outcome could lead to a price surge.

- Uncertainty: The uncertainty surrounding the legal battle creates significant risk for investors.

Market Volatility and Risk

Investing in cryptocurrencies carries inherent risks:

- Significant Losses: Cryptocurrency prices are highly volatile, and investors could experience significant losses.

- Portfolio Diversification: Diversifying investments across different asset classes is crucial to mitigate risk.

- Risk Management: Implementing appropriate risk management strategies, such as stop-loss orders, is vital for protecting investments.

Conclusion

Investing in XRP below $3 presents both opportunities and risks. While a lower entry point and potential future growth are attractive, the ongoing SEC lawsuit and inherent market volatility cannot be ignored. Before investing in XRP (Ripple) or any other cryptocurrency, it's crucial to conduct thorough research, understand the risks involved, and consider your own financial goals and risk tolerance. Remember, only invest what you can afford to lose. Consider consulting a qualified financial advisor before making any investment decisions. Weighing the potential rewards and risks, only you can decide if investing in XRP below $3 aligns with your financial strategy.

Featured Posts

-

Michael Sheens Million Pound Giveaway A Review By Christopher Stevens

May 01, 2025

Michael Sheens Million Pound Giveaway A Review By Christopher Stevens

May 01, 2025 -

On N Est Pas Stresse 8000 Km A Velo Pour Trois Jeunes Du Bocage Ornais

May 01, 2025

On N Est Pas Stresse 8000 Km A Velo Pour Trois Jeunes Du Bocage Ornais

May 01, 2025 -

Kampen Rechtszaak Over Stroomvoorziening Nieuw Duurzaam Schoolgebouw

May 01, 2025

Kampen Rechtszaak Over Stroomvoorziening Nieuw Duurzaam Schoolgebouw

May 01, 2025 -

From Pregnancy Craving To Global Phenomenon How One Chocolate Bar Fueled Inflation

May 01, 2025

From Pregnancy Craving To Global Phenomenon How One Chocolate Bar Fueled Inflation

May 01, 2025 -

West Bank Raid Leads To Palestinian Journalists Arrest

May 01, 2025

West Bank Raid Leads To Palestinian Journalists Arrest

May 01, 2025

Latest Posts

-

New Southern Cruises In 2025 A Travelers Guide To The Best Itineraries

May 01, 2025

New Southern Cruises In 2025 A Travelers Guide To The Best Itineraries

May 01, 2025 -

Planning A Southern Cruise In 2025 Explore The Best New Options

May 01, 2025

Planning A Southern Cruise In 2025 Explore The Best New Options

May 01, 2025 -

2025s Hottest Southern Cruises Unveiling The New Itineraries

May 01, 2025

2025s Hottest Southern Cruises Unveiling The New Itineraries

May 01, 2025 -

Cruising The South In 2025 The Best New Ships And Routes

May 01, 2025

Cruising The South In 2025 The Best New Ships And Routes

May 01, 2025 -

Norwegian Cruise Line Nclh Stock Is It Worth The Investment A Look At Hedge Fund Activity

May 01, 2025

Norwegian Cruise Line Nclh Stock Is It Worth The Investment A Look At Hedge Fund Activity

May 01, 2025