Norwegian Cruise Line (NCLH) Stock: Is It Worth The Investment? A Look At Hedge Fund Activity

Table of Contents

Understanding the Current State of NCLH

To assess the viability of NCLH investment, we must first understand the company's current financial health and the broader cruise line industry.

Recent Financial Performance of NCLH:

NCLH's recent financial performance has been a rollercoaster, reflecting the industry's recovery from the COVID-19 pandemic. Analyzing quarterly and annual reports reveals fluctuating revenue and profit margins. Key financial metrics need careful scrutiny.

- Significant Financial Events:

- Q[Insert Quarter] [Year]: Reported [Positive/Negative] earnings per share (EPS) of [Amount], exceeding/falling short of analyst expectations by [Percentage].

- [Year]: Successfully completed [Major Financial Event, e.g., debt refinancing, new ship launch].

- [Year]: Experienced [Major Event, e.g., surge in bookings, operational challenges].

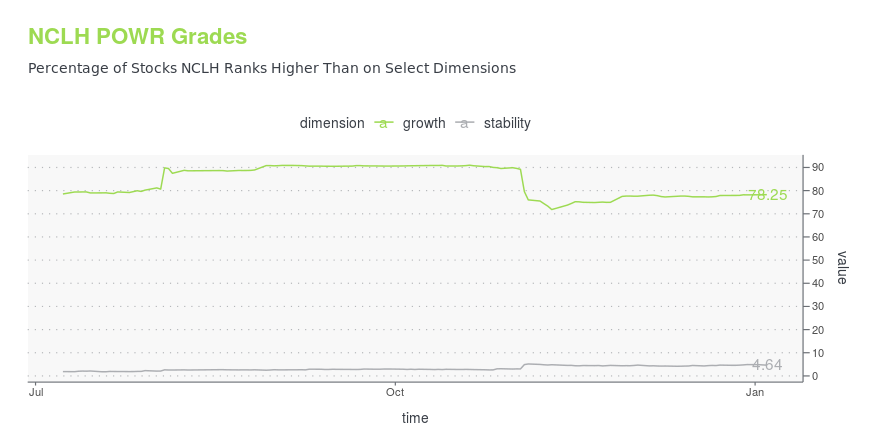

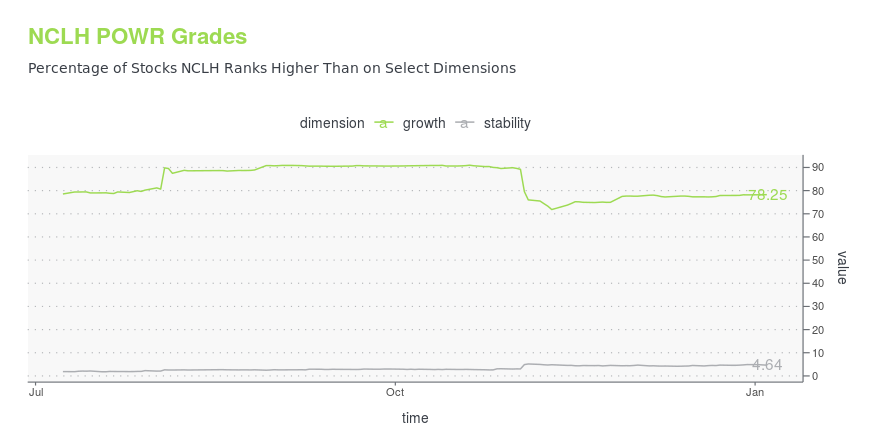

(Insert relevant charts and graphs visualizing revenue, profit, and debt over time. Source data should be cited.)

Keywords: NCLH financials, NCLH earnings, NCLH revenue, NCLH debt

Industry Trends Affecting NCLH:

The cruise industry's future growth depends on several factors. While the post-pandemic recovery is promising, headwinds remain.

- Positive Trends: Increased consumer spending on leisure travel, growing global middle class.

- Negative Trends: Fuel price volatility, geopolitical instability impacting tourism, intense competition from other cruise lines and alternative vacation options.

- COVID-19 Impact: The lingering effects of the pandemic, including potential future outbreaks and evolving health regulations, pose ongoing uncertainty.

Keywords: Cruise industry outlook, cruise ship industry trends, tourism recovery

Hedge Fund Activity and NCLH Stock

Analyzing hedge fund activity can provide valuable insights into market sentiment toward NCLH stock. However, it shouldn't be the sole factor in your investment decision.

Identifying Key Hedge Fund Investors in NCLH:

Several prominent hedge funds hold significant stakes in NCLH. Identifying these investors and understanding their investment strategies can offer clues about the perceived value of NCLH stock.

- Prominent Hedge Funds: [List prominent hedge funds and their approximate stake in NCLH. Source this information from reputable financial news sources and SEC filings.]

- Investment Rationale: [Analyze publicly available information about the hedge funds' investment strategies to understand why they hold NCLH stock. This could include long-term growth potential, value investing, or a turnaround play.]

- Recent Changes: [Highlight any recent significant buying or selling activity by these hedge funds. This can indicate changing market sentiment.]

Keywords: NCLH hedge fund ownership, institutional investors NCLH, hedge fund activity NCLH

Interpreting Hedge Fund Activity as an Investment Signal:

Hedge fund activity can be a useful, albeit imperfect, indicator of future stock performance. However, it is crucial to remember that hedge funds are not infallible.

- Positive Signals: Increased buying by multiple large hedge funds can suggest positive future prospects for NCLH stock.

- Negative Signals: Significant selling by key investors could indicate concerns about the company's future.

- Limitations: Hedge funds have diverse strategies and motivations; their actions alone don't guarantee future success. Consider this data alongside other factors.

Keywords: NCLH stock signals, hedge fund sentiment NCLH, investing in NCLH based on hedge fund activity.

Assessing the Risks and Rewards of Investing in NCLH Stock

Like any investment, NCLH stock carries both risks and potential rewards. A balanced assessment is crucial.

Potential Risks Associated with NCLH Investment:

Investing in NCLH involves several inherent risks.

- Economic Downturns: Recessions significantly impact discretionary spending, including cruise vacations.

- Geopolitical Instability: Global events can disrupt travel and negatively impact NCLH's operations.

- Industry-Specific Risks: Competition, fuel price fluctuations, and unforeseen events (like pandemics) pose significant challenges.

- High Debt Levels: NCLH, like many cruise lines, carries substantial debt, making it vulnerable to economic shocks.

Keywords: NCLH stock risk, NCLH investment risks, cruise industry risks

Potential Rewards of Investing in NCLH:

Despite the risks, NCLH offers potential rewards.

- Industry Growth: The cruise industry's long-term growth prospects remain positive.

- Strong Brand Recognition: NCLH enjoys strong brand recognition, giving it a competitive edge.

- Potential for Dividends: NCLH may offer dividends to its shareholders in the future, providing passive income.

- Innovation and Expansion: The company's ongoing efforts to innovate and expand its fleet could boost profitability.

Keywords: NCLH stock potential, NCLH investment returns, cruise industry growth

Conclusion: Should You Invest in NCLH Stock? A Final Verdict

Investing in NCLH stock presents a complex picture. While the cruise industry shows strong recovery potential, and positive hedge fund activity can be a suggestive factor, inherent risks remain. The analysis of NCLH financials, industry trends, and hedge fund activity suggests a cautiously optimistic outlook. However, no single factor should dictate your investment decision. A thorough due diligence process that incorporates your own risk tolerance and financial goals is essential.

Conduct your own thorough due diligence before making any investment decisions regarding NCLH stock. Remember to carefully assess your own risk tolerance before investing in NCLH, considering your personal financial situation and investment timeline. Remember to consult a financial advisor before making any investment decisions. Keywords: NCLH stock outlook, NCLH investment decision, NCLH stock analysis.

Featured Posts

-

Il Cardinale Becciu Condannato Al Risarcimento Danni 40 000 Euro Agli Accusatori

May 01, 2025

Il Cardinale Becciu Condannato Al Risarcimento Danni 40 000 Euro Agli Accusatori

May 01, 2025 -

Planning A Reactor Power Uprate Navigating The Nrc Process

May 01, 2025

Planning A Reactor Power Uprate Navigating The Nrc Process

May 01, 2025 -

Dosarele X O Redeschidere Posibila Viata Libera Galati

May 01, 2025

Dosarele X O Redeschidere Posibila Viata Libera Galati

May 01, 2025 -

Old Lantern Barn Charlotte Farmers And Foragers Business Acquisition

May 01, 2025

Old Lantern Barn Charlotte Farmers And Foragers Business Acquisition

May 01, 2025 -

How To Prepare For A Dragons Den Pitch

May 01, 2025

How To Prepare For A Dragons Den Pitch

May 01, 2025