XRP Price Prediction 2024: Will XRP Reach $5 After SEC Lawsuit?

Table of Contents

The Ripple vs. SEC Lawsuit: A Turning Point for XRP?

The Ripple vs. SEC lawsuit dominated headlines for years, significantly impacting XRP's price and overall market perception. The outcome of this legal battle proved pivotal in shaping the future of XRP and the broader cryptocurrency regulatory landscape.

The Verdict and its Implications

The partial victory for Ripple in the SEC lawsuit marked a significant development. The judge's ruling, specifically regarding programmatic sales, created a degree of regulatory clarity that was previously lacking. This clarity, however, is not absolute and leaves some aspects of XRP's regulatory standing open to interpretation.

- Impact on regulatory clarity for cryptocurrencies: The ruling provided some clarity, but the implications are still being debated, setting a precedent for other crypto projects facing similar regulatory challenges. This ambiguity creates both opportunities and risks for XRP.

- Short-term and long-term effects on XRP price: The immediate aftermath of the ruling saw a surge in XRP's price, reflecting a wave of positive investor sentiment. The long-term effects, however, remain uncertain and dependent on future regulatory actions and market forces.

- Analysis of investor sentiment post-verdict: Post-verdict, investor sentiment has been mixed, with some expressing optimism and others remaining cautious. Monitoring social media sentiment and news coverage provides valuable insights into evolving market perceptions.

- Comparison to other cryptocurrencies affected by regulatory scrutiny: The Ripple case serves as a benchmark for other cryptocurrencies facing SEC scrutiny. The outcome provides valuable lessons and sets a precedent that will likely influence future regulatory actions.

Technological Advancements and XRP's Ecosystem

XRP's underlying technology, the XRP Ledger (XRPL), continues to evolve, enhancing its capabilities and expanding its potential use cases. These advancements are crucial factors in the XRP price prediction.

XRP Ledger (XRPL) Developments

The XRPL has undergone significant improvements, focusing on scalability, speed, and energy efficiency. These upgrades aim to position XRP as a leading payment solution in a competitive market.

- New features and upgrades to the XRPL: Recent updates include improvements to transaction speeds, enhanced security measures, and the introduction of new functionalities aimed at boosting developer activity.

- Adoption of XRPL by businesses and developers: Increased adoption by businesses and developers is crucial for long-term growth. The development community's active contribution plays a pivotal role in the XRPL's future success.

- Potential for increased transaction volume and usage: Improvements to scalability and efficiency could lead to a significant increase in transaction volume, driving demand for XRP.

- Comparison with other blockchain technologies: The XRPL's performance and capabilities are often compared to other blockchain platforms, including Ethereum and Solana. Evaluating its strengths and weaknesses relative to competitors is vital in assessing its future prospects.

Market Sentiment and Adoption Rate

Market sentiment and adoption rate are crucial in determining XRP's price. A positive market outlook and widespread adoption are vital for driving price appreciation.

Institutional Investment and Market Demand

Institutional investors are increasingly participating in the cryptocurrency market. Their interest in XRP will be a key driver in its price movements.

- Tracking the volume of XRP traded on major exchanges: Analyzing trading volume on major exchanges provides valuable insights into market demand and investor activity.

- Analyzing social media sentiment and news coverage surrounding XRP: Tracking sentiment on social media platforms and monitoring news coverage can offer valuable indicators of market sentiment.

- Discussing the influence of Bitcoin and other major cryptocurrencies on XRP's price: Bitcoin's price movements often influence the broader cryptocurrency market, impacting XRP's price. The correlation needs to be considered when assessing XRP's outlook.

- Evaluating the potential for widespread adoption of XRP in payments and remittances: XRP's potential use in cross-border payments and remittances is a key factor in driving future demand and influencing the XRP price prediction.

Factors Affecting XRP Price Prediction in 2024

Several factors beyond the Ripple lawsuit and XRPL development influence the XRP price prediction for 2024.

Macroeconomic Conditions

Global economic factors, such as inflation and recessionary pressures, can significantly impact the cryptocurrency market and XRP's price. Economic uncertainty often leads to risk-aversion in investment strategies, potentially impacting the price of cryptocurrencies like XRP.

Regulatory Landscape

The regulatory environment surrounding cryptocurrencies continues to evolve. Clear and favorable regulations could boost investor confidence and drive price appreciation. Conversely, restrictive regulations could negatively impact XRP's price.

Competition from Other Cryptocurrencies

The cryptocurrency market is highly competitive. The emergence of new cryptocurrencies and the performance of existing competitors significantly influence XRP's market position and price.

- Potential for positive and negative price movements based on these factors: Each factor outlined above presents both opportunities and risks, leading to potential upward or downward price movements.

- Scenario planning for different market conditions: Developing different scenarios based on varying macroeconomic conditions, regulatory changes, and competitive pressures allows for a more nuanced price prediction.

- Risk assessment and potential downsides: A comprehensive XRP price prediction requires acknowledging potential downsides and risks associated with each contributing factor.

Conclusion

Predicting the price of XRP in 2024 involves considering several interconnected factors. The outcome of the Ripple vs. SEC lawsuit, XRPL development, market sentiment, macroeconomic conditions, regulatory landscape, and competition all play a role. While the potential for significant growth exists, especially if XRP gains wider adoption and regulatory clarity improves, it's crucial to remember that any price prediction inherently carries uncertainty.

Will XRP reach $5 in 2024? Reaching $5 in 2024 is a highly ambitious target, requiring a confluence of positive factors and substantial market adoption. While possible, it's a scenario that depends on numerous favorable market conditions and a significant increase in demand.

Call to Action: While a $5 XRP price in 2024 is ambitious, staying informed about XRP news, market trends, and regulatory developments is crucial for making informed investment decisions. Continue your research on XRP price prediction and the evolving cryptocurrency landscape to navigate this dynamic market effectively. Learn more about the XRP price prediction and how you can participate responsibly in the future of cryptocurrency.

Featured Posts

-

Liverpools Contract Offer To Salah A Potential Stalemate

May 02, 2025

Liverpools Contract Offer To Salah A Potential Stalemate

May 02, 2025 -

Two Celebrity Traitors Stars Depart Bbc Show

May 02, 2025

Two Celebrity Traitors Stars Depart Bbc Show

May 02, 2025 -

Toronto Firm Bids For Hudsons Bay Brand Expecting A Competitive Battle

May 02, 2025

Toronto Firm Bids For Hudsons Bay Brand Expecting A Competitive Battle

May 02, 2025 -

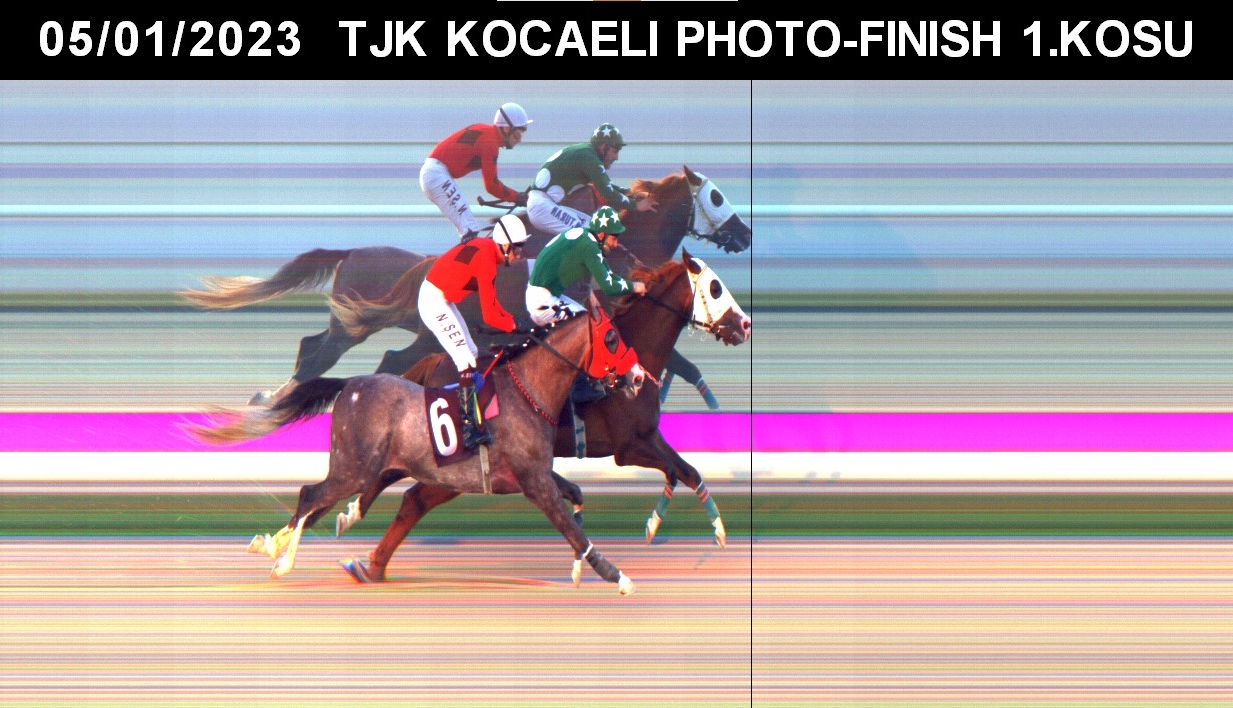

Kocaeli 1 Mayis Arbede Ayrintilari Ve Olay Gelisimi

May 02, 2025

Kocaeli 1 Mayis Arbede Ayrintilari Ve Olay Gelisimi

May 02, 2025 -

Is Now The Time To Buy Xrp Ripple At Less Than 3

May 02, 2025

Is Now The Time To Buy Xrp Ripple At Less Than 3

May 02, 2025