Is Now The Time To Buy XRP (Ripple) At Less Than $3?

Table of Contents

XRP, the native cryptocurrency of Ripple Labs, has experienced dramatic price swings, leaving many investors wondering if its current price below $3 represents a buying opportunity. This article provides a comprehensive analysis of the factors influencing XRP's price, exploring the potential rewards and inherent risks associated with investing in Ripple at this juncture. We will delve into the ongoing legal battle, examine Ripple's technological advancements, and assess market sentiment to help you make an informed investment decision.

Ripple's Ongoing Legal Battle with the SEC

Understanding the SEC Lawsuit

The Securities and Exchange Commission (SEC) lawsuit against Ripple Labs is a pivotal factor affecting XRP's price. The SEC alleges that Ripple sold XRP as an unregistered security, violating federal securities laws. This legal battle has significantly impacted XRP's price and investor confidence.

- Detailing the Arguments: The SEC argues that XRP's distribution and marketing constituted an unregistered securities offering. Ripple counters that XRP is a currency, not a security, and its sales were not subject to registration requirements. The case hinges on the "Howey Test," which defines what constitutes an investment contract.

- Potential Outcomes and Implications: A ruling in favor of the SEC could severely impact XRP's price, potentially leading to delisting from exchanges and significant investor losses. Conversely, a victory for Ripple could lead to a substantial price surge, driven by increased investor confidence and potential adoption. The outcome remains uncertain, adding to the volatility.

- Expert Opinions and Market Predictions: Legal experts offer differing opinions on the case's outcome. Some predict a settlement, while others anticipate a protracted legal battle. Market predictions are similarly diverse, reflecting the inherent uncertainty surrounding the lawsuit's resolution.

The Impact of the Lawsuit on XRP Price

The SEC lawsuit has demonstrably influenced XRP's price.

- Price Movements Correlated with Legal Developments: Significant price drops have often followed negative news related to the lawsuit, while positive developments have triggered price increases. Charting these price movements reveals a clear correlation between legal progress and XRP's market performance.

- Effect of Positive and Negative News: Positive news, such as a favorable court ruling or a settlement agreement, tends to boost XRP's price. Conversely, negative news can trigger substantial price declines, highlighting the lawsuit's profound impact on investor sentiment.

- Crypto Community Sentiment: The crypto community is divided on the outcome of the lawsuit. Some remain bullish on XRP's long-term prospects, while others remain cautious, highlighting the uncertainty surrounding the future of the cryptocurrency.

Ripple's Technology and Use Cases

RippleNet and its Adoption

RippleNet is Ripple's blockchain-based payment network designed to facilitate faster and more cost-effective cross-border transactions. Its adoption rate amongst financial institutions is a key indicator of XRP's potential.

- Successful Use Cases and Partnerships: RippleNet boasts partnerships with numerous banks and financial institutions globally, demonstrating its practical application in the real world. Successful use cases highlight its ability to streamline international payments.

- Potential for Future Growth and Expansion: The potential for future growth is significant, given the increasing demand for efficient cross-border payment solutions. Expansion into new markets and the onboarding of additional financial institutions could significantly boost XRP's adoption and price.

- Competitive Landscape: RippleNet faces competition from other payment solutions, but its established network and partnerships provide a strong competitive advantage. Its ability to innovate and adapt to evolving market demands will be crucial for future success.

XRP's Role in Cross-Border Payments

XRP plays a crucial role within RippleNet, facilitating faster and cheaper cross-border transactions.

- Transaction Speed and Fees: XRP transactions are significantly faster and cheaper than traditional banking methods. This speed and efficiency are key advantages driving its adoption within the financial industry.

- Disrupting the Traditional Financial System: The potential to disrupt the traditional financial system is substantial. By offering a faster, cheaper, and more transparent alternative to traditional cross-border payments, Ripple aims to revolutionize the industry.

- Long-Term Scalability and Sustainability: The long-term scalability and sustainability of XRP's payment technology are crucial factors to consider. The network's ability to handle increasing transaction volumes and adapt to future technological advancements is vital for its continued success.

Market Sentiment and Price Prediction

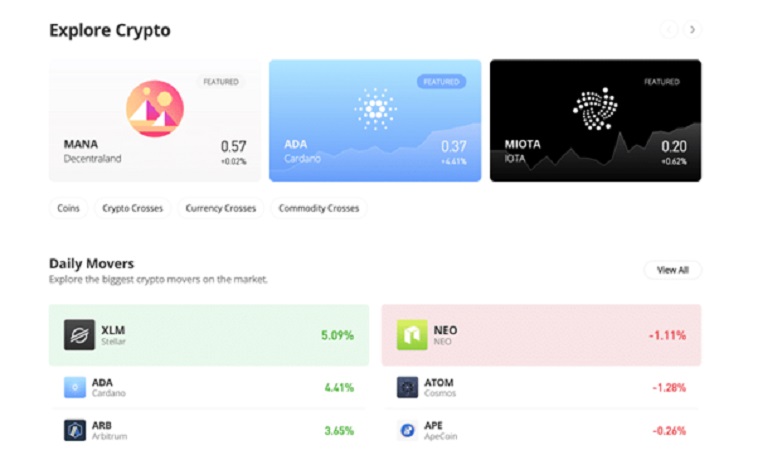

Analyzing Current Market Trends

Understanding the broader cryptocurrency market conditions is essential for assessing XRP's potential.

- Impacting Factors: Macroeconomic conditions, regulatory changes, and overall market sentiment influence the price of cryptocurrencies, including XRP. These external factors can significantly affect investor behavior and market trends.

- Correlation with Bitcoin: Bitcoin's price often influences the price of other cryptocurrencies, including XRP. A strong correlation exists, with both assets often moving in tandem, though the relationship is not always consistent.

- Market Indicators: Analyzing various market indicators, such as trading volume, market capitalization, and social media sentiment, provides valuable insights into XRP's current market position.

Predicting Future Price Movements

Predicting XRP's future price movements is inherently speculative. While the factors discussed provide insights, the cryptocurrency market is inherently volatile.

- Potential Scenarios: Several scenarios are possible, each with varying degrees of likelihood. These scenarios depend on the outcome of the SEC lawsuit, the adoption rate of RippleNet, and broader market conditions.

- Inherent Volatility: It's crucial to acknowledge the inherent volatility of the cryptocurrency market. Prices can fluctuate dramatically in short periods, creating both opportunities and significant risks.

- Thorough Research: Before making any investment decision, conduct thorough research and consider consulting with a financial advisor.

Risks and Considerations Before Investing in XRP

Volatility and Market Risk

Investing in XRP, like any cryptocurrency, carries significant risk.

- Price Drops: The potential for substantial price drops is considerable. Market volatility can lead to significant losses in a short period.

- Risk Management and Diversification: Implementing effective risk management strategies and diversifying investments are crucial to mitigate potential losses. Don't invest more than you can afford to lose.

- "Not Your Keys, Not Your Crypto": Storing your XRP on exchanges exposes you to counterparty risk. Consider using secure hardware wallets for better control and security.

Regulatory Uncertainty

Regulatory uncertainty remains a significant risk factor for XRP.

- Evolving Regulations: Cryptocurrency regulations vary across jurisdictions and are constantly evolving. Changes in regulations could negatively impact XRP's price and market accessibility.

- Impact of Future Regulatory Changes: Future regulatory changes could significantly alter the landscape for XRP, potentially leading to restrictions or even bans in certain regions.

- Staying Informed: Staying abreast of regulatory developments is crucial for understanding the potential risks and opportunities associated with XRP investment.

Conclusion

Investing in XRP at less than $3 presents a complex equation of potential and risk. The SEC lawsuit casts a shadow of uncertainty, but Ripple's technological advancements and potential within the cross-border payments sector remain compelling. The cryptocurrency market's inherent volatility underscores the need for thorough due diligence before committing capital.

Call to Action: Ultimately, the decision of whether to buy XRP at this price point is a personal one. Weigh the potential benefits and risks carefully, conduct your own comprehensive research, and consider seeking advice from a qualified financial advisor before investing in XRP or any other cryptocurrency. Remember to approach XRP investing with caution and a well-defined risk management strategy.

Featured Posts

-

Kshmyr Jng Ya Mdhakrat Pakstan Ka Mwqf Awr Bhart Ka Rdeml

May 02, 2025

Kshmyr Jng Ya Mdhakrat Pakstan Ka Mwqf Awr Bhart Ka Rdeml

May 02, 2025 -

Understanding Ongoing Nuclear Litigation Key Cases And Legal Ramifications

May 02, 2025

Understanding Ongoing Nuclear Litigation Key Cases And Legal Ramifications

May 02, 2025 -

Saudi Arabias Abs Market Opens A Rule Change Bigger Than Spain

May 02, 2025

Saudi Arabias Abs Market Opens A Rule Change Bigger Than Spain

May 02, 2025 -

Bbc Faces Setback As Two Stars Leave Celebrity Traitors

May 02, 2025

Bbc Faces Setback As Two Stars Leave Celebrity Traitors

May 02, 2025 -

Should You Buy Xrp Ripple While Its Below 3 A Comprehensive Guide

May 02, 2025

Should You Buy Xrp Ripple While Its Below 3 A Comprehensive Guide

May 02, 2025