XRP Price Prediction 2024: Is $2 Support A Reversal Signal Or A Fakeout?

Table of Contents

Analyzing the $2 Support Level for XRP

The $2 mark holds significant psychological and technical importance for XRP. Its breach could trigger substantial price movements, either upward or downward. Let's examine the situation from multiple perspectives.

Technical Analysis of the $2 Support

Technical indicators can offer valuable insights into potential support or resistance levels. Analyzing XRP's charts reveals key information.

- Moving Averages: The 50-day and 200-day moving averages' interaction near the $2 level could indicate a potential support zone. A bullish crossover could signal a price increase.

- RSI (Relative Strength Index): An RSI reading below 30 suggests oversold conditions, potentially indicating a bounce from the $2 support. Conversely, readings above 70 suggest overbought conditions, potentially signaling a price correction.

- MACD (Moving Average Convergence Divergence): A bullish MACD crossover near the $2 support could strengthen the argument for a price reversal. Conversely, a bearish divergence may indicate weakness.

- Chart Patterns: A double bottom pattern forming around the $2 support would be a strong bullish signal, suggesting a potential reversal and price increase. Conversely, a head and shoulders pattern would be bearish.

On-Chain Metrics and XRP's Fundamentals

Examining on-chain data provides a different perspective on XRP's potential.

- Transaction Volume: Increased transaction volume at or near the $2 support could suggest strong buying pressure, potentially supporting a price reversal.

- Active Addresses: A rise in the number of active addresses on the XRP ledger indicates growing network activity, which is generally a positive sign for the price.

- Ripple Developments: Positive developments from Ripple, such as partnerships or technological advancements, can positively influence XRP’s price and strengthen the $2 support.

Ripple Lawsuit's Influence on XRP Price

The ongoing Ripple lawsuit significantly impacts XRP's price.

- Positive Outcome: A favorable ruling could lead to a significant price surge, potentially breaking the $2 resistance easily.

- Negative Outcome: An unfavorable ruling could exert downward pressure on the price, potentially causing the $2 support to break.

- Uncertainty: The uncertainty surrounding the lawsuit itself contributes to volatility, making price prediction challenging.

Reversal Signals vs. Fakeouts: Identifying Key Differences

Differentiating between a genuine reversal and a fakeout at the $2 support is crucial for successful trading.

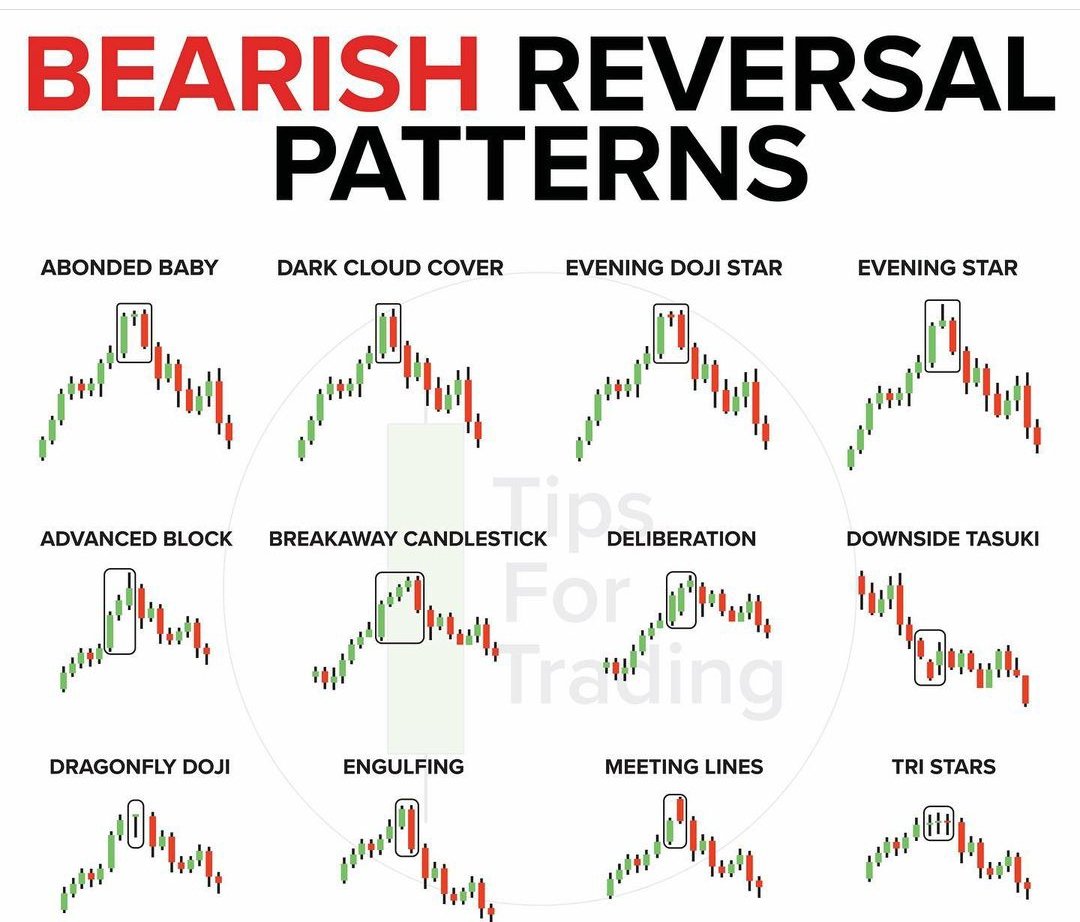

Understanding Reversal Patterns

Several chart patterns indicate potential price reversals.

- Head and Shoulders: This bearish pattern suggests a price decline after a temporary peak.

- Double Top/Bottom: A double bottom signals a potential bullish reversal after a price trough. A double top is bearish. These patterns must be confirmed with other indicators for reliability.

Distinguishing True Reversals from Fakeouts

Identifying a genuine reversal requires careful consideration of various factors.

- Trading Volume: High volume accompanying a price bounce from the support suggests a strong reversal. Low volume indicates a weak bounce, possibly a fakeout.

- Candlestick Patterns: Specific candlestick patterns (e.g., hammer, engulfing patterns) can confirm reversals or fakeouts.

- Confirmation from Indicators: Multiple technical indicators confirming the reversal pattern strengthen the signal.

Risk Management Strategies

Successful trading involves effective risk management, especially around key support levels.

- Stop-Loss Orders: Place stop-loss orders to limit potential losses if the support breaks.

- Position Sizing: Avoid over-leveraging to mitigate risks associated with fakeouts.

- Diversification: Diversify your portfolio to reduce the impact of potential losses on XRP.

XRP Price Prediction Scenarios for 2024

Considering the factors discussed above, we can outline several scenarios for XRP's price in 2024.

Bullish Scenario (XRP exceeding $2)

A positive outcome in the Ripple lawsuit, coupled with strong on-chain metrics and positive technical signals, could propel XRP beyond $2. This could lead to a price surge, potentially reaching higher price targets, depending on market sentiment and overall crypto market conditions.

Bearish Scenario (XRP failing to break $2)

A negative legal outcome, weak on-chain activity, and bearish technical signals could cause XRP to break the $2 support and continue its downward trend.

Neutral Scenario (XRP consolidating around $2)

The price could consolidate around $2 for an extended period, influenced by uncertainty surrounding the lawsuit and overall market conditions. This consolidation phase could precede a future decisive breakout in either direction.

Conclusion

Predicting XRP's price with certainty is impossible. The $2 support level represents a crucial juncture, and whether it signals a genuine reversal or a deceptive fakeout depends on several interconnected factors. This XRP Price Prediction 2024 analysis highlights the importance of considering technical analysis, on-chain metrics, the Ripple lawsuit's outcome, and implementing robust risk management strategies. Conduct your own thorough research, understand your risk tolerance, and make informed decisions. Stay updated on the latest XRP Price Prediction 2024 information and market trends. Subscribe to our newsletter for further insights and remember that responsible investing and thorough due diligence are crucial.

Featured Posts

-

Penny Pritzker The Billionaire Behind The Harvard Admissions Battle

May 08, 2025

Penny Pritzker The Billionaire Behind The Harvard Admissions Battle

May 08, 2025 -

Los Angeles Angels Baseball 2025 Streaming Options No Cable

May 08, 2025

Los Angeles Angels Baseball 2025 Streaming Options No Cable

May 08, 2025 -

Wednesday April 2nd 2025 Official Lotto And Lotto Plus Results

May 08, 2025

Wednesday April 2nd 2025 Official Lotto And Lotto Plus Results

May 08, 2025 -

El Betis Una Historia Forjada En Verde Y Blanco

May 08, 2025

El Betis Una Historia Forjada En Verde Y Blanco

May 08, 2025 -

Rain Shortened Game Paris Homer Delivers Angels Victory Over White Sox

May 08, 2025

Rain Shortened Game Paris Homer Delivers Angels Victory Over White Sox

May 08, 2025

Latest Posts

-

Scholar Rock Stock Price Plunge A Monday Market Analysis

May 08, 2025

Scholar Rock Stock Price Plunge A Monday Market Analysis

May 08, 2025 -

Dwp Benefit Changes What Claimants Need To Know About April 5th

May 08, 2025

Dwp Benefit Changes What Claimants Need To Know About April 5th

May 08, 2025 -

Jayson Tatum Seemingly Confirms Sons Birth With Ella Mai In New Ad

May 08, 2025

Jayson Tatum Seemingly Confirms Sons Birth With Ella Mai In New Ad

May 08, 2025 -

Thousands To Lose Dwp Benefits April 5th Changes Explained

May 08, 2025

Thousands To Lose Dwp Benefits April 5th Changes Explained

May 08, 2025 -

Universal Credit Overhaul Dwp Alters Claim Verification Process

May 08, 2025

Universal Credit Overhaul Dwp Alters Claim Verification Process

May 08, 2025