XRP Price Prediction 2024: Dubai License Fuels $10 Target?

Table of Contents

Main Points:

2.1 The Impact of the Dubai License on XRP Price

The Dubai license represents a pivotal moment for XRP. It signifies a significant step towards increased legitimacy and global adoption.

H3: Increased Institutional Adoption:

The license provides regulatory clarity, a crucial element for institutional investors hesitant to enter the crypto market due to regulatory uncertainty. This opens the door to significant partnerships with established financial institutions in Dubai and across the globe. This increased legitimacy can lead to a massive influx of capital.

- Increased Regulatory Clarity: The Dubai Virtual Asset Regulatory Authority (VARA) license provides a framework for operation, reducing the risk profile for institutions.

- Potential Partnerships with Financial Institutions: We can anticipate collaborations with banks and other financial players based in Dubai, facilitating easier integration of XRP into traditional finance.

- Access to a Larger Market: Dubai's strategic location and economic influence provide access to a vast and rapidly growing market. The World Bank estimates that remittances to the Middle East and North Africa region alone totalled over $70 billion in 2022, presenting a potentially lucrative market for XRP's payment solutions.

H3: Enhanced Liquidity and Trading Volume:

Increased market access translates to higher liquidity and trading volume.

- More Exchanges Listing XRP: Anticipate more cryptocurrency exchanges adding XRP trading pairs, furthering its accessibility and potentially driving price appreciation. Major exchanges like Binance and Coinbase have already shown strong support for XRP.

- Increased Trading Activity from Dubai-Based Investors: The Dubai license is expected to attract a surge of local investors, further boosting trading activity.

- Potential for Price Appreciation Due to Higher Demand: Increased demand, coupled with limited supply, can exert upward pressure on XRP's price.

2.2 Ripple's Ongoing Legal Battle and Its Influence on XRP Price

The ongoing legal battle between Ripple and the SEC significantly impacts XRP's price.

H3: Potential Positive Outcomes:

A favorable outcome, either a win or a settlement, could remove significant uncertainty and trigger a price surge.

- Removal of Uncertainty: A positive resolution would eliminate lingering doubts about XRP's regulatory status, attracting more investors and potentially increasing demand.

- Potential Price Surge Due to Positive Market Sentiment: A positive resolution could boost investor confidence, potentially leading to a substantial price increase.

- Improved Investor Confidence: A clear legal victory would solidify investor confidence, making XRP a more attractive investment. Positive sentiment analysis tools could track this shift.

H3: Worst-Case Scenarios and Risk Mitigation:

An unfavorable ruling could lead to a short-term price decline. However, diversification can mitigate potential losses.

- Short-Term Price Dip: A negative ruling could trigger a sell-off, leading to a temporary decrease in price.

- Investor Concerns: Uncertainty surrounding the legal outcome can discourage investment, impacting the XRP price negatively.

- Strategies for Mitigating Risk: Diversifying your cryptocurrency portfolio across different assets can help reduce the impact of a potential XRP price downturn.

2.3 Technological Advancements and XRP's Ecosystem Growth

Continuous improvements to the XRP Ledger (XRPL) contribute to its long-term potential.

H3: XRP Ledger Upgrades and Enhancements:

Ongoing developments improve scalability, speed, and functionality, attracting developers and users.

- Improved Efficiency: Upgrades to XRPL enhance transaction speed and reduce fees, making it a more competitive payment solution.

- Lower Transaction Fees: Reduced fees can encourage greater adoption among individuals and businesses.

- Attracting More Developers and Users to the XRP Ecosystem: A robust and evolving ecosystem fosters innovation and further adoption.

H3: Growing Adoption of XRP in Payments and Remittances:

XRP's potential as a fast and cost-effective cross-border payment solution is a key driver of growth.

- Faster and Cheaper International Transfers: XRP offers a significant advantage over traditional systems in terms of speed and cost, making it appealing to businesses and individuals.

- Increased Efficiency for Businesses and Individuals: Faster and cheaper transactions improve operational efficiency and reduce costs.

- Potential Partnerships with Payment Providers: Collaborations with established payment processors can expand XRP's reach and usage. A growing number of businesses are actively exploring the benefits of XRP in global commerce.

2.4 Market Sentiment and Overall Crypto Market Conditions

XRP's price is influenced by both its own performance and broader market factors.

H3: The Influence of Bitcoin and the Broader Crypto Market:

Bitcoin's price movements often correlate with altcoin prices, including XRP. The overall health of the crypto market also plays a significant role.

- Correlation Between Bitcoin and XRP Price: Historically, XRP has shown a degree of correlation with Bitcoin's price, meaning that positive or negative movements in Bitcoin often impact XRP's price as well.

- Potential for Altcoin Season: Periods of strong altcoin performance can lead to significant gains in XRP's price.

- Impact of Macroeconomic Factors: Global economic events, inflation, and interest rate changes can significantly impact the entire cryptocurrency market, including XRP.

H3: Predicting Market Sentiment and Investor Behavior:

News, regulations, social media trends, and technical analysis influence investor sentiment.

- News Events: Positive news, such as partnerships or regulatory developments, tends to boost XRP's price, while negative news can have the opposite effect.

- Regulatory Updates: Changes in crypto regulations worldwide significantly influence market sentiment and XRP's price.

- Social Media Trends: Social media sentiment, including discussions on forums and platforms like Twitter and Reddit, can influence investor behavior and, consequently, the XRP price.

- Technical Analysis: Technical indicators, such as chart patterns and trading volume, can provide insights into potential price movements.

Conclusion: XRP Price Prediction 2024 – A Realistic Outlook

The potential for XRP to reach $10 in 2024 depends on several interconnected factors. The Dubai license is a major catalyst, boosting institutional adoption and liquidity. However, the outcome of Ripple's legal battle and broader market conditions will also play significant roles. While the potential for growth is substantial, it's crucial to acknowledge the inherent risks associated with cryptocurrency investment. A diversified portfolio and careful risk management are essential.

Stay updated on the latest XRP price predictions, learn more about the XRP ecosystem, and invest wisely in XRP. Conduct thorough research and consult with financial advisors before making any investment decisions.

Featured Posts

-

England Vs France Six Nations Dalys Crucial Late Contribution

May 01, 2025

England Vs France Six Nations Dalys Crucial Late Contribution

May 01, 2025 -

How Nothings Modular Phone Changes The Game

May 01, 2025

How Nothings Modular Phone Changes The Game

May 01, 2025 -

Colorado Basketball Heads To Texas Tech After Toppins Big Game

May 01, 2025

Colorado Basketball Heads To Texas Tech After Toppins Big Game

May 01, 2025 -

Gaslucht Roden Vals Alarm

May 01, 2025

Gaslucht Roden Vals Alarm

May 01, 2025 -

Minority Government Election Will The Loonie Fall

May 01, 2025

Minority Government Election Will The Loonie Fall

May 01, 2025

Latest Posts

-

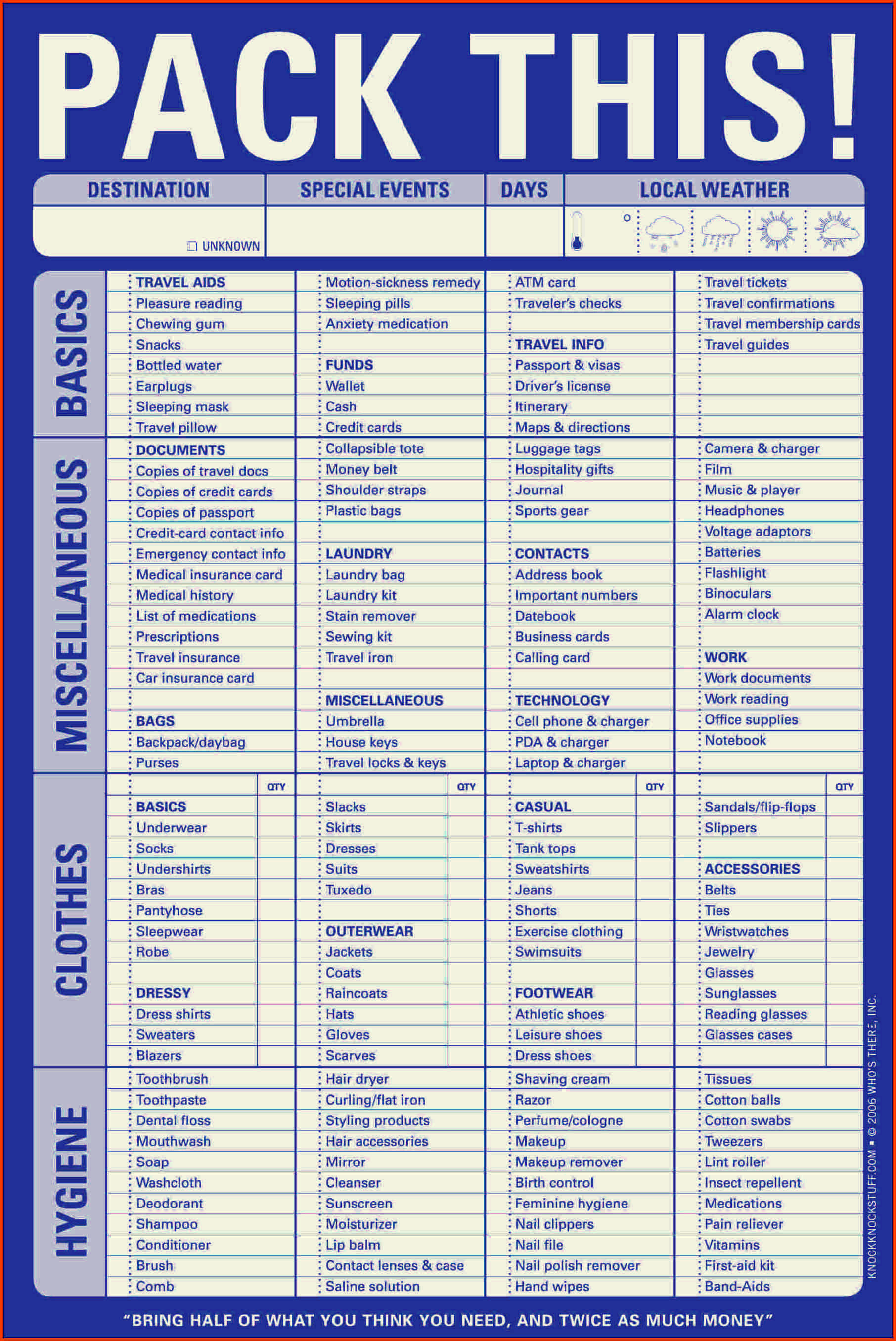

Cruise Packing Mistakes To Avoid The Ultimate Checklist

May 01, 2025

Cruise Packing Mistakes To Avoid The Ultimate Checklist

May 01, 2025 -

Banned From Cruising The Impact Of Negative Feedback

May 01, 2025

Banned From Cruising The Impact Of Negative Feedback

May 01, 2025 -

Cong Nhan Dien Luc Mien Nam Thu Thach Va Thanh Cong Tai Du An 500k V Mach 3

May 01, 2025

Cong Nhan Dien Luc Mien Nam Thu Thach Va Thanh Cong Tai Du An 500k V Mach 3

May 01, 2025 -

Hudsons Bay Artifacts A Natural Fit With Manitobas Collections

May 01, 2025

Hudsons Bay Artifacts A Natural Fit With Manitobas Collections

May 01, 2025 -

Cruise Ship Complaints And The Risk Of Permanent Bans

May 01, 2025

Cruise Ship Complaints And The Risk Of Permanent Bans

May 01, 2025