Minority Government Election: Will The Loonie Fall?

Table of Contents

Economic Policy Uncertainty Under a Minority Government

The inherent instability of minority governments significantly impacts policy implementation. The need for consensus among multiple parties inevitably slows decision-making processes. This can lead to:

- Slower decision-making processes: Legislative delays hinder the swift implementation of crucial economic policies.

- Increased risk of political deadlock on key economic issues: Disagreements among parties can result in inaction on important economic matters.

- Potential for inconsistent economic policies: Shifting alliances and changing priorities can lead to abrupt shifts in policy direction.

- Higher likelihood of snap elections: The fragility of a minority government increases the probability of early elections, further exacerbating uncertainty.

This uncertainty directly impacts investor confidence. When investors are unsure about the future direction of economic policy, they tend to become more cautious. This can lead to reduced investment, capital flight, and increased currency volatility, all of which can negatively affect the loonie's value. The resulting increase in political risk and negative investor sentiment can cause the CAD to depreciate against other major currencies.

Impact on Fiscal Policy and Government Spending

A minority government's ability to manage fiscal policy and government spending is significantly constrained. Passing a budget requires the support of other parties, potentially leading to compromises and unpredictable outcomes.

- Potential challenges in passing budgets: Negotiations with opposition parties may result in budget delays or significant alterations to the government's initial proposals.

- Negotiations with other parties could lead to unpredictable spending decisions: The final budget may reflect a compromise between competing priorities, resulting in unpredictable levels of government spending.

- Impact of different parties' economic platforms on the CAD: Different parties have different economic philosophies. For example, a focus on increased social spending could lead to higher budget deficits, potentially impacting inflation and interest rates, and subsequently weakening the loonie. Conversely, a focus on austerity could strengthen the currency.

These fiscal policy decisions significantly influence inflation, interest rates, and ultimately, the Canadian dollar's exchange rate. Higher government spending and budget deficits could fuel inflation, prompting the Bank of Canada to raise interest rates, potentially attracting foreign investment and strengthening the loonie. However, excessive deficit spending could also erode investor confidence, leading to a weaker CAD.

The Role of Global Economic Factors

It's crucial to acknowledge that the loonie's value isn't solely determined by domestic political factors. Global economic conditions play a significant role. Factors such as commodity prices (especially oil and lumber, key Canadian exports), the strength of the US dollar (USD), and global trade tensions all influence the CAD's exchange rate.

- Impact of commodity prices on CAD: Fluctuations in oil and lumber prices directly impact Canada's export revenues, influencing the demand for the Canadian dollar.

- Correlation between USD and CAD exchange rates: The Canadian dollar is closely tied to the US dollar. A strengthening USD generally leads to a weakening CAD.

- Effect of global trade wars and economic slowdowns: Global economic downturns or trade disputes can negatively impact Canadian exports and investor sentiment, resulting in a weaker loonie.

These external factors interact with the effects of a minority government. For instance, a weak global economy could exacerbate the negative impact of domestic political uncertainty on the CAD. Conversely, strong commodity prices might offset some of the negative effects of a minority government on the loonie.

Specific Examples of Potential Scenarios and Their Impact on the Loonie

Let's consider two scenarios:

Scenario 1: Budget Impasse: A prolonged budget impasse could lead to investor uncertainty, potentially weakening the loonie by 2-3% against the USD.

Scenario 2: Policy Reversal: A sudden reversal of key economic policies (e.g., changes to environmental regulations) could negatively impact investor confidence, leading to a potential short-term depreciation of the CAD of up to 1%. Note: These are hypothetical examples, and the actual impact could vary.

Conclusion: Minority Government and the Future of the Loonie

The impact of a minority government on the Canadian dollar is multifaceted. While the inherent instability might create short-term uncertainty and volatility, the ultimate effect depends on a complex interplay of domestic policy decisions and global economic conditions. Both positive and negative scenarios are possible. It's vital to consider both domestic political factors and global economic trends when predicting the loonie's future.

Stay informed about the evolving political and economic landscape to make informed decisions regarding your investments and financial planning in light of this minority government election and its potential impact on the loonie. Understanding the potential effects on the Canadian dollar forecast and the minority government's impact is crucial for navigating the loonie prediction and CAD outlook.

Featured Posts

-

Cavs Edge Blazers In Overtime Thriller Hunter Explodes For 32

May 01, 2025

Cavs Edge Blazers In Overtime Thriller Hunter Explodes For 32

May 01, 2025 -

Upcoming Coronation Street Departure A Shocking Twist For Fans

May 01, 2025

Upcoming Coronation Street Departure A Shocking Twist For Fans

May 01, 2025 -

After School Program Car Crash Four Dead Children Included

May 01, 2025

After School Program Car Crash Four Dead Children Included

May 01, 2025 -

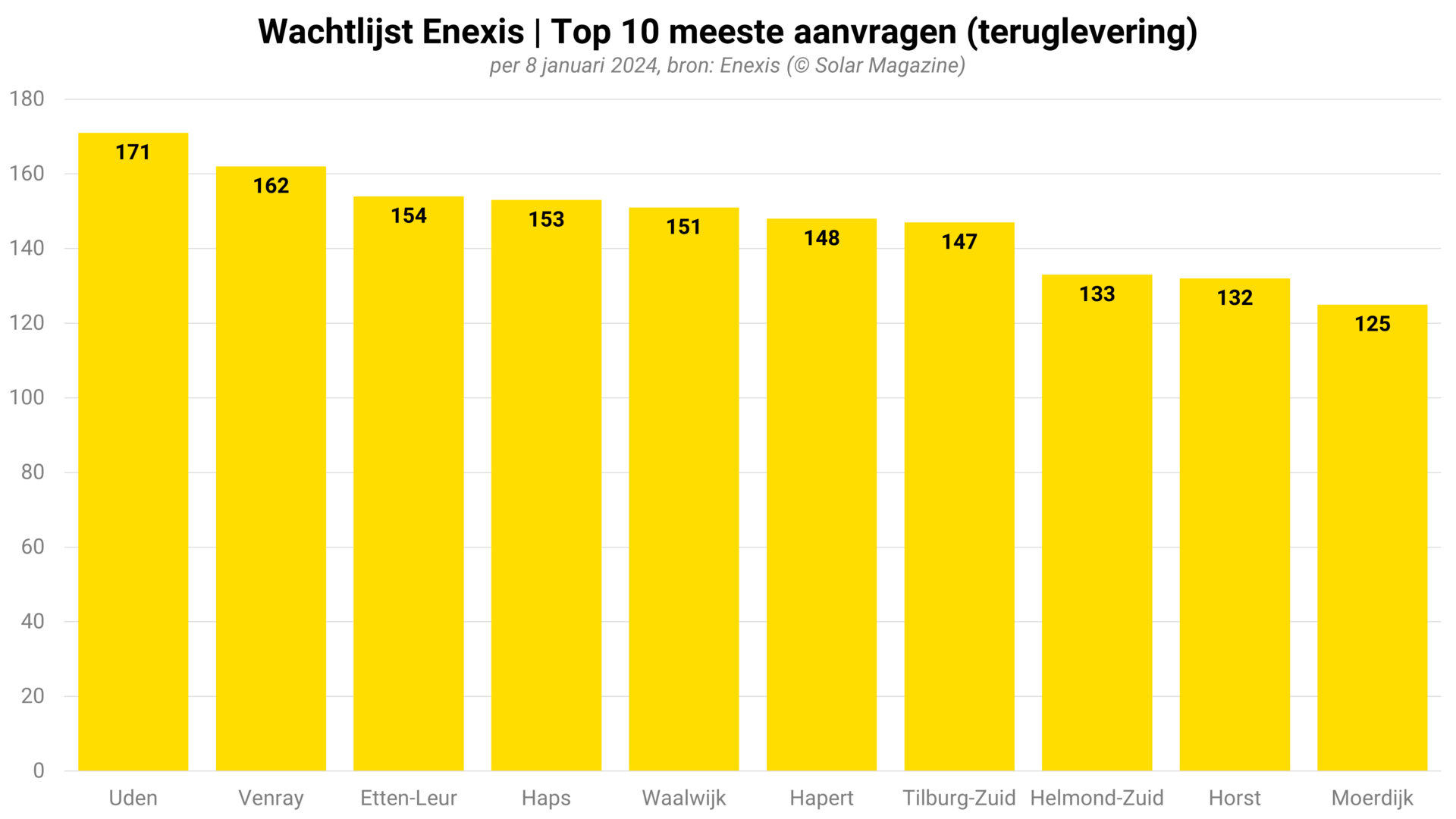

Duizenden Limburgse Bedrijven Op Wachtlijst Voor Enexis Aansluiting

May 01, 2025

Duizenden Limburgse Bedrijven Op Wachtlijst Voor Enexis Aansluiting

May 01, 2025 -

Another Dallas Star Passes Remembering The Icons Of The 80s Soap Opera

May 01, 2025

Another Dallas Star Passes Remembering The Icons Of The 80s Soap Opera

May 01, 2025