Can XRP (Ripple) Make You Rich? A Prudent Investor's Guide

Table of Contents

Understanding XRP and Ripple's Role in the Cryptocurrency Market

What is XRP and how does it differ from other cryptocurrencies?

XRP is a cryptocurrency designed to facilitate fast and low-cost international payments. Unlike Bitcoin, which operates as a decentralized digital currency, XRP is primarily used as a bridge currency on RippleNet, Ripple's payment network. Ripple's technology aims to improve the speed and efficiency of cross-border transactions for banks and financial institutions. This differs significantly from the decentralized ethos of Bitcoin and Ethereum.

- Key Differentiators: XRP's focus on institutional adoption contrasts with Bitcoin's decentralized, peer-to-peer approach. Ethereum, meanwhile, focuses on smart contracts and decentralized applications (dApps).

- Technological Advantages: RippleNet boasts significantly faster transaction speeds and lower fees compared to traditional banking systems. XRP's role in facilitating these transactions provides a unique value proposition.

- Market Position: XRP holds a significant market capitalization within the cryptocurrency landscape, although its ranking fluctuates. Its trading volume also reflects its prominence in the global crypto market.

Ripple's Legal Battles and Their Impact on XRP's Price

The ongoing SEC lawsuit against Ripple Labs significantly impacts XRP's price. The SEC alleges that Ripple conducted an unregistered securities offering, creating uncertainty for investors. The outcome of this lawsuit could dramatically affect XRP's future, potentially leading to either increased regulatory clarity or further price volatility.

- Key Legal Arguments: The SEC argues that XRP is a security, while Ripple contends it's a currency. The legal arguments center around the Howey Test, which defines what constitutes a security.

- Potential Rulings: A ruling in favor of the SEC could severely impact XRP's price and trading availability in the US. A ruling in favor of Ripple could lead to a surge in price and increased investor confidence.

- Effects on XRP Value: The legal uncertainty surrounding XRP has created significant price volatility. Investors must carefully consider the risks associated with this ongoing legal battle before investing in XRP.

Potential for Profit and Risks Involved in XRP Investment

Factors Influencing XRP's Price

Several factors influence XRP's price, making it a highly volatile investment. These include:

- Market Sentiment: Overall investor sentiment towards cryptocurrencies significantly impacts XRP's price. Positive news and broader market trends can lead to price increases, while negative news can trigger sharp declines.

- Regulatory Changes: Governmental regulations and policies concerning cryptocurrencies directly affect XRP's price. Increased regulatory clarity could stabilize the price, while stricter regulations could depress it.

- Technological Advancements: Improvements to Ripple's technology and the wider adoption of its payment solutions can positively impact XRP's price.

- Adoption by Financial Institutions: Greater adoption of RippleNet by banks and financial institutions increases XRP's utility and demand, potentially driving up the price.

- Bitcoin's Price Movements: As with many altcoins, XRP's price is often correlated with Bitcoin's price. A significant drop in Bitcoin's price can negatively impact XRP's value.

Assessing the Risks of Investing in XRP

Investing in XRP carries significant risks, and investors should be prepared for potential losses.

- Market Volatility: Cryptocurrency markets are notoriously volatile, with prices subject to rapid and substantial fluctuations. XRP is no exception, meaning significant losses are possible.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving. Changes in regulations could negatively impact XRP's value or even lead to its illegality in certain jurisdictions.

- Security Risks: Cryptocurrency exchanges and wallets are vulnerable to hacking and security breaches. Investors should prioritize secure storage practices to protect their XRP holdings.

- Loss of Entire Investment: There's a significant risk of losing your entire investment in XRP. The volatility of the market and regulatory uncertainty make this a real possibility.

Smart Strategies for Investing in XRP (if chosen)

Diversification and Risk Management

Never invest more than you can afford to lose. Diversification is crucial for managing risk. Spread your investments across various asset classes, not just cryptocurrencies.

- Diversification: Don't put all your eggs in one basket. Diversify your portfolio with other assets, such as stocks, bonds, and real estate.

- Risk Assessment: Carefully assess your risk tolerance before investing in XRP. Are you comfortable with the high volatility and potential for significant losses?

- Dollar-Cost Averaging (DCA): Consider using DCA to reduce your risk. This involves investing a fixed amount of money at regular intervals, regardless of price fluctuations.

Long-Term vs. Short-Term Investment Approaches

Both long-term and short-term investment approaches have their advantages and disadvantages.

- Long-Term Investment: This approach requires patience and involves holding XRP for an extended period, potentially weathering short-term price fluctuations. It's a good strategy if you believe in the long-term potential of Ripple and XRP.

- Short-Term Investment: This involves buying and selling XRP frequently to capitalize on short-term price movements. It's riskier but offers potentially higher returns (or losses).

Where to Buy and Store XRP Securely

Choose reputable cryptocurrency exchanges for buying XRP, and prioritize secure storage methods.

- Reputable Exchanges: Research and choose well-established and regulated cryptocurrency exchanges.

- Hardware Wallets: Consider using a hardware wallet for secure storage of your XRP. These devices provide an extra layer of security compared to software wallets.

- Security Best Practices: Be wary of phishing scams and other security threats. Never share your private keys or seed phrases with anyone.

Conclusion

Investing in XRP, like any cryptocurrency, offers the potential for significant returns but carries substantial risk. The ongoing legal battle and inherent volatility of the cryptocurrency market necessitate a prudent approach. Thorough research, diversification, and a clear understanding of your risk tolerance are crucial before considering any XRP investment.

While XRP may offer the potential to build wealth, it's vital to approach it with caution. Do your own research, assess your risk tolerance, and invest responsibly before considering whether XRP is right for your investment portfolio. Remember, making informed decisions is key to navigating the world of cryptocurrency and making smart choices about investing in XRP.

Featured Posts

-

Salmond Interview Nikki Fargas Vision For The Aces Future

May 07, 2025

Salmond Interview Nikki Fargas Vision For The Aces Future

May 07, 2025 -

Draymond Green And Steph Curry Behind The Scenes Of The Night Night Celebration

May 07, 2025

Draymond Green And Steph Curry Behind The Scenes Of The Night Night Celebration

May 07, 2025 -

Analyzing The Top Looks From The 2025 Met Gala Red Carpet

May 07, 2025

Analyzing The Top Looks From The 2025 Met Gala Red Carpet

May 07, 2025 -

Will Trumps 100 Tariff On Foreign Movies Become Reality

May 07, 2025

Will Trumps 100 Tariff On Foreign Movies Become Reality

May 07, 2025 -

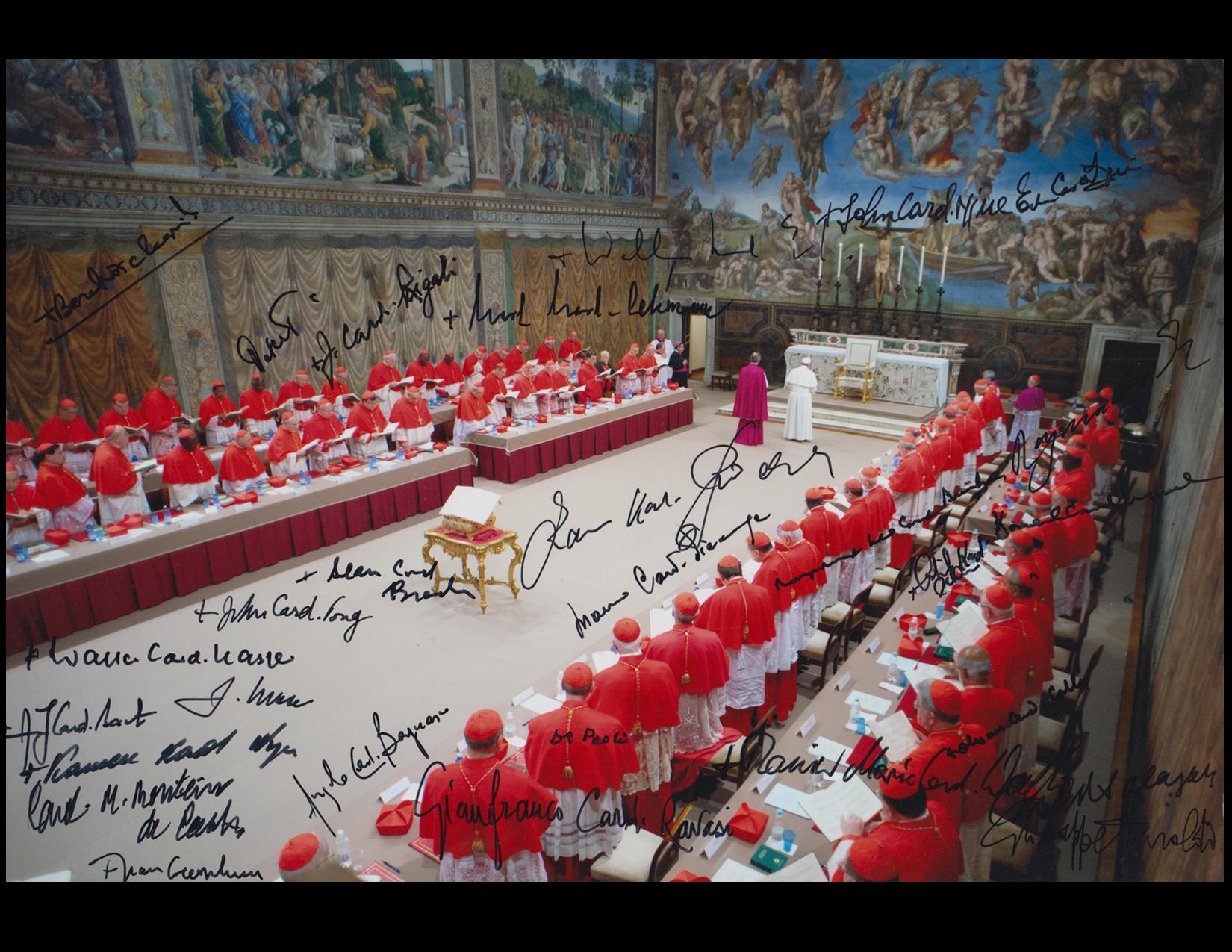

Conclave Process A Step By Step Guide To Papal Elections

May 07, 2025

Conclave Process A Step By Step Guide To Papal Elections

May 07, 2025

Latest Posts

-

Stephen King Thinks The Long Walk Trailer Is Too Intense

May 08, 2025

Stephen King Thinks The Long Walk Trailer Is Too Intense

May 08, 2025 -

The Long Walk Trailer Stephen King Calls It Too Dark

May 08, 2025

The Long Walk Trailer Stephen King Calls It Too Dark

May 08, 2025 -

New Dystopian Horror Movie Based On Stephen King First Trailer Unveiled

May 08, 2025

New Dystopian Horror Movie Based On Stephen King First Trailer Unveiled

May 08, 2025 -

Stephen Kings Underrated Novel Gets Dystopian Horror Treatment First Trailer Released

May 08, 2025

Stephen Kings Underrated Novel Gets Dystopian Horror Treatment First Trailer Released

May 08, 2025 -

First Trailer Dystopian Horror From Hunger Games Director Based On Stephen King

May 08, 2025

First Trailer Dystopian Horror From Hunger Games Director Based On Stephen King

May 08, 2025