Brookfield's Opportunistic Approach: Profiting From Market Disruptions

Table of Contents

Brookfield's Strategic Investment Philosophy

Brookfield's long-term value creation strategy hinges on a counter-cyclical investment philosophy. Instead of shying away from market downturns, they view these periods as ripe with opportunities to acquire undervalued assets and build long-term value. This opportunistic approach is characterized by:

- Emphasis on deep value investing: Brookfield meticulously searches for assets trading below their intrinsic value, often during periods of market stress. Their deep understanding of market cycles allows them to identify mispriced assets and capitalize on discrepancies.

- Active portfolio management and asset repositioning: They actively manage their portfolio, repositioning assets to maximize returns and adapt to changing market conditions. This proactive approach ensures they are constantly optimizing their investments for maximum profitability.

- Significant expertise in various asset classes: Brookfield's expertise spans real estate, infrastructure, renewable power, private equity, and credit investments. This diversification allows them to identify opportunities across a wide range of sectors, mitigating risk and maximizing returns.

- Strong risk management capabilities: Rigorous risk assessment and management are integral to Brookfield's strategy. They carefully analyze potential risks and implement mitigation strategies to protect their investments and ensure long-term success.

Capitalizing on Market Disruptions

Brookfield's success in profiting from market volatility is evident in its performance during significant market downturns. For instance, during the 2008 financial crisis, Brookfield capitalized on distressed assets, acquiring properties and businesses at significantly discounted prices. Their ability to identify undervalued assets during times of uncertainty stems from several key strategies:

- Acquisition of distressed assets at significant discounts: Brookfield actively seeks out distressed assets during market downturns, leveraging their financial strength and negotiating power to secure attractive deals.

- Strategic partnerships and joint ventures: They often collaborate with other investors to share risks and leverage expertise, enabling them to undertake larger and more complex transactions.

- Expertise in navigating regulatory hurdles and complex transactions: Brookfield possesses deep experience in navigating the legal and regulatory complexities involved in acquiring and managing distressed assets.

- Long-term hold strategy maximizing value appreciation: Rather than focusing on short-term gains, Brookfield adopts a long-term hold strategy, allowing them to capitalize on the eventual appreciation of assets.

Diversification Across Asset Classes

Brookfield’s diversified investment portfolio is a key factor in its ability to mitigate risk and profit from market disruptions. By investing across a variety of asset classes, they are less susceptible to the performance of any single sector. Their portfolio includes:

- Real estate: Residential, commercial, industrial, and hospitality properties provide exposure to different market segments and geographic regions.

- Infrastructure: Investments in transportation, utilities, and energy assets offer stable cash flows and long-term growth potential.

- Renewable power: Solar, wind, and hydro power generation projects provide exposure to the growing renewable energy sector.

- Private equity: Investments in private companies offer the potential for high returns, but also carry higher risk.

- Credit investments: Investing in various credit instruments provides additional diversification and income generation opportunities.

Brookfield's Competitive Advantages

Brookfield's success is also fueled by several key competitive advantages:

- Strong balance sheet and access to capital: Their robust financial position allows them to seize opportunities quickly and confidently, even during periods of market turmoil.

- Deep industry expertise and long-term relationships: Years of experience and strong relationships within various sectors provide Brookfield with valuable insights and competitive advantages.

- Global network and reach: Their global presence enables them to identify and exploit opportunities across multiple geographies and markets.

- Superior operational capabilities and asset management skills: Brookfield’s operational expertise allows them to enhance the performance of acquired assets and maximize returns.

Unlocking Opportunities with Brookfield's Opportunistic Approach

Brookfield’s success story is a testament to the power of a well-defined opportunistic approach to investment. Their ability to consistently profit from market disruptions is driven by a long-term vision, strategic diversification, deep value investing, and robust risk management. By understanding and leveraging these strategies, Brookfield has built a formidable track record. Learn how you can benefit from Brookfield's proven opportunistic approach by visiting [link to relevant resource]. Understanding Brookfield's strategy for navigating market disruption opportunities and their opportunistic investment strategies can provide valuable insights for investors seeking to profit from market volatility.

Featured Posts

-

Russell Westbrooks Birthday Serenade For Nikola Jokic Nuggets Heartfelt Tribute

May 08, 2025

Russell Westbrooks Birthday Serenade For Nikola Jokic Nuggets Heartfelt Tribute

May 08, 2025 -

The Long Walks First Trailer Simple Design Chilling Effect

May 08, 2025

The Long Walks First Trailer Simple Design Chilling Effect

May 08, 2025 -

Google Search Chief Warns Of Dojs Impact On User Trust

May 08, 2025

Google Search Chief Warns Of Dojs Impact On User Trust

May 08, 2025 -

Trump Appointee Predicts Bitcoin Rally Amidst Market Volatility

May 08, 2025

Trump Appointee Predicts Bitcoin Rally Amidst Market Volatility

May 08, 2025 -

Counting Crows Snl Performance A Career Retrospective

May 08, 2025

Counting Crows Snl Performance A Career Retrospective

May 08, 2025

Latest Posts

-

Counting Crows Snl Appearance A Turning Point

May 08, 2025

Counting Crows Snl Appearance A Turning Point

May 08, 2025 -

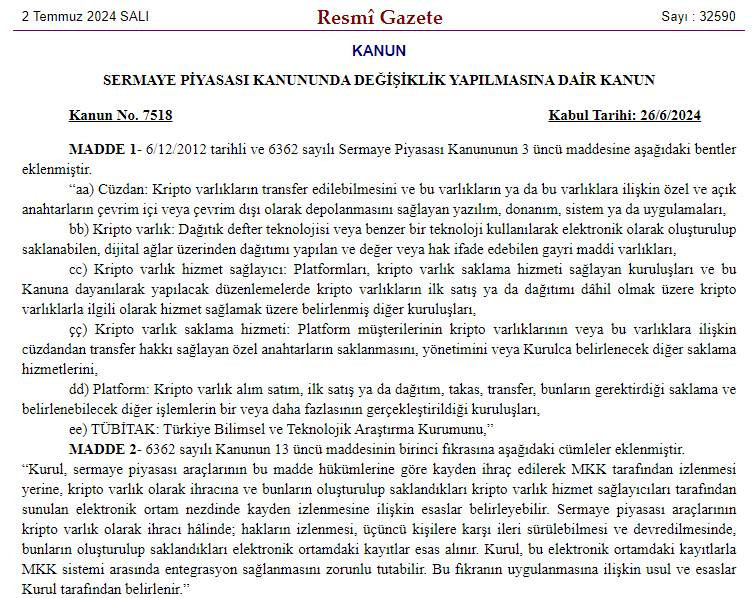

Kripto Para Miras Planlamasi Riskleri Ve Guevenli Yoentemleri

May 08, 2025

Kripto Para Miras Planlamasi Riskleri Ve Guevenli Yoentemleri

May 08, 2025 -

The Lasting Legacy Of Counting Crows Saturday Night Live Performance

May 08, 2025

The Lasting Legacy Of Counting Crows Saturday Night Live Performance

May 08, 2025 -

Sifrenizi Unuttunuz Mu Kripto Varliklarinizi Nasil Koruyabilirsiniz

May 08, 2025

Sifrenizi Unuttunuz Mu Kripto Varliklarinizi Nasil Koruyabilirsiniz

May 08, 2025 -

Son Dakika Bakan Simsek In Kripto Para Sektoeruene Yoenelik Uyarisi

May 08, 2025

Son Dakika Bakan Simsek In Kripto Para Sektoeruene Yoenelik Uyarisi

May 08, 2025