Would Privatizing Student Loans Under Trump Benefit Or Harm Borrowers?

Table of Contents

Potential Benefits of Privatizing Student Loans

Advocates of privatizing student loans argued that a shift away from government control could lead to significant improvements in the system.

Increased Competition and Innovation

The introduction of private lenders into the student loan market could foster competition, potentially leading to more competitive interest rates and more flexible repayment options. This increased competition could also spur innovation in loan servicing and borrower support. Imagine:

- More tailored repayment plans: Private lenders might offer plans designed to fit individual circumstances, such as income-based repayment options tailored to specific career paths.

- Incentives for on-time payments: Reward programs could encourage timely repayments, potentially lowering the overall cost of borrowing.

- Improved customer service: Private companies often prioritize customer satisfaction to maintain a competitive edge, potentially leading to better support for borrowers.

Enhanced Efficiency and Reduced Government Burden

Proponents also suggested that privatization could streamline the student loan process, reducing the administrative burden on the government. This, in turn, could lead to cost savings for taxpayers. However, this argument isn't without its critics. Concerns exist about:

- Increased risk of predatory lending: Without robust regulation, private lenders might engage in practices that exploit borrowers.

- Potential for higher default rates: If loans become less accessible or repayment terms are overly stringent, default rates could rise, negating any potential cost savings.

Potential Harms of Privatizing Student Loans

While the potential benefits are alluring, the potential negative consequences of privatizing student loans are equally significant and perhaps more impactful for borrowers.

Increased Costs for Borrowers

One of the most significant concerns is that private lenders, driven by profit motives, might charge significantly higher interest rates and fees compared to government-backed loans. This could result in:

- Higher overall loan costs: Borrowers could end up paying substantially more over the life of their loans.

- Limited access to loan forgiveness programs: Private loans typically don't qualify for the same forgiveness programs as federal loans.

- Increased risk of bankruptcy: The higher cost of borrowing could exacerbate financial hardship and increase the likelihood of borrowers filing for bankruptcy.

Reduced Access to Loans for Low-Income Borrowers

Privatization could disproportionately impact low-income students. Private lenders, focused on profitability, might be less willing to extend loans to students with limited credit history or those from disadvantaged backgrounds. This could lead to:

- Increased inequality in higher education access: Students from lower socioeconomic backgrounds could face greater barriers to obtaining a college education. This would further widen the existing achievement gap.

Lack of Regulatory Oversight and Consumer Protections

A crucial concern is the potential for weaker consumer protections under a privatized system. The government currently provides a significant level of oversight and regulation to protect borrowers from predatory lending practices. Removing this oversight could expose borrowers to risks such as:

- Difficulty enforcing repayment terms: Borrowers might find it harder to resolve disputes with private lenders.

- Lack of recourse for borrowers facing unfair practices: Without strong regulatory bodies, borrowers may have fewer options to address unfair or abusive lending practices.

Conclusion

The debate surrounding privatizing student loans under the Trump administration highlights a complex issue with significant implications for borrowers. While privatization might offer some potential benefits like increased competition and efficiency, the risks of increased costs, reduced access for low-income borrowers, and weakened consumer protections are substantial. Based on the evidence presented, the potential harms outweigh the potential benefits. Understanding the potential impacts of privatizing student loans is crucial for all borrowers. Continue researching this important topic and contact your elected officials to share your concerns about the future of student loan debt. The conversation surrounding student loan privatization and its effects on borrowers must continue.

Featured Posts

-

Track Roundup All Conference Honors Announced For Student Athletes

May 17, 2025

Track Roundup All Conference Honors Announced For Student Athletes

May 17, 2025 -

Tam Krwz Ke Jwte Pr Mdah Ka Pawn Hyran Kn Waqeh

May 17, 2025

Tam Krwz Ke Jwte Pr Mdah Ka Pawn Hyran Kn Waqeh

May 17, 2025 -

A Financial Planners Advice For Student Loan Borrowers

May 17, 2025

A Financial Planners Advice For Student Loan Borrowers

May 17, 2025 -

Investicije Srba U Nekretnine U Inostranstvu Gde I Zasto

May 17, 2025

Investicije Srba U Nekretnine U Inostranstvu Gde I Zasto

May 17, 2025 -

Peringatan Houthi Serangan Rudal Mendekati Dubai Dan Abu Dhabi

May 17, 2025

Peringatan Houthi Serangan Rudal Mendekati Dubai Dan Abu Dhabi

May 17, 2025

Latest Posts

-

Anunoby Scores 27 As Knicks Beat Sixers 105 91 Extending Losing Streak To Nine

May 17, 2025

Anunoby Scores 27 As Knicks Beat Sixers 105 91 Extending Losing Streak To Nine

May 17, 2025 -

Knicks Defeat 76ers 105 91 Anunobys 27 Points Key To Ninth Straight Sixers Loss

May 17, 2025

Knicks Defeat 76ers 105 91 Anunobys 27 Points Key To Ninth Straight Sixers Loss

May 17, 2025 -

Analyzing Piston And Knicks Success Key Factors And Predictions

May 17, 2025

Analyzing Piston And Knicks Success Key Factors And Predictions

May 17, 2025 -

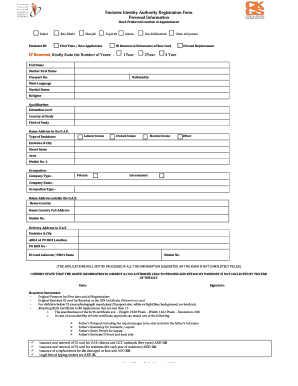

Emirates Id Application For Newborns Fees And Requirements Uae March 2025

May 17, 2025

Emirates Id Application For Newborns Fees And Requirements Uae March 2025

May 17, 2025 -

Detroit Pistons Vs New York Knicks Predicting The 2023 2024 Season

May 17, 2025

Detroit Pistons Vs New York Knicks Predicting The 2023 2024 Season

May 17, 2025