A Financial Planner's Advice For Student Loan Borrowers

Table of Contents

Understanding Your Student Loan Debt

Before you can strategize for effective student loan repayment, you need a clear picture of your debt. Understanding the different types of loans you have and their specific terms is the first crucial step.

This involves differentiating between federal student loans and private student loans. Federal loans offer various repayment plans and protections not available with private loans. Within federal loans, you'll encounter subsidized and unsubsidized loans. Subsidized loans don't accrue interest while you're in school (under certain conditions), while unsubsidized loans do.

To access your loan information, you'll need to utilize online resources. The National Student Loan Data System (NSLDS) is a central database providing access to your federal student loan information. Private loan details will be available through your lender's website or account portal.

- Identify all your loans and their interest rates. This includes both the principal amount and the annual percentage rate (APR).

- Determine your total loan balance. This gives you a comprehensive understanding of your overall debt.

- Understand the terms and conditions of each loan. Pay close attention to repayment periods, grace periods, and any penalties for late payments.

- Note any deferment or forbearance options available. These options can temporarily postpone or reduce your payments during times of financial hardship. However, understand that interest may still accrue during these periods, increasing your total debt.

Exploring Different Repayment Plans

The federal government offers several repayment plans designed to accommodate various financial situations. Choosing the right plan is crucial for effective student loan repayment.

- Standard Repayment Plan: This plan involves fixed monthly payments over 10 years. It's the simplest option but may result in higher monthly payments.

- Extended Repayment Plan: This plan stretches payments over a longer period (up to 25 years), leading to lower monthly payments but higher overall interest paid.

- Graduated Repayment Plan: This plan starts with lower monthly payments that gradually increase over time. It can be easier initially but can become more challenging as payments rise.

- Income-Driven Repayment (IDR) Plans: These plans (like ICR, PAYE, REPAYE, and IBR) base your monthly payment on your income and family size. They are excellent options for borrowers with lower incomes, but they may extend your repayment period significantly.

Choosing the best plan depends on your individual financial situation, income, and long-term goals. Consider consulting a financial advisor for personalized advice on which plan suits your needs best.

Strategies to Minimize Interest and Accelerate Repayment

Minimizing interest payments is key to reducing the overall cost of borrowing and achieving faster student loan repayment. Several strategies can help you achieve this:

- Make extra principal payments whenever possible. Even small extra payments can significantly reduce the total interest paid over the life of the loan.

- Explore refinancing options to potentially lower your interest rate. Refinancing can consolidate multiple loans into one with a lower interest rate, saving you money over time. However, be aware of the terms and conditions, and ensure it's the right option for your situation.

- Consider the debt avalanche (highest interest first) or snowball (smallest debt first) method. These debt repayment strategies can provide a sense of accomplishment and accelerate your progress.

- Automate payments to ensure consistent repayments. Setting up automatic payments removes the risk of missed payments and late fees.

Long-Term Financial Planning After Student Loan Repayment

Once you've conquered your student loans, shifting your focus to long-term financial planning is crucial. This involves creating a comprehensive plan that encompasses several key areas.

- Create a budget to track your income and expenses. This will help you manage your finances effectively and allocate resources towards your goals.

- Set realistic financial goals (e.g., saving for a down payment, investing). Having clear goals will provide direction and motivation.

- Start saving for retirement early, even with small amounts. Compounding interest over time will significantly boost your retirement savings.

- Build your credit score through responsible credit use. A good credit score will unlock better opportunities, such as securing loans with lower interest rates in the future.

Conclusion:

Effectively managing your student loan repayment is a crucial step toward achieving your long-term financial goals. By understanding your loan details, exploring different repayment options, and implementing smart repayment strategies, you can significantly reduce your debt burden and build a secure financial future. Remember to prioritize financial planning and seek professional advice when needed. Don't let student loan debt hold you back – take control of your student loan repayment today and start building the financial life you deserve. Learn more about effective student loan repayment strategies by [link to relevant resource/contact information].

Featured Posts

-

This Air Traffic Controllers Exclusive Account Of A Midair Collision

May 17, 2025

This Air Traffic Controllers Exclusive Account Of A Midair Collision

May 17, 2025 -

Best Crypto Casinos 2024 Is Jackbit The Top Bitcoin Casino

May 17, 2025

Best Crypto Casinos 2024 Is Jackbit The Top Bitcoin Casino

May 17, 2025 -

Hl Qst Hb Twm Krwz Wana Dy Armas Hqyqyt Farq 26 Eama Ythyr Aljdl

May 17, 2025

Hl Qst Hb Twm Krwz Wana Dy Armas Hqyqyt Farq 26 Eama Ythyr Aljdl

May 17, 2025 -

Gwendoline Christie From Game Of Thrones To Severance A Career Defined By Challenge

May 17, 2025

Gwendoline Christie From Game Of Thrones To Severance A Career Defined By Challenge

May 17, 2025 -

Srbija Na Evrobasketu Generalka I Poslednje Pripreme U Minhenu

May 17, 2025

Srbija Na Evrobasketu Generalka I Poslednje Pripreme U Minhenu

May 17, 2025

Latest Posts

-

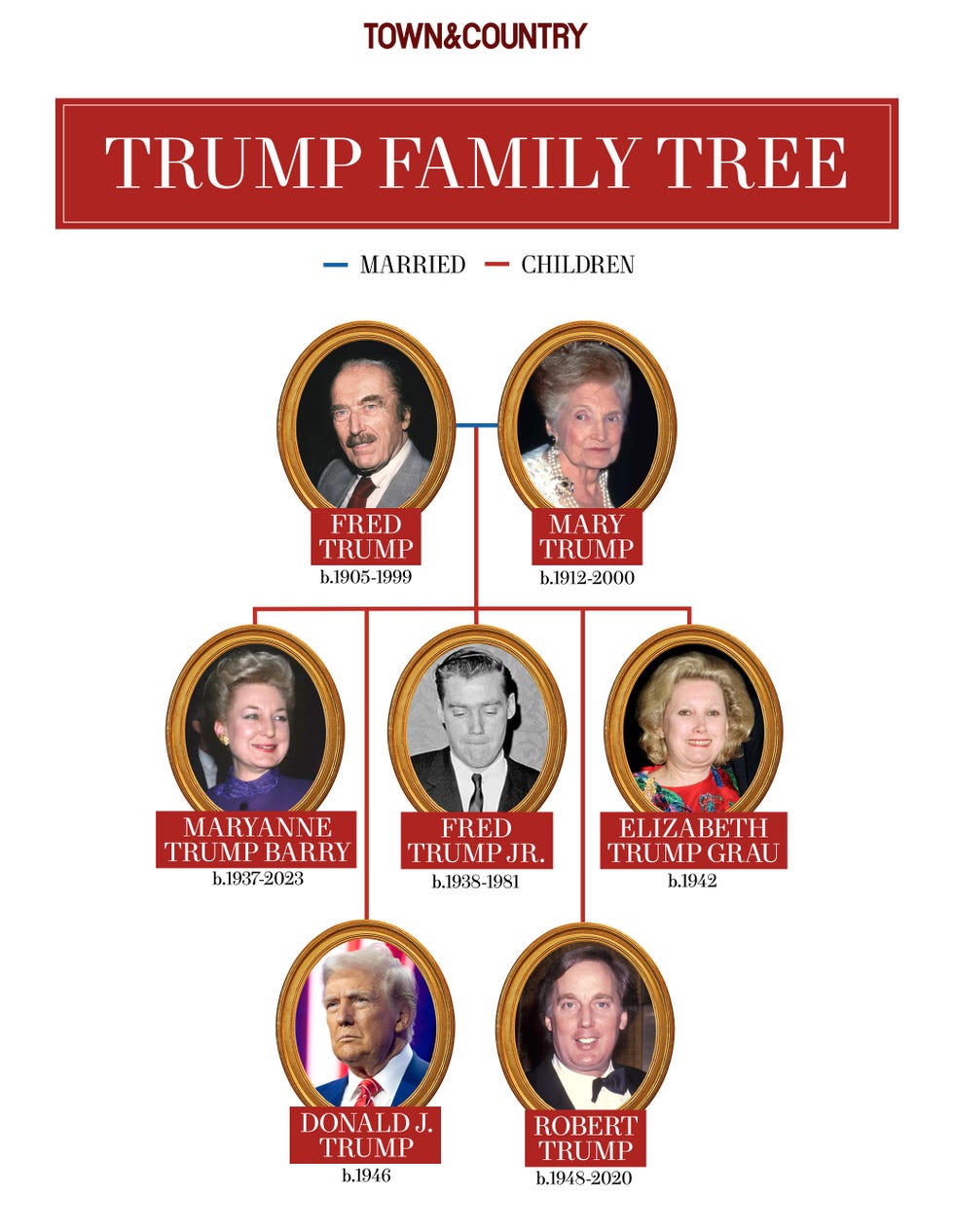

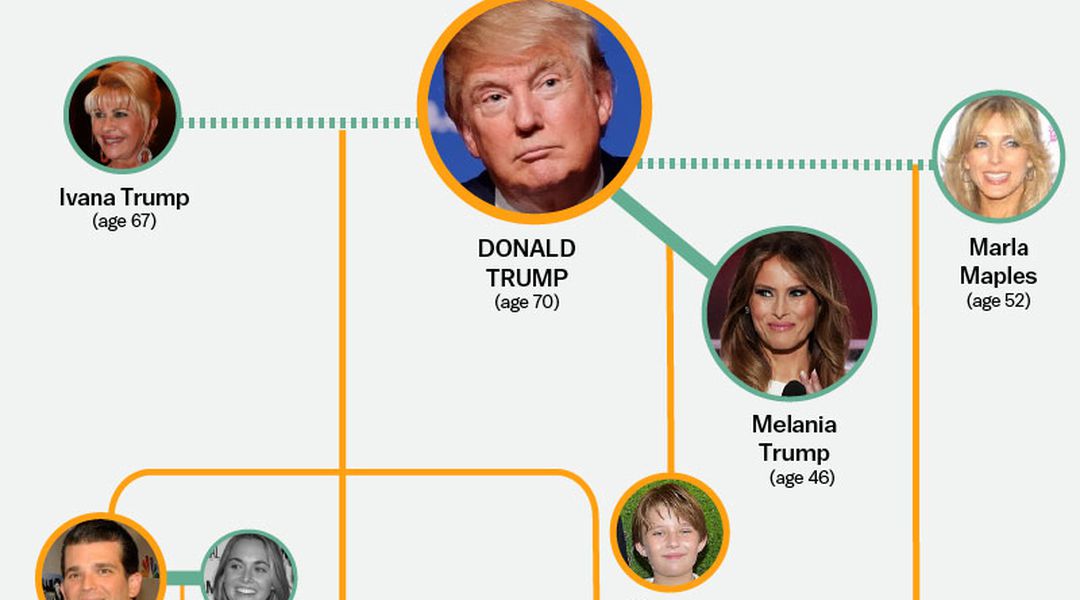

Donald Trumps Family Tree Exploring The Presidents Lineage

May 17, 2025

Donald Trumps Family Tree Exploring The Presidents Lineage

May 17, 2025 -

New York Knicks Prove Their Depth Without Jalen Brunson

May 17, 2025

New York Knicks Prove Their Depth Without Jalen Brunson

May 17, 2025 -

The Trump Family Genealogy And Relationships Of Donald Trumps Relatives

May 17, 2025

The Trump Family Genealogy And Relationships Of Donald Trumps Relatives

May 17, 2025 -

Jalen Brunson Out How The New York Knicks Are Showcasing Their Bench

May 17, 2025

Jalen Brunson Out How The New York Knicks Are Showcasing Their Bench

May 17, 2025 -

Trump Family Tree A Comprehensive Guide To The Trump Family

May 17, 2025

Trump Family Tree A Comprehensive Guide To The Trump Family

May 17, 2025