Will Republican Infighting Sink Trump's "Big Beautiful" Tax Bill?

Table of Contents

The Core Divisions Within the Republican Party

The Republican party, despite its unified control at the time of this proposed legislation, is far from monolithic. Significant fissures exist between different factions, threatening the passage of Trump's "big beautiful" tax bill. These divisions are primarily along ideological lines, with fiscal conservatives clashing with social conservatives, and moderates struggling against hardliners. This internal struggle creates a minefield for the already complex process of tax reform.

-

Differences in approaches to tax cuts: A key point of contention centers around the balance between corporate and individual tax cuts. Some Republicans prioritize slashing corporate taxes to stimulate economic growth, while others advocate for more significant reductions in individual income taxes to benefit average Americans. This debate is further complicated by the differing opinions on which income brackets should receive the largest tax breaks.

-

Disagreements on the scope of tax reform: The extent of the tax reform is another area of disagreement. Some favor a comprehensive overhaul of the tax code, addressing numerous aspects and potential loopholes. Others advocate for a more targeted approach, focusing on specific areas for reform while leaving others untouched. This disagreement complicates the already complex task of drafting legislation that will satisfy diverse interests.

-

Internal power struggles and competing agendas: Beyond ideological differences, internal power struggles within the Republican party further complicate the situation. Different factions vie for influence, leading to compromises that may dilute the bill's original intent or delay its progress. This power dynamic creates a complex political environment where compromises and concessions become necessary, potentially threatening the bill's core principles.

-

The role of lobbying groups and their influence: Powerful lobbying groups representing various industries exert considerable influence on the legislative process. Their contributions and advocacy efforts can sway individual lawmakers, further exacerbating internal divisions and making it harder to reach consensus on key provisions of Trump's "big beautiful" tax bill.

Specific Provisions Fueling the Infighting

Several aspects of Trump's proposed tax bill have become major sources of internal conflict within the Republican party. These specific provisions have fueled heated debates and threaten to derail the entire legislation.

-

Debate over the corporate tax rate: The proposed reduction in the corporate tax rate has sparked intense debate. While some believe it will boost economic growth, others worry about its impact on the federal budget and its potential to disproportionately benefit large corporations. This debate highlights the conflict between promoting economic growth and ensuring fiscal responsibility within the party.

-

Disagreements on individual tax brackets and deductions: Disagreements persist on how to adjust individual tax brackets and various deductions. The elimination or modification of specific deductions – like the state and local tax deduction (SALT) – has particularly inflamed tensions within the party, creating divisions between regions and economic interests.

-

Controversies surrounding the estate tax and alternative minimum tax: The fate of the estate tax and the alternative minimum tax (AMT) remains highly contentious. Proposals to repeal or significantly alter these taxes have sparked disagreements over fairness, economic impact, and the overall philosophy of taxation within the Republican party.

-

The impact on specific demographics and industries: The potential effects of the tax bill on various demographics and industries have also fueled internal divisions. Differing analyses of how the legislation will impact specific groups have made it difficult for the party to present a united front on the bill’s intended effects.

The Impact of Senate Procedures and Narrow Margins

The Senate's unique procedural rules and the narrow Republican majority significantly impact the prospects of Trump's "big beautiful" tax bill. The Senate's filibuster rule, which allows a minority of senators to block legislation, poses a significant hurdle.

-

The need for bipartisan support or overcoming internal dissent: To pass the bill, Republicans may need either bipartisan support or complete internal unity. Given the deep divisions within the party, achieving either of these scenarios is challenging. The necessity for near-unanimity makes the process extremely fragile and susceptible to disruption.

-

The potential for amendments and procedural delays: The Senate's rules allow for numerous amendments, which can be used by opponents to delay or significantly alter the bill. This potential for amendment and procedural maneuvering greatly increases the likelihood of unexpected outcomes and compromises that may threaten the bill's core objectives.

-

The role of key swing senators and their influence on the outcome: The votes of a few moderate or swing senators will likely prove decisive. Their decisions, influenced by internal party pressures, lobbying efforts, and constituent concerns, will significantly determine whether the legislation passes and, if so, in what form.

Potential Outcomes and Scenarios

Several scenarios are possible, ranging from successful passage to complete failure:

-

Scenario 1: Successful passage with compromises: The bill might pass after significant compromises and concessions are made to appease various factions within the Republican party. This scenario would likely result in a diluted version of the original proposal, potentially satisfying no one completely.

-

Scenario 2: Significant alterations to the bill due to infighting: Intense internal disagreements could lead to significant changes to the bill's original provisions. The outcome could be a substantially different piece of legislation than initially envisioned, potentially leading to dissatisfaction among supporters.

-

Scenario 3: Failure to pass the bill: The most likely scenario, given the existing divisions, is the bill's failure to pass due to a lack of consensus. This outcome would represent a significant setback for the Trump administration and the Republican party's legislative agenda.

Conclusion

The passage of Trump's "big beautiful" tax bill faces significant hurdles, primarily due to deep internal divisions within the Republican party. Disagreements over specific provisions, procedural challenges in the Senate, and the influence of lobbying groups all contribute to this precarious situation. The potential outcomes range from a significantly altered bill to its complete failure. The political implications of either success or failure are profound, impacting not only the Trump administration's economic agenda but also the future of the Republican party itself. Stay informed about the ongoing developments surrounding Trump's "big beautiful" tax bill. Follow our website for up-to-date analysis and coverage of this crucial piece of legislation. The future of the bill—and perhaps the future of the Republican party—depends on overcoming these significant internal challenges.

Featured Posts

-

Fussball Austria Wien Jancker Der Neue Trainer

Apr 29, 2025

Fussball Austria Wien Jancker Der Neue Trainer

Apr 29, 2025 -

Papal Conclave Debate Surrounding Convicted Cardinals Voting Rights

Apr 29, 2025

Papal Conclave Debate Surrounding Convicted Cardinals Voting Rights

Apr 29, 2025 -

Ray Epps Sues Fox News For Defamation January 6th Falsehoods At The Center Of The Lawsuit

Apr 29, 2025

Ray Epps Sues Fox News For Defamation January 6th Falsehoods At The Center Of The Lawsuit

Apr 29, 2025 -

British Paralympian Missing In Las Vegas Belongings Left Behind At Hostel

Apr 29, 2025

British Paralympian Missing In Las Vegas Belongings Left Behind At Hostel

Apr 29, 2025 -

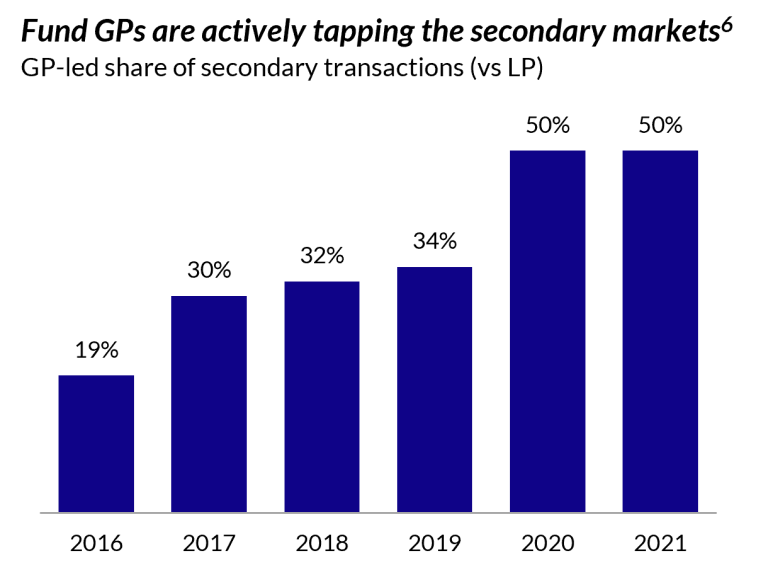

Is The Venture Capital Secondary Market Right For You

Apr 29, 2025

Is The Venture Capital Secondary Market Right For You

Apr 29, 2025