Is The Venture Capital Secondary Market Right For You?

Table of Contents

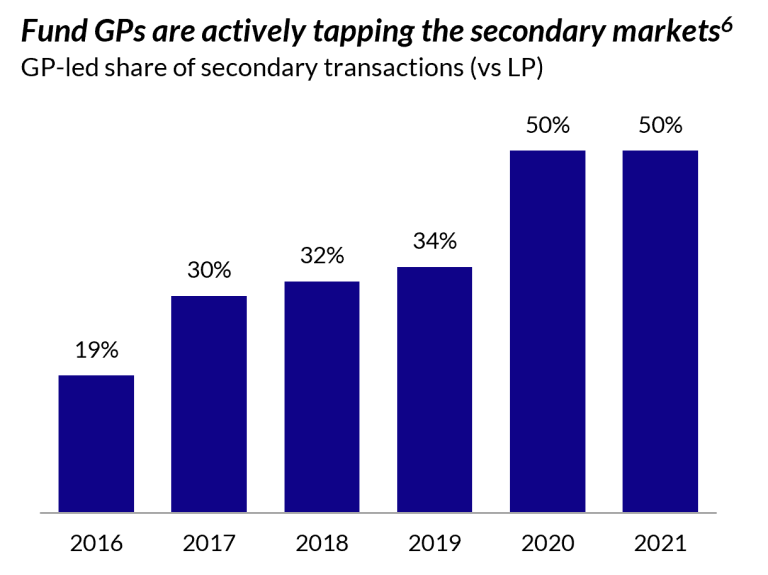

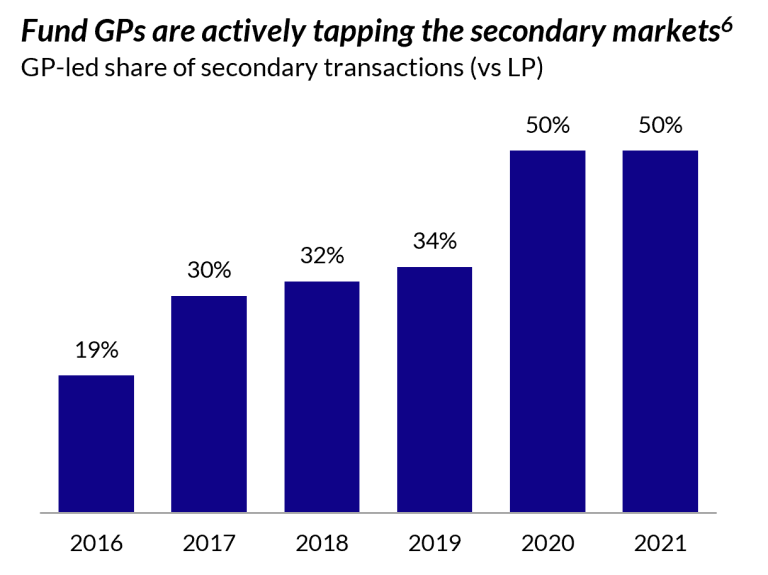

Understanding the Venture Capital Secondary Market

The venture capital secondary market is a marketplace where existing venture capital investments are bought and sold. Unlike the primary market, where investors directly fund startups, the secondary market involves the trading of already-existing stakes in privately held companies. This creates several key distinctions:

- Trading of existing VC investments: Investors can buy and sell their shares in privately held companies without waiting for an IPO or acquisition.

- Liquidity for early-stage investors: This market provides a crucial exit strategy for early investors who need to realize returns on their investments before a traditional exit event.

- Access to diversified portfolios for new investors: It allows new investors to gain exposure to a diversified portfolio of promising private companies, often without the high minimum investment thresholds of the primary market.

- Transactions facilitated by brokers and marketplaces: Specialized brokers and online marketplaces facilitate these transactions, connecting buyers and sellers. These platforms often provide valuation support and streamline the transaction process.

Advantages of the Venture Capital Secondary Market

Participating in the venture capital secondary market offers several compelling advantages:

- Enhanced Liquidity: One of the biggest benefits is the ability to access capital much faster than waiting for an IPO or acquisition, which can take years or may never happen. This liquidity is particularly attractive to Limited Partners (LPs) in venture capital funds with shorter investment horizons.

- Portfolio Diversification: Investors can easily rebalance their portfolios, selling less promising investments to acquire stakes in more attractive opportunities. This allows for dynamic portfolio management and risk mitigation.

- Access to Pre-IPO Opportunities: The secondary market allows investors to gain exposure to high-growth companies at potentially lower valuations than they might achieve in the public markets post-IPO. This presents an opportunity for significant returns.

- Tax Optimization Strategies: Depending on your jurisdiction and specific circumstances, there may be opportunities for tax optimization strategies when participating in secondary market transactions. However, it's crucial to consult with a qualified tax professional to understand the implications.

Disadvantages of the Venture Capital Secondary Market

While the venture capital secondary market offers exciting prospects, it's essential to acknowledge the potential drawbacks:

- Valuation Challenges: Determining the fair market value of a private company stake can be complex and subjective. Valuation methodologies can vary, leading to potential discrepancies between buyer and seller expectations.

- Liquidity Risk: While the secondary market enhances liquidity compared to holding an illiquid private company stake indefinitely, it is still less liquid than publicly traded securities. Finding a buyer for a specific investment can take time.

- Transaction Costs: Brokerage fees, legal fees, and other transaction expenses can be substantial, impacting overall returns. These costs should be factored into your investment analysis.

- Regulatory Considerations: Navigating the regulatory landscape surrounding private securities transactions is critical. Compliance with securities laws and regulations is paramount.

- Information Asymmetry: There’s a potential for information asymmetry, where sellers might possess more information about the underlying company than buyers. Thorough due diligence is crucial to mitigate this risk.

Who Should Consider the Venture Capital Secondary Market?

The venture capital secondary market isn't suitable for every investor. Ideal profiles often include:

- LPs seeking liquidity: Limited partners in venture capital funds often need to exit investments to meet obligations or redeploy capital. The secondary market provides a mechanism to do so.

- High-net-worth individuals: High-net-worth individuals and family offices seeking diversification and access to pre-IPO opportunities often find the secondary market attractive.

- Family offices: Family offices with complex investment portfolios can use the secondary market to manage their holdings more efficiently and strategically.

- Institutional investors: Sophisticated institutional investors may utilize the secondary market as part of a broader alternative investment strategy.

Due Diligence and Risk Mitigation in the Venture Capital Secondary Market

Thorough due diligence is paramount when participating in the venture capital secondary market. Risk mitigation strategies should include:

- Independent valuation: Obtain an independent valuation of the investment to ensure fair pricing.

- Legal review of transaction documents: Engage legal counsel to review all transaction documents and ensure compliance with applicable regulations.

- Understanding the underlying company's financials and prospects: Conduct comprehensive research on the underlying company's financial performance, growth trajectory, and competitive landscape.

- Assessing the reputation and experience of the broker or marketplace: Choose reputable brokers and marketplaces with a proven track record.

Conclusion

The venture capital secondary market offers unique opportunities for both existing and new investors. While it presents advantages like enhanced liquidity and diversification, it's crucial to be aware of potential challenges such as valuation complexities and transaction costs. Carefully weigh the benefits and risks before participating. If you're seeking alternative investment strategies and believe the venture capital secondary market aligns with your investment goals, consult with financial advisors specializing in this area to explore the possibilities further. Consider your risk tolerance and investment timeline. Make informed decisions about your venture capital secondary market investments.

Featured Posts

-

Vatican Defrauded London Property Deal Ruled Fraudulent By British Court

Apr 29, 2025

Vatican Defrauded London Property Deal Ruled Fraudulent By British Court

Apr 29, 2025 -

Nach Dem Klauss Aus Bei Rapid Rueckkehr Von Pacult Im Gespraech

Apr 29, 2025

Nach Dem Klauss Aus Bei Rapid Rueckkehr Von Pacult Im Gespraech

Apr 29, 2025 -

This Fall Cassidy Hutchinsons Account Of The January 6th Hearings

Apr 29, 2025

This Fall Cassidy Hutchinsons Account Of The January 6th Hearings

Apr 29, 2025 -

Celebrate Independence Day Willie Nelsons Texas Picnic

Apr 29, 2025

Celebrate Independence Day Willie Nelsons Texas Picnic

Apr 29, 2025 -

160km

Apr 29, 2025

160km

Apr 29, 2025

50 Godini Praznuva Lyubimetst Na Milioni

50 Godini Praznuva Lyubimetst Na Milioni