Why Investors Shouldn't Fear High Stock Market Valuations: BofA's Perspective

Table of Contents

BofA's Rationale: Understanding the Nuances of High Valuations

BofA's optimistic outlook on high stock market valuations isn't based on blind faith. Instead, their analysis rests on several key pillars.

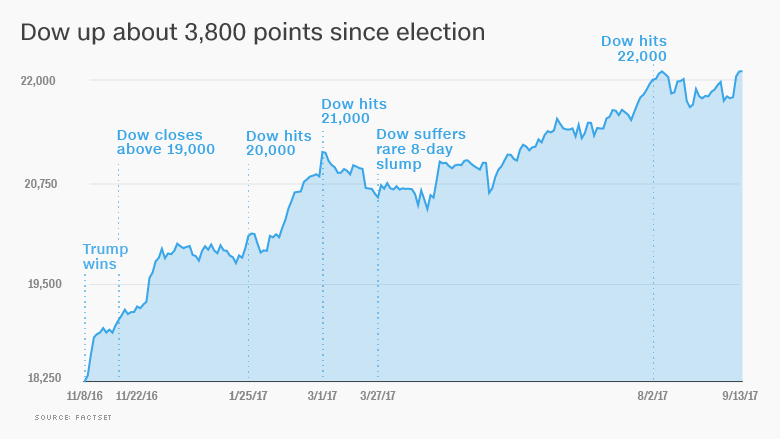

The Role of Low Interest Rates: Historically low interest rates significantly influence valuation metrics like price-to-earnings (P/E) ratios. These low rates make equities comparatively more attractive than bonds, driving up stock prices.

- Inverse Relationship: Lower interest rates generally lead to higher stock valuations. When borrowing costs are low, companies can invest more readily, fueling growth and increasing investor demand for equities.

- Impact on Current Valuations: The prolonged period of near-zero interest rates has undeniably inflated P/E ratios across many sectors. However, BofA argues that this inflation is, to a significant degree, a reflection of the low-cost-of-capital environment.

- BofA's Commentary: BofA analysts have consistently highlighted the impact of low interest rates on valuation multiples, emphasizing that a direct comparison to historical P/E ratios without considering the prevailing interest rate environment would be misleading.

Strong Corporate Earnings and Profit Growth: BofA's analysis goes beyond just interest rates. They point to robust corporate earnings and strong projections for future profit growth as key justifications for current valuations.

- Earnings Growth Data: Recent data show sustained growth in corporate earnings across various sectors, exceeding many initial forecasts.

- Growth Sectors: Technology, healthcare, and consumer staples are among the sectors demonstrating particularly strong earnings growth, contributing significantly to the overall market valuation.

- Future Earnings Forecasts: BofA's analysts project continued, albeit possibly moderating, earnings growth over the coming years, supporting their view that current valuations are not entirely detached from fundamentals.

Technological Innovation and Long-Term Growth Potential: Technological advancements are a crucial factor driving higher valuations and long-term growth potential. BofA acknowledges this.

- Impacting Advancements: Artificial intelligence (AI), cloud computing, and biotechnology are revolutionizing various sectors, creating new markets and boosting productivity.

- Future Earnings Potential: These technological innovations significantly contribute to the expansion of potential future earnings, making higher current valuations more justifiable in a long-term perspective.

- BofA's Long-Term View: BofA's assessment incorporates the long-term growth potential unlocked by these technological disruptors, viewing them as catalysts for sustained market expansion.

Addressing Common Concerns About High Stock Market Valuations

While acknowledging the concerns surrounding high stock market valuations, BofA addresses common anxieties.

The Myth of an Imminent Market Crash: The fear of an imminent market crash solely based on high valuations is, according to BofA, largely unfounded.

- Risk Assessment: BofA's comprehensive risk assessment considers a multitude of factors beyond just valuations, including macroeconomic conditions, geopolitical events, and company-specific fundamentals.

- Market Bubbles: While acknowledging the possibility of specific market bubbles within certain sectors, BofA doesn't see evidence of a broad, systemic bubble across the entire market.

- Supporting Data: Their analysis points to factors such as strong corporate balance sheets and resilient consumer spending as mitigating against the likelihood of a sudden, dramatic market collapse.

Strategies for Navigating High Valuations: BofA implicitly suggests several strategies for investors to navigate the landscape of high stock market valuations.

- Diversification: Diversifying investments across different asset classes, including bonds and real estate, can help mitigate risk.

- Focus on Quality: Investing in high-quality companies with strong fundamentals, consistent earnings growth, and robust balance sheets is crucial.

- Dollar-Cost Averaging: Implementing a dollar-cost averaging strategy, where regular investments are made regardless of market fluctuations, can help reduce the impact of market volatility.

Conclusion:

BofA's analysis suggests that while high stock market valuations warrant attention, they are not an automatic harbinger of doom. Factors such as historically low interest rates, robust corporate earnings, and technological innovation contribute significantly to the current valuation levels. By carefully considering these factors and adopting prudent investment strategies, investors can mitigate risks and potentially benefit from the long-term growth potential. Learn more about navigating high stock market valuations and managing your risk in the face of high stock market valuations by seeking further expert advice. Remember to carefully consider high stock market valuations within the broader economic context before making any investment decisions.

Featured Posts

-

Tik Toks Just Contact Us Tariff Workarounds A Cnn Investigation

Apr 22, 2025

Tik Toks Just Contact Us Tariff Workarounds A Cnn Investigation

Apr 22, 2025 -

Exclusive Harvards 1 Billion Funding At Risk Under Trump Administration

Apr 22, 2025

Exclusive Harvards 1 Billion Funding At Risk Under Trump Administration

Apr 22, 2025 -

Saudi Aramco And Byd A New Ev Technology Partnership

Apr 22, 2025

Saudi Aramco And Byd A New Ev Technology Partnership

Apr 22, 2025 -

Pope Francis Legacy A Defining Moment For The Next Conclave

Apr 22, 2025

Pope Francis Legacy A Defining Moment For The Next Conclave

Apr 22, 2025 -

Trumps Economic Agenda Who Bears The Cost

Apr 22, 2025

Trumps Economic Agenda Who Bears The Cost

Apr 22, 2025