Why 10-Year Mortgages Aren't Popular In Canada

Table of Contents

Higher Initial Interest Rate Risk

Ten-year mortgages typically come with a higher initial interest rate compared to shorter-term options like 5-year or even 1-year mortgages. This is a significant factor influencing their unpopularity. The Canadian interest rate environment is known for its volatility, meaning rates can fluctuate significantly over time.

- Increased upfront cost: A higher initial interest rate translates to increased monthly payments and a larger overall cost upfront. This can be a considerable barrier for many homebuyers, especially those with tighter budgets.

- Uncertainty about future interest rate fluctuations: Predicting interest rate movements over a decade is nearly impossible. Rates could potentially decrease, making your initial higher rate seem less advantageous. Conversely, rates could increase significantly, leading to considerable financial strain over the remaining term. This uncertainty is a major deterrent for many.

- Potential for higher monthly payments: The higher initial interest rate directly impacts your monthly payments, potentially making them significantly higher than those of a shorter-term mortgage with a lower initial rate. This needs to be carefully considered against potential long-term savings. Understanding mortgage rates Canada and how they impact your budget is crucial. Considering both variable rate mortgages and fixed rate mortgages in your planning is advisable.

Prepayment Penalties and Flexibility Concerns

One of the most significant drawbacks of 10-year mortgages in Canada is the substantial prepayment penalties associated with breaking the mortgage early. These penalties can be considerable, significantly impacting your financial situation.

- High penalties deter early payoff or refinancing: Should your circumstances change—requiring you to sell your home or refinance your mortgage—the hefty prepayment penalties can make it financially unfeasible to do so before the 10-year term is up.

- Limited flexibility to adapt to changing financial circumstances: Life is unpredictable. Job loss, unexpected medical expenses, or family changes can dramatically alter your financial situation. A 10-year mortgage offers little flexibility to adapt to these unforeseen circumstances.

- Contrast with the flexibility offered by shorter-term mortgages: Shorter-term mortgages, such as 5-year terms, allow for refinancing or renewal at the end of the term, offering more flexibility to adjust your mortgage payments based on changing interest rates and your financial situation. Understanding mortgage refinancing Canada is key to appreciating this difference. Exploring various home financing options allows for greater financial control.

Uncertainty and Long-Term Commitment

Committing to a 10-year mortgage represents a significant long-term commitment, and this is a considerable source of hesitation for many Canadians. The uncertainty inherent in such a long timeframe can be daunting.

- Job loss or unexpected financial hardship: Over a 10-year period, the likelihood of experiencing unforeseen financial difficulties is significantly higher. A long-term mortgage with substantial prepayment penalties leaves you with limited options if your financial situation deteriorates.

- Relocating for work or family reasons: Life events such as job relocations or family needs can necessitate a move, often before the end of a 10-year mortgage term. The penalties for breaking a 10-year mortgage can make such moves financially challenging.

- Changes in housing needs over a decade: Your housing needs can evolve significantly over 10 years. A family might grow, requiring a larger home, or conversely, downsizing might become necessary. A 10-year mortgage doesn't accommodate these shifting needs. Considering various mortgage options Canada, including shorter-term mortgages Canada, offers greater adaptability to such changes. Good financial planning for homeownership should incorporate this flexibility.

Limited Availability and Higher Application Requirements

Another factor contributing to the low popularity of 10-year mortgages is their limited availability and stricter lending criteria. Lenders may be more reluctant to offer these longer-term mortgages.

- Fewer lenders offering these products: Compared to shorter-term mortgages, 10-year mortgages are offered by fewer lenders in Canada. This limited availability restricts the options available to borrowers.

- Higher credit score requirements: Lenders often have higher credit score requirements for 10-year mortgages due to the increased risk associated with the longer term. Meeting these stricter requirements can be challenging for some borrowers.

- More stringent income verification processes: Given the longer commitment, lenders often implement more rigorous income verification processes to ensure borrowers' ability to manage payments over the extended timeframe. Navigating the mortgage application process can be more demanding for 10-year mortgages. Working with a mortgage broker Canada can significantly ease this process and increase the chances of approval. Understanding the landscape of mortgage lenders Canada is also important.

Conclusion

In summary, the relative unpopularity of 10-year mortgages in Canada stems from several key factors: high initial interest rate risk, substantial prepayment penalties limiting flexibility, the inherent uncertainty of a long-term commitment, and limited availability from lenders. These factors emphasize the importance of considering individual financial circumstances and risk tolerance before choosing a mortgage term. While 10-year mortgages might offer potential long-term savings, they are not the ideal choice for all Canadians. Explore your options and choose the mortgage term that best suits your needs. Consider consulting with a mortgage professional to discuss the advantages and disadvantages of different mortgage terms, including shorter-term alternatives to 10-year mortgages in Canada. Make informed decisions about your 10-Year Mortgages Canada by understanding the realities of the Canadian market.

Featured Posts

-

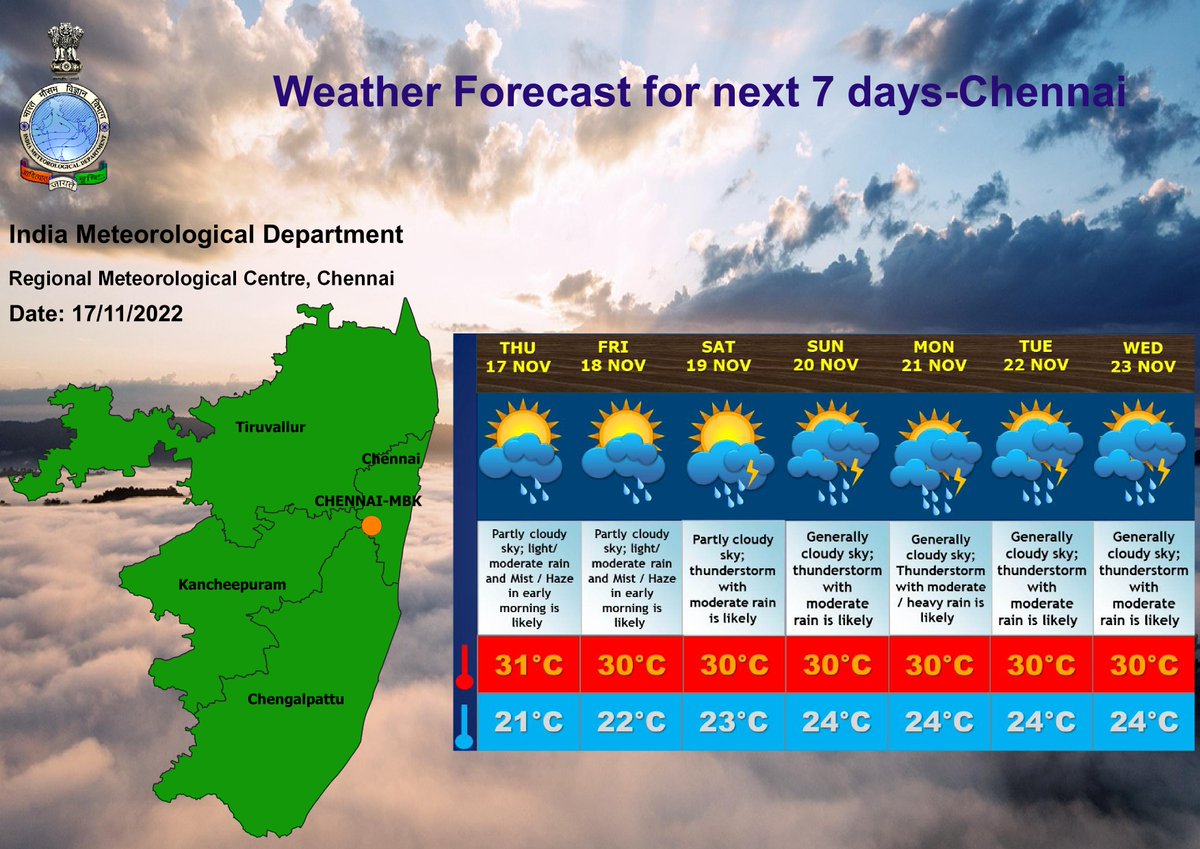

North Bengal Braces For Rain Met Departments Weather Forecast

May 05, 2025

North Bengal Braces For Rain Met Departments Weather Forecast

May 05, 2025 -

Stanley Cup Playoffs Understanding The Dynamics Of First Round Matchups

May 05, 2025

Stanley Cup Playoffs Understanding The Dynamics Of First Round Matchups

May 05, 2025 -

Nhl Playoffs First Round What To Expect And Who To Watch

May 05, 2025

Nhl Playoffs First Round What To Expect And Who To Watch

May 05, 2025 -

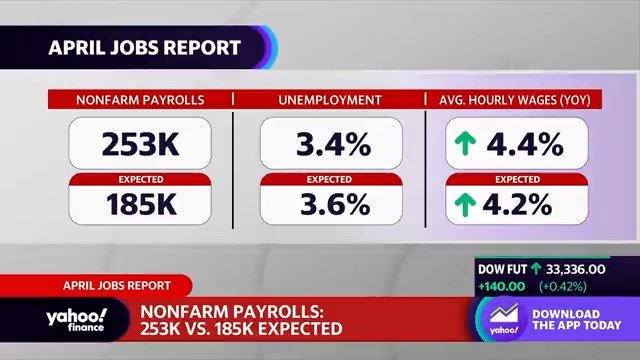

U S Jobs Report 177 000 Jobs Added In April Unemployment Remains At 4 2

May 05, 2025

U S Jobs Report 177 000 Jobs Added In April Unemployment Remains At 4 2

May 05, 2025 -

Rain Alert Met Department Issues Weather Warning For North Bengal

May 05, 2025

Rain Alert Met Department Issues Weather Warning For North Bengal

May 05, 2025

Latest Posts

-

Alexander Volkanovski Vs Diego Lopes Ufc 314 Fight Card Analysis

May 05, 2025

Alexander Volkanovski Vs Diego Lopes Ufc 314 Fight Card Analysis

May 05, 2025 -

Paddy Pimblett On Dustin Poiriers Retirement A Critical Analysis

May 05, 2025

Paddy Pimblett On Dustin Poiriers Retirement A Critical Analysis

May 05, 2025 -

Ufc 314 Complete Fight Card And Predictions For Volkanovski Vs Lopes

May 05, 2025

Ufc 314 Complete Fight Card And Predictions For Volkanovski Vs Lopes

May 05, 2025 -

Did Dustin Poirier Make A Mistake Retiring Paddy Pimbletts Take

May 05, 2025

Did Dustin Poirier Make A Mistake Retiring Paddy Pimbletts Take

May 05, 2025 -

Paddy Pimblett Was Dustin Poirier Wrong To Retire

May 05, 2025

Paddy Pimblett Was Dustin Poirier Wrong To Retire

May 05, 2025