What Fueled The Recent Surge In Bitcoin Mining?

Table of Contents

The Rise of Institutional Investment in Bitcoin Mining

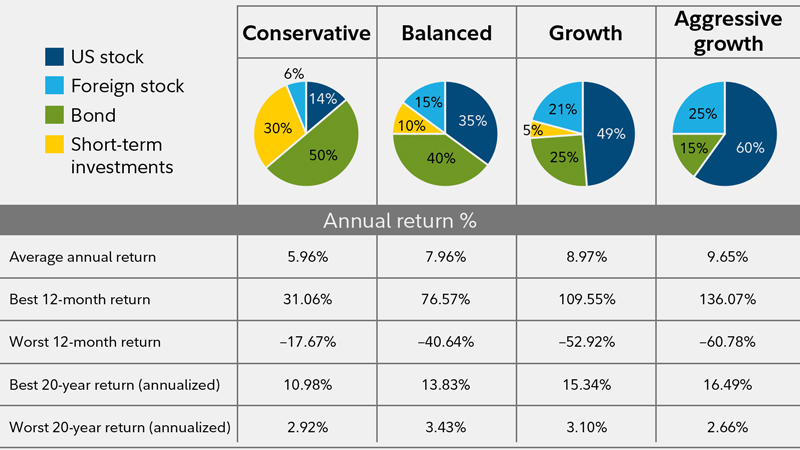

Large corporations and institutional investors are increasingly participating in Bitcoin mining, injecting significant capital into the market. This influx of institutional money is a major driver of the recent surge. For institutional investors, Bitcoin mining offers several compelling benefits. Firstly, it provides diversification beyond traditional asset classes, reducing portfolio risk. Secondly, it presents a potential avenue for long-term growth, aligning with the increasing adoption and value of Bitcoin.

Examples of large-scale mining operations, like those run by publicly traded companies and established investment firms, are significantly impacting the network's hash rate (a measure of computational power). Their involvement brings sophisticated management, technological expertise, and substantial financial resources to the table.

- Increased capital influx leading to larger mining farms: Institutional investment allows for the creation of massive mining facilities with thousands of ASIC miners, boosting overall network hash rate.

- Sophisticated mining technology adoption by institutions: These investors often leverage advanced technologies and data analytics to optimize mining efficiency and profitability.

- Strategic partnerships between institutions and mining companies: Collaborations between established corporations and experienced mining operators combine financial strength with operational expertise, leading to increased mining activity.

Technological Advancements in Bitcoin Mining Hardware

Advancements in Application-Specific Integrated Circuits (ASICs) are fundamentally altering the Bitcoin mining landscape. Newer ASICs boast significantly higher hash rates and improved energy efficiency compared to their predecessors. This technological leap reduces mining costs and increases profitability, attracting more miners to the network.

The development of more efficient cooling systems and innovative chip designs are further contributing factors. These improvements, coupled with optimized manufacturing processes, result in lower entry barriers and increased accessibility for smaller-scale mining operations.

- Higher hash rates per unit of power consumption: Modern ASICs deliver substantially more computational power with less energy, reducing electricity costs and environmental impact.

- Reduced manufacturing costs leading to lower entry barriers: Economies of scale and improved manufacturing techniques have lowered the cost of ASICs, making mining more accessible to a wider range of participants.

- Development of specialized cooling systems for enhanced efficiency: Advanced cooling solutions maximize ASIC performance and prevent overheating, contributing to higher hash rates and lower operational costs.

The Growing Adoption of Bitcoin and Increased Network Demand

The price of Bitcoin is directly correlated with the profitability of mining. A higher Bitcoin price incentivizes more miners to join the network, as the rewards (in Bitcoin) for successfully solving cryptographic puzzles become more lucrative. Increased transaction volume also plays a vital role, leading to higher transaction fees that contribute to miner revenue.

The growing adoption of Bitcoin by both individuals and institutions is driving network demand. This increased demand necessitates a higher level of network security, requiring a larger and more powerful network of miners to maintain its integrity.

- Higher Bitcoin price incentivizes more miners to join the network: Increased profitability attracts both new and existing miners to expand their operations.

- Increased transaction fees contribute to miner revenue: Higher transaction volumes on the Bitcoin network translate to higher fees for miners, bolstering their profitability.

- Growing demand for Bitcoin increases network security needs: A larger and more robust mining network is essential to maintain the security and integrity of the Bitcoin blockchain.

The Impact of Regulatory Changes and Geographic Shifts in Mining

Regulatory landscapes significantly influence Bitcoin mining activities. Favorable regulations, such as tax incentives or clear legal frameworks, attract significant investment and mining operations to specific regions. We've seen a geographic shift in recent years, with countries offering cheaper electricity and supportive regulations becoming mining hubs. For example, areas like Kazakhstan and Texas have seen a significant influx of mining operations due to low electricity costs and relatively favorable regulatory environments.

Conversely, regulatory crackdowns in other regions can force miners to relocate, impacting the overall distribution of mining power globally.

- Countries offering tax incentives for Bitcoin mining attract investment: Governments are actively competing to attract Bitcoin mining businesses through attractive fiscal policies.

- Access to renewable energy sources reduces operational costs: Regions with abundant renewable energy, such as hydropower or wind power, offer lower electricity costs, making mining more sustainable and profitable.

- Regulatory uncertainty can lead to shifts in mining activity geographically: Unclear or restrictive regulations can drive miners to seek more favorable jurisdictions, impacting the geographical distribution of mining power.

Conclusion: Understanding the Drivers Behind the Bitcoin Mining Boom

The recent surge in Bitcoin mining is a multifaceted phenomenon driven by a confluence of factors. Institutional investment has injected significant capital, while technological advancements have increased efficiency and profitability. Simultaneously, the growing adoption of Bitcoin and increased network demand have created a need for a more powerful and secure mining network. Finally, regulatory changes and geographic shifts have further shaped the landscape of Bitcoin mining. Bitcoin mining remains critical for the security and decentralization of the Bitcoin network. Learn more about the future of Bitcoin mining and its impact on the cryptocurrency ecosystem. Stay updated on the latest trends impacting Bitcoin mining profitability and network security.

Featured Posts

-

Did Saturday Night Live Make Counting Crows Famous

May 08, 2025

Did Saturday Night Live Make Counting Crows Famous

May 08, 2025 -

Black Rock Etf Billionaire Investment Strategy For 2025 And Beyond

May 08, 2025

Black Rock Etf Billionaire Investment Strategy For 2025 And Beyond

May 08, 2025 -

Bitcoin Rebound Is This The Start Of A New Bull Run

May 08, 2025

Bitcoin Rebound Is This The Start Of A New Bull Run

May 08, 2025 -

The Monkey 2025 A Potential Low Point In A Strong Year For Stephen King Adaptations

May 08, 2025

The Monkey 2025 A Potential Low Point In A Strong Year For Stephen King Adaptations

May 08, 2025 -

Us China Trade Deal Spurs Bitcoin Price Increase

May 08, 2025

Us China Trade Deal Spurs Bitcoin Price Increase

May 08, 2025

Latest Posts

-

Tnts Hilarious Commentary Tatum Takes The Heat In Lakers Celtics Promo

May 08, 2025

Tnts Hilarious Commentary Tatum Takes The Heat In Lakers Celtics Promo

May 08, 2025 -

Jayson Tatums Status Celtics Vs Nets Game Injury Update

May 08, 2025

Jayson Tatums Status Celtics Vs Nets Game Injury Update

May 08, 2025 -

Jayson Tatum Gets Roasted Tnts Hilarious Abc Promo For Lakers Vs Celtics

May 08, 2025

Jayson Tatum Gets Roasted Tnts Hilarious Abc Promo For Lakers Vs Celtics

May 08, 2025 -

Tnt Announcers Roast Jayson Tatum In Hilarious Lakers Celtics Promo

May 08, 2025

Tnt Announcers Roast Jayson Tatum In Hilarious Lakers Celtics Promo

May 08, 2025 -

Is Jayson Tatum Playing Tonight Celtics Vs Nets Injury Report

May 08, 2025

Is Jayson Tatum Playing Tonight Celtics Vs Nets Injury Report

May 08, 2025