Weak Retail Sales Fuel Speculation Of Bank Of Canada Rate Cuts

Table of Contents

Declining Retail Sales: A Deeper Dive

The Numbers Tell the Story

Recent retail sales data paints a concerning picture for the Canadian economy. Statistics Canada reported a [insert specific percentage]% decline in retail sales for [insert month/period], marking the [insert description, e.g., steepest fall in several months/a significant drop from the previous period]. This represents a considerable shortfall compared to analyst expectations of [insert analyst prediction] and signals a potential broader economic slowdown.

- Specific percentage decrease in retail sales: [Insert precise percentage from Statistics Canada data].

- Key sectors experiencing the largest declines: The automotive sector experienced a particularly sharp decline of [insert percentage]%, followed by furniture sales, which dropped by [insert percentage]%. Other significant declines were observed in [list other affected sectors and percentages].

- Comparison to analyst expectations: The actual decline surpassed the consensus forecast among economists, indicating a more severe situation than initially anticipated.

- Geographic variations in sales performance: While the national picture is bleak, regional variations exist. [Insert details on regional differences in sales performance, citing sources].

Underlying Factors Contributing to Weak Sales

Several factors are contributing to this alarming drop in retail spending. The confluence of these issues is creating a perfect storm for consumers and businesses alike.

- High inflation eroding consumer purchasing power: Persistent high inflation, currently at [insert current inflation rate]%, is significantly eroding consumer purchasing power. Rising prices for essential goods and services are leaving less disposable income for discretionary spending.

- Increased interest rates impacting borrowing and consumer confidence: The BoC's previous interest rate hikes, aimed at curbing inflation, have increased borrowing costs for consumers and businesses. This has dampened consumer confidence and reduced borrowing for large purchases.

- Global economic uncertainty and its ripple effects on the Canadian economy: Global economic uncertainty, including concerns about a potential recession in major economies, is further impacting consumer sentiment and investment decisions in Canada.

- Potential impact of supply chain disruptions: Lingering supply chain disruptions, though easing in some sectors, continue to impact the availability and pricing of certain goods, further hindering retail sales.

The Bank of Canada's Response: Rate Cuts on the Horizon?

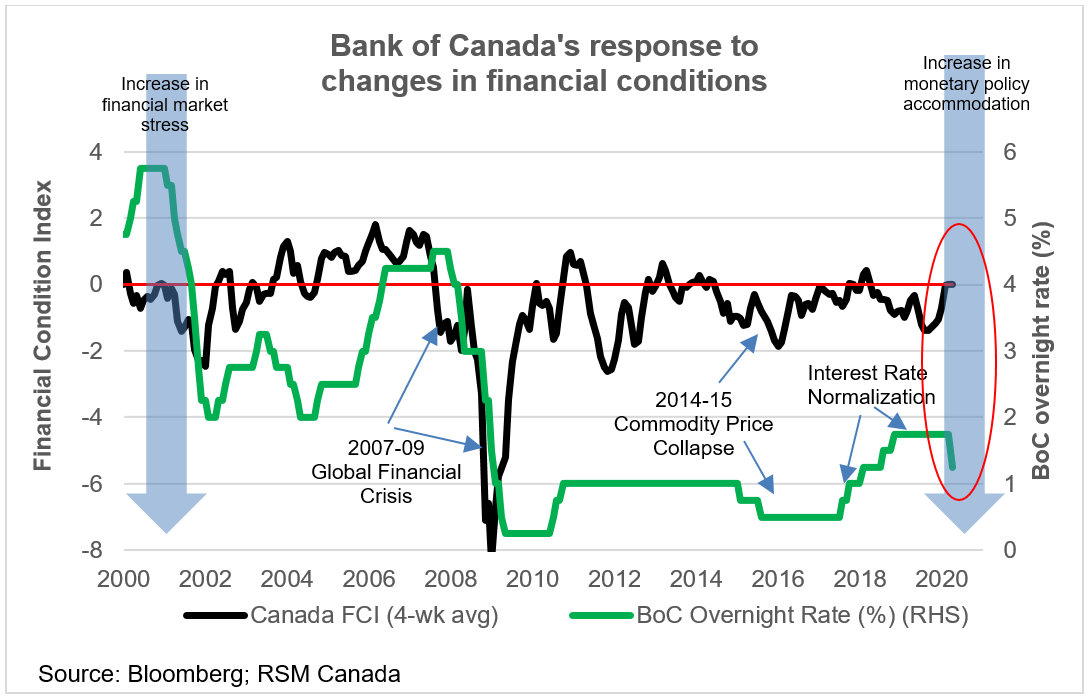

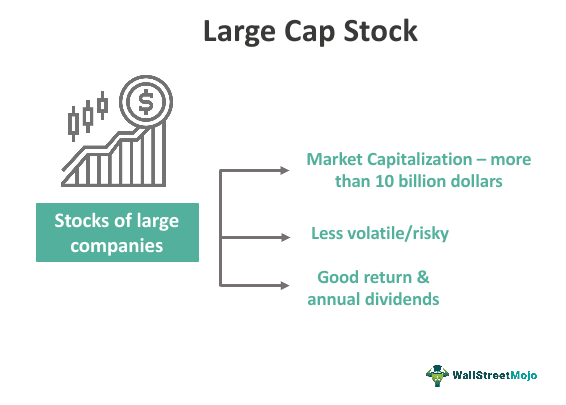

Analyzing the BoC's Current Monetary Policy Stance

The Bank of Canada's recent actions and statements provide clues about their potential response to the weakening retail sales.

- Summary of the BoC's most recent rate announcement: In its [insert date] announcement, the BoC [summarize the key points of the announcement, including any changes to interest rates and the rationale behind the decision].

- Analysis of the BoC's inflation targets and current inflation rate: The BoC's inflation target is [insert target percentage]%, while current inflation stands at [insert current rate]%. The gap between these figures is a key factor in the BoC's deliberations.

- Examination of the BoC's commentary on economic growth and risks: The BoC's commentary on the state of the Canadian economy and the risks it faces will be carefully scrutinized for hints about future policy moves.

Arguments For and Against an Imminent Rate Cut

The question of whether the BoC will implement rate cuts is a subject of intense debate among economists.

- Arguments For:

- Weak retail sales serve as a clear indicator of a significant economic slowdown, potentially signaling a recession.

- Rate cuts are necessary to stimulate consumer spending and business investment, preventing a deeper economic contraction.

- Failure to intervene could lead to a prolonged period of economic stagnation.

- Arguments Against:

- Premature rate cuts risk reigniting inflation, undoing the progress made in curbing price increases.

- Rate cuts could weaken the Canadian dollar, potentially impacting import costs and fueling inflation further.

- More data is needed to confirm whether the weak retail sales represent a sustained trend or a temporary blip.

Potential Economic Consequences of BoC Rate Cuts (or Lack Thereof)

Impact on Consumers

A rate cut would likely lower borrowing costs, potentially boosting consumer spending and reducing debt servicing burdens. However, it could also lead to increased inflation if not carefully managed. Conversely, maintaining high interest rates could stifle consumer spending and increase financial strain.

Impact on Businesses

Rate cuts could stimulate business investment and hiring by lowering borrowing costs. Conversely, maintaining high interest rates could lead to decreased investment and reduced hiring. The impact will depend on the overall business environment and market confidence.

Impact on the Canadian Dollar

A rate cut could potentially weaken the Canadian dollar relative to other currencies, impacting both import and export prices. The consequences for the Canadian dollar will depend on several factors, including global economic conditions and market sentiment.

Conclusion

Weak retail sales are significantly impacting the Canadian economy, leading to speculation about potential Bank of Canada rate cuts. The decision faces a complex balancing act between stimulating growth and controlling inflation. The BoC's next move will be closely watched by economists and Canadians alike. The implications for consumers, businesses, and the Canadian dollar are substantial, making this a pivotal moment for the Canadian economy.

Call to Action: Stay informed about the evolving economic situation and the Bank of Canada's response to weak retail sales and potential rate cuts. Monitor the BoC's announcements and follow expert analysis to understand how these developments might impact your personal finances and business strategies. Regularly check for updates on the Bank of Canada’s monetary policy and related economic news to make informed decisions.

Featured Posts

-

Podsumowanie Testu Porsche Cayenne Gts Coupe Czy Spelnia Oczekiwania

Apr 29, 2025

Podsumowanie Testu Porsche Cayenne Gts Coupe Czy Spelnia Oczekiwania

Apr 29, 2025 -

Anthony Edwards Faces 50 K Nba Fine Following Fan Exchange

Apr 29, 2025

Anthony Edwards Faces 50 K Nba Fine Following Fan Exchange

Apr 29, 2025 -

Uk Courts Definition Of Woman Impact On Sex Based Rights And Transgender Issues

Apr 29, 2025

Uk Courts Definition Of Woman Impact On Sex Based Rights And Transgender Issues

Apr 29, 2025 -

Reliance Q Quarter Earnings A Catalyst For Indian Large Cap Stock Growth

Apr 29, 2025

Reliance Q Quarter Earnings A Catalyst For Indian Large Cap Stock Growth

Apr 29, 2025 -

Oh What A Beautiful World A Review Of Willie Nelsons New Album

Apr 29, 2025

Oh What A Beautiful World A Review Of Willie Nelsons New Album

Apr 29, 2025