Reliance Q[Quarter] Earnings: A Catalyst For Indian Large-Cap Stock Growth?

![Reliance Q[Quarter] Earnings: A Catalyst For Indian Large-Cap Stock Growth? Reliance Q[Quarter] Earnings: A Catalyst For Indian Large-Cap Stock Growth?](https://autolinq.de/image/reliance-q-quarter-earnings-a-catalyst-for-indian-large-cap-stock-growth.jpeg)

Table of Contents

Reliance's Q3 Performance: A Detailed Analysis

Financial Highlights:

- Revenue: [Insert Q3 Revenue Figure] – showcasing a [YoY percentage change]% increase/decrease compared to Q3 of the previous year.

- EBITDA: [Insert Q3 EBITDA Figure] – reflecting a [YoY percentage change]% increase/decrease.

- Net Profit: [Insert Q3 Net Profit Figure] – indicating a [YoY percentage change]% increase/decrease.

- EPS (Earnings Per Share): [Insert Q3 EPS Figure] – showing a [YoY percentage change]% increase/decrease.

These figures, when compared to analyst expectations and previous quarters, reveal [summarize the overall financial health - strong, weak, in line with expectations, etc.]. Significant changes in the balance sheet, such as [mention any significant changes, e.g., increased debt, improved cash flow], further contribute to the overall picture of Reliance's financial performance. Strong revenue growth and improved profitability are key indicators of a healthy company.

Segment-Wise Performance Breakdown:

Reliance Jio: Jio's Q3 performance saw [insert specific details, e.g., X million net subscriber additions, a Y% increase in ARPU, and Z% growth in data consumption]. The ongoing 5G rollout and competitive landscape in the telecom sector significantly impact Jio’s growth trajectory.

Reliance Retail: Reliance Retail demonstrated strong growth in Q3 with [insert specific details, e.g., X% revenue growth, expansion into Y new locations, and Z% growth in online sales]. Their omnichannel strategy and focus on expanding their retail footprint across India are critical drivers of this success. The performance reflects positive consumer spending despite macroeconomic challenges.

Reliance Industries' Energy Business: The energy business's performance is heavily influenced by global oil prices. In Q3, refining margins were [describe the margins – strong, weak, etc.], while petrochemical production saw [insert specific figures]. The company's ongoing investments in the energy transition are crucial to consider for long-term growth.

Impact of Macroeconomic Factors:

Inflationary pressures, fluctuating interest rates, and the volatile rupee have all had an impact on Reliance's Q3 performance. However, Reliance's diversified business model appears to have exhibited [describe the resilience – strong, moderate, weak, etc.] resilience to these macroeconomic headwinds. The company's ability to navigate these economic uncertainties is a critical factor influencing investor confidence.

Reliance's Influence on Indian Large-Cap Stock Market Growth

Correlation between Reliance Performance and Large-Cap Indices:

Reliance Industries carries significant weight in major Indian large-cap indices like the Nifty 50 and Sensex. Historically, there’s a strong positive correlation between Reliance's stock price movement and the overall performance of these indices. A strong performance from Reliance typically boosts market sentiment, leading to gains in other large-cap stocks. Conversely, underperformance can trigger a negative market reaction.

Investor Sentiment and Future Outlook:

Investor sentiment towards Reliance remains [describe as positive, negative, or neutral]. Upcoming projects, like [mention specific projects], and strategic initiatives will play a vital role in shaping Reliance's future performance. Analyst ratings and price targets for Reliance stock are currently [mention average ratings and price targets]. The outlook suggests [positive/negative/neutral] growth prospects for the company in the coming quarters.

Conclusion: Reliance Q3 Earnings – A Catalyst for Growth?

Reliance's Q3 earnings demonstrate [summarize the key findings – strong growth, moderate growth, or challenges]. While the company navigated macroeconomic headwinds effectively, the impact of global factors remains a crucial consideration. Considering the substantial weight of Reliance in the Indian large-cap indices and the historical correlation between its performance and broader market trends, its Q3 results are likely to [state whether it is likely to act as a catalyst or not]. However, investors must maintain a balanced perspective, considering potential risks and uncertainties before making investment decisions. To stay informed about Reliance's performance and its implications for your investment strategies, continue following the Reliance Q3 earnings updates and conduct thorough research on its impact on the Indian large-cap stock market. Subscribe to our updates for regular analysis of Reliance quarterly earnings and other key market drivers.

![Reliance Q[Quarter] Earnings: A Catalyst For Indian Large-Cap Stock Growth? Reliance Q[Quarter] Earnings: A Catalyst For Indian Large-Cap Stock Growth?](https://autolinq.de/image/reliance-q-quarter-earnings-a-catalyst-for-indian-large-cap-stock-growth.jpeg)

Featured Posts

-

The Rise Of Disaster Betting Examining The La Wildfire Case

Apr 29, 2025

The Rise Of Disaster Betting Examining The La Wildfire Case

Apr 29, 2025 -

Hagia Sophia Enduring Monument Of Byzantine And Ottoman History

Apr 29, 2025

Hagia Sophia Enduring Monument Of Byzantine And Ottoman History

Apr 29, 2025 -

Black Hawk Helicopter Crash Pilot Ignored Instructors Warnings

Apr 29, 2025

Black Hawk Helicopter Crash Pilot Ignored Instructors Warnings

Apr 29, 2025 -

Capital Summertime Ball 2025 Tickets Your Guide To Securing Entry

Apr 29, 2025

Capital Summertime Ball 2025 Tickets Your Guide To Securing Entry

Apr 29, 2025 -

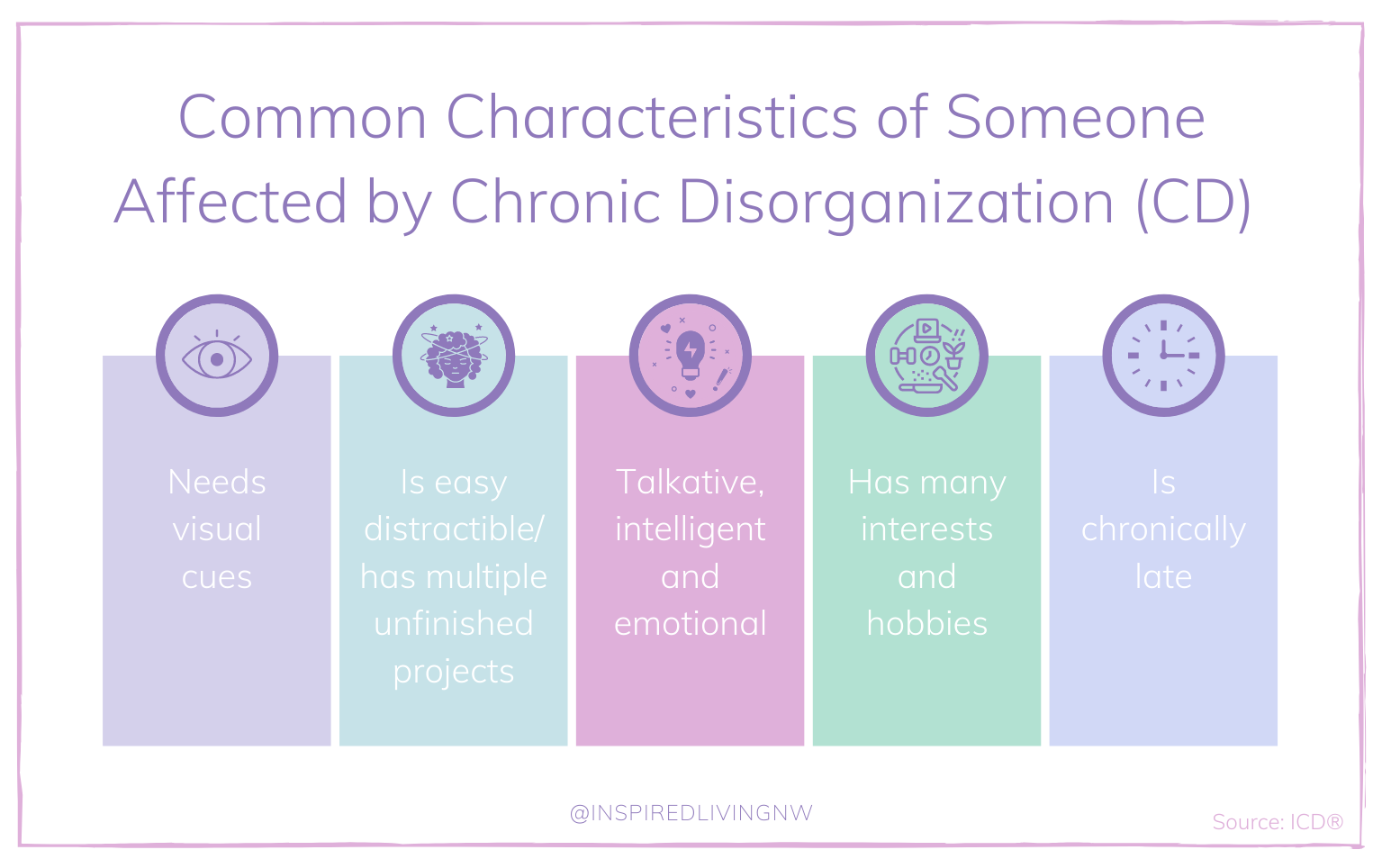

8 Subtle Signs Of Adhd In Adults From Chronic Disorganization To Poor Time Management

Apr 29, 2025

8 Subtle Signs Of Adhd In Adults From Chronic Disorganization To Poor Time Management

Apr 29, 2025