From Triumph To Setback: Understanding Warren Buffett's Investment Journey

Table of Contents

Early Years and the Genesis of Buffett's Investment Philosophy

Warren Buffett's fascination with investing began early. Even as a child, he displayed an innate understanding of finance, making shrewd investments in newspapers and pinball machines. This early entrepreneurial spirit laid the groundwork for his future success. His understanding of value investing was significantly shaped by the teachings of Benjamin Graham, whose book "The Intelligent Investor" profoundly influenced Buffett's investment philosophy. This emphasis on fundamental analysis and identifying undervalued assets became a cornerstone of his Warren Buffett investment strategy.

- Early investments: Buffett's early ventures, such as his paper route and pinball machine business, instilled valuable lessons about entrepreneurship and capital allocation.

- Influence of Benjamin Graham: Graham's focus on intrinsic value, margin of safety, and long-term investing profoundly impacted Buffett's approach.

- Buffett Partnership: The formation of the Buffett Partnership in 1956 marked a significant step, showcasing his growing expertise and attracting investors who shared his long-term vision. This early success solidified his unique investment approach.

The core tenets of Buffett's value investing approach include:

- Identifying undervalued companies: Buffett meticulously analyzes financial statements to uncover companies trading below their intrinsic value.

- Long-term holding: He famously advocates for a buy-and-hold strategy, focusing on companies with strong fundamentals and sustainable competitive advantages.

- Intrinsic value calculation: Buffett's valuation methods emphasize the company's future earning power and discounted cash flow analysis, rather than short-term market fluctuations.

Berkshire Hathaway and Major Investment Triumphs

The acquisition and subsequent growth of Berkshire Hathaway are testaments to Buffett's astute investment decisions and long-term vision. His successful investments in iconic companies like Coca-Cola and American Express have generated substantial returns, solidifying his reputation and further refining his Warren Buffett investment strategy. These weren't just lucky picks; they were strategically chosen based on thorough due diligence and an understanding of each company's enduring competitive advantage.

- Successful investments: Coca-Cola, American Express, and many other holdings showcase his ability to identify companies with strong brands, sustainable business models, and capable management teams.

- Strategic acquisitions: Buffett’s acquisitions aren't just about financial returns; he seeks synergistic potential and long-term growth opportunities within the acquired companies.

- Long-term vision: His approach emphasizes patience and a focus on long-term value creation, resisting the urge to react to short-term market volatility.

The impressive returns generated by Berkshire Hathaway over the decades are a clear demonstration of the effectiveness of Buffett's long-term, value-focused Warren Buffett investment strategy. Annualized returns consistently outperformed market averages, highlighting the power of patience and disciplined investing.

Notable Setbacks and Lessons Learned

Despite his remarkable success, Buffett's investment journey wasn't without setbacks. These experiences, while initially disappointing, provided valuable lessons that shaped his future investment decisions.

- Dexter Shoe Company: This investment highlights the risk of clinging to underperforming assets even with a strong management team. The realization that even a good company in a declining industry can fail was a key learning experience.

- Berkshire Hathaway Energy (formerly MidAmerican Energy) near-miss: This near-miss, though ultimately a success, demonstrated the importance of thorough due diligence and understanding potential regulatory risks.

- Adapting his strategy: These setbacks underscored the importance of continuous learning and adapting his strategy in response to changing market dynamics and industry trends.

It's crucial to remember that even the most successful investors experience failures. These setbacks reinforce the idea that a robust Warren Buffett investment strategy incorporates risk management, continuous learning, and the willingness to acknowledge mistakes.

Analyzing Buffett's Risk Management Techniques

Buffett's approach to risk management is as crucial to his success as his investment acumen.

- Thorough due diligence: He emphasizes extensive research and analysis before making any investment, ensuring a deep understanding of the company's financials, industry position, and management team.

- Competitive advantage: Buffett looks for companies with strong moats – durable competitive advantages that protect them from competitors and ensure long-term profitability.

- Avoiding speculation: He avoids speculative investments and focuses on companies with proven track records and predictable cash flows.

- Diversification and margin of safety: While not overly diversified, his portfolio selections demonstrate a prudent approach to risk, seeking investments with a margin of safety—buying at a price significantly below intrinsic value.

The Warren Buffett Investment Strategy Today and its Applicability

Buffett's Warren Buffett investment strategy has evolved over time, adapting to changing market conditions while remaining fundamentally rooted in value investing.

- Adaptation to changing markets: While his core principles remain consistent, his approach has adapted to incorporate technological advancements and shifts in the global economic landscape.

- Continuing importance of value investing: Despite the rise of growth investing and technological disruptions, Buffett continues to emphasize the importance of identifying undervalued companies with strong fundamentals.

- Succession planning: The careful planning for succession at Berkshire Hathaway ensures the continuation of his investment philosophy and the long-term growth of the company.

While the speed and complexity of today's markets pose new challenges, the core tenets of Buffett's Warren Buffett investment strategy – thorough analysis, long-term perspective, and disciplined risk management – remain highly relevant for investors of all levels.

Conclusion

Warren Buffett's investment journey is a compelling narrative of both remarkable triumphs and valuable lessons learned from setbacks. His Warren Buffett investment strategy, built upon a foundation of fundamental analysis, long-term thinking, and disciplined risk management, has yielded extraordinary results over decades. However, his journey emphasizes that even the most successful investors encounter challenges. The core principles of his approach—identifying undervalued companies, holding for the long term, and conducting thorough due diligence—continue to provide valuable insights for aspiring investors. Learn more about the intricacies of the Warren Buffett investment strategy and how you can incorporate some of his principles into your own portfolio by exploring further resources and analysis.

Featured Posts

-

Aussie Dollar Vs Kiwi Dollar Traders Bet On Aud Strength

May 06, 2025

Aussie Dollar Vs Kiwi Dollar Traders Bet On Aud Strength

May 06, 2025 -

Five Crucial Commodity Market Charts To Monitor This Week

May 06, 2025

Five Crucial Commodity Market Charts To Monitor This Week

May 06, 2025 -

Bmw And Porsches China Challenges A Broader Industry Issue

May 06, 2025

Bmw And Porsches China Challenges A Broader Industry Issue

May 06, 2025 -

Smart Shopping High Value Low Cost Items

May 06, 2025

Smart Shopping High Value Low Cost Items

May 06, 2025 -

Tracking Global Commodity Markets 5 Essential Charts For This Week

May 06, 2025

Tracking Global Commodity Markets 5 Essential Charts For This Week

May 06, 2025

Latest Posts

-

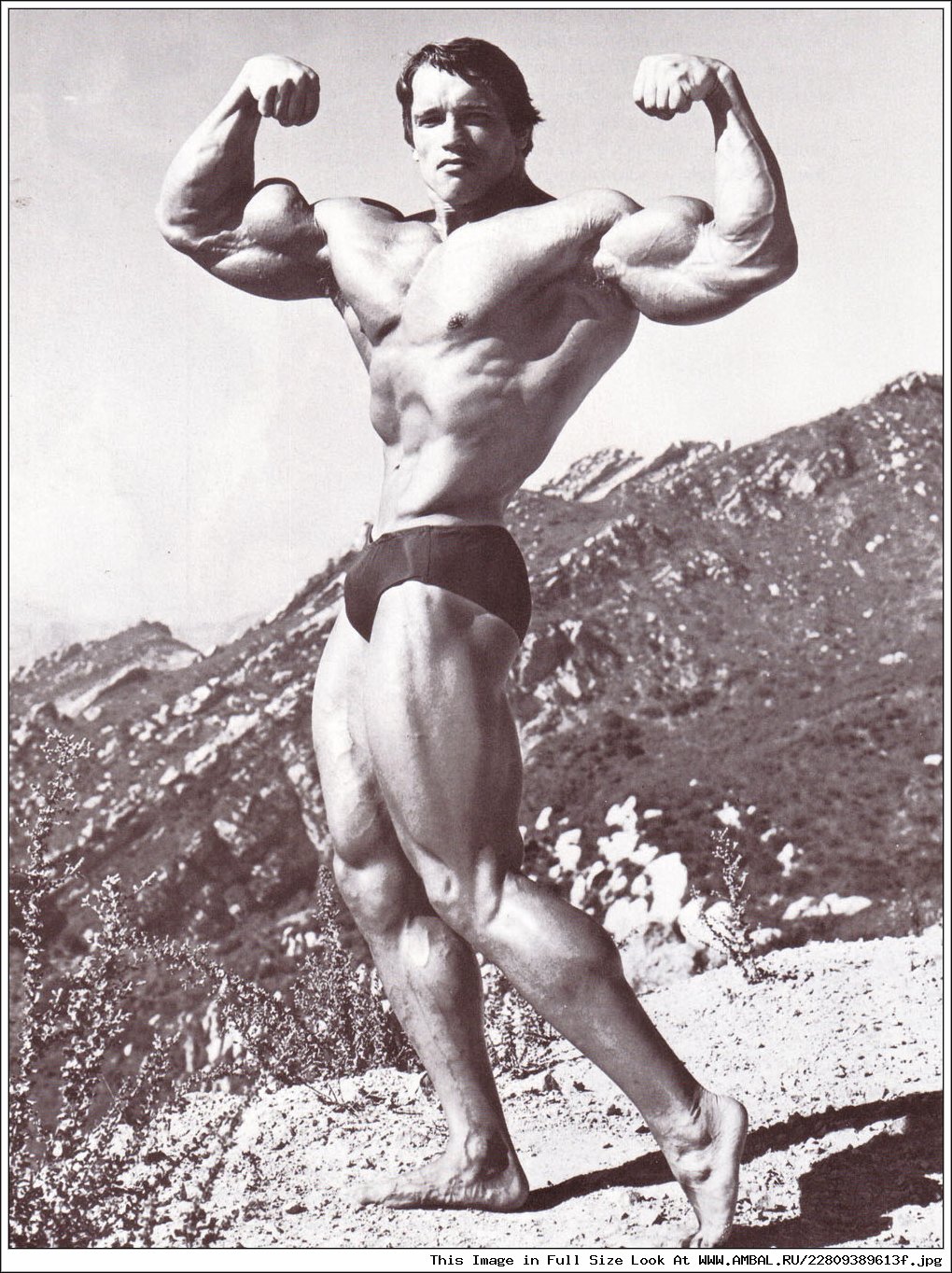

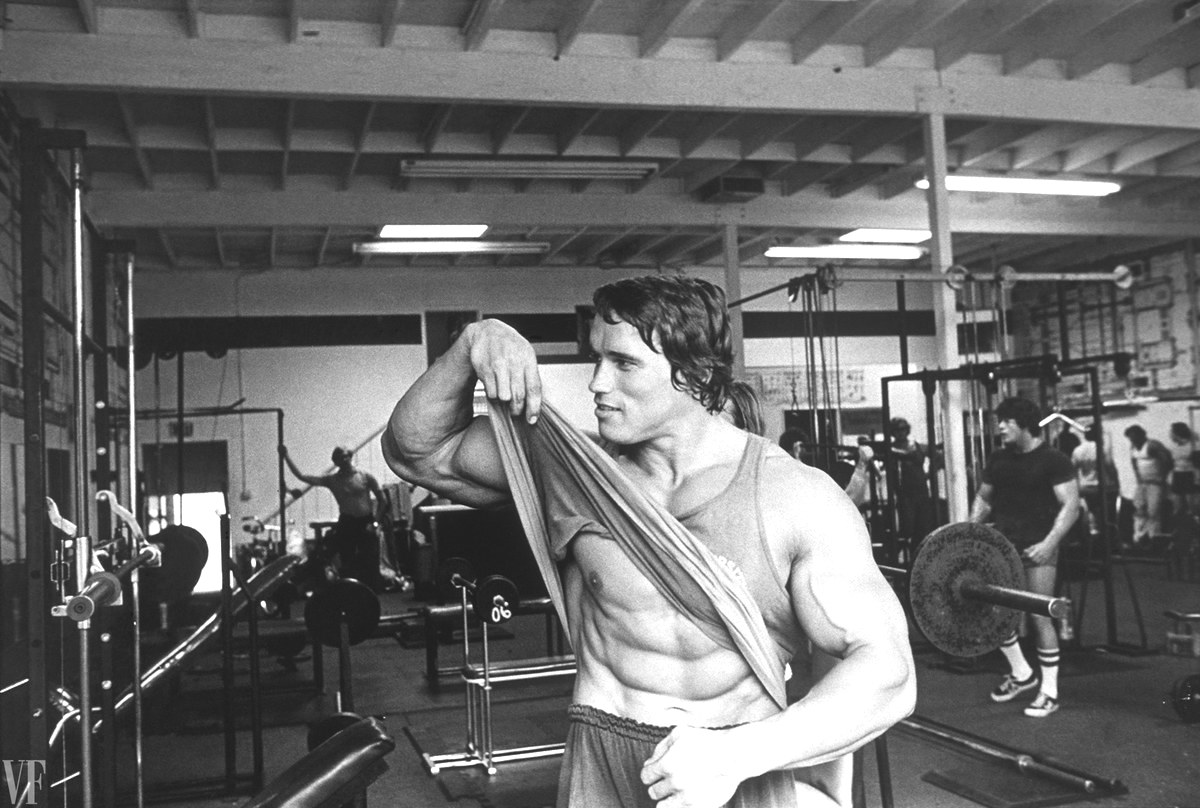

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025 -

Foto Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025

Foto Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025 -

Arnold Schwarzenegger On Patrick Schwarzeneggers Nudity In Film

May 06, 2025

Arnold Schwarzenegger On Patrick Schwarzeneggers Nudity In Film

May 06, 2025 -

Patrik Shvartsenegger I Ebbi Chempion Fotosessiya Dlya Kim Kardashyan

May 06, 2025

Patrik Shvartsenegger I Ebbi Chempion Fotosessiya Dlya Kim Kardashyan

May 06, 2025 -

Joseph Baena Arnold Schwarzenegger Fia Es A Siker Utja

May 06, 2025

Joseph Baena Arnold Schwarzenegger Fia Es A Siker Utja

May 06, 2025