Wall Street Predicts 110% Gain: The BlackRock ETF Billionaires Are Buying

Table of Contents

The BlackRock Factor: Understanding Their Investment Strategies

BlackRock, a global investment management corporation, is a behemoth in the financial world, wielding substantial influence over market trends. Understanding their investment strategies is crucial to understanding the potential 110% gain predicted by Wall Street analysts.

BlackRock's Market Dominance and Influence

- Massive Asset Under Management: BlackRock manages trillions of dollars in assets globally, making its investment decisions incredibly impactful.

- Diversified ETF Offerings: They offer a vast array of exchange-traded funds (ETFs) covering diverse sectors, including iShares Core S&P 500 (IVV), iShares Core US Aggregate Bond ETF (AGG), and iShares MSCI Emerging Markets ETF (EEM). This diversification allows for exposure to various market segments.

- Market Sentiment Influence: BlackRock's actions and investment choices often serve as a bellwether for market sentiment, influencing the behavior of other investors.

Analyzing Billionaire Portfolio Holdings

While specific details of individual billionaire portfolios aren't always public, it's widely known that many high-net-worth individuals invest heavily in BlackRock ETFs. These investments often reflect a belief in long-term growth potential across various sectors.

- Focus on Long-Term Growth: Billionaire investors often favor BlackRock ETFs for their long-term growth potential rather than short-term gains.

- Diversification Across Asset Classes: Many billionaires utilize BlackRock ETFs as a core component of a diversified portfolio, mitigating risk through exposure to different asset classes.

- Access to Expertise: Investing through BlackRock provides access to the expertise of a leading investment management firm.

Deconstructing the 110% Prediction: What's Driving the Forecast?

The 110% gain prediction isn't based on mere speculation. Several factors contribute to this optimistic outlook.

Market Analysis and Underlying Factors

- Technological Advancements: Rapid innovation in technology, particularly in artificial intelligence and renewable energy, fuels significant growth potential.

- Emerging Market Growth: Developing economies offer attractive investment opportunities with high growth potential, contributing to the overall forecast.

- Positive Macroeconomic Indicators: Certain macroeconomic factors, such as low interest rates (in some regions) and increasing consumer spending (in certain sectors), support the 110% prediction.

Risk Assessment and Potential Downsides

It's crucial to acknowledge the inherent risks associated with any investment, especially those promising high returns.

- Market Corrections: Market downturns are inevitable. A significant correction could impact the predicted 110% gain.

- Geopolitical Uncertainty: Global events can significantly influence market performance, creating uncertainty and potential volatility.

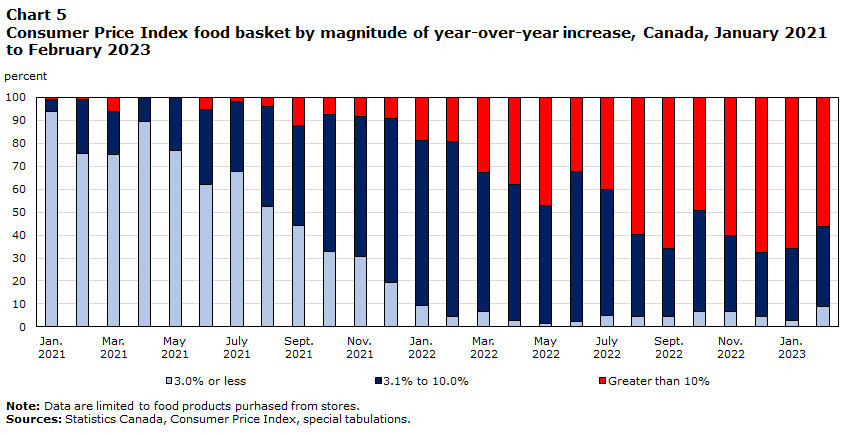

- Inflationary Pressures: Unexpected increases in inflation can erode investment returns, impacting the overall prediction.

Practical Strategies: How to Approach Investing in BlackRock ETFs

Investing in BlackRock ETFs, or any investment, requires careful planning and research.

Due Diligence and Research

- Understand the ETF Prospectus: Thoroughly review the ETF's prospectus to understand its investment objectives, risks, and fees.

- Analyze Historical Performance: Review the ETF's historical performance to assess its track record and volatility.

- Assess Your Risk Tolerance: Determine your investment goals and risk tolerance before investing.

Diversification and Portfolio Management

- Diversify Your Investments: Don't put all your eggs in one basket. Spread your investments across different asset classes and ETFs.

- Develop a Long-Term Investment Strategy: Focus on long-term growth rather than short-term gains.

- Seek Professional Advice: Consult a financial advisor to create a personalized investment strategy tailored to your individual needs and risk tolerance.

Capitalizing on the Opportunity: BlackRock ETFs and the Path to Potential 110% Gains

The predicted 110% gain from BlackRock ETF investments presents a significant opportunity, driven by the influence of billionaire investors, strong market fundamentals, and the potential for significant growth in various sectors. However, remember that this is a prediction, and significant risks exist. We've stressed the importance of due diligence, diversification, and professional guidance. While a potential 110% gain from BlackRock ETF investments is exciting, remember to proceed with caution and conduct thorough research. Don't hesitate to seek professional advice to create a well-diversified portfolio tailored to your risk tolerance. Investing wisely in BlackRock ETFs, with careful consideration, could potentially lead to substantial returns.

Featured Posts

-

Reliable Crypto News Your Key To Informed Investment Decisions

May 08, 2025

Reliable Crypto News Your Key To Informed Investment Decisions

May 08, 2025 -

Racha Imparable De Los Dodgers Mejor Inicio En Su Historia Y A La Caza Del Record De Los Yankees

May 08, 2025

Racha Imparable De Los Dodgers Mejor Inicio En Su Historia Y A La Caza Del Record De Los Yankees

May 08, 2025 -

Invictos Los Dodgers Y Su Imparable Ascenso Hacia El Record De Los Yankees

May 08, 2025

Invictos Los Dodgers Y Su Imparable Ascenso Hacia El Record De Los Yankees

May 08, 2025 -

Canadian Dollars Strength A Call For Immediate Economic Strategy

May 08, 2025

Canadian Dollars Strength A Call For Immediate Economic Strategy

May 08, 2025 -

Shreveport Police Announce Arrests In Major Vehicle Theft Case

May 08, 2025

Shreveport Police Announce Arrests In Major Vehicle Theft Case

May 08, 2025

Latest Posts

-

A Whistle For Krypto Supermans Summer Special Next Week

May 08, 2025

A Whistle For Krypto Supermans Summer Special Next Week

May 08, 2025 -

Dc Comics July 2025 Superman Battles Darkseids Powerful Legion

May 08, 2025

Dc Comics July 2025 Superman Battles Darkseids Powerful Legion

May 08, 2025 -

Injured Superman Sneak Peek Shows Kryptos Brutal Attack

May 08, 2025

Injured Superman Sneak Peek Shows Kryptos Brutal Attack

May 08, 2025 -

Supermans Summer Special Kryptos Cameo Next Week

May 08, 2025

Supermans Summer Special Kryptos Cameo Next Week

May 08, 2025 -

Superman Vs Darkseids Legion Dc Comics July 2025 Solicitations

May 08, 2025

Superman Vs Darkseids Legion Dc Comics July 2025 Solicitations

May 08, 2025