Vodacom's (VOD) Improved Earnings Drive Higher-Than-Expected Payout

Table of Contents

Strong Revenue Growth Fuels Vodacom's (VOD) Earnings Surge

Vodacom's (VOD) impressive earnings surge is primarily fueled by robust revenue growth across several key sectors. The company experienced significant gains in several areas, contributing to its overall financial success.

-

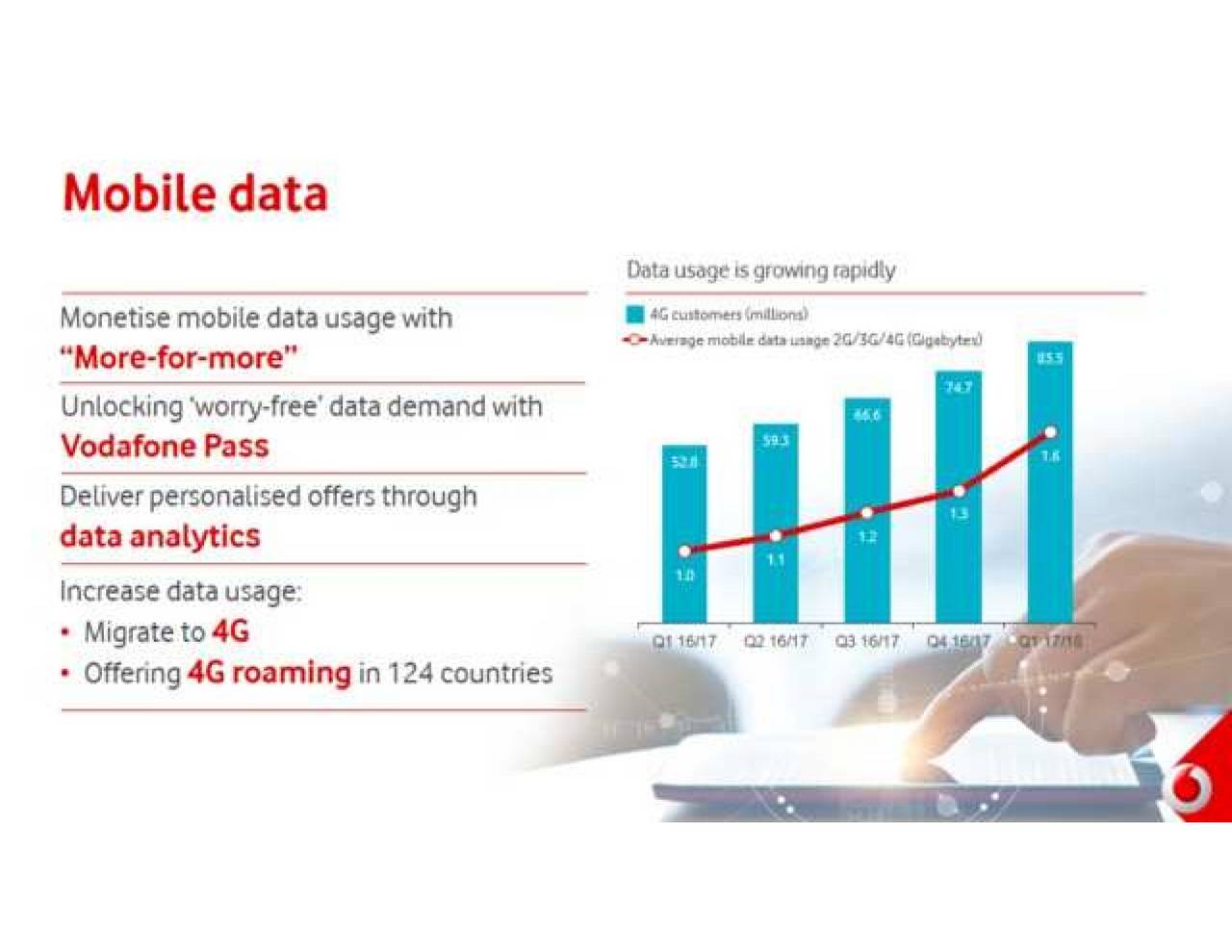

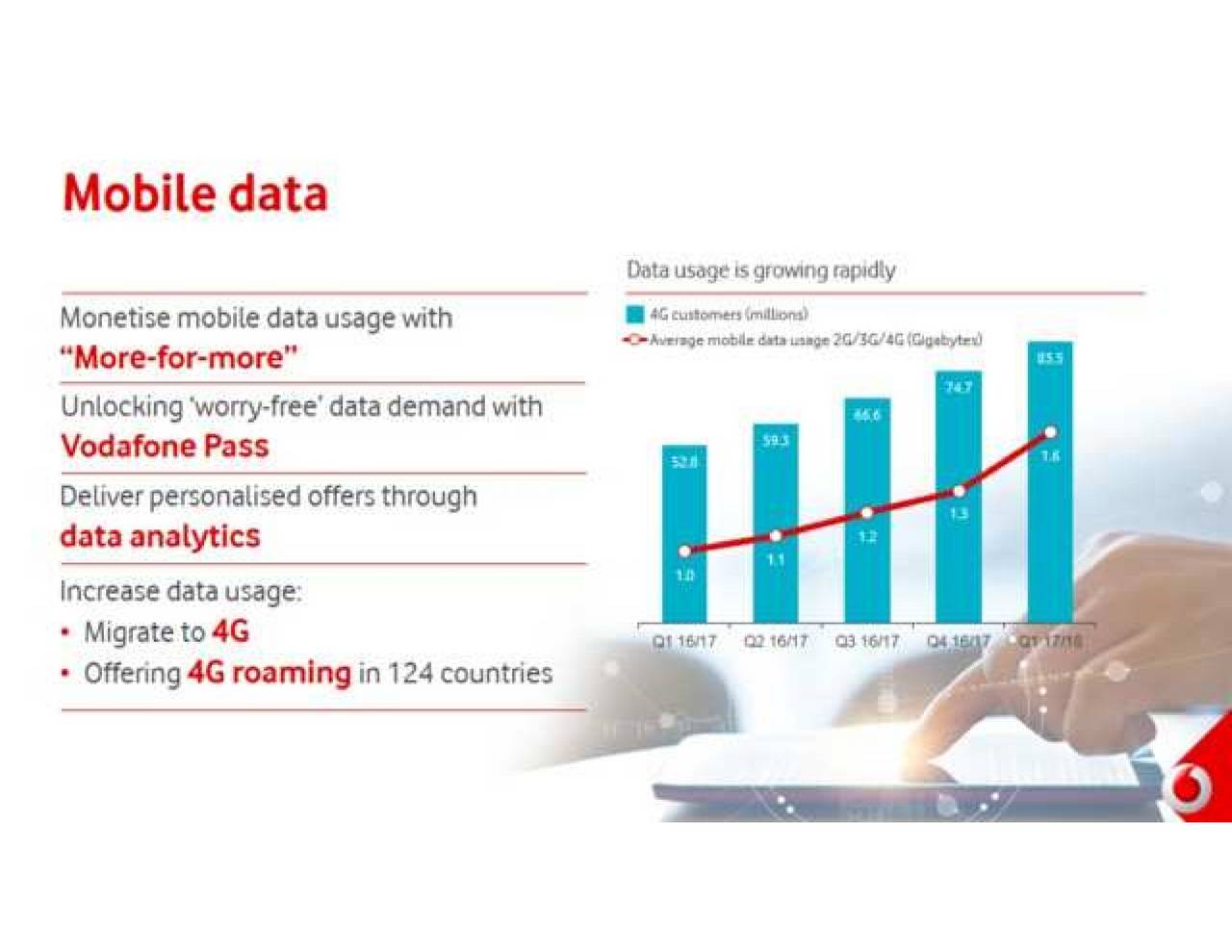

Mobile Data Revenue: Increased demand for mobile data services, driven by rising smartphone penetration and increased data consumption, played a crucial role in boosting Vodacom's (VOD) revenue. This growth reflects the company's successful strategy in expanding its 4G and 5G network coverage, attracting more data-hungry customers. Preliminary reports suggest a double-digit percentage increase in this sector.

-

Fintech Services: Vodacom's (VOD) foray into fintech solutions, including mobile money transfers and financial services, has yielded substantial returns. The increasing adoption of mobile money platforms in Africa contributed significantly to this growth area, showcasing the company's ability to adapt to and capitalize on market trends.

-

Enterprise Solutions: Vodacom's (VOD) enterprise solutions segment also saw robust growth, driven by increased demand for connectivity and digital transformation solutions from businesses of all sizes. This reflects a successful strategy in catering to the evolving needs of the corporate sector.

These key sectors all contributed to strong Vodacom financial results, significantly impacting VOD stock performance. The company's diversified revenue streams demonstrate resilience and adaptability in a dynamic market.

Improved Operational Efficiency Contributes to Higher Profitability

Beyond revenue growth, Vodacom's (VOD) enhanced profitability is also a result of significant improvements in operational efficiency. The company implemented several strategic initiatives to streamline operations and reduce costs, leading to better profit margins.

-

Cost Reduction Measures: Vodacom (VOD) implemented various cost-cutting measures, including optimizing network infrastructure and streamlining administrative processes. This resulted in considerable savings, contributing to improved profitability.

-

Strategic Initiatives: The company also focused on strategic initiatives to enhance operational efficiency, such as investing in advanced technologies and improving customer service processes. These improvements not only reduced costs but also enhanced customer satisfaction and loyalty.

The combination of these cost reduction measures and strategic initiatives significantly improved Vodacom (VOD) strategy and resulted in a noticeable increase in profit margins, further bolstering the company's overall financial performance.

Higher-Than-Expected Dividend Payout: A Win for Shareholders

The most significant outcome of Vodacom's (VOD) strong financial performance is the higher-than-expected dividend payout announced to shareholders. This increase reflects the company's commitment to delivering value to its investors.

-

Increased Returns on Investment: The increased dividend payout translates to increased returns on investment for shareholders, enhancing their overall portfolio performance.

-

Significance of the Increase: Comparing the current dividend with previous payouts clearly highlights the significance of this increase. This demonstrates Vodacom's confidence in its future prospects and its commitment to rewarding shareholders.

This VOD dividend payout underscores Vodacom's (VOD) commitment to shareholder value and its ability to deliver strong financial results.

Future Outlook for Vodacom (VOD) and Investment Implications

Analysts foresee continued growth for Vodacom (VOD), predicting sustained revenue growth and increased profitability in the coming years. However, the company faces potential challenges, such as increasing competition and regulatory changes.

-

Vodacom Growth Prospects: Despite potential risks, Vodacom's (VOD) diversified revenue streams and strategic initiatives position it well for continued growth. The continued expansion of its 5G network and its focus on fintech services are key drivers for future growth.

-

Vodacom Stock Forecast: The current financial performance strengthens the case for Vodacom (VOD) as an attractive investment opportunity. However, potential investors should conduct their due diligence and consider the risks associated with any investment.

The strong Vodacom future outlook suggests promising investment opportunities, but careful consideration of market analysis and potential risks is essential.

Conclusion: Vodacom's (VOD) Impressive Earnings Drive Enhanced Shareholder Value

In summary, Vodacom's (VOD) impressive earnings, driven by strong revenue growth and improved operational efficiency, have resulted in a higher-than-expected dividend payout, significantly enhancing shareholder value. This performance demonstrates the company's ability to navigate the dynamic telecommunications market and deliver substantial returns for its investors. Learn more about investing in Vodacom (VOD) and its attractive dividend payouts by visiting [link to relevant resource]. Stay informed about the latest Vodacom (VOD) financial news and updates by subscribing to our newsletter.

Featured Posts

-

Tadic Daytonov Sporazum Politicko Sarajevo Na Putu Samounistenja

May 20, 2025

Tadic Daytonov Sporazum Politicko Sarajevo Na Putu Samounistenja

May 20, 2025 -

Bournemouth Vs Fulham Premier League Match Free Live Stream Tv Channel And Kick Off Time 14 04 2025

May 20, 2025

Bournemouth Vs Fulham Premier League Match Free Live Stream Tv Channel And Kick Off Time 14 04 2025

May 20, 2025 -

Improving Siri Apples Investment In Llm Technology

May 20, 2025

Improving Siri Apples Investment In Llm Technology

May 20, 2025 -

Beiers Double Propels Dortmund Past Mainz

May 20, 2025

Beiers Double Propels Dortmund Past Mainz

May 20, 2025 -

Friis Paljasti Avauskokoonpanon Kamara Ja Pukki Penkillae

May 20, 2025

Friis Paljasti Avauskokoonpanon Kamara Ja Pukki Penkillae

May 20, 2025

Latest Posts

-

Huuhkajien Uusi Valmennus Tie Mm Karsintoihin

May 20, 2025

Huuhkajien Uusi Valmennus Tie Mm Karsintoihin

May 20, 2025 -

Aj Styles Contract Situation A Backstage Report

May 20, 2025

Aj Styles Contract Situation A Backstage Report

May 20, 2025 -

Zoey Stark Sidelined After Wwe Raw Injury

May 20, 2025

Zoey Stark Sidelined After Wwe Raw Injury

May 20, 2025 -

Update Zoey Starks Injury On Wwe Raw

May 20, 2025

Update Zoey Starks Injury On Wwe Raw

May 20, 2025 -

Wwe Raw Zoey Stark Suffers Injury

May 20, 2025

Wwe Raw Zoey Stark Suffers Injury

May 20, 2025