Vodacom (VOD): Better-Than-Projected Earnings Result In Increased Payout

Table of Contents

Stronger-Than-Expected Financial Performance of Vodacom (VOD)

Vodacom's financial performance for the first half of 2024 significantly exceeded projections, demonstrating robust growth across key metrics. The company reported a substantial increase in revenue and earnings, solidifying its position as a leading telecommunications player.

- Revenue Growth: Vodacom reported a 15% year-on-year increase in revenue, surpassing analyst expectations of a 10% growth. This impressive figure showcases strong demand for Vodacom's services.

- Earnings Per Share (EPS): Earnings per share experienced a remarkable 20% surge, reflecting improved operational efficiency and increased profitability. This translates to higher returns for Vodacom (VOD) shareholders.

- Key Growth Drivers: The growth can be attributed to several factors, including a substantial increase in the subscriber base, particularly in data services, and the continued success of its M-Pesa mobile money platform. The expansion into fintech services has also contributed significantly to the overall financial performance.

- Official Financial Report: For a detailed breakdown of the financial results, please refer to Vodacom's official financial report [insert link to official report here].

Increased Dividend Payout: Good News for Vodacom (VOD) Investors

The improved financial performance has directly translated into a generous increase in the Vodacom dividend payout. This is excellent news for investors looking for strong returns on their investments.

- Dividend Increase: The dividend payout has been increased by 18%, representing a significant boost for shareholders. The actual amount per share is [insert amount here].

- Factors Contributing to the Increase: This substantial increase in the Vodacom dividend is a direct result of strong cash flow generation and significantly improved profitability. The company's effective cost management strategies have also played a vital role.

- Dividend Yield Attractiveness: The increased dividend yield makes Vodacom (VOD) a more attractive investment compared to many other stocks in the telecommunications sector. The current yield is [insert yield here], making it a compelling option for income-seeking investors.

Market Reaction and Future Outlook for Vodacom (VOD)

The market reacted positively to Vodacom's better-than-expected earnings announcement and the increased Vodacom dividend.

- Share Price Movement: Following the announcement, the VOD share price experienced a [percentage]% increase, reflecting investor confidence in the company's future prospects.

- Analyst Predictions: Analysts generally hold a positive outlook for Vodacom, with many predicting continued growth in the coming quarters. [Mention specific analyst predictions if available, citing the source].

- Potential Risks and Challenges: While the outlook is optimistic, challenges remain, including increased competition, regulatory hurdles, and economic uncertainties within its operating markets. These factors need to be considered when evaluating the long-term investment potential.

- Future Growth Strategies and Investments: Vodacom's continued investment in network expansion, particularly in 5G technology, and its ongoing development of digital services are expected to drive future growth.

Vodacom's Strategic Initiatives Driving Growth

Vodacom's strategic initiatives have played a crucial role in its improved performance. These include:

- Network Expansion: Investments in expanding its network coverage and capacity, particularly in underserved areas, have led to a significant increase in subscribers.

- Digital Services: The company's focus on offering a wider range of digital services, including mobile financial services (M-Pesa) and data-centric offerings, has tapped into growing market demand.

Conclusion

Vodacom's better-than-projected earnings and the consequent increase in the Vodacom dividend payout represent exceptionally positive news for investors. This demonstrates the company's strong financial health and its commitment to rewarding shareholders. The increased Vodacom dividend payout underscores the attractiveness of Vodacom as a solid investment option. Stay informed about future Vodacom (VOD) earnings announcements and consider investing in this growing telecommunications company to benefit from potential future dividend payouts and share price appreciation. Learn more about Vodacom (VOD) investment opportunities by visiting [link to relevant resource].

Featured Posts

-

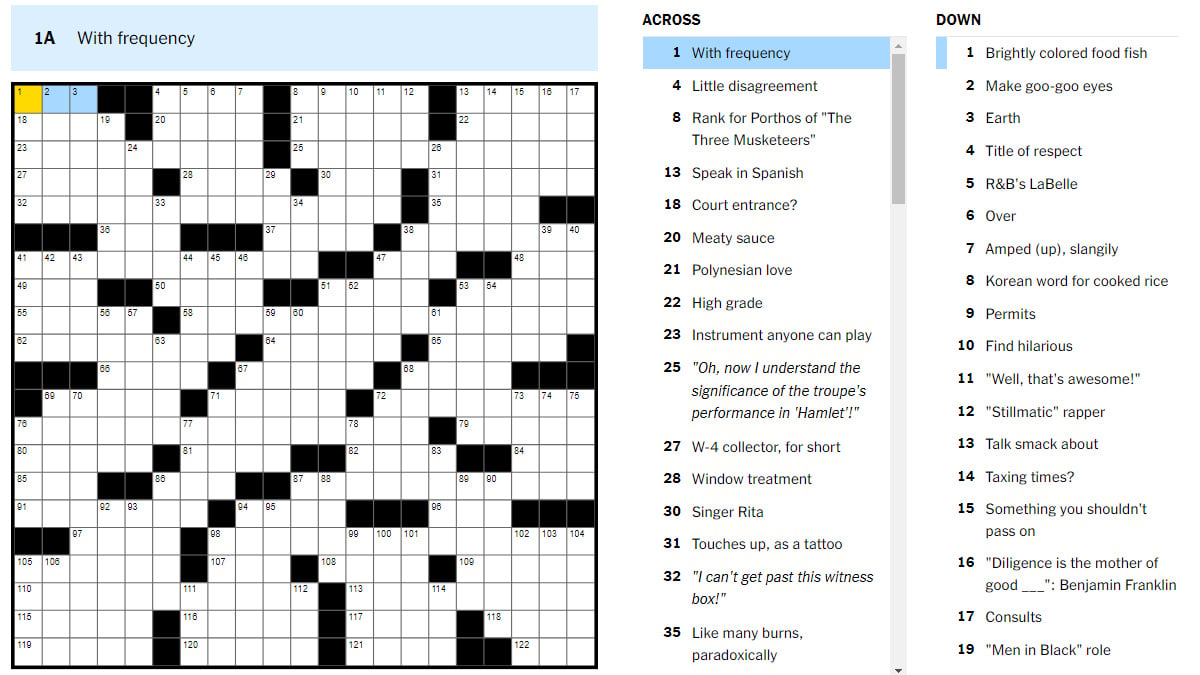

Nyt Mini Crossword Answers Today March 20 2025 Hints And Clues

May 20, 2025

Nyt Mini Crossword Answers Today March 20 2025 Hints And Clues

May 20, 2025 -

Will Abc News Show Survive Recent Layoffs Impact On Programming

May 20, 2025

Will Abc News Show Survive Recent Layoffs Impact On Programming

May 20, 2025 -

D Wave Quantum Qbts Stock Plunge Kerrisdale Capitals Valuation Concerns

May 20, 2025

D Wave Quantum Qbts Stock Plunge Kerrisdale Capitals Valuation Concerns

May 20, 2025 -

Nyt Mini Crossword Answers And Clues March 24 2025

May 20, 2025

Nyt Mini Crossword Answers And Clues March 24 2025

May 20, 2025 -

Robert Pattinson And Suki Waterhouse Spotted Holding Hands In Nyc The Batman 2 Connection

May 20, 2025

Robert Pattinson And Suki Waterhouse Spotted Holding Hands In Nyc The Batman 2 Connection

May 20, 2025

Latest Posts

-

Espns Insights Into The Boston Bruins Crucial Offseason Changes

May 21, 2025

Espns Insights Into The Boston Bruins Crucial Offseason Changes

May 21, 2025 -

Bruins Offseason Espn Highlights Key Decisions Shaping The Franchises Future

May 21, 2025

Bruins Offseason Espn Highlights Key Decisions Shaping The Franchises Future

May 21, 2025 -

Espn Uncovers Key To Bruins Franchise Defining Offseason

May 21, 2025

Espn Uncovers Key To Bruins Franchise Defining Offseason

May 21, 2025 -

Espns Bruins Offseason Analysis Key Franchise Altering Moves Revealed

May 21, 2025

Espns Bruins Offseason Analysis Key Franchise Altering Moves Revealed

May 21, 2025 -

Sydney Sweeney Post Echo Valley And The Housemaid New Film Project

May 21, 2025

Sydney Sweeney Post Echo Valley And The Housemaid New Film Project

May 21, 2025