D-Wave Quantum (QBTS) Stock Plunge: Kerrisdale Capital's Valuation Concerns

Table of Contents

Kerrisdale Capital's Report: Key Arguments Against D-Wave's Valuation

Kerrisdale Capital's report presented a compelling case against D-Wave's current valuation, arguing that the company's stock price was significantly inflated. Their analysis employed a combination of discounted cash flow (DCF) analysis and comparable company analysis to arrive at their conclusion. Key criticisms included:

- Overly Optimistic Revenue Projections: Kerrisdale argued that D-Wave's revenue projections were overly optimistic and lacked sufficient supporting evidence. They questioned the company's ability to achieve the projected market penetration within the given timeframe.

- Unproven Technological Advantage: The report cast doubt on D-Wave's claims of possessing a significant technological advantage over competitors in the quantum computing space. They highlighted the challenges faced by D-Wave's specific type of quantum annealing technology compared to other approaches like gate-based quantum computing.

- Limited Market Size for Quantum Annealing: Kerrisdale questioned the overall market size for D-Wave's specific type of quantum computing solutions, suggesting a narrower addressable market than D-Wave's projections implied. This directly impacted their DCF valuation.

- High Burn Rate and Limited Cash Runway: The report highlighted D-Wave's significant operating losses and high burn rate, raising concerns about the company's ability to sustain operations without further substantial funding. This analysis factored heavily into their assessment of the company's future financial health.

Market Reaction to Kerrisdale Capital's Report: QBTS Stock's Decline

The release of Kerrisdale Capital's report immediately triggered a sharp decline in QBTS stock price. Trading volume spiked significantly as investors reacted to the negative news, resulting in a substantial sell-off. Investor sentiment shifted dramatically, with many reassessing their previously positive outlook on D-Wave's prospects. While Kerrisdale's report was the primary catalyst, other factors such as broader market conditions and concerns about the overall quantum computing sector likely contributed to the stock plunge. The combination of these factors created a perfect storm that significantly impacted the QBTS share price.

D-Wave Quantum's Response and Future Outlook

D-Wave Quantum responded to Kerrisdale Capital's report with a formal statement refuting several of the criticisms. The company defended its revenue projections, emphasizing its growing customer base and strategic partnerships. They also reiterated their belief in the long-term potential of quantum annealing technology and its suitability for specific applications. However, the credibility and effectiveness of D-Wave's counterarguments remain a subject of ongoing debate among investors. The long-term implications of this controversy are still unfolding, and the future success of D-Wave will depend on its ability to deliver on its promises and navigate the challenges of a rapidly evolving quantum computing landscape. Future developments in the field, including breakthroughs in other quantum computing technologies, will play a significant role in shaping D-Wave's future.

The Significance of Short Selling in the Quantum Computing Sector

Short selling plays a crucial role in the stock market, acting as a counterbalance to overly optimistic valuations. In the high-growth, often speculative, quantum computing sector, short selling can be particularly impactful. Kerrisdale Capital's actions highlight the risks and potential rewards associated with shorting QBTS. Their report could influence investor confidence, leading to further sell-offs, or conversely, it could prompt D-Wave to address underlying concerns, ultimately benefiting shareholders. Similar short-selling events have affected other companies in the quantum computing space, emphasizing the volatility and inherent risk in this emerging sector.

Conclusion: Navigating the Uncertainty – D-Wave Quantum (QBTS) Stock and Future Implications

This analysis of the D-Wave Quantum (QBTS) stock plunge reveals the significant impact of Kerrisdale Capital's valuation concerns. Their report highlighted key weaknesses in D-Wave's financial projections and market positioning, triggering a sharp decline in the stock price. While D-Wave has offered counterarguments, the uncertainty surrounding its future prospects remains. The quantum computing industry is still in its nascent stages, and inherent risks associated with emerging technologies are considerable. Therefore, it is crucial for investors to carefully consider their investment in D-Wave Quantum (QBTS) and understand the risks associated with QBTS and similar quantum computing stocks. Before making any investment decisions, assess the valuation of D-Wave Quantum thoroughly and conduct comprehensive due diligence. Only through careful research and a balanced understanding of the risks involved can investors navigate the complexities of this dynamic and potentially rewarding, but undeniably volatile, sector.

Featured Posts

-

Friisin Yllaetysvalinnat Kamara Ja Pukki Penkillae Avausottelussa

May 20, 2025

Friisin Yllaetysvalinnat Kamara Ja Pukki Penkillae Avausottelussa

May 20, 2025 -

Honest Critic Reactions To Jennifer Lawrences New Film Release

May 20, 2025

Honest Critic Reactions To Jennifer Lawrences New Film Release

May 20, 2025 -

Tampoy Erotas Fygi Kai Syllipsi Mia Eksonyxistiki Analysi

May 20, 2025

Tampoy Erotas Fygi Kai Syllipsi Mia Eksonyxistiki Analysi

May 20, 2025 -

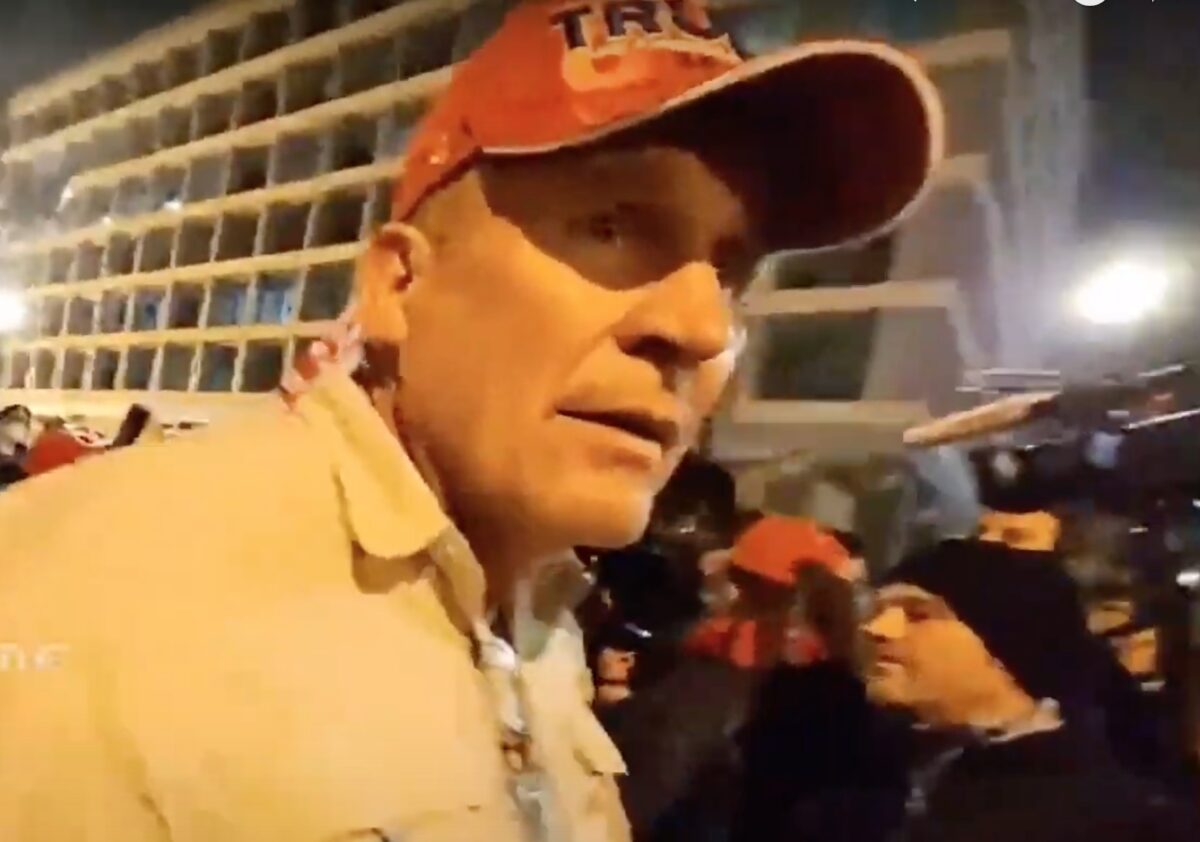

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Jan 6th Falsehoods

May 20, 2025

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Jan 6th Falsehoods

May 20, 2025 -

Plans D Urbanisme De Detail En Cote D Ivoire Bruno Kone Appelle A La Participation Des Maires

May 20, 2025

Plans D Urbanisme De Detail En Cote D Ivoire Bruno Kone Appelle A La Participation Des Maires

May 20, 2025

Latest Posts

-

Giakoymakis Kai Kroyz Azoyl I Poreia Pros Ton Teliko Champions League

May 20, 2025

Giakoymakis Kai Kroyz Azoyl I Poreia Pros Ton Teliko Champions League

May 20, 2025 -

Kroyz Azoyl Ston Teliko Champions League I Symvoli Toy Giakoymaki

May 20, 2025

Kroyz Azoyl Ston Teliko Champions League I Symvoli Toy Giakoymaki

May 20, 2025 -

Prokrisi Kroyz Azoyl O Giakoymakis Ston Teliko Champions League

May 20, 2025

Prokrisi Kroyz Azoyl O Giakoymakis Ston Teliko Champions League

May 20, 2025 -

Eyresi Efimereyontos Giatroy Stin Patra 10 And 11 Maioy

May 20, 2025

Eyresi Efimereyontos Giatroy Stin Patra 10 And 11 Maioy

May 20, 2025 -

Patra Efimereyontes Iatroi Savvatokyriako 10 11 Maioy

May 20, 2025

Patra Efimereyontes Iatroi Savvatokyriako 10 11 Maioy

May 20, 2025