US Tech IPO Freeze: Impact Of Tariffs On Market Entry

Table of Contents

Increased Costs and Reduced Profitability

Tariffs significantly impact the financial health of tech companies, making the IPO process less appealing. This is primarily due to increased costs and reduced profitability, hindering their ability to attract investors.

Tariff Impact on Supply Chains

Tariffs directly inflate the cost of imported components crucial for tech manufacturing. This ripple effect permeates the entire supply chain, leading to:

- Increased manufacturing costs leading to higher product prices: Consumers face higher prices, potentially impacting demand and reducing sales volumes.

- Reduced competitiveness in the global market: Higher production costs make US tech companies less competitive against international rivals who may not face the same tariff burdens.

- Uncertainty around future tariff increases hindering long-term planning: The unpredictable nature of tariffs makes it incredibly difficult for businesses to forecast future costs and profits, creating a climate of uncertainty that deters investment and IPOs.

Higher Capital Expenditure

Beyond supply chain disruptions, tariffs increase the cost of essential resources, including raw materials, specialized equipment, and advanced technologies. This leads to:

- Need for greater investment to offset tariff costs: Companies need to invest more capital simply to maintain their current operational levels, leaving less for expansion and innovation.

- Reduced investor confidence due to increased financial risk: Investors are hesitant to back companies facing significant cost pressures and unpredictable financial outlooks.

- Potential for delayed or cancelled IPOs: The added financial strain and uncertainty often lead to postponements or complete cancellations of planned IPOs.

Investor Sentiment and Market Volatility

The geopolitical climate surrounding tariffs significantly influences investor sentiment, creating a volatile market environment. This impacts the attractiveness of tech IPOs.

Uncertainty and Risk Aversion

Trade wars and unpredictable tariff policies foster uncertainty, causing investors to become increasingly risk-averse. This translates to:

- Reduced investor appetite for tech IPOs: Investors seek safer, more stable investment opportunities during times of economic and political uncertainty.

- Increased scrutiny of company financials and future projections: Investors demand more rigorous due diligence and accurate financial forecasting, making the IPO process more challenging.

- Demand for higher returns to compensate for increased risk: Investors require higher potential returns to justify the increased risk associated with investing in a volatile market.

Geopolitical Risks and Global Market Access

Tariffs not only increase domestic costs but also complicate access to crucial international markets. This uncertainty significantly impacts the viability of many tech businesses:

- Difficulty in predicting global sales and market penetration: Uncertainties in international trade make it nearly impossible to accurately forecast revenue streams from global markets.

- Potential for reduced international expansion opportunities: Tariffs can effectively restrict access to significant foreign markets, limiting growth potential.

- Increased dependence on the domestic market, creating vulnerabilities: Over-reliance on the domestic market exposes companies to economic downturns and fluctuations within the US economy.

Alternative Funding Strategies and Delayed IPOs

Faced with the challenges of a tariff-burdened IPO market, many tech companies are exploring alternative funding routes and delaying their public debuts.

Private Equity and Venture Capital

The difficulties of going public have led to a surge in reliance on private funding sources:

- Increased competition for private funding: More companies vying for private equity and venture capital creates a more competitive and potentially less lucrative funding environment.

- Potential for higher valuations in later funding rounds: Companies may wait for more favorable market conditions, potentially leading to higher valuations in subsequent funding rounds.

- Delayed IPOs as companies wait for more favorable market conditions: Companies are delaying IPOs until economic uncertainty lessens and investor confidence increases.

Mergers and Acquisitions

As an alternative to a challenging IPO, some tech companies opt for acquisition by larger corporations:

- Increased merger and acquisition activity in the tech sector: We are seeing more companies choosing acquisition as a less risky path to growth and financial stability.

- Potential loss of independent operations and innovation: Being acquired often results in the loss of independent operations and potentially stifled innovation.

- Shift in the competitive landscape of the tech industry: The increased M&A activity reshapes the competitive dynamics within the tech sector.

Conclusion

The US tech IPO freeze is a complex situation with far-reaching implications for innovation and economic growth. The impact of escalating tariffs is undeniable, leading to increased costs, reduced profitability, and significant investor uncertainty. This makes the market entry process significantly harder for tech companies. Companies are adjusting by seeking alternative financing and delaying IPOs. Understanding the intricate effects of tariffs on the US tech IPO market is vital for navigating this challenging environment. To stay abreast of the latest developments impacting US tech IPOs and the ongoing effects of tariffs, diligent monitoring of industry news and expert analyses is crucial. The future of US tech IPOs relies heavily on resolving trade uncertainties and establishing a more stable and predictable market.

Featured Posts

-

Tommy Fury Fined For Speeding Days After Molly Mae Hague Split

May 14, 2025

Tommy Fury Fined For Speeding Days After Molly Mae Hague Split

May 14, 2025 -

Shark Ninja Pressure Cooker Recall Burn Injuries Prompt Cpsc Action

May 14, 2025

Shark Ninja Pressure Cooker Recall Burn Injuries Prompt Cpsc Action

May 14, 2025 -

Cybercriminals Office365 Heist Millions In Losses Reported

May 14, 2025

Cybercriminals Office365 Heist Millions In Losses Reported

May 14, 2025 -

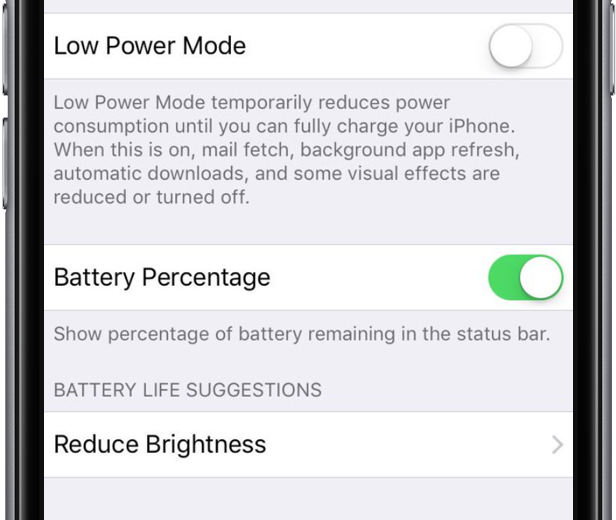

Improved Battery Life With I Os 19s Intelligent Battery Management

May 14, 2025

Improved Battery Life With I Os 19s Intelligent Battery Management

May 14, 2025 -

Boycott Eurovision In Israel Director Responds To Criticism

May 14, 2025

Boycott Eurovision In Israel Director Responds To Criticism

May 14, 2025

Latest Posts

-

Aina And Awoniyi Lead Nottingham Forest To Victory Against Manchester City

May 14, 2025

Aina And Awoniyi Lead Nottingham Forest To Victory Against Manchester City

May 14, 2025 -

Epl Nottingham Forest Offer Update On Awoniyis Fitness

May 14, 2025

Epl Nottingham Forest Offer Update On Awoniyis Fitness

May 14, 2025 -

Nottingham Forests Victory Over Manchester City Awoniyis Key Role

May 14, 2025

Nottingham Forests Victory Over Manchester City Awoniyis Key Role

May 14, 2025 -

Awoniyis Impact Nottingham Forest Defeat Manchester City

May 14, 2025

Awoniyis Impact Nottingham Forest Defeat Manchester City

May 14, 2025 -

Nottingham Forest Injury Update Awoniyis Status Revealed

May 14, 2025

Nottingham Forest Injury Update Awoniyis Status Revealed

May 14, 2025