US IPO Filing: Chime's Rise In Digital Banking And Revenue Growth

Table of Contents

Chime's Disruptive Business Model and Market Position

Chime's success stems from its unique approach to digital banking. Unlike traditional banks burdened by fees and complex processes, Chime offers a fee-free model, prioritizing user-friendliness and accessibility. This strategy has resonated strongly with a large segment of the population underserved by traditional financial institutions. Its competitive advantages are numerous:

- Fee-free checking and savings accounts: Eliminating fees is a major draw for customers tired of hidden charges and overdraft penalties.

- Early access to direct deposits: Chime provides users with early access to their paychecks, improving cash flow management and financial stability.

- User-friendly mobile app: The intuitive and easy-to-navigate mobile app enhances user experience and encourages engagement.

- Strong focus on financial inclusion: Chime actively targets underserved communities, promoting financial literacy and accessibility for all.

- Rapid customer acquisition: Its innovative approach and effective marketing have led to rapid and substantial customer growth, establishing Chime as a major player in the digital banking space.

This combination of features positions Chime favorably against both traditional banks and other fintech competitors, allowing it to capture a significant market share and fuel its impressive revenue growth.

Analyzing Chime's Revenue Growth and Financial Performance

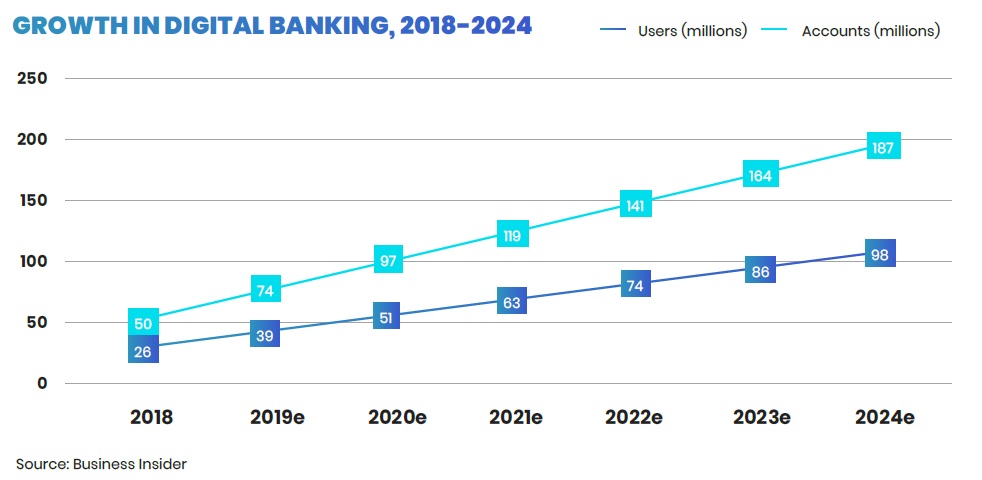

Chime's revenue growth trajectory has been nothing short of spectacular. While specific financial details are not always publicly available before an IPO, reports suggest significant year-over-year increases. This growth can be attributed to several factors:

- Year-over-year revenue growth percentages: While precise figures remain confidential, analysts predict substantial growth percentages.

- Key revenue sources: Chime's revenue streams primarily include interchange fees generated from debit card transactions and potential subscription-based services for premium features.

- Profitability metrics: While profitability is a key consideration for any IPO, the focus on rapid growth might initially prioritize customer acquisition over immediate profitability.

- Discussion of any challenges faced regarding revenue generation: Like any rapidly scaling business, Chime likely faces challenges in balancing growth with profitability and managing operational costs.

Understanding these revenue streams and growth drivers is crucial for assessing Chime's financial health and potential valuation in the upcoming IPO.

Implications of the US IPO Filing for Chime and the Digital Banking Sector

The Chime IPO holds significant implications for both the company and the broader digital banking sector.

- Expected IPO valuation: Industry analysts predict a substantial valuation reflecting Chime's rapid growth and market position.

- Access to capital for further expansion and innovation: The IPO will provide Chime with substantial capital to further expand its services, invest in technology, and potentially acquire other fintech companies.

- Increased competition among digital banks: Chime's successful IPO will likely intensify competition within the digital banking landscape, prompting other players to innovate and adapt.

- Potential impact on regulatory landscape: The increased prominence of digital banks like Chime could influence future regulations in the financial sector.

- Attracting further investment in the fintech space: A successful Chime IPO will signal investor confidence in the fintech sector, attracting further investment and innovation.

Potential Risks and Challenges Associated with the IPO

Despite the positive outlook, Chime faces potential risks and challenges:

- Regulatory scrutiny: Increased regulatory oversight and compliance requirements can impact operational efficiency and profitability.

- Competition: The digital banking landscape is increasingly competitive, requiring Chime to continuously innovate and maintain its competitive edge.

- Market volatility: Market fluctuations and economic downturns can impact investor sentiment and the overall IPO valuation.

Navigating these challenges successfully will be crucial for Chime's long-term success after going public.

Conclusion: US IPO Filing: The Future of Chime and Digital Banking

Chime's anticipated US IPO filing represents a landmark achievement for the company and a significant moment for the digital banking industry. Its disruptive business model, focusing on fee-free services and a user-friendly platform, has fueled impressive revenue growth and rapid customer acquisition. The IPO will provide Chime with the resources to further expand its operations and solidify its position as a leading player in the fintech space. However, success will depend on effectively navigating the challenges inherent in a highly competitive and evolving market. The Chime IPO and its implications will undoubtedly reshape the landscape of digital banking.

Stay tuned for updates on Chime's US IPO filing and its continued revolution of the digital banking landscape. Follow our blog for the latest news and analysis on Chime's journey and the evolution of the fintech industry.

Featured Posts

-

Kupovina Novakovikh Patika Vodich Kroz Modele Od 1 500 Evra

May 14, 2025

Kupovina Novakovikh Patika Vodich Kroz Modele Od 1 500 Evra

May 14, 2025 -

Shopify Shares Rocket Nasdaq 100 Inclusion Drives 14 Increase

May 14, 2025

Shopify Shares Rocket Nasdaq 100 Inclusion Drives 14 Increase

May 14, 2025 -

Chime Ipo Digital Banking Startups Financial Performance Revealed

May 14, 2025

Chime Ipo Digital Banking Startups Financial Performance Revealed

May 14, 2025 -

Federal Wholesale Fibre Policy Bells Plea For Change

May 14, 2025

Federal Wholesale Fibre Policy Bells Plea For Change

May 14, 2025 -

Captain America Brave New World Disney Streaming Date Confirmed

May 14, 2025

Captain America Brave New World Disney Streaming Date Confirmed

May 14, 2025

Latest Posts

-

Nonnas Vince Vaughns Italian Restaurant Opens Its Doors

May 14, 2025

Nonnas Vince Vaughns Italian Restaurant Opens Its Doors

May 14, 2025 -

Exclusive First Look Vince Vaughns Restaurant Featuring Authentic Italian Nonna Chefs

May 14, 2025

Exclusive First Look Vince Vaughns Restaurant Featuring Authentic Italian Nonna Chefs

May 14, 2025 -

Nonna Old Fashioned Comedy And Family Fun

May 14, 2025

Nonna Old Fashioned Comedy And Family Fun

May 14, 2025 -

Ashley Judds Heartbreaking Last Words With Naomi Judd

May 14, 2025

Ashley Judds Heartbreaking Last Words With Naomi Judd

May 14, 2025 -

Vince Vaughn Partners With Italian Grandmothers For New Restaurant Concept

May 14, 2025

Vince Vaughn Partners With Italian Grandmothers For New Restaurant Concept

May 14, 2025