US Economic Growth To Slow Considerably: Deloitte's Prediction

Table of Contents

Deloitte's Key Findings and Methodology

Deloitte's forecast relies on a sophisticated econometric modeling approach, incorporating a wide range of data sources and employing rigorous statistical techniques. Their credibility stems from years of experience in economic forecasting and a commitment to data-driven analysis. The firm's methodology considers both leading and lagging economic indicators to provide a comprehensive and nuanced view of the future economic trajectory.

- Specific GDP growth rate predicted by Deloitte for the next year(s): Deloitte projects a GDP growth rate of approximately 1.5% for 2024, significantly lower than previous years' growth. This represents a considerable deceleration compared to earlier growth rates.

- Key economic indicators Deloitte analyzed (inflation, consumer spending, business investment, etc.): The analysis included crucial indicators like the Consumer Price Index (CPI) to measure inflation, consumer spending data from the Bureau of Economic Analysis, and business investment figures from various industry surveys.

- Comparison to previous Deloitte predictions and other economic forecasts: While specific figures vary slightly across different forecasting institutions, there's a general consensus among many economists about the impending slowdown. This prediction aligns broadly with other leading economic forecasts, emphasizing the seriousness of the projected slowdown in US economic growth.

- Mention any specific models or data sets used: Deloitte's analysis incorporates a variety of proprietary models and public data sets, including those from the Federal Reserve, the Bureau of Labor Statistics, and other reputable sources. The precise models employed are often proprietary, but the firm’s commitment to transparency in methodology is evident.

Factors Contributing to the Predicted Slowdown

Several interconnected factors contribute to Deloitte's prediction of a significant slowdown in US economic growth.

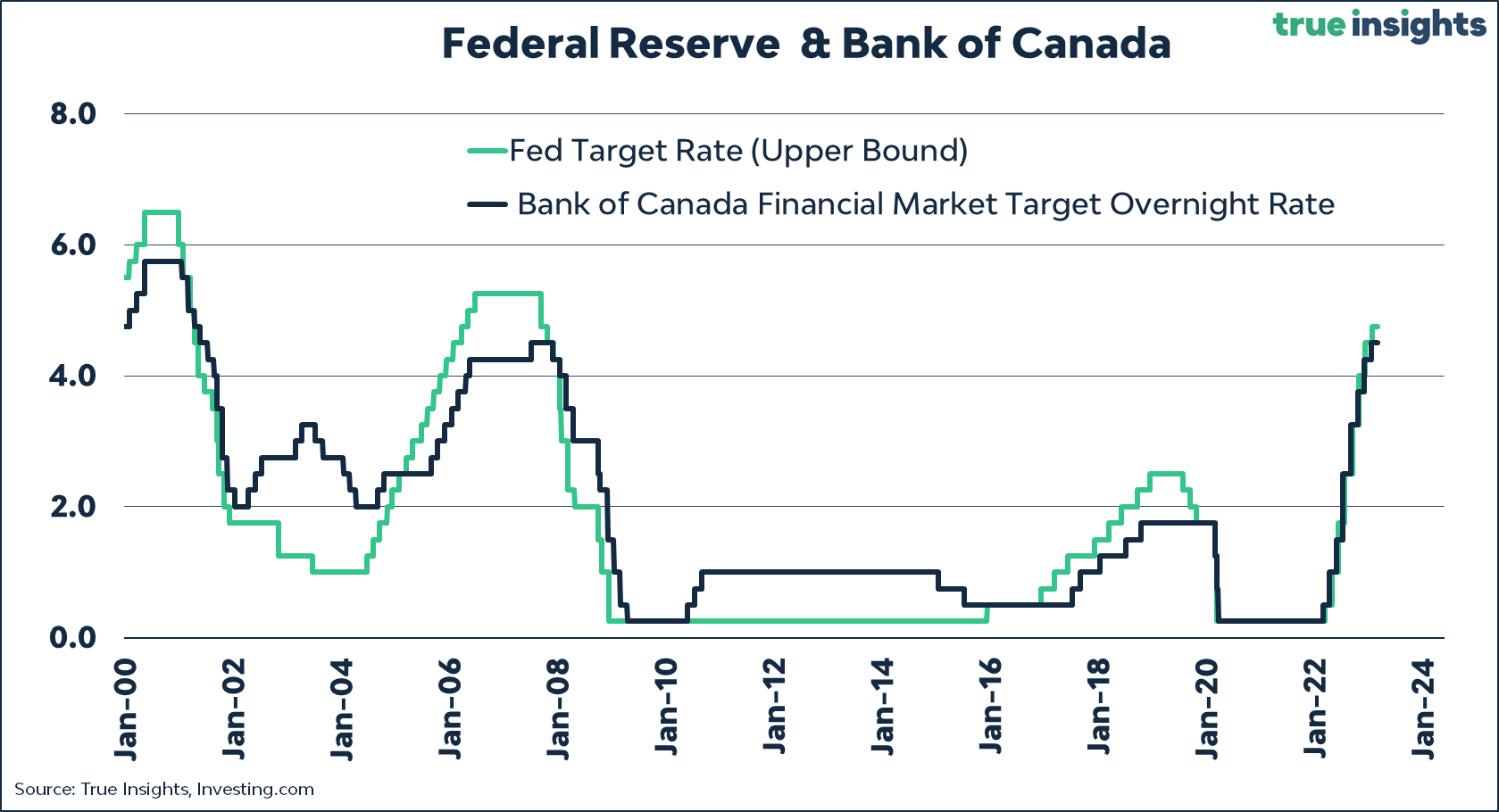

Persistent Inflation and Interest Rate Hikes

High inflation continues to erode purchasing power and stifle economic activity. The Federal Reserve's response, through aggressive interest rate hikes, aims to curb inflation but carries the risk of slowing economic growth further, potentially triggering a recession.

- Impact on consumer spending and borrowing: Higher interest rates increase borrowing costs, making it more expensive for consumers to finance purchases like homes and cars, thus reducing consumer spending.

- Effect on business investment and expansion plans: Businesses are less likely to invest in expansion or new projects when interest rates are high, leading to decreased capital expenditures.

- Potential for a recessionary environment: The combined effect of reduced consumer spending and business investment creates a significant risk of a recessionary environment, characterized by falling GDP and rising unemployment.

Global Economic Uncertainty

Geopolitical instability and persistent supply chain disruptions are adding to the headwinds facing the US economy. These global factors create uncertainty and dampen economic growth.

- Impact of the war in Ukraine on energy prices and global trade: The ongoing conflict in Ukraine has significantly impacted energy prices, fueling inflation and disrupting global trade patterns.

- Challenges posed by ongoing supply chain bottlenecks: Supply chain issues persist, leading to higher input costs for businesses and further inflationary pressures.

- Effects of slowing growth in other major economies: Slower growth in major global economies reduces demand for US exports, adding to the challenges facing domestic producers.

Weakening Consumer Confidence

Declining consumer confidence indicates reduced optimism about the future economy and, consequently, lower spending. This further dampens economic activity and reinforces the slowdown.

- Data on consumer confidence indices: Several key consumer confidence indices, such as the Consumer Confidence Index from the Conference Board, show a consistent downward trend, reflecting growing pessimism among consumers.

- Reasons behind declining consumer sentiment (inflation, job market uncertainty, etc.): Inflation, concerns about job security, and geopolitical uncertainty are major factors contributing to this decline in consumer sentiment.

- Impact on retail sales and other consumer-driven sectors: Reduced consumer spending negatively impacts retail sales and other sectors heavily reliant on consumer demand, contributing to slower overall economic growth.

Potential Impacts Across Different Sectors

The predicted economic slowdown will differentially affect various sectors of the US economy.

- Impact on the housing market: Rising interest rates are already cooling the housing market, leading to reduced home sales and potential price declines.

- Effects on the manufacturing and technology sectors: Manufacturing and technology sectors are particularly vulnerable to reduced business investment and weakening global demand.

- Implications for the service industry and employment: The service industry, a significant component of the US economy, will also feel the impact, potentially leading to reduced hiring or even job losses.

Strategies for Businesses to Navigate the Slowdown

Businesses need to proactively adapt their strategies to mitigate the impact of the predicted economic slowdown.

- Cost-cutting measures and efficiency improvements: Streamlining operations and identifying areas for cost reduction are crucial to maintaining profitability.

- Diversification strategies to reduce risk: Reducing reliance on single markets or products can help mitigate the impact of economic downturns.

- Investing in innovation and technology: Investing in research and development and adopting new technologies can help businesses remain competitive and adapt to changing market conditions.

- Adapting to changing consumer behavior: Businesses need to understand and adapt to shifts in consumer spending patterns and preferences.

Conclusion

Deloitte's prediction of a considerable slowdown in US economic growth underscores the significant challenges facing the US economy. Factors like persistent inflation, global uncertainty, and weakening consumer confidence all contribute to this forecast, creating a complex and potentially difficult environment for businesses and individuals. Understanding these factors and implementing proactive strategies is crucial for businesses and individuals to navigate this potentially challenging economic environment. A proactive and adaptable approach will be essential for weathering this period of slower US economic growth.

Call to Action: Stay informed about the evolving US economic landscape and Deloitte's future predictions regarding US economic growth to make informed decisions for your business and investments. Monitor key economic indicators like inflation, interest rates, and consumer confidence, and adapt your strategies accordingly to successfully weather this period of slower US economic growth.

Featured Posts

-

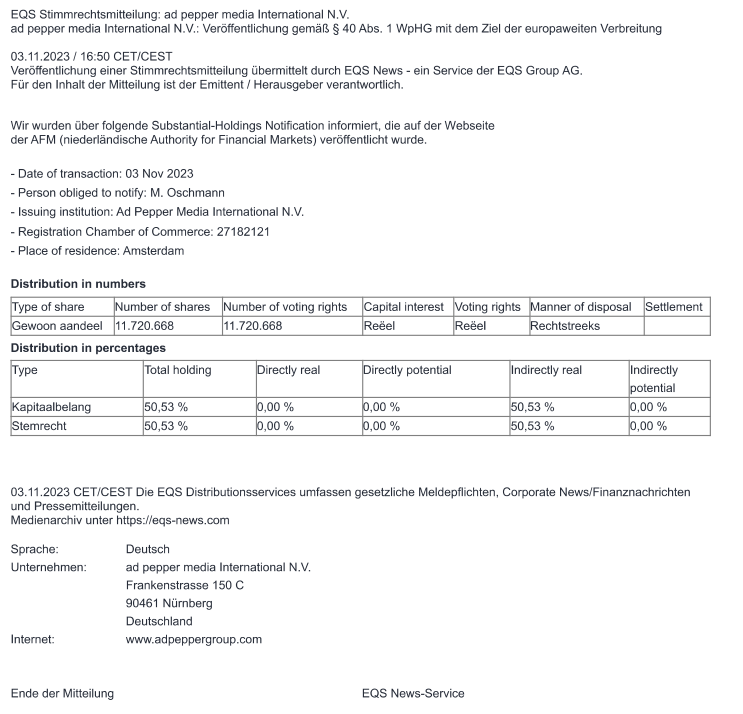

Pne Ag Aktuelle Mitteilung Nach Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025

Pne Ag Aktuelle Mitteilung Nach Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025 -

Investigating The Cdcs Hiring Of A Figure Associated With Misinformation

Apr 27, 2025

Investigating The Cdcs Hiring Of A Figure Associated With Misinformation

Apr 27, 2025 -

Swarovski Campaign Showcases Ariana Grandes Unique Dip Dyed Ponytail

Apr 27, 2025

Swarovski Campaign Showcases Ariana Grandes Unique Dip Dyed Ponytail

Apr 27, 2025 -

Elina Svitolina Dominates Anna Kalinskaya In Us Open First Round

Apr 27, 2025

Elina Svitolina Dominates Anna Kalinskaya In Us Open First Round

Apr 27, 2025 -

Ad Hoc Meldung Pne Ag Und Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025

Ad Hoc Meldung Pne Ag Und Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025

Latest Posts

-

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025 Free

Apr 28, 2025

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025 Free

Apr 28, 2025 -

2000 Yankees Season Remembering The Royals Win

Apr 28, 2025

2000 Yankees Season Remembering The Royals Win

Apr 28, 2025 -

Yankees 2000 A Game Recap Victory Over The Royals

Apr 28, 2025

Yankees 2000 A Game Recap Victory Over The Royals

Apr 28, 2025 -

2000 Yankees Diary Bombers Defeat Royals In Thrilling Victory

Apr 28, 2025

2000 Yankees Diary Bombers Defeat Royals In Thrilling Victory

Apr 28, 2025 -

Retail Sales Slump Will The Bank Of Canada Reverse Course On Interest Rates

Apr 28, 2025

Retail Sales Slump Will The Bank Of Canada Reverse Course On Interest Rates

Apr 28, 2025