Retail Sales Slump: Will The Bank Of Canada Reverse Course On Interest Rates?

Table of Contents

The Severity of the Retail Sales Slump in Canada

The decline in Canadian retail sales is far from negligible. Statistics Canada reported a [insert percentage]% drop in [insert month/quarter] sales, marking the [insert description, e.g., steepest decline in years]. This downturn significantly impacts the overall Canadian economy, affecting everything from employment to GDP growth. Several contributing factors have fueled this economic slowdown:

- High Inflation and Cost of Living: Soaring inflation has eroded consumer purchasing power, leaving less disposable income for discretionary spending. The rising cost of essential goods and services forces consumers to prioritize necessities, leaving little room for non-essential purchases.

- Increased Interest Rates and Mortgage Payments: The Bank of Canada's interest rate hikes have directly increased borrowing costs for consumers. Higher mortgage payments and loan repayments leave less money for spending on goods and services, further contributing to the consumer spending decline.

- Decreased Consumer Confidence: Uncertainty about the future economic outlook has led to a decline in consumer confidence. Consumers are hesitant to make large purchases, opting instead for saving and reducing spending.

The impact varies across sectors. Specific retail areas feeling the pinch include:

- Furniture and Home Furnishings: Higher interest rates make large purchases like furniture less accessible.

- Electronics and Appliances: Consumers are delaying purchases of non-essential electronics.

- Automobiles: Increased borrowing costs and higher vehicle prices have significantly reduced car sales.

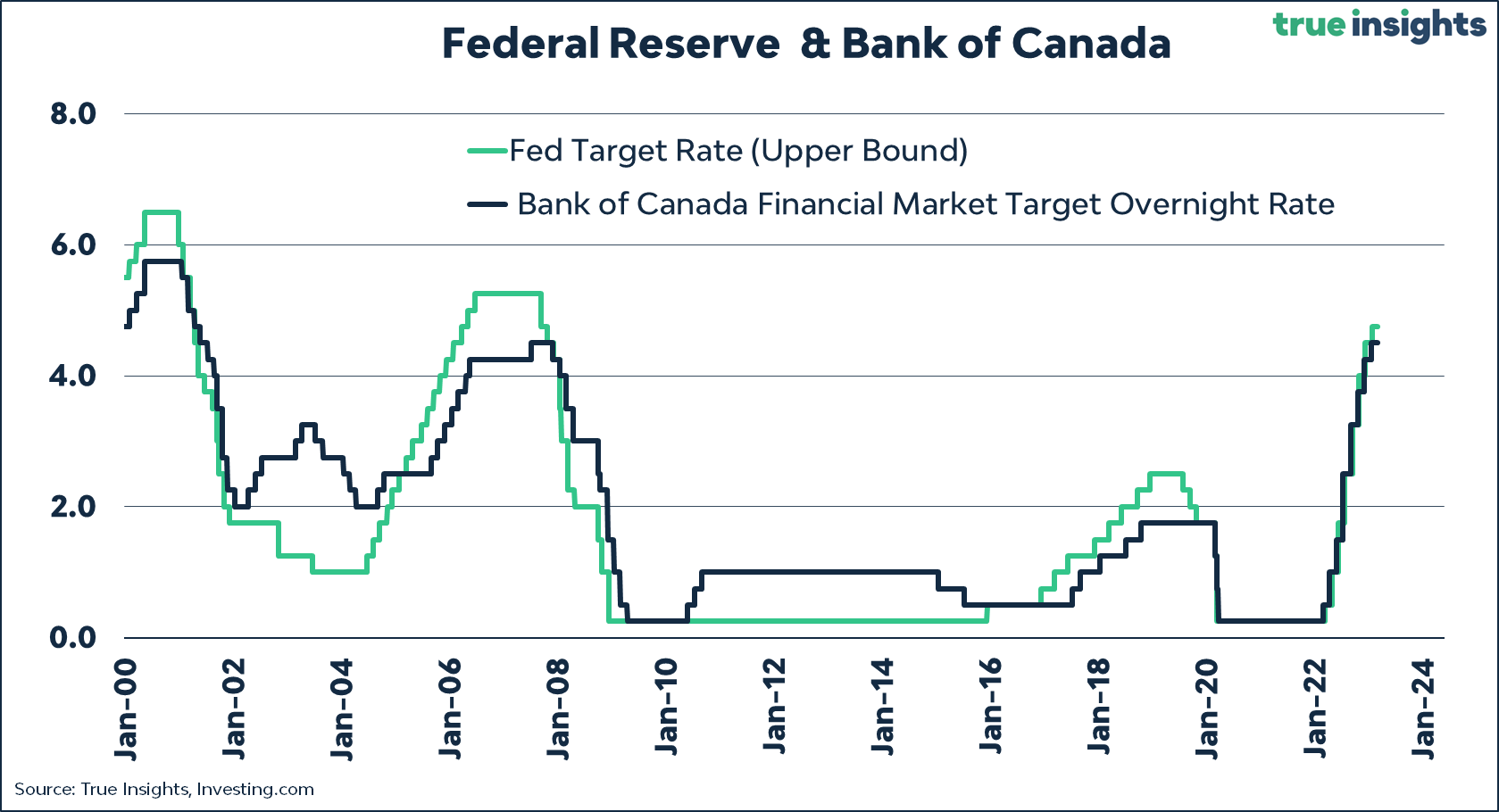

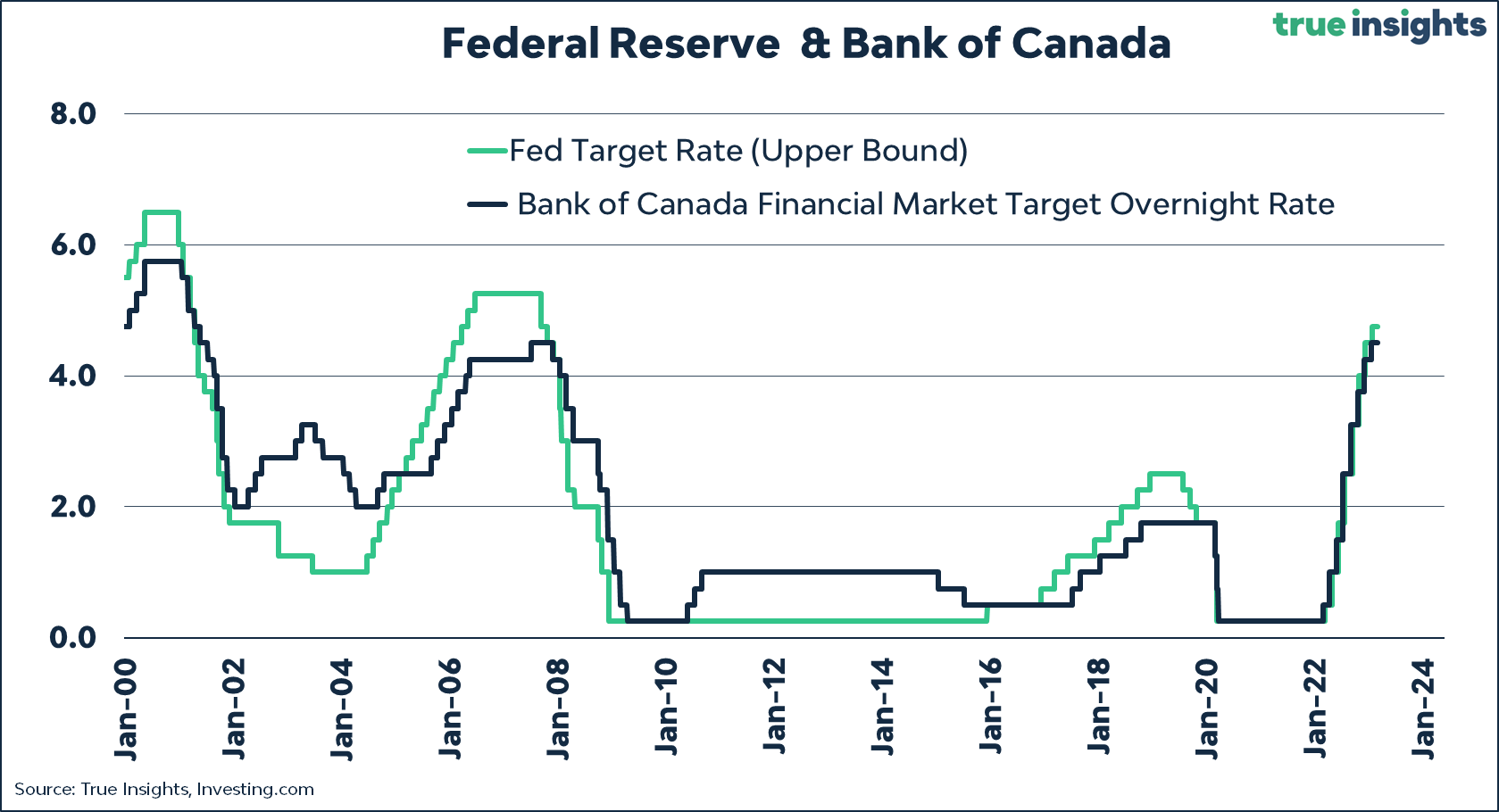

The Bank of Canada's Interest Rate Policy and its Impact

The Bank of Canada has implemented several interest rate hikes in recent months, aiming to curb inflation by cooling down the economy. Their monetary policy focuses on controlling inflation by influencing borrowing costs. The intended consequence is a reduction in inflation; however, unintended consequences include:

- Slower Economic Growth: Higher interest rates inevitably lead to reduced economic activity. Businesses invest less, and consumers spend less, leading to decreased GDP growth.

- Increased Borrowing Costs for Businesses and Consumers: Higher interest rates increase the cost of borrowing for both businesses and consumers, impacting investment and spending decisions.

- Potential for Recession: A prolonged period of decreased economic activity, spurred by high interest rates, could lead to a recession.

The Bank's upcoming rate announcements will be crucial in determining the future direction of the economy. Their current stance suggests [insert current Bank of Canada position, e.g., a cautious approach, a pause in rate hikes].

Economic Indicators Suggesting a Potential Course Correction

Beyond the retail sales slump, other key economic indicators point towards a potential need for a change in the Bank of Canada's approach:

- Employment Rate: [Insert data on employment rate, e.g., a slight increase or decrease in unemployment]. This data indicates [explain the implication of the employment data].

- Housing Market: [Insert data on the housing market, e.g., a slowdown in sales or price decreases]. This signifies [explain the implication for the housing market data].

- GDP Growth: [Insert data on GDP growth, e.g., slower-than-expected growth]. This data suggests [explain the implications of the GDP growth data].

These economic indicators collectively suggest a possible slowdown or even contraction in the economy, strengthening the argument for a potential course correction by the Bank of Canada. Possible scenarios include a pause in rate hikes, or even a rate cut to stimulate the economy.

Expert Opinions and Market Predictions

Economists and financial analysts offer differing opinions on the likelihood of a Bank of Canada rate reversal. Some, like [mention an economist and their viewpoint], believe that the current retail sales slump, coupled with other weak economic indicators, necessitates a change in monetary policy. Others, like [mention another economist and their viewpoint], argue that inflation remains a primary concern and that further rate hikes might still be necessary.

Market predictions vary, with some forecasting a potential rate cut [mention time frame] while others anticipate a pause or continued gradual increases. These differing market analysis perspectives highlight the complexity of the situation and the uncertainty surrounding the future direction of interest rates.

Conclusion: The Future of Retail Sales and Interest Rates in Canada

The retail sales slump in Canada is a serious concern, directly linked to the Bank of Canada's interest rate policy. The severity of the decline, combined with other weak economic indicators, puts pressure on the central bank to reconsider its approach. While controlling inflation remains a priority, the potential for a recession necessitates a careful evaluation of the risks associated with aggressive rate hikes. The likelihood of a course correction remains uncertain, dependent on evolving economic data and the Bank of Canada's assessment of the situation.

To stay informed about the evolving situation regarding the retail sales slump and the Bank of Canada's response, follow reputable economic news sources such as [list relevant sources, e.g., the Globe and Mail, The Financial Post, Statistics Canada] and subscribe to newsletters from leading financial institutions. Understanding Canadian retail sales trends and the impact of interest rates on retail sales is crucial for both businesses and consumers navigating these uncertain economic times.

Featured Posts

-

The Subtle Signs Of A Silent Divorce Recognizing The Warning Signals

Apr 28, 2025

The Subtle Signs Of A Silent Divorce Recognizing The Warning Signals

Apr 28, 2025 -

Are High Stock Market Valuations A Concern Bof As Analysis

Apr 28, 2025

Are High Stock Market Valuations A Concern Bof As Analysis

Apr 28, 2025 -

Hudsons Bay Closing Sales Up To 70 Off At Remaining Stores

Apr 28, 2025

Hudsons Bay Closing Sales Up To 70 Off At Remaining Stores

Apr 28, 2025 -

Navigating The High Cost Of Gpus In 2024

Apr 28, 2025

Navigating The High Cost Of Gpus In 2024

Apr 28, 2025 -

Ryujinx Emulator Project Ends After Reported Nintendo Contact

Apr 28, 2025

Ryujinx Emulator Project Ends After Reported Nintendo Contact

Apr 28, 2025

Latest Posts

-

Boston Red Sox Roster Shuffle Casass Demise And Outfield Change

Apr 28, 2025

Boston Red Sox Roster Shuffle Casass Demise And Outfield Change

Apr 28, 2025 -

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025 -

Is This Red Sox Outfielder The Next Jarren Duran A Breakout Season Prediction

Apr 28, 2025

Is This Red Sox Outfielder The Next Jarren Duran A Breakout Season Prediction

Apr 28, 2025 -

Orioles Announcers Jinx Finally Snapped After 160 Game Streak

Apr 28, 2025

Orioles Announcers Jinx Finally Snapped After 160 Game Streak

Apr 28, 2025 -

Orioles Broadcasters Jinx Broken 160 Game Hit Streak Ends

Apr 28, 2025

Orioles Broadcasters Jinx Broken 160 Game Hit Streak Ends

Apr 28, 2025