Understanding The Thursday Decline In D-Wave Quantum (QBTS) Shares

Table of Contents

Recent weeks have witnessed a recurring pattern: a noticeable dip in the D-Wave Quantum (QBTS) stock price on Thursdays. This consistent decline, amidst the excitement surrounding the burgeoning quantum computing market, demands closer examination. D-Wave Quantum, a leading player in the field of quantum annealing computers, has seen its shares experience this peculiar Thursday volatility. This article aims to analyze the potential reasons behind this recurring Thursday decline in QBTS shares, offering insights into market sentiment, company-specific factors, and technical analysis to help investors better understand and navigate this intriguing market phenomenon. Our analysis incorporates keywords such as D-Wave Quantum, QBTS, stock price, quantum computing, Thursday decline, market volatility, and investment analysis to provide comprehensive coverage.

2. Main Points:

2.1. Market Sentiment and Investor Behavior:

H3: The Psychology of Thursday Trading: The stock market is influenced by various psychological factors, and Thursday often exhibits unique characteristics. Many investors engage in profit-taking or hedging strategies towards the end of the week, potentially leading to increased selling pressure on various stocks, including QBTS. The performance of broader market indices, such as the NASDAQ Composite, also plays a significant role. A negative trend in these broader indices can trigger a sell-off across various sectors, including quantum computing stocks like QBTS.

- Increased risk aversion on Thursdays often leads to investors locking in profits from earlier week gains.

- Algorithmic trading patterns can exacerbate existing downward trends, particularly on days with lower trading volume.

- Institutional selling pressure, perhaps driven by portfolio rebalancing or end-of-quarter adjustments, could contribute to the Thursday decline.

H3: News and Information Flow: The dissemination of news and information significantly impacts stock prices. A lack of substantial positive news releases on Thursdays might contribute to a negative sentiment. Conversely, the delayed reaction to news released earlier in the week could also lead to a price correction on Thursday. Social media sentiment, while often volatile, plays a significant role in shaping market perception and could exert influence on the QBTS stock price.

- A lack of significant news on Thursdays can lead to a period of uncertainty, prompting some investors to sell.

- Positive or negative social media sentiment, amplified by online communities and forums, can influence market sentiment towards QBTS.

- Delayed reaction to news released earlier in the week could lead to sell-offs on Thursday as investors assess the full implications.

2.2. Specific Factors Affecting D-Wave Quantum (QBTS):

H3: Company-Specific News and Developments: Internal developments within D-Wave Quantum directly affect its stock price. Announcements regarding partnerships, product launches, financial reports, or changes in management all impact investor confidence. Technological breakthroughs, conversely, can boost the stock price while setbacks can cause declines.

- Upcoming product launches or delays can generate considerable excitement or disappointment, respectively, influencing the QBTS share price.

- Changes in management or leadership can impact investor sentiment, depending on the perception of the new leadership team.

- Financial performance updates, especially those revealing missed earnings expectations or disappointing revenue figures, will likely negatively impact QBTS shares.

H3: Competition and Industry Trends: The quantum computing industry is highly competitive. Announcements from rival companies, technological advancements in competing technologies, and the overall market capitalization of the sector greatly impact investor sentiment towards D-Wave Quantum. Negative news regarding competitors, for example, could indirectly benefit QBTS, however, significant advancements in a rival's technology may put downward pressure on QBTS's price.

- Competitor announcements of groundbreaking technological achievements can shift investor focus away from D-Wave Quantum, leading to a decline in QBTS stock.

- Technological advancements in competing technologies, such as superconducting or trapped-ion quantum computers, could negatively affect the perception of D-Wave's quantum annealing approach.

- Overall market capitalization changes in the quantum computing sector—a general downturn, for example—could drag QBTS down with the rest of the industry.

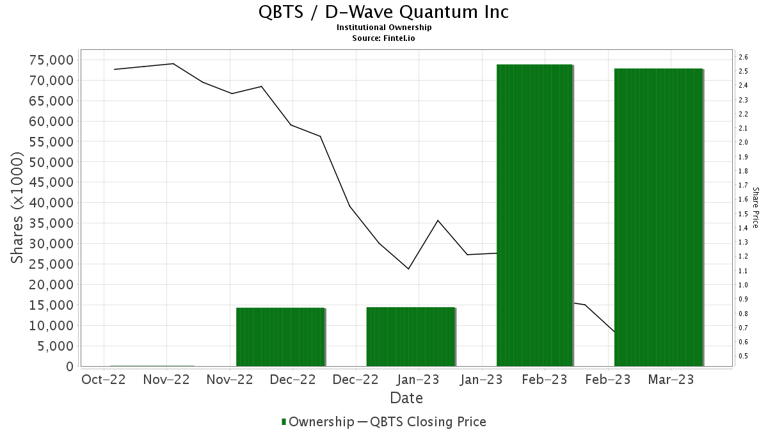

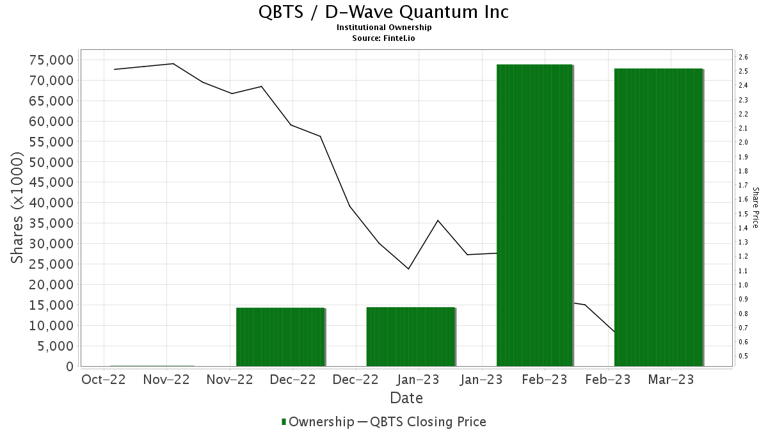

2.3. Technical Analysis of QBTS Stock Price:

H3: Chart Patterns and Support/Resistance Levels: Examining historical QBTS price data reveals potential patterns and significant support and resistance levels. These levels often indicate price boundaries where buying or selling pressure is strongest. Technical indicators, like moving averages and the Relative Strength Index (RSI), can provide additional insights into price trends and potential reversals.

- Moving averages (e.g., 50-day, 200-day) can signal potential trend changes.

- The Relative Strength Index (RSI) can identify overbought or oversold conditions, which might suggest a reversal.

- Volume analysis can reveal whether price movements are driven by strong conviction or weak trading.

H3: Trading Volume on Thursdays: Analyzing trading volume on Thursdays compared to other days reveals potential anomalies. Lower trading volume on Thursdays might indicate reduced investor activity, which often correlates with greater price fluctuations due to the reduced liquidity. High volume on Thursdays, however, could indicate a significant amount of buying or selling pressure.

- Comparison of Thursday volume to other weekdays provides a crucial context to understand the drivers behind price movements.

- Correlation between volume and price changes indicates the strength of the buying or selling pressure.

- Unusually high or low volume on Thursdays might indicate market manipulation or other abnormal trading activity.

3. Conclusion: Understanding and Navigating the QBTS Thursday Dip

The recurring Thursday decline in D-Wave Quantum (QBTS) shares appears to be a complex phenomenon influenced by a combination of market sentiment, company-specific news, and technical factors. Understanding the psychology of Thursday trading, the impact of news flow, and the competitive landscape of the quantum computing industry are all crucial. Closely monitoring support and resistance levels, and paying attention to technical indicators and trading volume, can help investors make more informed decisions. By thoroughly understanding these aspects, investors can better navigate the QBTS stock price fluctuations, especially on Thursdays. Conduct thorough research, monitor the D-Wave Quantum (QBTS) stock price closely—paying particular attention to Thursday’s performance—and stay informed about market trends and company developments to make informed investment decisions regarding QBTS and understand the nuances of this recurring pattern.

Featured Posts

-

Vodacom Vod Better Than Projected Earnings Result In Increased Payout

May 20, 2025

Vodacom Vod Better Than Projected Earnings Result In Increased Payout

May 20, 2025 -

Understanding Suki Waterhouses Viral Twinks Tik Tok Video

May 20, 2025

Understanding Suki Waterhouses Viral Twinks Tik Tok Video

May 20, 2025 -

Mild Temperatures Little Rain A Detailed Weather Outlook

May 20, 2025

Mild Temperatures Little Rain A Detailed Weather Outlook

May 20, 2025 -

Highfield Rugby Appoints James Cronin As Head Coach

May 20, 2025

Highfield Rugby Appoints James Cronin As Head Coach

May 20, 2025 -

Kaellman Ja Hoskonen Loppu Puolan Seuralegendaan

May 20, 2025

Kaellman Ja Hoskonen Loppu Puolan Seuralegendaan

May 20, 2025

Latest Posts

-

Tory Councillors Spouse Imprisoned After Hotel Fire Tweet Appeal Process Begins

May 21, 2025

Tory Councillors Spouse Imprisoned After Hotel Fire Tweet Appeal Process Begins

May 21, 2025 -

Reddit Post To Become Feature Film Sydney Sweeney Lands Lead Role Warner Bros

May 21, 2025

Reddit Post To Become Feature Film Sydney Sweeney Lands Lead Role Warner Bros

May 21, 2025 -

Warner Bros Developing Film Based On Popular Reddit Post Starring Sydney Sweeney

May 21, 2025

Warner Bros Developing Film Based On Popular Reddit Post Starring Sydney Sweeney

May 21, 2025 -

Sydney Sweeney To Star In Warner Bros Movie Based On Viral Reddit Thread

May 21, 2025

Sydney Sweeney To Star In Warner Bros Movie Based On Viral Reddit Thread

May 21, 2025 -

Javier Baez Un Regreso A La Productividad

May 21, 2025

Javier Baez Un Regreso A La Productividad

May 21, 2025