Understanding The Surge In The Venture Capital Secondary Market

Table of Contents

Key Drivers of the Venture Capital Secondary Market Surge

The dramatic increase in venture capital secondary market transactions is fueled by several interconnected factors. Understanding these drivers is crucial for anyone navigating this increasingly complex landscape.

Increased Investor Demand for Liquidity

Limited Partners (LPs), such as pension funds, endowments, and insurance companies, often face pressure to rebalance their portfolios and access capital. This is especially true given the increasing trend towards shorter fund lifecycles and the heightened expectations of investors demanding quicker returns. Market volatility and economic uncertainty further exacerbate this need for liquidity, prompting LPs to seek secondary market transactions as a means to meet their obligations and maintain strategic flexibility.

- Pension funds: Require regular payouts to retirees, necessitating portfolio adjustments.

- Endowments: Need to maintain a consistent stream of funding for their institutions.

- Family offices: May need to liquidate assets for estate planning or other personal reasons.

Strategic Portfolio Adjustments by LPs

Secondary market transactions also allow LPs to strategically adjust their portfolio composition. This involves actions such as diversifying across sectors, geographies, or investment stages. By selling certain stakes, LPs can reduce overexposure to specific sectors or regions, mitigating concentration risk and improving the overall balance of their portfolio.

- Reducing overexposure: Selling down positions in overperforming sectors to re-allocate capital elsewhere.

- Geographic diversification: Selling stakes in companies concentrated in one region to broaden geographical spread.

- Improving portfolio balance: Selling less desirable assets to reinvest in higher-growth opportunities.

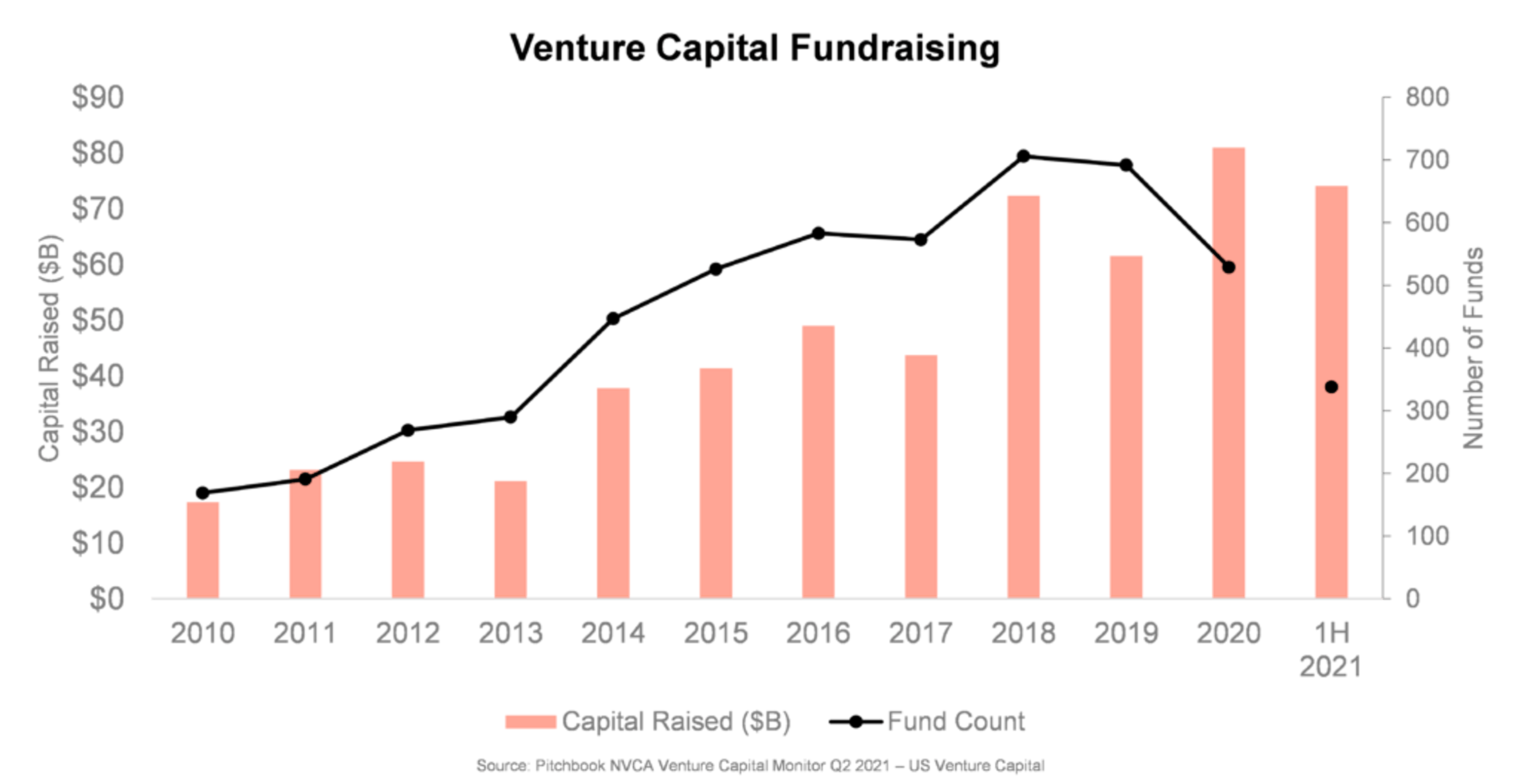

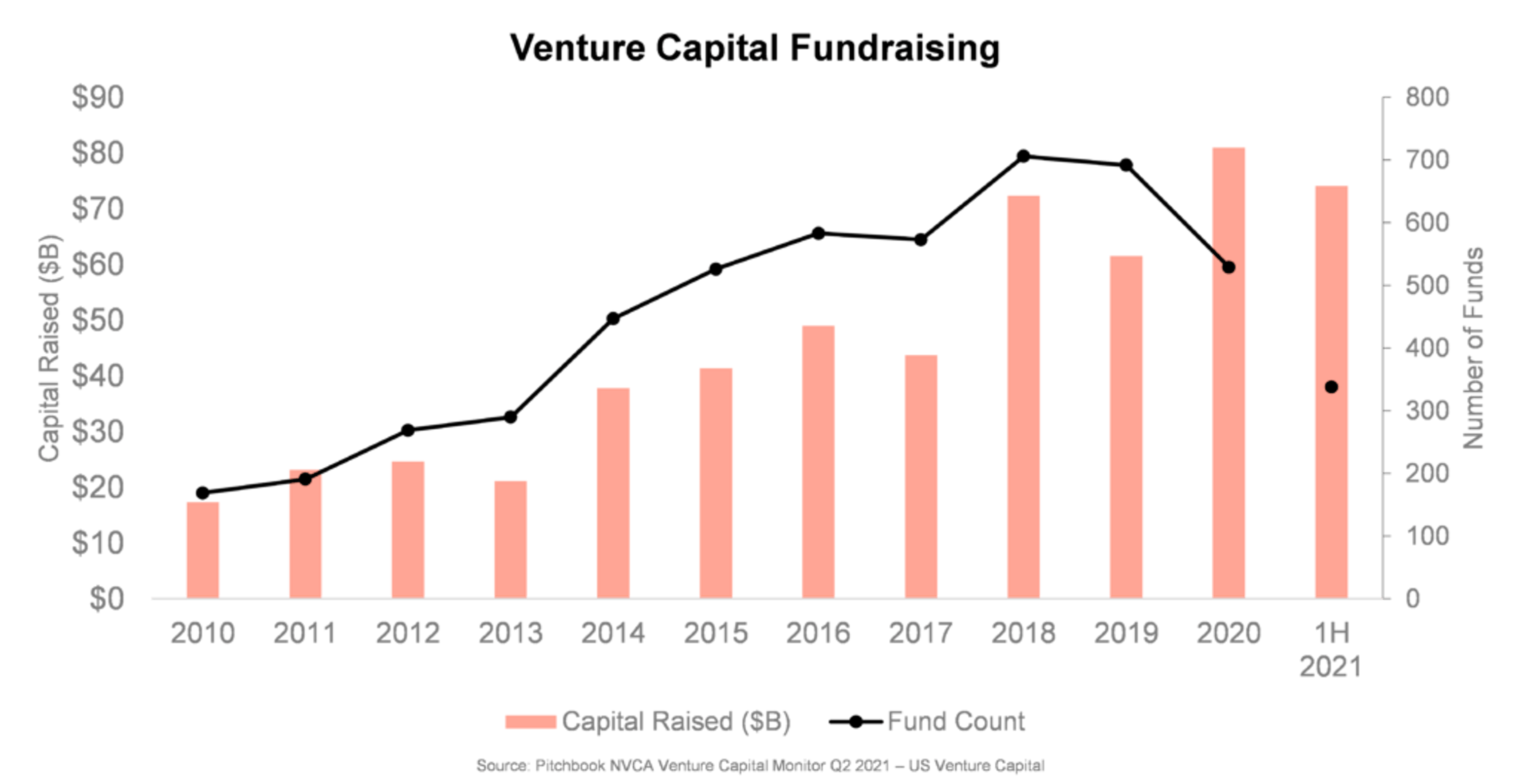

Growing Number of Buyers in the Secondary Market

The expansion of the venture capital secondary market is also driven by the influx of new buyers. Specialized secondary funds have emerged, focusing solely on these types of transactions. Furthermore, corporate acquirers are increasingly participating, looking to acquire promising startups strategically. Sovereign wealth funds and family offices are also showing heightened interest, seeking diversification and exposure to high-growth potential.

- Specialized secondary funds: Dedicated investment vehicles focusing exclusively on secondary transactions.

- Corporate acquirers: Companies seeking to expand their product lines or gain access to new technologies.

- Sovereign wealth funds: Government-owned investment funds seeking diversification and long-term returns.

Types of Transactions in the Venture Capital Secondary Market

Several types of transactions characterize the venture capital secondary market, each with its own set of complexities and implications.

Direct Sales

In a direct sale, an LP directly sells its stake in a private company to a buyer. This is often a simpler transaction compared to other methods, though it can still involve significant negotiation and due diligence.

Stapled Secondary Transactions

A stapled secondary transaction combines a secondary sale with a new funding round. This allows the selling LP to realize liquidity while simultaneously providing the portfolio company with fresh capital for growth.

Structured Transactions

More complex transactions, such as tender offers and auctions, are employed for larger portfolios or when multiple LPs wish to sell their stakes simultaneously. These often involve specialized advisors and legal counsel.

- Direct Sales: Simple, efficient, but finding the right buyer can take time.

- Stapled Secondary Transactions: Attractive for both LPs seeking liquidity and companies needing funding.

- Structured Transactions: Suitable for larger portfolios, but more complex to execute.

Challenges and Considerations in the Venture Capital Secondary Market

While the venture capital secondary market offers significant opportunities, it also presents certain challenges.

Valuation Challenges

Accurately valuing private company stakes can be difficult due to the lack of publicly available market data. This requires sophisticated valuation methodologies and expert judgment.

Due Diligence and Transparency

Thorough due diligence is essential to identify potential risks and ensure the accuracy of the information provided. Transparency and open communication are key to successful transactions.

Regulatory and Legal Considerations

Navigating the legal and regulatory landscape associated with secondary market transactions requires careful attention. Compliance with relevant regulations is paramount.

- Valuation Risk: The need for robust valuation methodologies to avoid overpaying or underselling.

- Information Asymmetry: The risk of incomplete or inaccurate information regarding the portfolio company.

- Legal and Regulatory Compliance: Adhering to all relevant securities laws and regulations.

The Future of the Venture Capital Secondary Market

The venture capital secondary market is poised for continued growth, driven by technological advancements, such as improved data analytics for better valuation and due diligence. Potential regulatory changes could also shape the future of this market. The increasing adoption of blockchain technology may also increase transparency and efficiency in transactions.

- Increased Market Depth: A wider range of buyers and sellers will lead to a more liquid market.

- Technological Advancements: Improved data analytics and AI will streamline valuation and due diligence processes.

- Regulatory Evolution: Changes in regulations will likely influence transaction structures and processes.

Conclusion: Understanding the Continued Surge in the Venture Capital Secondary Market

The surge in the venture capital secondary market is driven by a combination of factors including increased demand for liquidity among LPs, strategic portfolio adjustments, and the emergence of new buyers. Transactions range from simple direct sales to more complex structured deals, each presenting unique challenges and considerations, particularly regarding valuation, due diligence, and regulatory compliance. However, despite these challenges, the future of the venture capital secondary market remains bright, promising continued growth and evolution. To effectively navigate this dynamic market and capitalize on its opportunities, understanding the intricacies of venture capital secondary market investments is paramount. Consider seeking expert guidance from specialists in venture capital secondary market transactions to ensure success in this rapidly evolving space.

Featured Posts

-

Cardinal Claims New Evidence Exposes Prosecutorial Misconduct In Trial Of The Century

Apr 29, 2025

Cardinal Claims New Evidence Exposes Prosecutorial Misconduct In Trial Of The Century

Apr 29, 2025 -

Trump Supporter Ray Epps Defamation Suit Against Fox News Jan 6 Falsehoods

Apr 29, 2025

Trump Supporter Ray Epps Defamation Suit Against Fox News Jan 6 Falsehoods

Apr 29, 2025 -

Trumps Tax Bill Republican Opposition And Potential Roadblocks

Apr 29, 2025

Trumps Tax Bill Republican Opposition And Potential Roadblocks

Apr 29, 2025 -

Trump Faces Gop Headwinds On Tax Legislation

Apr 29, 2025

Trump Faces Gop Headwinds On Tax Legislation

Apr 29, 2025 -

Zuckerberg And Trump A New Era Begins For Meta

Apr 29, 2025

Zuckerberg And Trump A New Era Begins For Meta

Apr 29, 2025