Trump's Tax Bill: Republican Opposition And Potential Roadblocks

Table of Contents

Conservative Concerns: Fiscal Responsibility and the National Debt

Many fiscal conservatives within the Republican party harbor deep concerns about the long-term fiscal implications of the proposed tax cuts. The core of their apprehension centers on the potential for a dramatically increased national debt and its consequences.

Concerns about increased national debt:

The projected increase in the national deficit is a major sticking point for these Republicans. They argue that:

- Projected increases in the deficit could lead to future spending cuts in essential programs. This fear of cuts to vital social services and infrastructure projects is a powerful motivator for opposition. The potential for reduced funding for Medicare, Medicaid, and education is a significant concern.

- Concerns about the sustainability of the tax cuts over the long term. Many conservatives question whether the economic growth promised by the bill will be sufficient to offset the cost of the tax cuts in the long run. They advocate for a more fiscally responsible approach.

- Calls for alternative approaches to fiscal policy that don't exacerbate the debt. These Republicans are pushing for alternative solutions, such as targeted tax cuts or spending reforms, that would be less detrimental to the national debt. They are advocating for a more responsible approach to tax reform.

Tax cuts favoring the wealthy:

Another source of Republican resistance stems from concerns that the tax cuts disproportionately benefit the wealthy, undermining the party's professed commitment to economic fairness. Critics point to:

- Analysis of the tax bill's impact on different income brackets. Detailed analyses showing a larger percentage benefit for high-income earners fuel the argument that the bill is not equitable.

- Comparison to alternative proposals that offer more equitable tax relief. Opponents highlight alternative tax reform plans that focus on providing relief to the middle class and lower-income families. These alternatives are often seen as more fair and less likely to exacerbate income inequality.

- Arguments for focusing on middle-class tax relief instead of broad-based cuts. The focus on broad-based tax cuts is criticized for being inefficient and potentially harmful to long-term economic stability.

Moderate Republican Opposition: Healthcare and Social Programs

Moderate Republicans represent another significant source of opposition to the Trump tax bill. Their concerns are primarily focused on the potential impact on healthcare and other essential social programs.

Concerns about cuts to healthcare and social programs:

The fear that cuts to crucial social programs will be necessary to offset the cost of the tax cuts is a major driver of moderate Republican opposition. This includes concerns about:

- Analysis of the potential impact on Medicare, Medicaid, and other social safety nets. Studies analyzing the potential impact of the tax bill on these programs are used to highlight the potential negative consequences for vulnerable populations.

- Arguments for protecting these programs and finding alternative ways to fund the tax cuts. Moderates are pushing for solutions that protect these vital programs while still achieving some level of tax reform.

- Calls for bipartisan solutions to address the budgetary challenges. They advocate for bipartisan cooperation to find fiscally responsible solutions that minimize the impact on social programs.

Lack of bipartisan support:

The lack of bipartisan support for the Trump tax bill poses a significant obstacle to its passage. The close partisan divide in Congress means that:

- The importance of garnering Democratic support to ensure the bill's success. Securing even a small number of Democratic votes could be crucial to overcoming procedural hurdles.

- Strategies for achieving bipartisan compromise on key aspects of the bill. Finding common ground on crucial aspects of the bill is vital for its passage, and this requires compromise and negotiation.

- The potential consequences of failure to achieve bipartisan consensus. Without bipartisan support, the bill faces a much higher risk of failure.

Procedural Hurdles and Legislative Challenges

Beyond the ideological opposition, the Trump tax bill faces a series of procedural hurdles and legislative challenges that could significantly impede its progress.

Senate filibuster and procedural rules:

The Senate's filibuster rule presents a major challenge, potentially requiring 60 votes for passage rather than a simple majority. This means:

- Explanation of the Senate's filibuster rules and their potential impact on the bill's fate. Understanding the filibuster's mechanics is crucial to understanding the bill's uncertain future.

- Strategies for overcoming the filibuster and ensuring the bill's passage. The strategies employed to overcome the filibuster will be key to the bill's success or failure.

- The role of Senate leadership in navigating the procedural challenges. The Senate leadership's ability to manage the process will be a critical factor.

Internal disagreements within the Republican party:

Disagreements within the Republican party itself further complicate the legislative process. These internal divisions include:

- Examples of internal disagreements within the Republican party regarding the bill's provisions. Specific points of contention within the party illustrate the challenges faced by leadership.

- The role of party leadership in resolving these disagreements and forging a unified approach. The effectiveness of the party leadership in resolving internal conflicts is a crucial factor.

- The potential consequences of internal divisions on the bill's success. These internal divisions significantly increase the likelihood of the bill failing to pass.

Conclusion

The Trump tax bill faces a complex and potentially insurmountable set of challenges. Internal Republican opposition, based on concerns about fiscal responsibility, equitable tax relief, and the impact on social programs, presents significant hurdles. These are further compounded by procedural difficulties and the lack of bipartisan support. Understanding these obstacles—the Republican opposition to Trump's Tax Bill and its potential consequences—is critical for anyone seeking to grasp the current political landscape. Staying informed about the ongoing debate surrounding the Trump's Tax Bill is vital to understanding its potential impact. Continue to follow the news and engage in informed discussions to fully comprehend this pivotal legislation.

Featured Posts

-

Debate Surrounding Convicted Cardinals Conclave Voting Rights

Apr 29, 2025

Debate Surrounding Convicted Cardinals Conclave Voting Rights

Apr 29, 2025 -

Misstoene Beim Lask Und Klagenfurt Analyse Der Bundesliga Situation

Apr 29, 2025

Misstoene Beim Lask Und Klagenfurt Analyse Der Bundesliga Situation

Apr 29, 2025 -

Hungary Defies Us Pressure Maintains Strong China Ties

Apr 29, 2025

Hungary Defies Us Pressure Maintains Strong China Ties

Apr 29, 2025 -

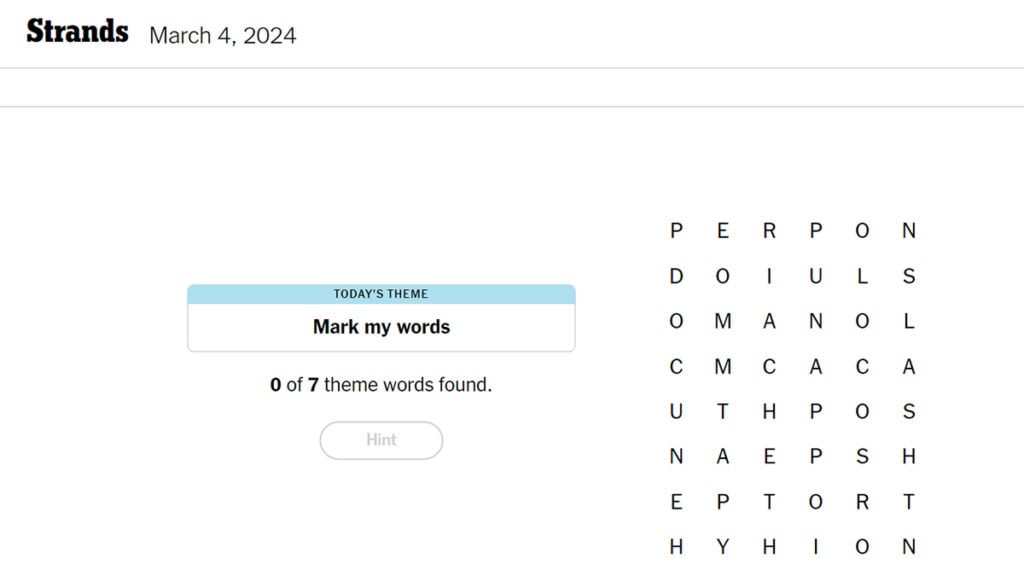

Nyt Strands Puzzle 393 March 31 Complete Solution Guide

Apr 29, 2025

Nyt Strands Puzzle 393 March 31 Complete Solution Guide

Apr 29, 2025 -

The Tik Tok Effect How Social Media Shapes Adhd Understanding

Apr 29, 2025

The Tik Tok Effect How Social Media Shapes Adhd Understanding

Apr 29, 2025