Understanding The Stealthy Wealthy: Their Approach To Sustainable Wealth

Table of Contents

The Mindset of the Stealthy Wealthy

The foundation of Stealthy Wealth lies in a specific mindset, characterized by patience, discipline, and a long-term perspective. This contrasts sharply with get-rich-quick schemes often touted in popular media.

Long-Term Vision

The Stealthy Wealthy prioritize long-term financial security over short-term gains. They are patient investors with a clear understanding of their financial goals, focusing on the power of compounding.

- Focus on compounding returns: They understand that small, consistent returns, compounded over time, can yield substantial wealth. This requires patience and discipline, resisting the temptation to chase immediate, potentially risky profits.

- Resist the urge for quick riches and speculative investments: They avoid high-risk, high-reward ventures that promise quick returns but often result in significant losses. Instead, they favor investments with proven track records and sustainable growth potential.

- Develop a comprehensive financial plan: This involves setting clear financial goals (retirement, education, etc.), budgeting effectively, and regularly reviewing their progress. A well-defined plan provides a roadmap for achieving their long-term financial aspirations.

Frugal Living and Conscious Spending

Stealthy Wealth isn't solely about earning; it's equally about spending wisely. They understand the power of saving and investing, avoiding unnecessary expenses to maximize their wealth-building potential.

- Prioritize needs over wants: They differentiate between essential expenses and discretionary spending, focusing on needs and making conscious choices about wants. This mindful approach allows for greater savings and investment opportunities.

- Track expenses meticulously: They carefully monitor their spending habits to identify areas where they can cut back and redirect funds towards investments. Budgeting apps and spreadsheets are valuable tools in this process.

- Invest surplus funds strategically: Any money saved is actively channeled into investments aligned with their long-term financial plan. This consistent investment strategy is crucial for building lasting wealth.

Diversification and Risk Management

The Stealthy Wealthy understand that diversification is key to mitigating risk. They don't put all their eggs in one basket.

- Utilize a diversified portfolio (stocks, bonds, real estate, etc.): They spread their investments across different asset classes to reduce the impact of potential losses in any single area. This strategy aims to balance risk and reward effectively.

- Regularly rebalance their portfolio: They periodically adjust their investment mix to maintain their desired asset allocation, ensuring their portfolio remains aligned with their risk tolerance and financial goals.

- Understand and manage their risk tolerance: They have a clear understanding of their risk profile and make investment decisions accordingly. They avoid investments that exceed their comfort level.

Key Investment Strategies of the Stealthy Wealthy

The Stealthy Wealthy employ a range of investment strategies, all geared towards long-term growth and preservation of capital.

Value Investing

Value investing is a cornerstone of the Stealthy Wealthy's approach. They focus on identifying undervalued assets with significant long-term potential.

- Thorough due diligence before investing: They conduct extensive research and analysis before making any investment decision, ensuring they fully understand the risks and potential rewards.

- Focus on intrinsic value over market hype: They are less swayed by short-term market fluctuations and focus on the underlying value of an asset. This long-term perspective helps them weather market volatility.

- Patience in waiting for returns: They are not looking for quick profits. They are willing to hold onto investments for extended periods, allowing their value to appreciate over time.

Index Fund Investing

Many Stealthy Wealthy individuals utilize low-cost index funds for long-term growth and diversification.

- Low expense ratios translate to higher returns: These funds typically have low fees, maximizing returns compared to actively managed funds.

- Simplicity and ease of management: Index funds require minimal management, freeing up time and resources.

- Market-based diversification: Index funds provide instant diversification across a broad range of companies or asset classes.

Real Estate Investing

Real estate often forms a core component of their portfolio, offering both income generation and capital appreciation.

- Long-term rental properties: They may acquire rental properties to generate passive income and build equity over time.

- Strategic property flips (with caution): Some engage in property flipping, but only after meticulous research and risk assessment.

- Understanding of local market dynamics: They carefully analyze local market trends and conditions before investing in real estate.

Protecting and Growing Stealth Wealth

Preserving and growing wealth requires a proactive approach to tax optimization and estate planning.

Tax Optimization Strategies

The Stealthy Wealthy actively seek legal and ethical means to minimize their tax burden.

- Consult with a qualified financial advisor: They seek professional advice to optimize their tax strategies within legal frameworks.

- Utilize tax-advantaged accounts (401k, IRA, etc.): They maximize contributions to tax-advantaged retirement accounts to reduce their taxable income.

- Understand tax implications of investments: They carefully consider the tax implications of their investment choices to minimize their overall tax liability.

Estate Planning

Protecting their legacy is a priority for the Stealthy Wealthy. They ensure their wealth is passed on efficiently and effectively.

- Create a will and trust: They establish legal documents outlining their wishes for the distribution of their assets after their death.

- Establish clear inheritance plans: They develop a clear plan for the transfer of wealth to heirs, minimizing potential disputes and ensuring a smooth transition.

- Minimize estate taxes: They take steps to minimize estate taxes through strategic planning and legal structures.

Continuous Learning and Adaptation

The Stealthy Wealthy recognize that the financial landscape is constantly evolving. They remain informed and adaptable.

- Regularly review financial plans: They regularly reassess their financial plans and adjust their strategies as needed to align with changing circumstances.

- Stay informed about market trends: They stay abreast of economic and market trends to make informed investment decisions.

- Seek advice from financial professionals: They consult with financial advisors and other professionals for guidance and support.

Conclusion

The principles of the Stealthy Wealthy—long-term vision, frugal living, diversification, and strategic investing—provide a roadmap for building sustainable wealth. By understanding their mindset and adopting their key strategies, you can embark on your own journey toward lasting financial security. Don't chase fleeting trends; instead, embrace the principles of the Stealthy Wealthy and build your own path towards a secure financial future. Start building your sustainable wealth today and learn more about the secrets of the Stealthy Wealthy!

Featured Posts

-

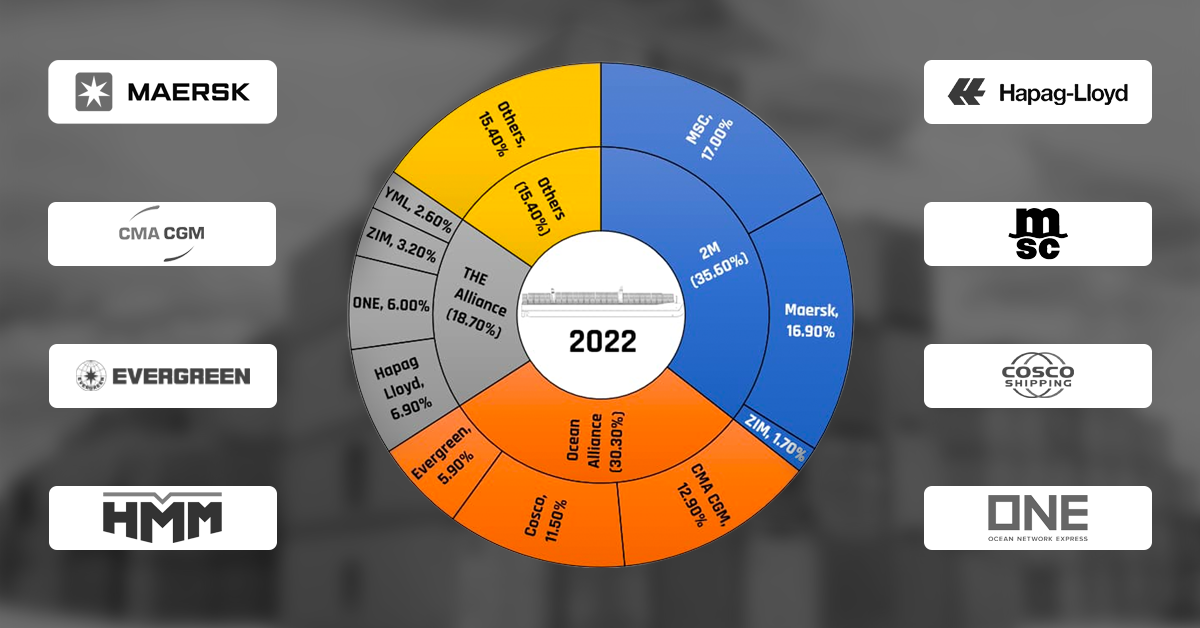

Payden And Rygel China Us Container Shipping A Comprehensive Market Overview

May 19, 2025

Payden And Rygel China Us Container Shipping A Comprehensive Market Overview

May 19, 2025 -

Uk Festival Under Fire Environmentalists Raise 31 000 In Protest

May 19, 2025

Uk Festival Under Fire Environmentalists Raise 31 000 In Protest

May 19, 2025 -

Ufc 313 Livestream Watch Pereira Vs Ankalaev Fight Online

May 19, 2025

Ufc 313 Livestream Watch Pereira Vs Ankalaev Fight Online

May 19, 2025 -

Luca Haenni And Eurovision 2025 A Swiss Connection

May 19, 2025

Luca Haenni And Eurovision 2025 A Swiss Connection

May 19, 2025 -

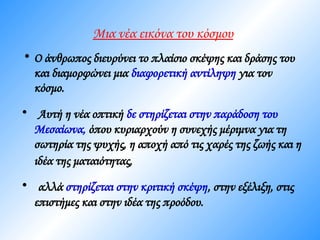

Ierosolyma Antioxeia Synergasia Kai Nea Optiki Stis Sxeseis

May 19, 2025

Ierosolyma Antioxeia Synergasia Kai Nea Optiki Stis Sxeseis

May 19, 2025