Payden & Rygel: China-US Container Shipping: A Comprehensive Market Overview

Table of Contents

Current Market Dynamics: Growth, Challenges, and Trends

The China-US container shipping market is a massive and ever-evolving landscape. While precise market size fluctuates based on various factors, it represents a significant portion of global container volume. Recent years have witnessed periods of robust growth, followed by significant contractions due to external pressures. Growth projections vary depending on global economic conditions and geopolitical stability, but the market remains substantial and key to global trade.

-

Market Size and Growth Projections: While precise figures vary depending on the source and year, estimates for the China-US container shipping market are in the hundreds of billions of dollars annually. Growth rates have been volatile, impacted by global events. Tracking container volume is a key indicator of market health.

-

Major Challenges: The industry faces numerous hurdles. Port congestion, particularly in major US ports like Los Angeles and Long Beach, consistently causes delays and increased costs. Supply chain bottlenecks, often stemming from unforeseen events like the pandemic, exacerbate these issues. Geopolitical factors and trade disputes between the US and China directly influence shipping volumes and routes.

-

Emerging Trends: The industry is undergoing a transformation driven by technology and sustainability concerns. Digitalization of logistics, including the use of blockchain for increased transparency and efficiency, is gaining traction. Port automation is improving speed and reducing congestion. Finally, increasing pressure for sustainable shipping and green shipping practices is leading to investments in alternative fuels and eco-friendly technologies.

- Specific Data Points: In [Year], container volume between China and the US experienced a [percentage]% [increase/decrease]. The [Specific Event] in [Year] led to a [Number] day backlog at the Port of [Port Name].

- Examples of Digitalization: Companies like [Company Name] are using AI-powered route optimization software. [Another Company] is implementing blockchain technology to track cargo.

- Examples of Sustainable Shipping Initiatives: Several shipping lines are investing in LNG-powered vessels and exploring alternative fuels.

Key Players and Competitive Landscape: A Deep Dive

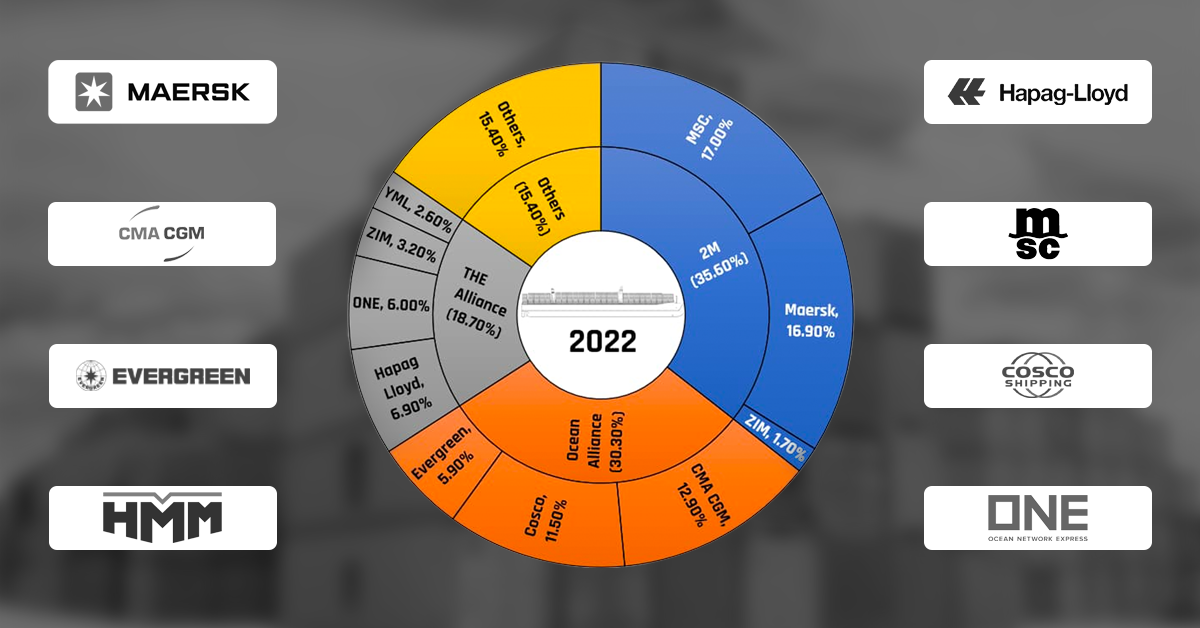

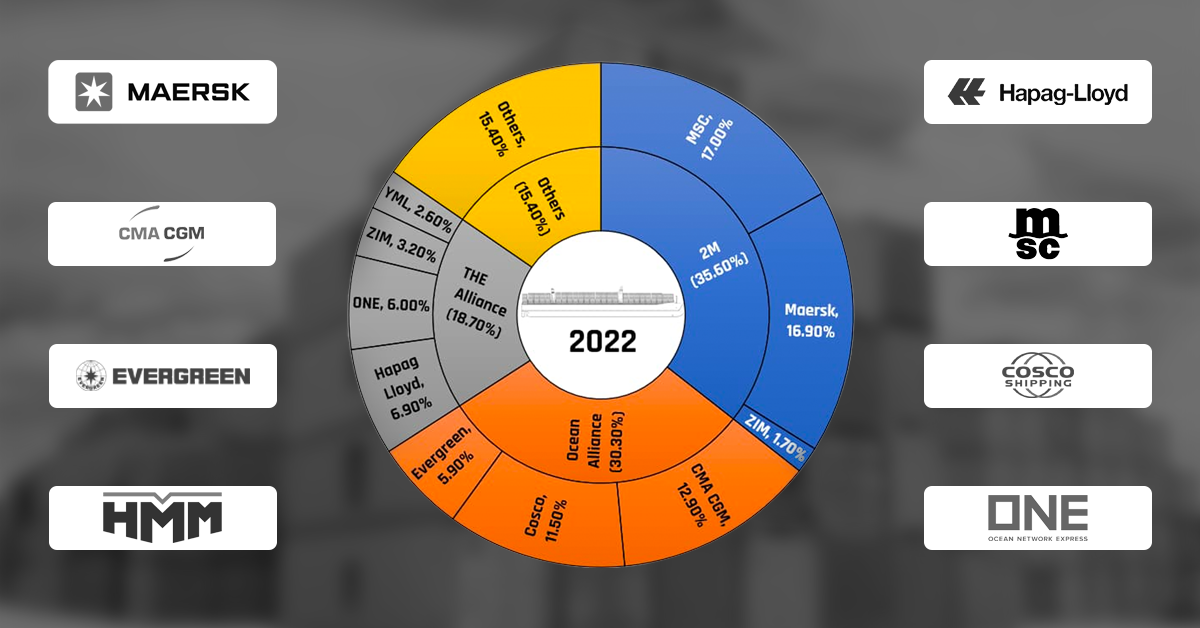

The China-US container shipping market is dominated by a few major players, but a complex web of relationships exists.

-

Major Players: Leading shipping lines such as Maersk, COSCO, CMA CGM, ONE, and Evergreen control a significant market share, often through strategic alliances and vessel-sharing agreements. Large port operators in both countries also exert considerable influence. Freight forwarders play a critical role in facilitating the movement of goods.

-

Market Share and Strategies: The competitive landscape is dynamic, with each player employing various strategies to maintain or increase market share. These include expanding port capacity, investing in new technologies, and forming strategic alliances.

-

Mergers and Acquisitions: Industry consolidation through mergers and acquisitions is a recurring theme, aiming to achieve economies of scale and enhance operational efficiency.

- List of Top Shipping Lines: (Include a list of the top 5-10 shipping lines operating on the China-US route, linking to their websites where possible).

- Examples of Strategies: [Shipping Line A] focuses on [Strategy], while [Shipping Line B] emphasizes [Strategy].

- Examples of Mergers & Acquisitions: [Example 1] and [Example 2] demonstrate the ongoing consolidation within the industry.

Freight Rates and Pricing Analysis: Understanding the Volatility

Freight rates in the China-US container shipping market are notoriously volatile.

-

Historical and Current Freight Rates: Freight rates have experienced dramatic swings in recent years, influenced by supply and demand imbalances. Graphs illustrating historical fluctuations would provide valuable context. Spot rates, which reflect the current market price, can differ significantly from contract rates, which are negotiated in advance.

-

Factors Influencing Rate Volatility: Several factors contribute to this volatility. Supply and demand imbalances are perhaps the most significant, but fuel costs (oil prices) and unforeseen global events (e.g., pandemics, geopolitical tensions) all play a crucial role.

-

Strategies for Managing Freight Costs: Businesses need effective strategies to mitigate the impact of volatile freight rates. Negotiating long-term contracts, diversifying shipping routes, and optimizing cargo consolidation are some key approaches.

- Graphs Showing Freight Rate Fluctuations: (Include relevant graphs illustrating historical freight rate volatility. Data source should be cited).

- Explanation of Pricing Models: Spot rates offer flexibility but come with higher risk, while contract rates provide predictability but might be less competitive in periods of low demand.

- Tips for Negotiating Favorable Rates: (Provide practical advice on negotiating favorable freight rates, including leveraging volume discounts and exploring alternative shipping options).

Future Outlook and Predictions for China-US Container Shipping

Predicting the future of China-US container shipping requires considering several factors.

-

Future Market Trends and Growth Potential: Growth is expected to continue, albeit with fluctuations, driven by continued trade between the two economic powerhouses. However, the rate of growth will depend on global economic conditions and geopolitical stability.

-

Technological Advancements: The adoption of AI, blockchain, IoT, and digital twins will transform the industry, enhancing efficiency, transparency, and sustainability. Automation will continue to play a significant role in port operations.

-

Potential Risks and Challenges: Future challenges include maintaining sustainability, adapting to evolving regulations, and mitigating geopolitical risks. Cybersecurity concerns will also grow in importance as digitalization expands.

- Growth Projections: (Provide reasonable growth projections for the next 5-10 years, citing credible sources).

- Predictions on Technology Adoption: (Discuss the likely timeline for the adoption of key technologies like AI and blockchain).

- Potential Impacts of Global Trade Policies: (Analyze the potential impact of future trade policies and regulations on the China-US container shipping market).

Conclusion: Mastering the China-US Container Shipping Market

The China-US container shipping market presents both significant challenges and substantial opportunities. Understanding the intricate market dynamics, identifying key players, and mastering freight cost management strategies are crucial for success. The market’s complexity requires ongoing research and adaptation to its ever-evolving landscape. Payden & Rygel offers in-depth analysis and insights into this critical sector. To gain a deeper understanding of China-US container shipping, its associated freight rates, and the wider implications for global trade, contact Payden & Rygel for consultations and further analysis tailored to your specific needs. Let us help you master the complexities of China-US container shipping and optimize your maritime logistics.

Featured Posts

-

Dessert Francais Facile Preparez Un Delicieux Salami Au Chocolat

May 19, 2025

Dessert Francais Facile Preparez Un Delicieux Salami Au Chocolat

May 19, 2025 -

Proedria Ee Syzitiseis Kompos Sigiarto Gia Kypriako Kai Dimereis Sxeseis Kyproy Oyggarias

May 19, 2025

Proedria Ee Syzitiseis Kompos Sigiarto Gia Kypriako Kai Dimereis Sxeseis Kyproy Oyggarias

May 19, 2025 -

Rafa Nadal Lamenta La Muerte De Una Leyenda Del Tenis Un Gran Referente

May 19, 2025

Rafa Nadal Lamenta La Muerte De Una Leyenda Del Tenis Un Gran Referente

May 19, 2025 -

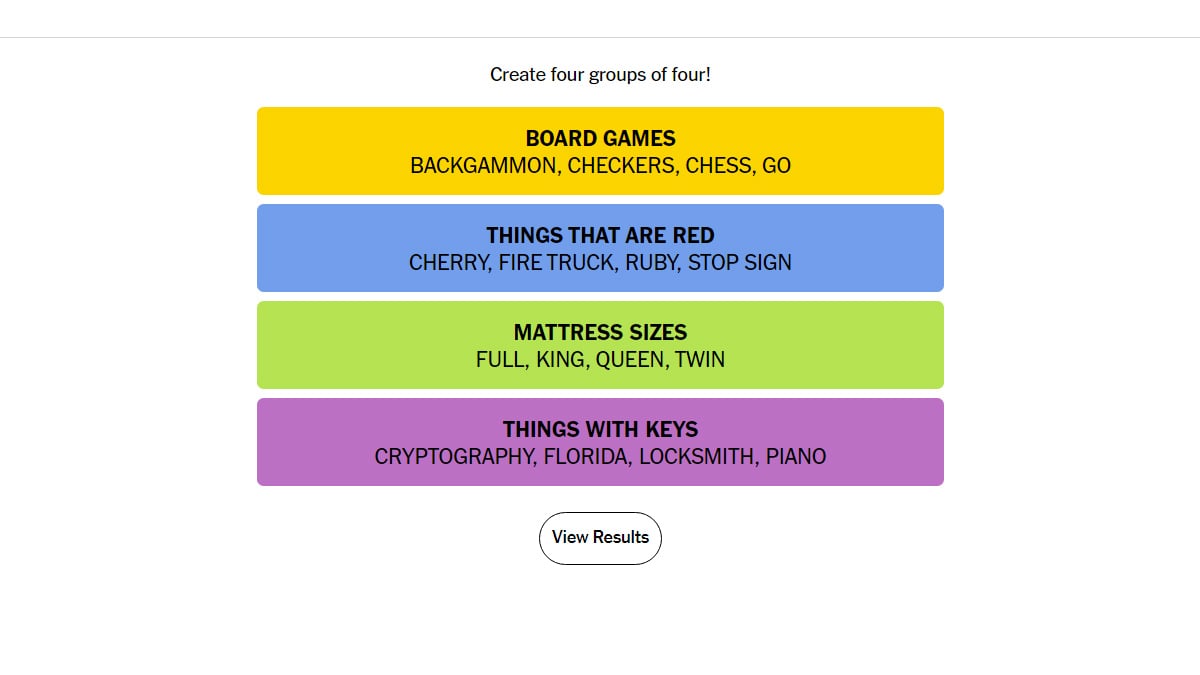

Nyt Connections Today March 5 2025 Hints And Answers

May 19, 2025

Nyt Connections Today March 5 2025 Hints And Answers

May 19, 2025 -

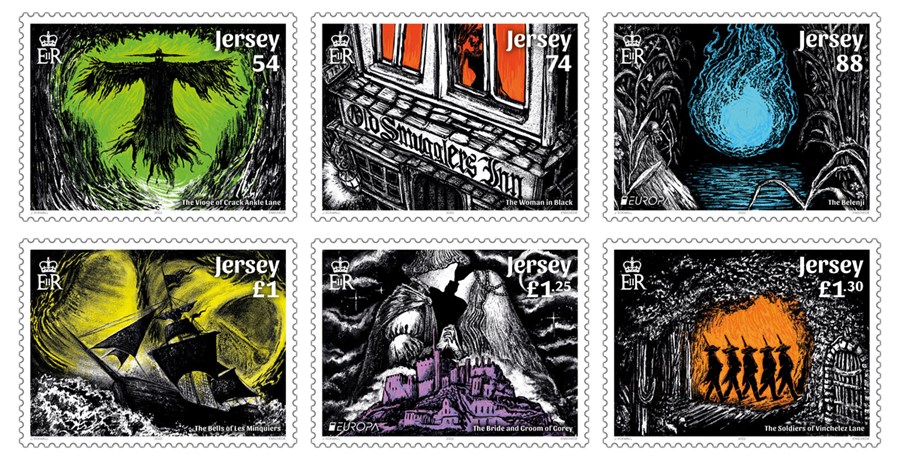

Post Office Releases Stamps Featuring British Myths And Legends

May 19, 2025

Post Office Releases Stamps Featuring British Myths And Legends

May 19, 2025