Understanding Stock Market Valuations: BofA's Take

Table of Contents

- Key Valuation Metrics: Understanding P/E Ratio, PEG Ratio, and More

- Interpreting Valuation Data: Identifying Undervalued and Overvalued Stocks

- The Role of Qualitative Factors in Stock Valuation

- BofA's Current Market Outlook and Valuation Strategies

- Conclusion: Mastering Stock Market Valuations with BofA's Guidance

Key Valuation Metrics: Understanding P/E Ratio, PEG Ratio, and More

Understanding stock market valuations begins with mastering key valuation metrics. These metrics provide a quantitative assessment of a company's worth relative to its earnings, assets, or sales.

-

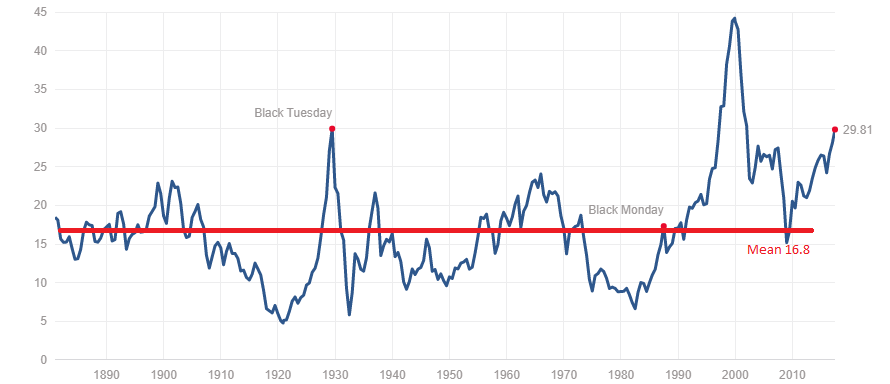

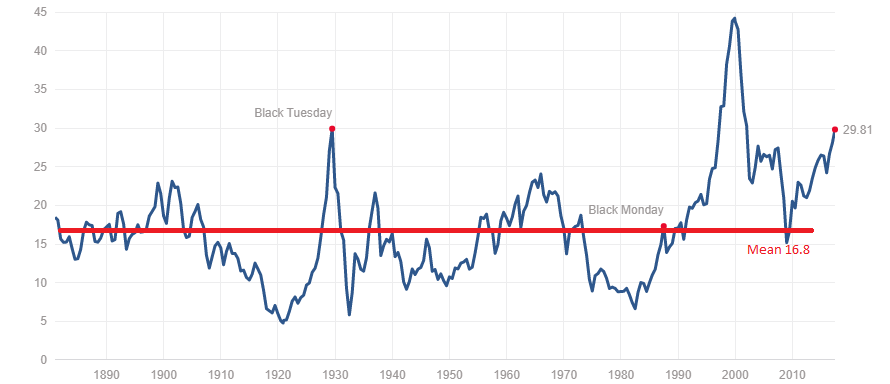

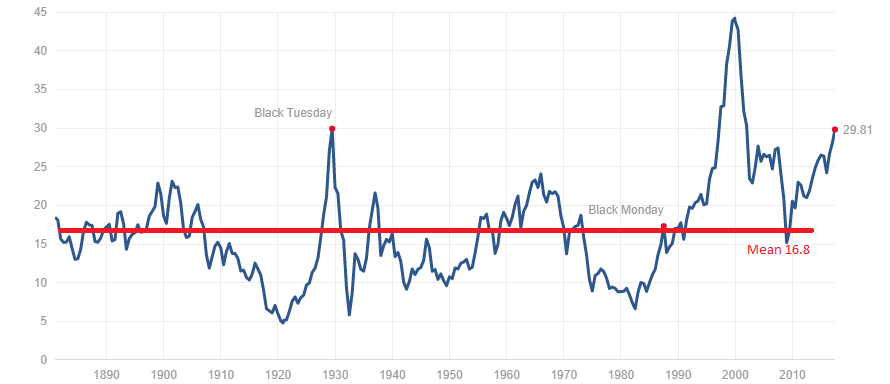

Price-to-Earnings (P/E) Ratio: This widely used metric represents the market price per share divided by the earnings per share (EPS). A high P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially indicating higher growth expectations or market optimism. However, the P/E ratio has limitations; it can be distorted by accounting practices and doesn't account for future growth potential.

-

Price-to-Earnings-to-Growth (PEG) Ratio: The PEG ratio refines the P/E ratio by incorporating the company's earnings growth rate. Calculated as P/E ratio divided by the earnings growth rate, it provides a more nuanced perspective. A PEG ratio below 1 is generally considered undervalued, suggesting the stock is priced attractively relative to its growth prospects.

-

Other Relevant Valuation Metrics:

- Price-to-Book (P/B) Ratio: Compares a company's market value to its book value (assets minus liabilities). Useful for valuing asset-heavy companies.

- Price-to-Sales (P/S) Ratio: Relates a company's market capitalization to its revenue. Often used for companies with negative earnings.

- Dividend Yield: The annual dividend per share divided by the stock price. Attractive to income-oriented investors.

-

BofA's Approach: While BofA utilizes a range of valuation metrics, their analysts likely employ a multifaceted approach, combining quantitative data with qualitative factors (discussed later). (Include a link to a relevant BofA research report here if available.)

-

Summary of Metric Strengths and Weaknesses:

Metric Strengths Weaknesses P/E Ratio Simple to calculate, widely used Sensitive to accounting practices, ignores growth PEG Ratio Accounts for growth, more comprehensive than P/E Relies on accurate growth forecasts P/B Ratio Useful for asset-heavy companies Book value may not reflect market value P/S Ratio Applicable to companies with negative earnings Doesn't directly reflect profitability Dividend Yield Useful for income investors Can be misleading if dividends are unsustainable

Interpreting Valuation Data: Identifying Undervalued and Overvalued Stocks

Understanding individual metrics is only half the battle; effective stock market valuation involves comparing data across multiple dimensions.

-

Comparing Valuation Metrics: It's crucial to benchmark a company's valuation metrics against its industry peers and its historical performance. A high P/E ratio might be justified if a company consistently outperforms its competitors.

-

Intrinsic Value: Investors often attempt to estimate a company's intrinsic value – its true worth based on its fundamentals – using discounted cash flow (DCF) analysis or other methods. If the market price is significantly below the intrinsic value, the stock might be considered undervalued.

-

Factors Influencing Valuations: External factors significantly impact valuations. Interest rate changes, economic growth rates, and overall market sentiment can all influence investor demand and, consequently, stock prices.

-

BofA's Insights on Market Trends: (Here, incorporate BofA's current market outlook and any insights they provide regarding undervalued or overvalued sectors. Reference specific reports or analyses if possible.)

-

Steps to Interpret Valuation Data Effectively:

- Analyze multiple valuation metrics.

- Compare to industry peers and historical trends.

- Consider external factors influencing market sentiment.

- Estimate intrinsic value using appropriate valuation models.

- Account for qualitative factors.

The Role of Qualitative Factors in Stock Valuation

While quantitative metrics are essential, a comprehensive stock market valuation must also consider qualitative factors.

-

Limitations of Quantitative Analysis: Metrics alone cannot fully capture a company's potential. Factors like management quality, competitive landscape, and future growth prospects are crucial.

-

Impact of Intangible Assets: Brand reputation, intellectual property, and other intangible assets significantly influence a company's long-term value, but they aren't reflected in traditional accounting.

-

BofA’s Consideration of Qualitative Factors: BofA analysts likely incorporate qualitative assessments into their valuation process, weighing factors like competitive advantages, management expertise, and innovation capabilities.

-

Key Qualitative Factors to Consider:

- Management team quality and experience.

- Competitive landscape and market share.

- Innovation and research and development efforts.

- Brand reputation and customer loyalty.

- Regulatory environment and legal risks.

BofA's Current Market Outlook and Valuation Strategies

(This section should summarize BofA's current market outlook, including their predictions for various sectors, and their recommended investment strategies. Include relevant quotes from BofA research reports to strengthen your analysis.)

-

BofA's Current Stance: (Example: BofA might be bullish on technology stocks due to their long-term growth potential, while being more cautious about the energy sector given recent price volatility.)

-

Recommended Investment Strategies: (Example: BofA might recommend a diversified portfolio approach, with a tilt towards undervalued companies in promising sectors.)

-

Key Recommendations and Strategies: (Summarize BofA's key recommendations in bullet points.)

Conclusion: Mastering Stock Market Valuations with BofA's Guidance

Understanding stock market valuations is crucial for making informed investment decisions. This article explored key valuation metrics, interpretation strategies, and the importance of considering qualitative factors. By incorporating BofA's insights and employing a multifaceted approach, you can improve your ability to identify undervalued and overvalued stocks. Remember that thorough due diligence, combining quantitative analysis with qualitative assessment, remains paramount. Learn more about effective stock market valuation techniques and leverage BofA's expertise to make informed investment decisions. Explore BofA's research and resources today!

Minnesota Twins Win 6 3 Against New York Mets

Minnesota Twins Win 6 3 Against New York Mets

Ex Leoben Trainer Carsten Jancker Neuer Job Bestaetigt

Ex Leoben Trainer Carsten Jancker Neuer Job Bestaetigt

Culture Department Announces Annual Canoe Awakening Celebration

Culture Department Announces Annual Canoe Awakening Celebration

Understanding Stock Market Valuations Bof As Take

Understanding Stock Market Valuations Bof As Take

Canadian Voters Face Crucial Election Amidst Us Trade War And Annexation Fears

Canadian Voters Face Crucial Election Amidst Us Trade War And Annexation Fears