Understanding Greg Abel: Berkshire Hathaway's New Leader

Table of Contents

Greg Abel's Background and Career at Berkshire Hathaway

From Insurance to Energy: A Berkshire Hathaway Journey

Greg Abel's journey within Berkshire Hathaway is a testament to his dedication and expertise. His career has spanned multiple sectors, most notably insurance and energy, giving him a broad understanding of the diverse businesses under the Berkshire umbrella. This multifaceted experience provides a unique perspective crucial for leading such a complex conglomerate.

- Early career at Berkshire: Abel joined Berkshire Hathaway in 1992, starting his career in a relatively less public-facing role. This grounded his understanding of the company's operations from the ground up.

- Rise through the ranks: He steadily climbed the corporate ladder, showcasing consistent competence and dedication, demonstrating a strategic mindset well-suited to the complexities of Berkshire Hathaway's operations.

- Key roles in Berkshire Hathaway Energy: His significant contributions to Berkshire Hathaway Energy, a substantial subsidiary, played a pivotal role in his rise to the top. He successfully managed and expanded this energy sector giant, a key division within the Berkshire portfolio.

- Successes in managing diverse business units: Abel’s experience extends beyond energy. He's overseen various other Berkshire subsidiaries, displaying remarkable versatility and an ability to adapt to different industry landscapes.

- Demonstrated financial acumen and strategic planning abilities: His success is not merely circumstantial. It's the result of proven financial acumen, insightful strategic planning, and decisive leadership capabilities—essential qualities for steering Berkshire Hathaway's future.

A Proven Track Record of Success

Abel's career is marked by tangible achievements. His leadership is synonymous with consistent profitability and efficiency improvements across various Berkshire Hathaway subsidiaries.

- Specific examples of successful projects or initiatives: While specific details may not be publicly available for all projects, his contributions to Berkshire Hathaway Energy’s growth and efficiency are widely recognized. Reports highlight significant increases in revenue and asset value under his tenure.

- Metrics showing improved performance under his management (e.g., revenue growth, cost reduction): Quantifiable data, although not always readily accessible, points to significant positive impacts on the bottom line across various Berkshire entities under his stewardship. Industry analysts often cite his contributions as key to maintaining profitability.

- Testimonials or accolades received from colleagues or industry experts: While formal statements are limited, anecdotal evidence and industry perceptions strongly support his reputation as a highly effective and respected leader within the Berkshire Hathaway ecosystem.

Abel's Leadership Style and Management Approach

A Collaborative and Data-Driven Leader

Abel's leadership style is characterized by collaboration and a data-driven approach. This differs somewhat from the more intuitive style often associated with Warren Buffett, suggesting a blend of experience-based judgement and analytical precision.

- Examples illustrating his collaborative nature: While specifics are limited to protect confidential business operations, his leadership style is described as inclusive and collaborative, fostering a team environment where diverse perspectives are valued and integrated into decision-making processes.

- Focus on data analysis and strategic planning: Abel's decision-making relies heavily on data analysis and strategic forecasting. This methodical approach contrasts with solely relying on intuition or gut feeling.

- Decision-making process: His approach suggests a structured, thorough evaluation of multiple data points, coupled with insights garnered from extensive operational experience.

- Communication style: Reports suggest a clear, concise communication style—essential for leading a large, diverse workforce.

- Employee relations: Building strong working relationships with his teams is a key tenet of his leadership philosophy.

Navigating the Future of Berkshire Hathaway

Abel faces the challenge of leading Berkshire Hathaway through evolving economic landscapes. His strategies will be crucial for adapting to and exploiting new opportunities.

- Potential investments in emerging technologies or markets: His experience suggests an openness to exploring and investing in areas such as renewable energy, technology, and potentially other disruptive technologies.

- Maintaining a long-term investment perspective: Berkshire Hathaway’s long-term investment philosophy is unlikely to change under Abel's leadership. Expect continued focus on identifying companies with strong fundamentals and long-term growth potential.

- Strategies for handling economic uncertainty: Abel's data-driven approach will be instrumental in navigating periods of economic uncertainty. Expect a cautious yet strategic approach to investment decisions during times of market volatility.

- Adapting to changing regulatory environments: Navigating evolving regulations will require adaptable strategies, something Abel's extensive experience will undoubtedly aid in executing efficiently and effectively.

The Future of Berkshire Hathaway Under Greg Abel's Leadership

Maintaining the Berkshire Legacy

Abel inherits a remarkable legacy, but also significant challenges. He must continue Berkshire Hathaway's success while navigating a changing investment landscape.

- Challenges posed by a changing market: Adapting to rapidly evolving technological advancements and economic uncertainties will be paramount.

- Maintaining Berkshire's unique culture: Preserving the company's unique culture of long-term value investing and operational excellence will be crucial for ongoing success.

- Innovation and adapting to new technologies: Embracing innovation and adapting to new technologies will be critical to maintain Berkshire Hathaway's competitiveness.

- Attracting and retaining top talent: Attracting and retaining highly skilled employees will be essential for continued growth and innovation.

Potential Investment Strategies

Predicting Abel's precise investment strategies is speculative, but we can draw some inferences.

- Emphasis on value investing: It's highly likely that Abel will adhere to Berkshire Hathaway’s long-standing principle of value investing, focusing on undervalued companies with sustainable long-term growth prospects.

- Potential investment targets (e.g., technology, renewable energy, healthcare): Given his experience with Berkshire Hathaway Energy, increased investment in renewable energy and potentially technology sectors seems plausible.

- Diversification strategies: While maintaining a focus on value investing, diversifying Berkshire's portfolio across various sectors will likely remain a key strategy.

- Long-term versus short-term investment horizons: The company's established long-term investment horizon will almost certainly persist under Abel's leadership.

Conclusion

Understanding Greg Abel is key to comprehending Berkshire Hathaway's future trajectory. His proven track record, collaborative leadership style, and data-driven approach suggest a continuation of Berkshire’s success, albeit potentially with a modern twist reflecting current market dynamics. While challenges remain, Abel's experience positions him well to navigate the complex world of investment and business leadership. To stay informed about the evolution of Berkshire Hathaway under Greg Abel's leadership, continue following industry news and analysis on the company's activities. Learning more about Greg Abel and his vision for Berkshire Hathaway will be crucial in understanding one of the world’s most impactful investment firms.

Featured Posts

-

The Impact Of Trumps Xrp Support On Institutional Interest

May 07, 2025

The Impact Of Trumps Xrp Support On Institutional Interest

May 07, 2025 -

Dive Into Fast Paced Action Nhl 25s Arcade Mode

May 07, 2025

Dive Into Fast Paced Action Nhl 25s Arcade Mode

May 07, 2025 -

Who Wants To Be A Millionaire Celebrity Special The Biggest Wins And Biggest Losses

May 07, 2025

Who Wants To Be A Millionaire Celebrity Special The Biggest Wins And Biggest Losses

May 07, 2025 -

Simone Biles And Jonathan Owens Share Loved Up Photos Featuring New Hairstyle

May 07, 2025

Simone Biles And Jonathan Owens Share Loved Up Photos Featuring New Hairstyle

May 07, 2025 -

Lewis Capaldis Return A Two Year Hiatus Ends

May 07, 2025

Lewis Capaldis Return A Two Year Hiatus Ends

May 07, 2025

Latest Posts

-

Rogue Unleashes Cyclops Style Abilities New X Men Reveal

May 08, 2025

Rogue Unleashes Cyclops Style Abilities New X Men Reveal

May 08, 2025 -

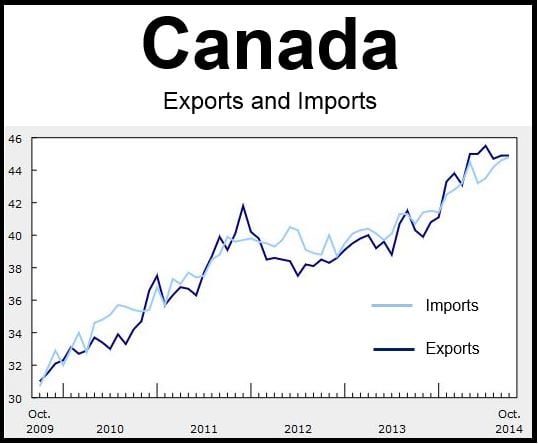

506 Million Canadas Narrowed Trade Deficit And The Role Of Tariffs

May 08, 2025

506 Million Canadas Narrowed Trade Deficit And The Role Of Tariffs

May 08, 2025 -

Toronto Real Estate Market Slowdown Sales Down 23 Prices Dip 4

May 08, 2025

Toronto Real Estate Market Slowdown Sales Down 23 Prices Dip 4

May 08, 2025 -

Canadas Trade Deficit Narrows To 506 Million Amidst New Tariffs

May 08, 2025

Canadas Trade Deficit Narrows To 506 Million Amidst New Tariffs

May 08, 2025 -

Canadas Trade Overtures A Positive Signal For Washington

May 08, 2025

Canadas Trade Overtures A Positive Signal For Washington

May 08, 2025