Uber Technologies (UBER): Investment Potential And Risks

Table of Contents

Uber's Growth and Market Dominance

Uber's significant market share in the ride-sharing industry is undeniable. Its expansion beyond ride-hailing into food delivery (Uber Eats), freight transportation (Uber Freight), and even micromobility services (e-scooters and e-bikes) demonstrates a commitment to diversification and market leadership. This strategy positions Uber for continued growth, especially in emerging markets with increasing smartphone penetration and a burgeoning demand for convenient transportation and delivery options. The company's strong brand recognition and customer loyalty are additional assets contributing to its market dominance.

- Market leadership: Uber holds a significant share in numerous segments of the transportation and delivery markets globally.

- International expansion: Uber's global footprint allows it to tap into diverse markets and economic growth opportunities.

- Innovation and expansion: The company's continuous innovation and expansion into new services helps mitigate risks associated with relying on a single product.

- Brand recognition and loyalty: Strong brand recognition and customer loyalty provide a competitive edge against emerging competitors.

Financial Performance and Profitability

Analyzing Uber's financial performance requires a careful look at its revenue streams, profitability trends, and overall financial health. While Uber has demonstrated significant revenue growth, achieving consistent profitability has been a challenge. Factors affecting profitability include driver compensation, operating expenses (including marketing and technology investments), and intense competition. Investors should closely examine Uber's financial statements, focusing on key performance indicators (KPIs) like revenue growth, operating margins, and free cash flow. Understanding the company's path to sustained profitability and how it aligns with investor expectations is crucial.

- Revenue growth: Examining recent financial reports reveals the trends in Uber's revenue generation across various segments.

- Expense management: Efficient expense management is critical for improving profitability and achieving positive cash flow.

- Profitability margins: Analyzing profitability margins helps gauge the efficiency of Uber's operations and its pricing strategies.

- Competitor comparison: Comparing Uber's financial performance to its competitors provides valuable context and insights.

Risks and Challenges Facing Uber

Despite its impressive growth, Uber faces substantial risks and challenges. Intense competition from established players and new entrants is a constant threat. Regulatory hurdles vary significantly across different jurisdictions, impacting licensing, labor laws, and operating costs. Safety concerns, driver relations, and the potential for technological disruption are additional considerations. Furthermore, ongoing legal battles and potential liabilities add to the complexity of assessing the investment risk. The company's reliance on gig workers also presents ethical and legal challenges regarding employment classification and benefits.

- Competition: Companies like Lyft, Didi Chuxing, and Bolt are significant competitors in the ride-sharing and delivery markets.

- Regulatory risks: Changes in regulations concerning ride-sharing, labor laws, and data privacy pose significant risks.

- Safety concerns: Maintaining high safety standards and addressing concerns about driver and passenger safety is paramount.

- Driver relations: Maintaining positive relationships with drivers and addressing their concerns about compensation and working conditions is crucial.

- Technological disruption: The rapid pace of technological advancement presents both opportunities and risks for Uber.

Valuation and Investment Strategy

Uber's current market valuation needs to be analyzed carefully, comparing it to its peers and factoring in its growth potential. A detailed price-to-earnings ratio (P/E) analysis helps gauge the company's valuation relative to its earnings. Investors should consider a long-term perspective, evaluating the potential for future growth and return on investment. However, understanding and managing risk is vital. Diversification of your investment portfolio and a thorough risk assessment aligned with your investment goals are crucial before investing in UBER stock.

- P/E Ratio Analysis: Comparing Uber's P/E ratio to its competitors provides valuable insights into its relative valuation.

- Competitor Valuation: Examining the valuations of similar companies in the ride-sharing and delivery sector offers a benchmark for comparison.

- Long-Term Growth: Assessing Uber's long-term growth prospects and potential returns is essential for long-term investors.

- Risk Assessment: A thorough risk assessment should consider various factors, including regulatory changes, competition, and technological advancements.

Conclusion

This analysis of Uber Technologies (UBER) reveals significant growth potential fueled by its market dominance and expansion into diverse services. However, potential investors must carefully consider substantial risks, including intense competition, regulatory challenges, and operational complexities. A comprehensive understanding of both the potential rewards and the inherent risks is crucial for informed investment decisions.

Call to Action: Before investing in Uber Technologies (UBER) stock, conduct your own thorough due diligence and consider seeking professional financial advice. Evaluate your risk tolerance and investment goals to determine if UBER aligns with your portfolio strategy. Remember to always carefully consider the potential rewards and inherent risks associated with any UBER investment.

Featured Posts

-

Will Michael Conforto Emulate Teoscar Hernandezs Success In La

May 18, 2025

Will Michael Conforto Emulate Teoscar Hernandezs Success In La

May 18, 2025 -

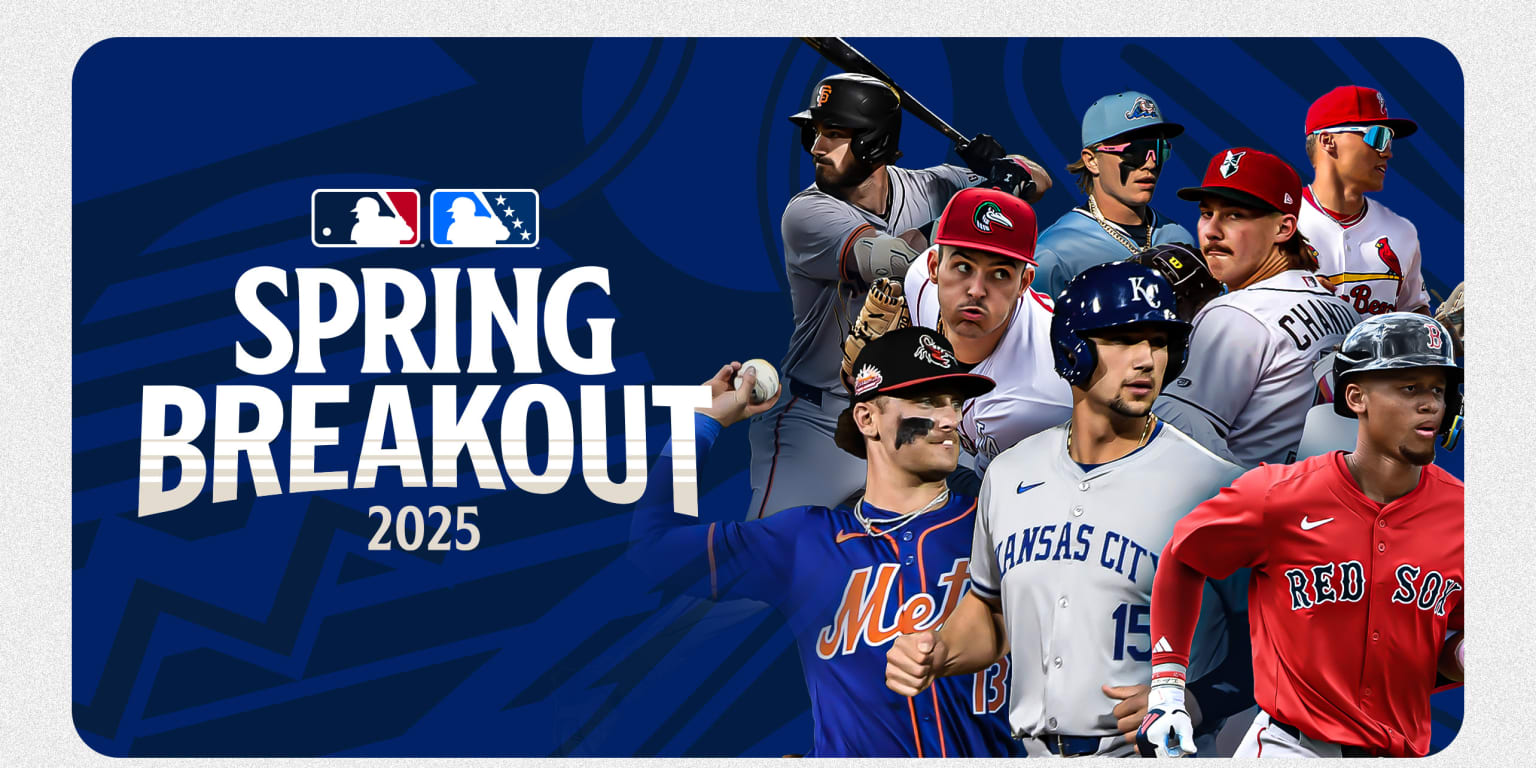

Spring Breakout Rosters 2025 Top Prospects And Potential Stars

May 18, 2025

Spring Breakout Rosters 2025 Top Prospects And Potential Stars

May 18, 2025 -

The Complete Spring Breakout 2025 Roster Breakdown

May 18, 2025

The Complete Spring Breakout 2025 Roster Breakdown

May 18, 2025 -

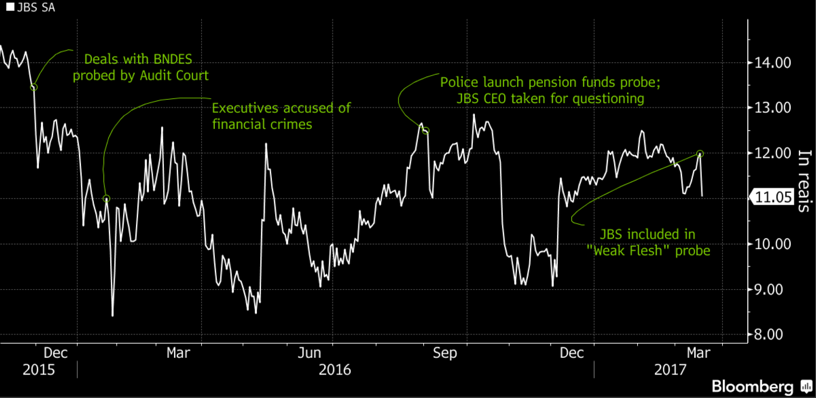

Jbs Ends Banco Master Asset Purchase Negotiations

May 18, 2025

Jbs Ends Banco Master Asset Purchase Negotiations

May 18, 2025 -

Iga Svjontek Najnovije Vesti O Pobedi Nad Ukrajinskom Teniserkom

May 18, 2025

Iga Svjontek Najnovije Vesti O Pobedi Nad Ukrajinskom Teniserkom

May 18, 2025

Latest Posts

-

Pengakuan Palestina Oleh Prancis Analisis Politik Dan Dampaknya

May 18, 2025

Pengakuan Palestina Oleh Prancis Analisis Politik Dan Dampaknya

May 18, 2025 -

1 May 2025 Daily Lotto Results Check Your Numbers

May 18, 2025

1 May 2025 Daily Lotto Results Check Your Numbers

May 18, 2025 -

Reaksi Israel Atas Kemungkinan Pengakuan Palestina Oleh Prancis

May 18, 2025

Reaksi Israel Atas Kemungkinan Pengakuan Palestina Oleh Prancis

May 18, 2025 -

Thursday May 1st 2025 Daily Lotto Winning Numbers

May 18, 2025

Thursday May 1st 2025 Daily Lotto Winning Numbers

May 18, 2025 -

Akankah Presiden Macron Akui Palestina Dampaknya Pada Israel

May 18, 2025

Akankah Presiden Macron Akui Palestina Dampaknya Pada Israel

May 18, 2025