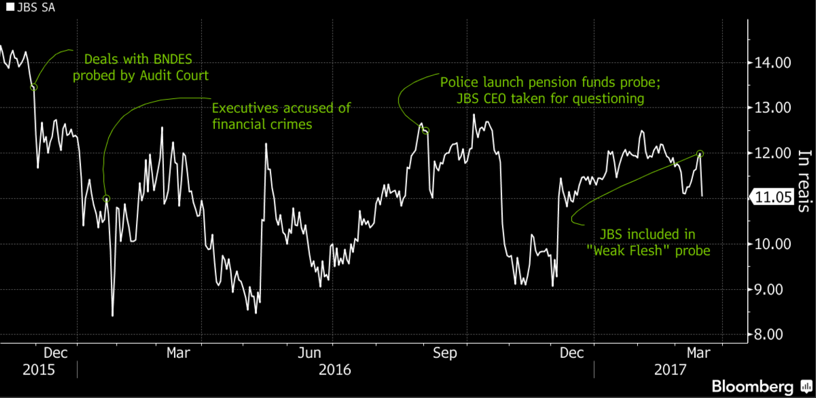

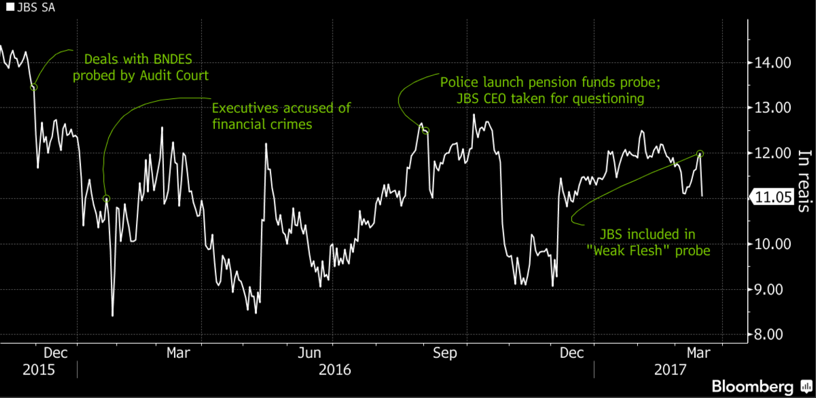

JBS Ends Banco Master Asset Purchase Negotiations

Table of Contents

Reasons for the Termination of JBS Banco Master Asset Purchase Negotiations

The termination of the JBS Banco Master asset purchase negotiations is a complex issue with several potential contributing factors. While the exact reasons remain officially unstated, several possibilities merit consideration:

-

Valuation Discrepancies: A significant hurdle in many mergers and acquisitions is reaching a mutually agreeable valuation. Discrepancies between JBS's assessment of Banco Master's assets and Banco Master's own valuation could have led to an impasse, making a deal impossible. This is a common occurrence in complex transactions involving diverse assets.

-

Regulatory Hurdles and Compliance Issues: Acquisitions, particularly those involving financial institutions like Banco Master, are subject to stringent regulatory scrutiny. Unforeseen regulatory hurdles or compliance issues related to antitrust laws, banking regulations, or other legal frameworks might have emerged, proving insurmountable for JBS. The process of navigating such complexities can be lengthy and ultimately lead to deal failure.

-

Changes in JBS's Business Strategy and Financial Priorities: JBS's overall business strategy and financial priorities may have shifted since initial negotiations began. A change in market conditions, a reassessment of risk tolerance, or the emergence of more attractive investment opportunities could have prompted JBS to reconsider the acquisition. Strategic shifts are common in dynamic business environments.

-

Discovery of Unforeseen Liabilities: During the due diligence process, JBS may have uncovered unforeseen liabilities within Banco Master's assets that were not initially apparent. These could range from hidden debts to potential legal liabilities, rendering the acquisition less attractive or even financially unviable. Thorough due diligence is critical in preventing such surprises.

Impact on JBS

The termination of the Banco Master asset purchase agreement will undoubtedly have several implications for JBS, both in the short and long term:

-

Stock Price and Investor Confidence: The news is likely to impact JBS's stock price, at least temporarily. Investor confidence may waver, particularly if the market interprets the failed acquisition as a sign of poor strategic decision-making or an indication of underlying financial concerns. Market reaction will depend on several factors, including the overall market sentiment and JBS's communication strategy.

-

Shift in Investment Focus: The decision to abandon the Banco Master acquisition might signal a shift in JBS's investment focus. They might now prioritize other acquisitions in the agricultural sector or explore entirely new investment avenues. This could involve focusing on internal growth or seeking alternative partnerships.

-

Impact on Diversification Strategy: JBS's diversification strategy might be affected by the failed acquisition. The planned purchase of Banco Master's assets would likely have diversified JBS’s portfolio. The failure to acquire these assets may mean JBS needs to explore alternative paths to achieve its desired diversification.

Impact on Banco Master

The termination of the deal leaves Banco Master facing significant challenges:

-

Finding Alternative Buyers: Banco Master now faces the task of finding alternative buyers for its assets or implementing a restructuring strategy. This might prove difficult, especially given the current market conditions and the potential for a lower valuation than initially expected. Attracting a suitable buyer will depend on market conditions and the perceived value of its assets.

-

Financial Stability and Operations: The failure to secure the acquisition could impact Banco Master's financial stability and its operational efficiency. The company may need to reassess its financial projections and explore alternative means of securing funding or reducing its debt.

-

Effect on Employees and Stakeholders: The failed acquisition could also affect Banco Master's employees and stakeholders, causing uncertainty about job security and future prospects. Clear communication with employees and stakeholders is vital during this uncertain period.

Future Outlook and Potential Scenarios

The failed JBS Banco Master asset purchase leaves several possible future scenarios:

-

JBS's Future Acquisition Targets: JBS is likely to continue exploring acquisition opportunities in the agricultural sector or potentially look at other strategic investments. The search for acquisitions that align with their redefined strategies will continue.

-

Restructuring or Strategic Partnerships for Banco Master: Banco Master may need to undergo restructuring to improve its financial position or explore strategic partnerships to enhance its competitiveness. Restructuring or seeking strategic alliances could be essential for survival.

-

Long-Term Market Effects: The long-term effects on the market are uncertain. It could lead to increased volatility in both the financial and agricultural sectors, potentially impacting investor confidence and future mergers and acquisitions activity.

Conclusion

The termination of the JBS Banco Master asset purchase negotiations marks a significant development with wide-ranging implications for both companies and the broader market. Several factors, including valuation discrepancies, regulatory hurdles, and strategic shifts, likely contributed to the deal's collapse. The future for both JBS and Banco Master is now uncertain, necessitating strategic adaptation and careful planning. Stay informed on the evolving situation surrounding the failed JBS Banco Master asset purchase. Continue to follow our updates for the latest developments and analysis on the JBS Banco Master asset purchase and its implications for the future of both entities. Further research into the JBS Banco Master asset purchase and the financial strategies of both companies will shed more light on this important business development.

Featured Posts

-

Worldwide Reddit Problems A Major Outage

May 18, 2025

Worldwide Reddit Problems A Major Outage

May 18, 2025 -

Audience Curses Rock Snls Ego Nwodim Weekend Update Segment

May 18, 2025

Audience Curses Rock Snls Ego Nwodim Weekend Update Segment

May 18, 2025 -

Cassie Ventura And Alex Fines Red Carpet Appearance Pregnant Cassies Mob Land Premiere Debut

May 18, 2025

Cassie Ventura And Alex Fines Red Carpet Appearance Pregnant Cassies Mob Land Premiere Debut

May 18, 2025 -

Assessing Stephen Millers Suitability As National Security Advisor

May 18, 2025

Assessing Stephen Millers Suitability As National Security Advisor

May 18, 2025 -

Indias Economic Isolation Of Pakistan Turkey And Azerbaijan

May 18, 2025

Indias Economic Isolation Of Pakistan Turkey And Azerbaijan

May 18, 2025

Latest Posts

-

Canterbury Castle Sold For 705 499 A New Chapter Begins

May 18, 2025

Canterbury Castle Sold For 705 499 A New Chapter Begins

May 18, 2025 -

Former Colleague Details Stephen Millers Horrible Conduct

May 18, 2025

Former Colleague Details Stephen Millers Horrible Conduct

May 18, 2025 -

Assessing Stephen Millers Suitability As National Security Advisor

May 18, 2025

Assessing Stephen Millers Suitability As National Security Advisor

May 18, 2025 -

Is Stephen Miller The Next National Security Advisor Analyzing His Qualifications

May 18, 2025

Is Stephen Miller The Next National Security Advisor Analyzing His Qualifications

May 18, 2025 -

Stephen Miller A Contender For National Security Advisor

May 18, 2025

Stephen Miller A Contender For National Security Advisor

May 18, 2025