Uber Implements Cash-Only Policy For Auto Service

Table of Contents

Understanding Uber's New Cash-Only Auto Service Policy

Uber's new cash-only auto service is a significant departure from its predominantly cashless platform. This policy currently applies to a select range of services and geographical locations. While the precise details are still emerging, here's what we know so far:

- Specific types of auto services covered: Currently, the cash-only option seems to focus on basic maintenance and minor repairs, including oil changes, tire rotations, and fluid top-offs. More complex repairs are likely to remain under the traditional cashless system.

- Geographical areas where the cash-only policy is in effect: Uber is initially rolling out this policy in specific areas with a higher concentration of underserved communities or those with limited access to banking services and credit cards. This targeted approach suggests a strategic aim to expand Uber's auto service reach.

- The rationale behind Uber's decision: Uber's likely motivation is twofold. First, it aims to increase accessibility for customers who may not possess bank accounts or credit cards. Second, processing cash transactions avoids the fees associated with electronic payment processing, potentially increasing profitability for both Uber and the participating mechanics.

Advantages and Disadvantages of Uber's Cash-Only Approach

Uber's decision to offer a cash-only auto service presents a complex equation of potential benefits and drawbacks.

Advantages:

- Increased accessibility: This is arguably the most significant advantage. Many individuals lack access to traditional banking or credit cards. A cash-only option makes essential auto services more readily available to these customers.

- Lower transaction costs: Eliminating credit card processing fees can translate to considerable savings for both Uber and the mechanics providing the services. These cost savings could lead to lower prices for consumers or increased profit margins.

- Faster transaction times: Cash transactions are generally quicker than electronic payments, streamlining the service process and potentially increasing efficiency for mechanics.

- Reaching underserved markets: Targeting cash-centric communities allows Uber to expand its market reach and tap into a previously inaccessible customer base for its auto services.

Disadvantages:

- Security risks: Handling large amounts of cash presents inherent security risks for both Uber and the mechanics, increasing the potential for theft or robbery. Robust security protocols will be crucial for mitigating these risks.

- Customer inconvenience: Many customers are accustomed to the convenience of cashless payments. The requirement to carry cash may deter some users and could affect customer satisfaction and convenience of car service.

- Record-keeping challenges: Tracking cash transactions accurately can be more complex than electronic payments, potentially leading to discrepancies and increased accounting challenges for both Uber and the mechanics.

- Limited data analysis: The inability to electronically track transactions limits the ability to analyze sales data effectively, potentially hindering strategic decision-making regarding pricing, service offerings, and market trends.

Alternatives and Future Implications for Cashless Payments

While Uber's cash-only option aims for inclusivity, the long-term viability may hinge on its ability to adapt and offer alternatives.

- Integration of mobile payment apps: Combining cash with mobile payment options like Apple Pay or Google Pay could provide a balance between accessibility and convenience.

- Partnerships with prepaid card providers: Collaborating with prepaid card providers could offer a bridge between cash and cashless transactions, broadening access for customers without traditional bank accounts.

- Impact on customer loyalty: The convenience of cashless transactions significantly influences customer loyalty. Uber will need to carefully consider how the cash-only policy impacts customer retention.

- Regulatory hurdles: Increased cash transactions might attract regulatory scrutiny regarding compliance with anti-money laundering and tax reporting regulations.

The implications extend beyond Uber. This policy could influence competitors in the auto service industry, prompting them to evaluate their payment options and explore strategies to cater to underserved markets.

Conclusion

Uber's foray into cash-only auto services presents a fascinating case study in balancing accessibility with efficiency and security. While it offers increased reach to underserved communities and potential cost savings, it also introduces security risks and operational challenges. The long-term success of this policy will likely depend on Uber's ability to mitigate these challenges while maintaining its commitment to inclusivity.

What are your thoughts on Uber’s new cash-only approach to auto service? Will this strategy prove successful, or will it ultimately hinder the company's growth? Let's discuss the future of Uber's cash-only auto service in the comments below!

Featured Posts

-

Psg Nantes Beraberlik Karsilasmasinin Detaylari

May 08, 2025

Psg Nantes Beraberlik Karsilasmasinin Detaylari

May 08, 2025 -

Long Term Investment Berkshire Hathaways Impact On Japanese Trading Houses

May 08, 2025

Long Term Investment Berkshire Hathaways Impact On Japanese Trading Houses

May 08, 2025 -

Istori Ski Tri Umf Segeda Nad Pariz U Ligi Shampiona

May 08, 2025

Istori Ski Tri Umf Segeda Nad Pariz U Ligi Shampiona

May 08, 2025 -

Top 10 Characters In Saving Private Ryan A Definitive Ranking

May 08, 2025

Top 10 Characters In Saving Private Ryan A Definitive Ranking

May 08, 2025 -

Hot Toys Japan Exclusive 1 6 Scale Galen Erso Rogue One Figure Unveiled

May 08, 2025

Hot Toys Japan Exclusive 1 6 Scale Galen Erso Rogue One Figure Unveiled

May 08, 2025

Latest Posts

-

Su Vu Bao Mau Tat Tre Em Tien Giang Can Nhung Bien Phap Ngan Chan

May 09, 2025

Su Vu Bao Mau Tat Tre Em Tien Giang Can Nhung Bien Phap Ngan Chan

May 09, 2025 -

Bao Mau Tat Tre O Tien Giang Bai Hoc Ve An Toan Va Quan Ly Truong Mam Non

May 09, 2025

Bao Mau Tat Tre O Tien Giang Bai Hoc Ve An Toan Va Quan Ly Truong Mam Non

May 09, 2025 -

Xu Ly Nghiem Ngat Vu Bao Mau Tat Tre O Tien Giang Tuong Lai An Toan Cho Tre Em

May 09, 2025

Xu Ly Nghiem Ngat Vu Bao Mau Tat Tre O Tien Giang Tuong Lai An Toan Cho Tre Em

May 09, 2025 -

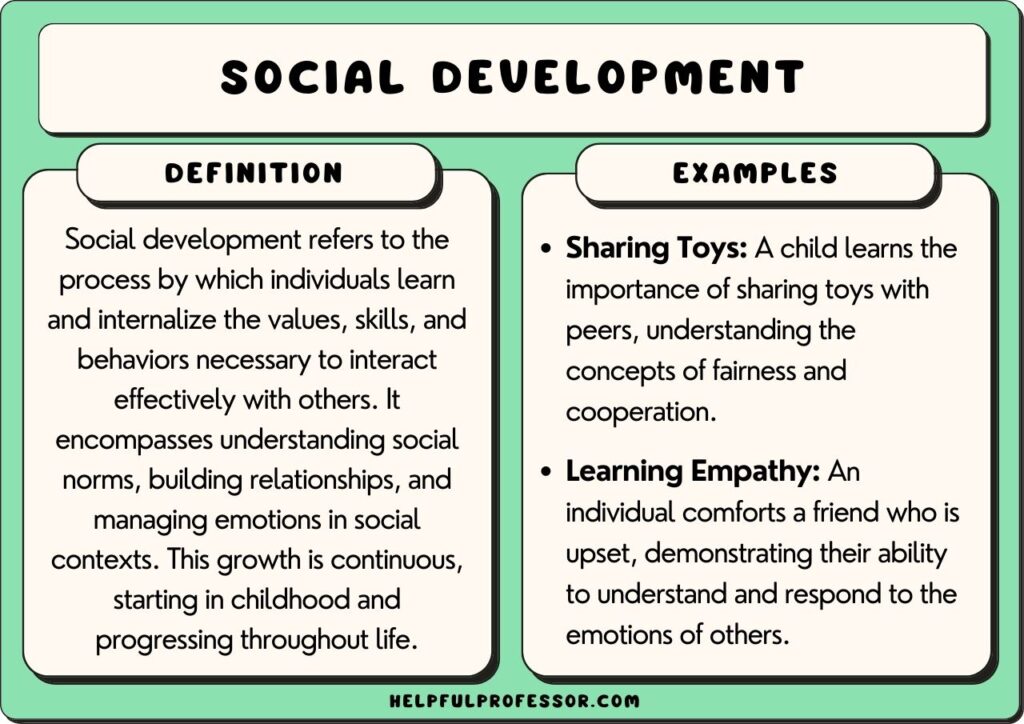

The Delicate Years Daycare Decisions And Your Childs Development

May 09, 2025

The Delicate Years Daycare Decisions And Your Childs Development

May 09, 2025 -

Should You Delay Daycare Expert Weighs In On Infant Vulnerability

May 09, 2025

Should You Delay Daycare Expert Weighs In On Infant Vulnerability

May 09, 2025